Answered step by step

Verified Expert Solution

Question

1 Approved Answer

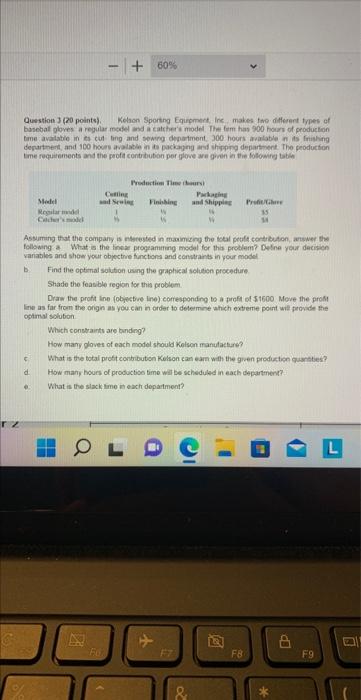

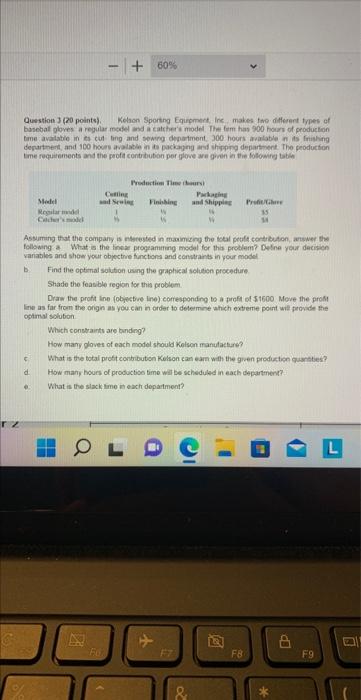

I need this queation for today. Help with letter B. thank you - +60% Question 3 (20 points). Kelson Sporting Equipment, Inc makes two different

I need this queation for today. Help with letter B.

- +60% Question 3 (20 points). Kelson Sporting Equipment, Inc makes two different types of basebal gloves a regular model and a catcher's model. The fem has 900 hours of production time available in its cut ting and sewing department. 300 hours available in its finishing department, and 100 hours available in its packaging and shipping department. The production time requirements and the profit contribution per glove are given in the following table Production Time hours) Cutting Model and Sewing Finishing Packaging and Shipping Profit/Che Regilar model Cacher's old Assuming that the company is interested in maximizing the total profit contribution, answer the following a What is the linear programming model for this problem? Define your decision variables and show your objective functions and constraints in your model b Find the optimal solution using the graphical solution procedure Shade the feasible region for this problem Draw the profit ine (objective line) corresponding to a profit of $1600 Move the profit line as far from the origin as you can in order to determine which extreme point will provide the optimal solution Which constraints are binding? How many gloves of each model should Kelson manufacture? F d What is the total profit contribution Kelson can eam with the given production quantities? How many hours of production time will be scheduled in each department? What is the slack time in each department? + & 2 F8 BP F9 D thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started