Question

I need to find the cost of financing of a project. The projected beta of equity for the project is 1.2, and the firm is

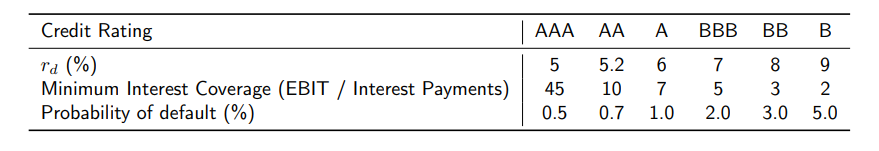

I need to find the cost of financing of a project. The projected beta of equity for the project is 1.2, and the firm is planning to maintain a constant debt-to-equity ratio (in market values) of 0.4. Using expert forecasts for stock market returns, you find that the annual expected return for the entire market is 8% for the next 5 years, and that the risk-free rate will be projected to remain at 4% over the entire life of the project. The cost of debt is unknown, however, you have the following information concerning the current market interest rates for corporate bonds of various ratings. Firms of a given credit rating can borrow at an associated cost of debt, as long as they achieve an interest coverage ratio that is above the minimum required threshold as per the table below:

The EBIT is generated by the project is 700.000 annually (5 years). We assume beta of debt to be 0. The total project cost is 5 million.

AAA . BBB BB B Credit Rating Ta (%) Minimum Interest Coverage (EBIT / Interest Payments) Probability of default (%) 5 45 0.5 5.2 10 0.7 6 7 1.0 7 5 2.0 8 3 3.0 9 2 5.0 AAA . BBB BB B Credit Rating Ta (%) Minimum Interest Coverage (EBIT / Interest Payments) Probability of default (%) 5 45 0.5 5.2 10 0.7 6 7 1.0 7 5 2.0 8 3 3.0 9 2 5.0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started