Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need this very Quickly Answer the following questions: Enter the amounts without Rand, decimals or space (example 1000). Do not provide any calculations. 2.1

I need this very Quickly

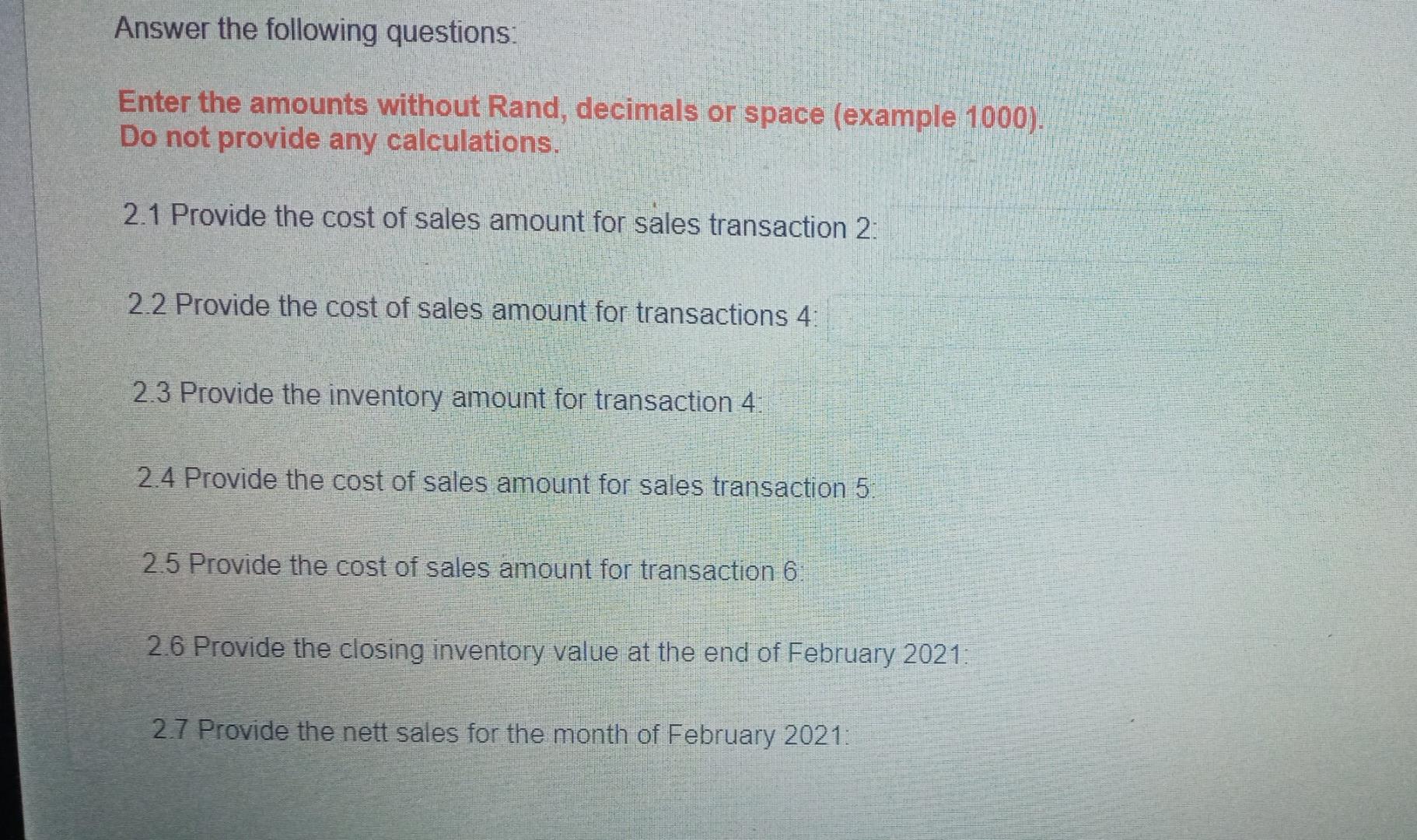

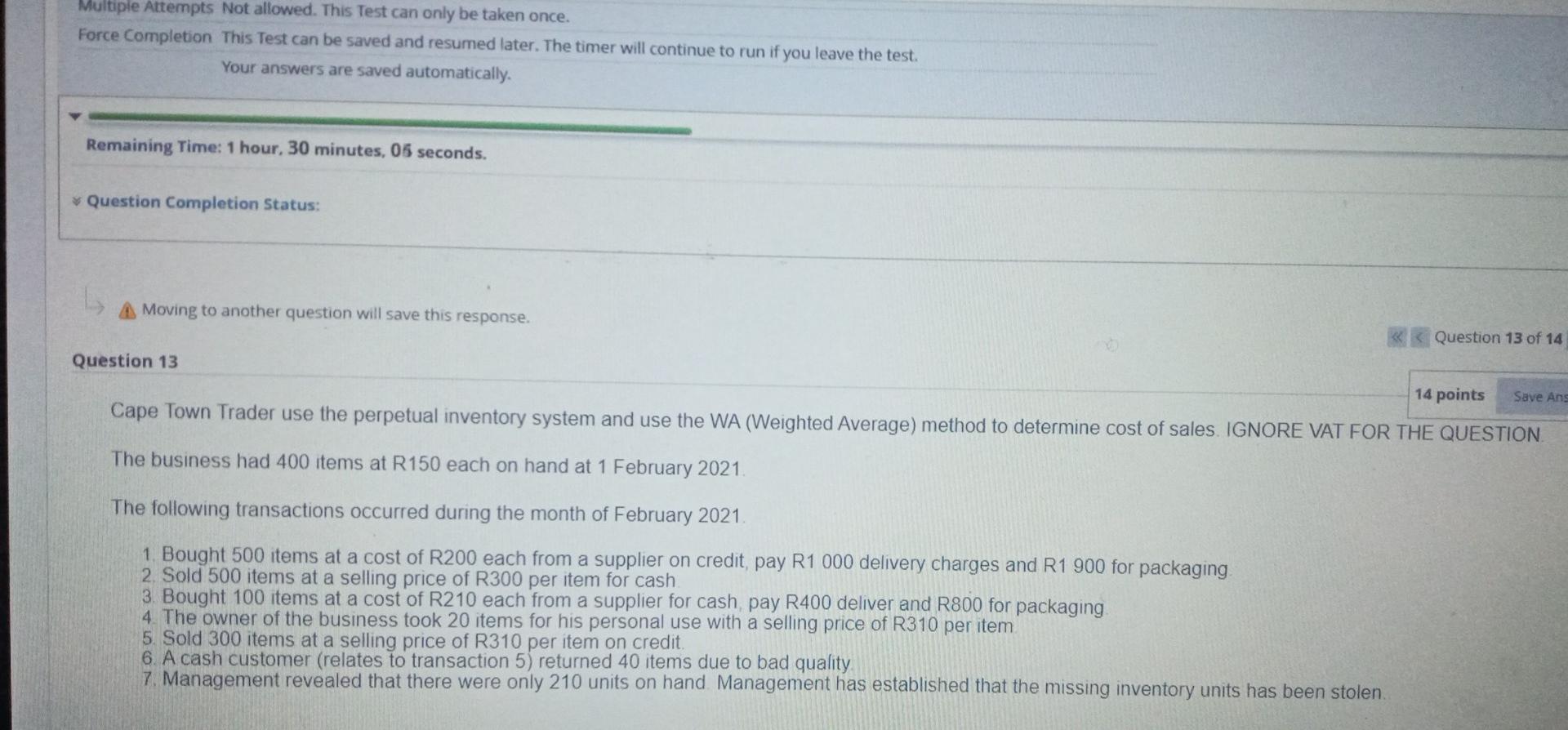

Answer the following questions: Enter the amounts without Rand, decimals or space (example 1000). Do not provide any calculations. 2.1 Provide the cost of sales amount for sales transaction 2: 2.2 Provide the cost of sales amount for transactions 4: 2.3 Provide the inventory amount for transaction 4: 2.4 Provide the cost of sales amount for sales transaction 5: 2.5 Provide the cost of sales amount for transaction 6: 2.6 Provide the closing inventory value at the end of February 2021: 2.7 Provide the nett sales for the month of February 2021: Answer the following questions: Enter the amounts without Rand, decimals or space (example 1000). Do not provide any calculations. 2.1 Provide the cost of sales amount for sales transaction 2: 2.2 Provide the cost of sales amount for transactions 4: 2.3 Provide the inventory amount for transaction 4: 2.4 Provide the cost of sales amount for sales transaction 5: 2.5 Provide the cost of sales amount for transaction 6: 2.6 Provide the closing inventory value at the end of February 2021: 2.7 Provide the nett sales for the month of February 2021: Multiple Attempts Not allowed. This Test can only be taken once. Force Completion This Test can be saved and resumed later. The timer will continue to run if you leave the test. Your answers are saved automatically. Remaining Time: 1 hour, 30 minutes, 05 seconds. Question Completion Status: A Moving to another question will save this response. Question 13 of 14 Question 13 14 points Save Ans Cape Town Trader use the perpetual inventory system and use the WA (Weighted Average) method to determine cost of sales. IGNORE VAT FOR THE QUESTION. The business had 400 items at R150 each on hand at 1 February 2021. The following transactions occurred during the month of February 2021. 1. Bought 500 items at a cost of R200 each from a supplier on credit, pay R1 000 delivery charges and R1 900 for packaging. 2. Sold 500 items at a selling price of R300 per item for cash 3. Bought 100 items at a cost of R210 each from a supplier for cash, pay R400 deliver and R800 for packaging 4. The owner of the business took 20 items for his personal use with a selling price of R310 per item 5. Sold 300 items at a selling price of R310 per item on credit. 6. A cash customer (relates to transaction 5) returned 40 items due to bad quality 7. Management revealed that there were only 210 units on hand Management has established that the missing inventory units has been stolenStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started