Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need this urgently The question was: At year end, December 31, 2014 Bentley Inc showed unadjusted balances of $235,000 in Accounts Receivable, $5,300 credit

i need this urgently

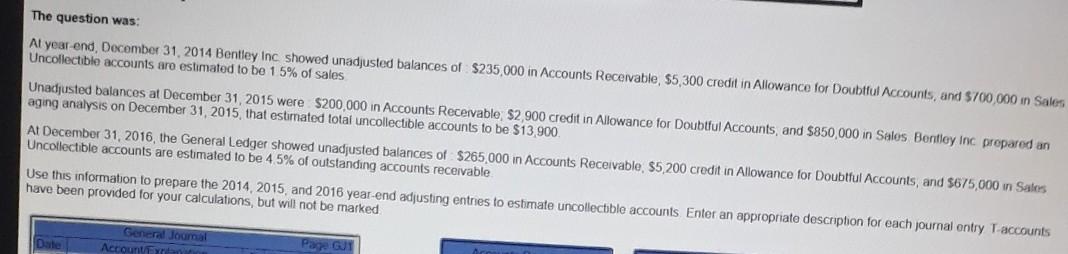

The question was: At year end, December 31, 2014 Bentley Inc showed unadjusted balances of $235,000 in Accounts Receivable, $5,300 credit in Allowance for Doubtful Accounts, and $700,000 in Sales Uncollectible accounts are estimated to be 1 5% of sales Unadjusted balances at December 31, 2015 were $200,000 in Accounts Receivable, $2,900 credit in Allowance for Doubtful Accounts, and $850,000 in Sales Bentley Inc propared an aging analysis on December 31, 2015, that estimated total uncollectible accounts to be $13,900 At December 31, 2016, the General Ledger showed unadjusted balances of $265,000 in Accounts Receivable, $5,200 credit in Allowance for Doubtful Accounts, and 5675,000 in Sales Uncollectible accounts are estimated to be 4.5% of outstanding accounts receivable Use this information to prepare the 2014, 2015, and 2016 year-end adjusting entries to estimate uncollectible accounts Enter an appropriate description for each journal ontry Taccounts have been provided for your calculations, but will not be marked Date General Journal Account Fyw Page GulStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started