I need to figure out how to calculate the Excess Charitable Contributions

I need to figure out how to calculate the Excess Charitable Contributions

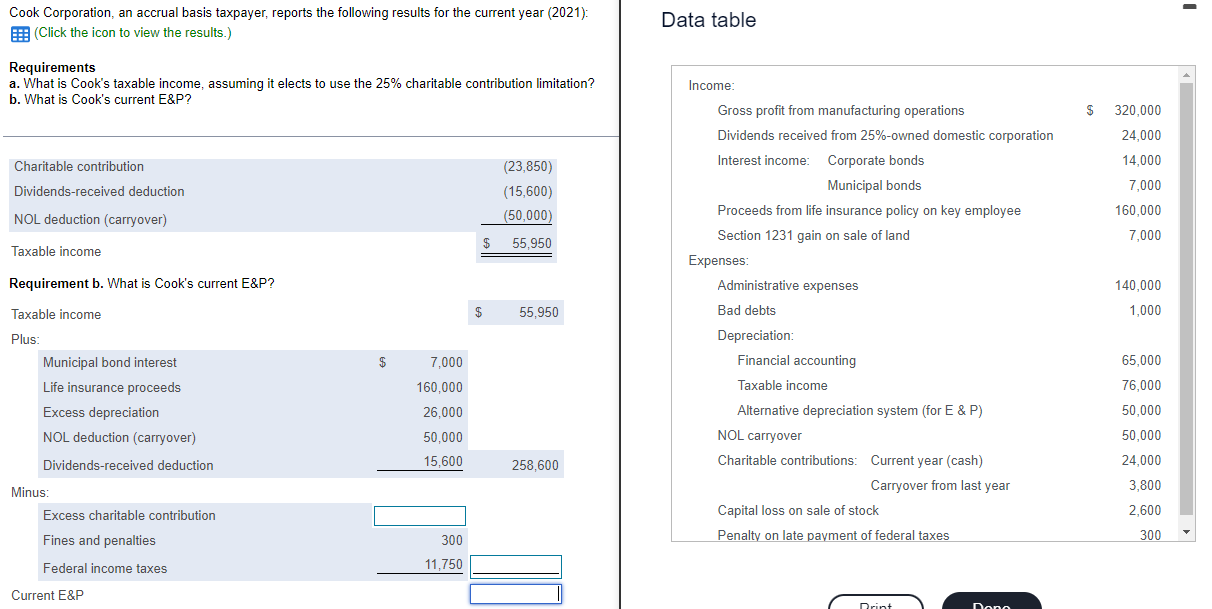

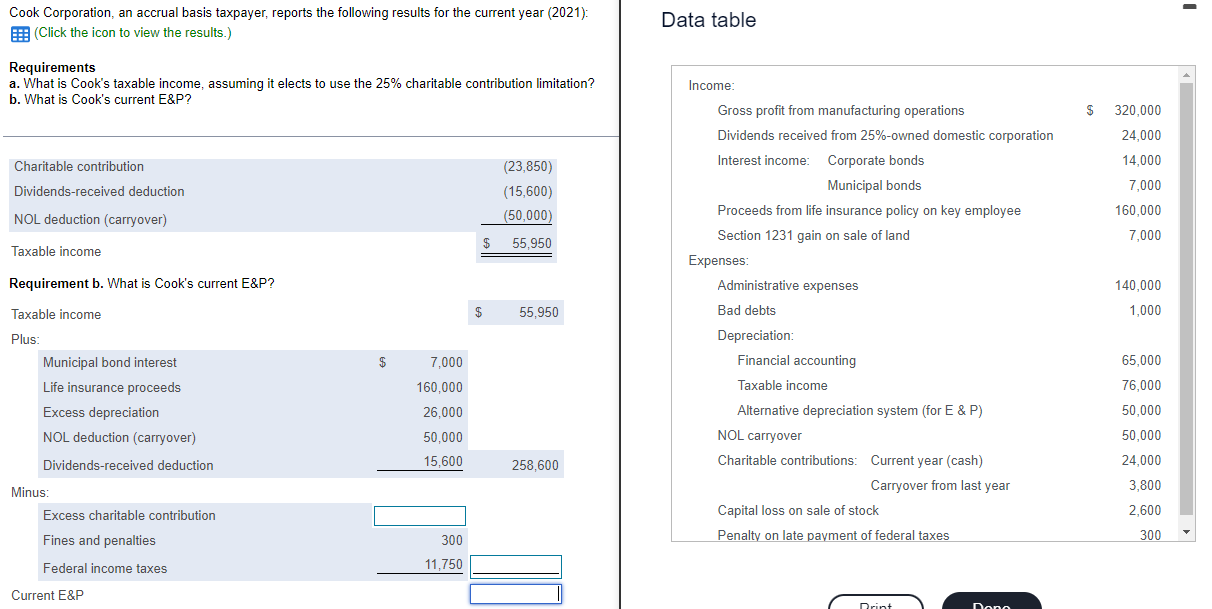

- Cook Corporation, an accrual basis taxpayer, reports the following results for the current year (2021): (Click the icon to view the results.) Data table Requirements a. What is Cook's taxable income, assuming it elects to use the 25% charitable contribution limitation? b. What is Cook's current E&P? $ 320,000 24,000 Charitable contribution 14,000 Dividends-received deduction (23,850) (15,600) (50,000) 7,000 160,000 NOL deduction (carryover) 7,000 $ 55,950 Taxable income Requirement b. What is Cook's current E&P? 140,000 Taxable income $ 55,950 Income: : Gross profit from manufacturing operations Dividends received from 25%-owned domestic corporation Interest income: Corporate bonds Municipal bonds Proceeds from life insurance policy on key employee Section 1231 gain on sale of land Expenses Administrative expenses Bad debts Depreciation: Financial accounting Taxable income Alternative depreciation system (for E&P) NOL carryover Charitable contributions: Current year (cash) Carryover from last year Capital loss on sale of stock Penalty on late payment of federal taxes 1,000 $ 7,000 Plus: Municipal bond interest Life insurance proceeds Excess depreciation 160,000 26,000 65,000 76,000 50,000 50,000 24,000 3,800 NOL deduction (carryover) 50,000 15,600 Dividends-received deduction 258,600 2,600 300 Minus: Excess charitable contribution Fines and penalties Federal income taxes Current E&P E&P 300 11,750 Drint Dono - Cook Corporation, an accrual basis taxpayer, reports the following results for the current year (2021): (Click the icon to view the results.) Data table Requirements a. What is Cook's taxable income, assuming it elects to use the 25% charitable contribution limitation? b. What is Cook's current E&P? $ 320,000 24,000 Charitable contribution 14,000 Dividends-received deduction (23,850) (15,600) (50,000) 7,000 160,000 NOL deduction (carryover) 7,000 $ 55,950 Taxable income Requirement b. What is Cook's current E&P? 140,000 Taxable income $ 55,950 Income: : Gross profit from manufacturing operations Dividends received from 25%-owned domestic corporation Interest income: Corporate bonds Municipal bonds Proceeds from life insurance policy on key employee Section 1231 gain on sale of land Expenses Administrative expenses Bad debts Depreciation: Financial accounting Taxable income Alternative depreciation system (for E&P) NOL carryover Charitable contributions: Current year (cash) Carryover from last year Capital loss on sale of stock Penalty on late payment of federal taxes 1,000 $ 7,000 Plus: Municipal bond interest Life insurance proceeds Excess depreciation 160,000 26,000 65,000 76,000 50,000 50,000 24,000 3,800 NOL deduction (carryover) 50,000 15,600 Dividends-received deduction 258,600 2,600 300 Minus: Excess charitable contribution Fines and penalties Federal income taxes Current E&P E&P 300 11,750 Drint Dono

I need to figure out how to calculate the Excess Charitable Contributions

I need to figure out how to calculate the Excess Charitable Contributions