Answered step by step

Verified Expert Solution

Question

1 Approved Answer

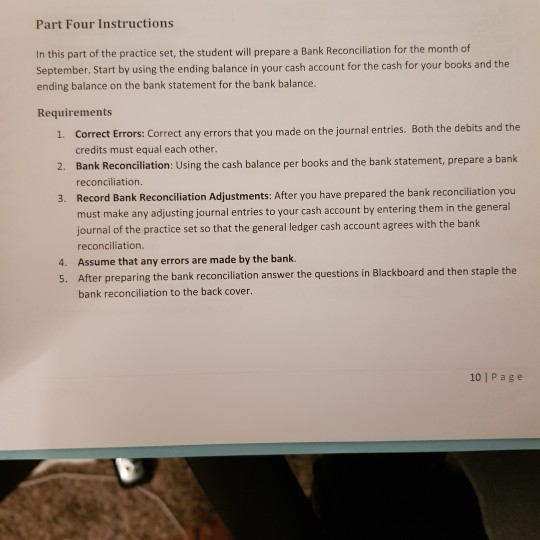

I need to help for solving last picture based on first three pictures please need a help:)))) Date Deposit No. Check No. Description 1. i

I need to help for solving last picture based on first three pictures please need a help:))))

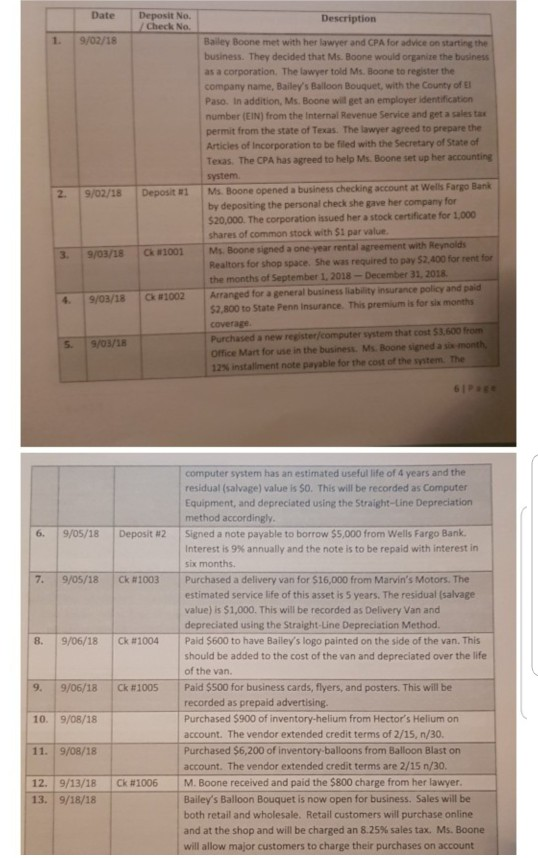

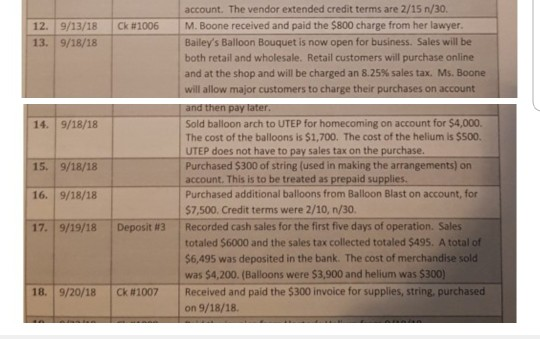

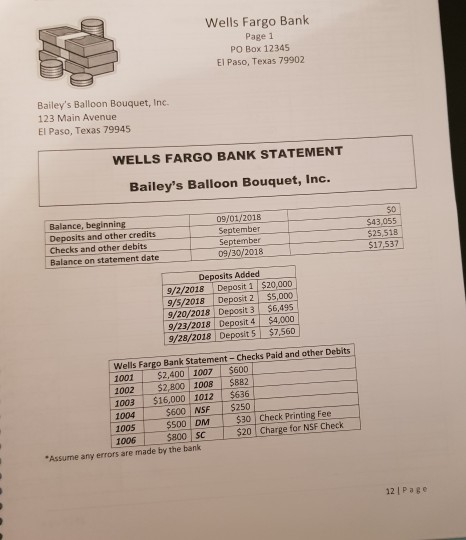

Date Deposit No. Check No. Description 1. i 9/02/18 Baley Boone met with her lawyer and CPA for advice on starting the business. They decided that Ms. Boone would organize the business as a corporation. The lawyer told Ms. Boone to register the company name, Bailey's Balloon Bouquet, with the County of E Paso. In addition, Ms. Boone will get an employer identification number (EIN) from the Internal Revenue Service and get a sales tax permit from the state of Texas. The lawyer agreed to prepare the Articles of Incorporation to be filed with the Secretary of State of Texas. The CPA has agreed to help Ms. Boone set up her accounting system. | Deposit #1 | Ms Boone opened a business checking account at Wells Fargo Bank 2. 9/02/18 by depositing the personal check she gave her company for $20,000. The corporation ssued her a stock certificate for 1,000 shares of common stock with $1 par value. 3. 9/03/18 Ck 81001 Ms. Boone signed a one-year rental agreement with Reynolds Realtors for shop space. She was required to pay $2,400 for rent for the months of September 1, 2018- December 31, 2018 9/03/18C #1002 Arranged for a general business iability insurance policy and paid 2,800 to State Penn insurance. This premium is for sis months coverage Purchased a new register/computer system that cost $3,600 from Office Mart for use in the business. Ms. Boone signed a six month 12% installment note payable for the cost of the system The 5. 9/03/18 computer system has an estimated useful life of 4 years and the residual (salvage) value is $O. This will be recorded as Computer Equipment, and depreciated using the Straight-Line Depreciation method accordingly 6. | 9/05/18 | Deposit #2 | Signed a note payable to borrow $5,000 from Wells Fargo Bank. Interest is 9% annually and the note is to be repaid with interest in six months. 7. | 9/05/18 | Ck #1003 | Purchased a delivery van for S 16,000 from Marvin's Motors. The estimated service life of this asset is 5 years. The residual (salvage value) is $1,000. This will be recorded as Delivery Van and depreciated using the Straight-Line Depreciation Method 8. | 9/06/18 | ck #1004 | Paid S600 to have Bailey's logo painted on the side of the van. This should be added to the cost of the van and depreciated over the life of the van. 9. | 9/06/18 10. 9/08/18 11. 9/08/18 12. | 9/13/18 | ck #1005 | Paid SS00 for business cards, flyers, and posters. This will be recorded as prepaid advertising. Purchased $900 of inventory-helium from Hector's Helium on account. The vendor extended credit terms of 2/15, n/30. Purchased $6,200 of inventory-balloons from Balloon Blast on account. The vendor extended credit terms are 2/15 n/30, | ck #1006 | M. Boone received and paid the S800 charge from her lawyer. Bailey's Balloon Bouquet is now open for business. Sales will be both retail and wholesale. Retail customers will purchase online and at the shop and will be charged an 8.25% sales tax. Ms. Boone 13. 9/18/18Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started