Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need to create the worksheet 3. The following accounts at 12/31/2020 are listed in alphabetical order. Create a worksheet. Record the adjusting entries (info

i need to create the worksheet

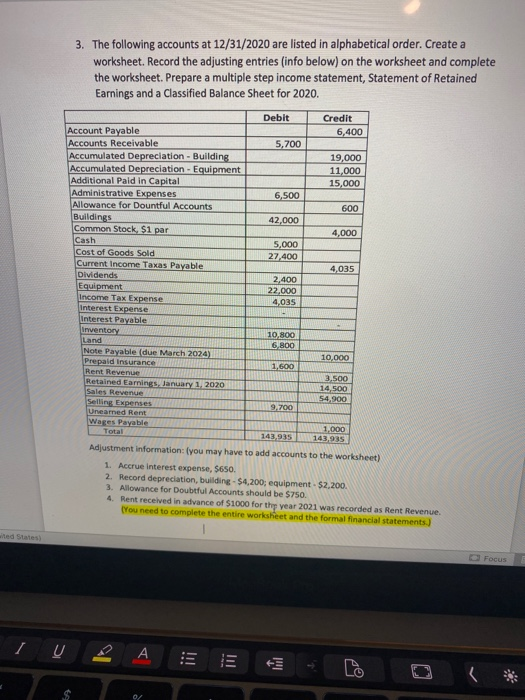

3. The following accounts at 12/31/2020 are listed in alphabetical order. Create a worksheet. Record the adjusting entries (info below) on the worksheet and complete the worksheet. Prepare a multiple step income statement, Statement of Retained Earnings and a Classified Balance Sheet for 2020. Debit Credit 6,400 5,700 19,000 11,000 15,000 6,500 600 42,000 4,000 5,000 27,400 4,035 Account Payable Accounts Receivable Accumulated Depreciation - Building Accumulated Depreciation Equipment Additional Pald in Capital Administrative Expenses Allowance for Dountful Accounts Buildings Common Stock, $1 par Cash Cost of Goods Sold Current Income Taxas Payable Dividends Equipment Income Tax Expense Interest Expense Interest Payable Inventory Land Note Payable (due March 2024) Prepaid Insurance Rent Revenue Retained Earnings January 1, 2020 Sales Revenue Selling Expenses Unearned Rent Wages Payable Total 2,400 22,000 4,035 10.800 6,800 10,000 1,600 3.500 14.500 54.900 9,700 143,93 1,000 143,935 Adjustment information: you may have to add accounts to the worksheet) 1. Accrue Interest expense, 5650. 2. Record depreciation, building - $4,200, equipment - $2,200 3. Allowance for Doubtful Accounts should be $750. 4. Rent received in advance of $1000 for the year 2021 was recorded as Rent Revenue. (You need to complete the entire worksheet and the formal financial statements.) Focus I U A bd Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started