Answered step by step

Verified Expert Solution

Question

1 Approved Answer

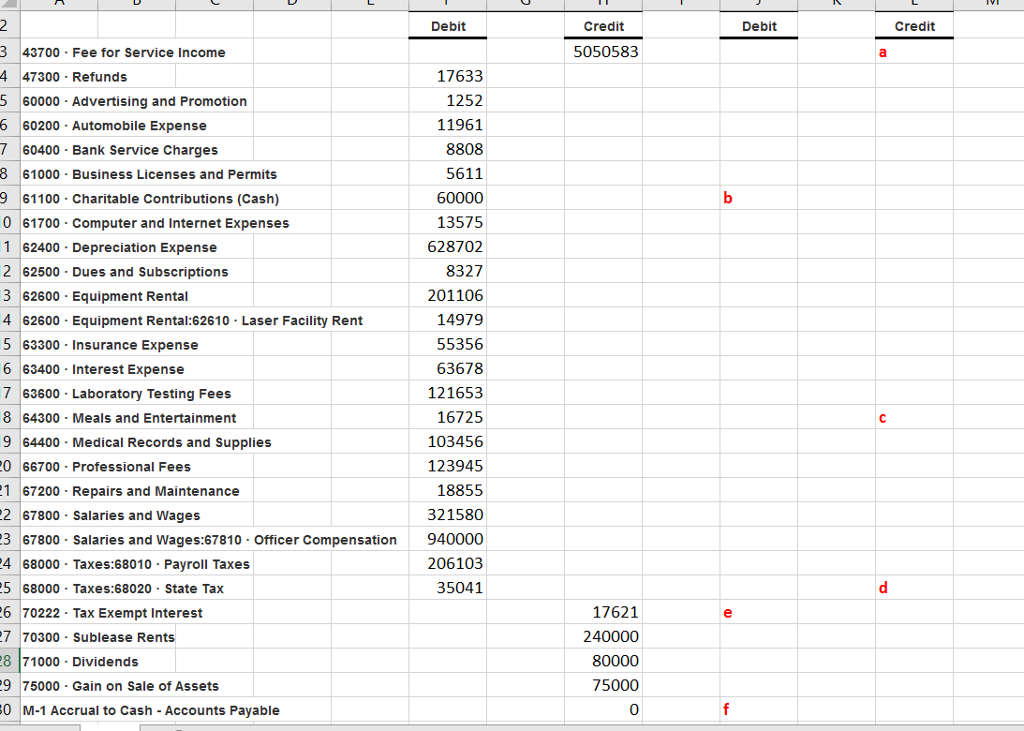

I need to fill out the spreadsheet based on the provided information: Please help. The adjustments are labeled where they go, I just am unsure

I need to fill out the spreadsheet based on the provided information:

Please help. The adjustments are labeled where they go, I just am unsure about the amounts of each one.

1. Determine taxable income. Show all adjustments in the Microsoft Excel spreadsheet. Footnote references are provided to assist you. 2. The Dr. has filed his prior tax returns on the cash basis. a. What questions will you ask to be sure he can continue to file on the cash basis? 3. You find that in 2014, the Dr. qualifies, and choose to file on the cash basis. His books are kept on the accrual basis. Determine the adjustments needed. 4. No federal taxes were paid in 2013, and no estimated taxes were paid in 2014 5. Within the state tax expense, you find $4,389 is late payment penalties. 6. While analyzing the financial information, you find that hidden in "Accounts Payable" is $28,953 of accrued salaries. You also find that the salaries were paid in the first week of February. a. Does this have an impact on taxable income? 7. Determine the accrual to cash adjustments for accounts receivable and accounts payable 8. A charitable contribution carryforward of $40,000 is available. Included in insurance expense is $12,523 of officers' life insurance. You determine the company is the beneficiary, and each officer is a greater than 20% shareholderStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started