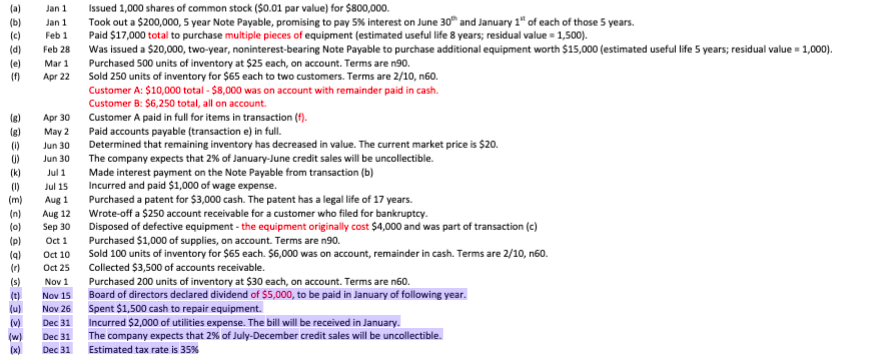

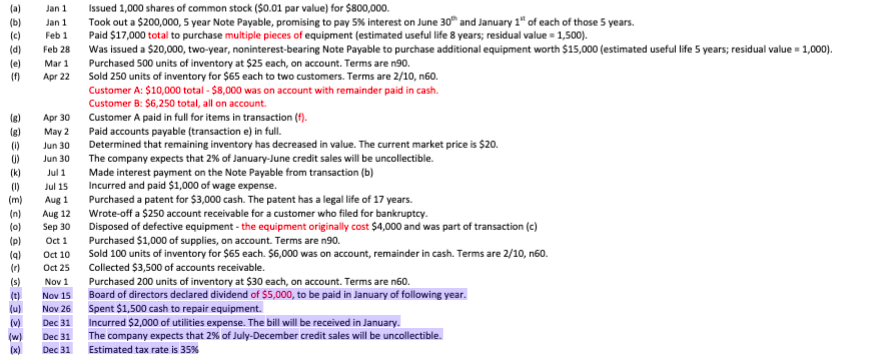

I need to do a balance sheet all these transactions (a-x)

(a) (b) (c) (d) (e) (f) Jan 1 Jan 1 Feb 1 Feb 28 Mar 1 (6) (6) (0) (k) (0) Issued 1,000 shares of common stock ($0.01 par value) for $800,000 Took out a $200,000, 5 year Note Payable, promising to pay 5% interest on June 30" and January 1" of each of those 5 years. Paid $17,000 total to purchase multiple pieces of equipment (estimated useful life 8 years; residual value = 1,500). Was issued a $20,000, two-year, noninterest-bearing Note Payable to purchase additional equipment worth $15,000 (estimated useful life 5 years; residual value = 1,000). Purchased 500 units of inventory at $25 each, on account. Terms are n90. Apr 22 Sold 250 units of inventory for $65 each to two customers. Terms are 2/10, n60. Customer A: $10,000 total - $8,000 was on account with remainder paid in cash. Customer B: $6,250 total, all on account. Apr 30 Customer A paid in full for items in transaction (f). May 2 Paid accounts payable (transaction e) in full . Jun 30 Determined that remaining inventory has decreased in value. The current market price is $20. Jun 30 The company expects that 2% of January-June credit sales will be uncollectible. Jul 1 Made interest payment on the Note Payable from transaction (b) Jul 15 Incurred and paid $1,000 of wage expense. Aug 1 Purchased a patent for $3,000 cash. The patent has a legal life of 17 years. Aug 12 Wrote-off a $250 account receivable for a customer who filed for bankruptcy. Sep 30 Disposed of defective equipment - the equipment originally cost $4,000 and was part of transaction (c) Oct 1 Purchased $1,000 of supplies, on account. Terms are n90. Oct 10 Sold 100 units of inventory for $65 each. $6,000 was on account, remainder in cash. Terms are 2/10, n60. Oct 25 Collected $3,500 of accounts receivable. Nov 1 Purchased 200 units of inventory at $30 each, on account. Terms are n60. Nov 15 Board of directors declared dividend of $5,000, to be paid in January of following year. Nov 26 Spent $1,500 cash to repair equipment. Dec 31 Incurred $2,000 of utilities expense. The bill will be received in January. The company expects that 2% of July-December credit sales will be uncollectible. Estimated tax rate is 35% (m) (n) () (p) (a (s) t (u () w Dec 31 Dec 31