Answered step by step

Verified Expert Solution

Question

1 Approved Answer

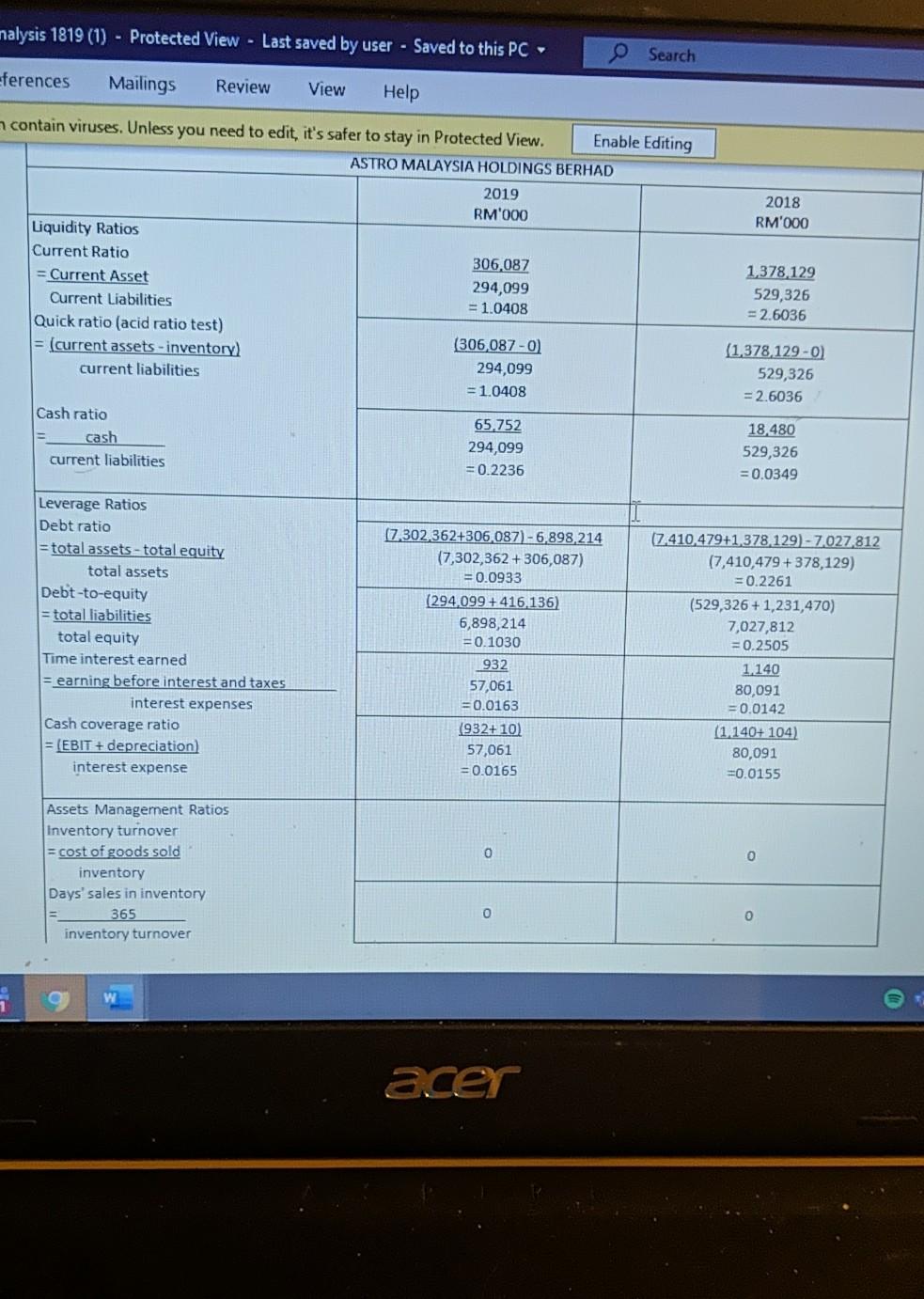

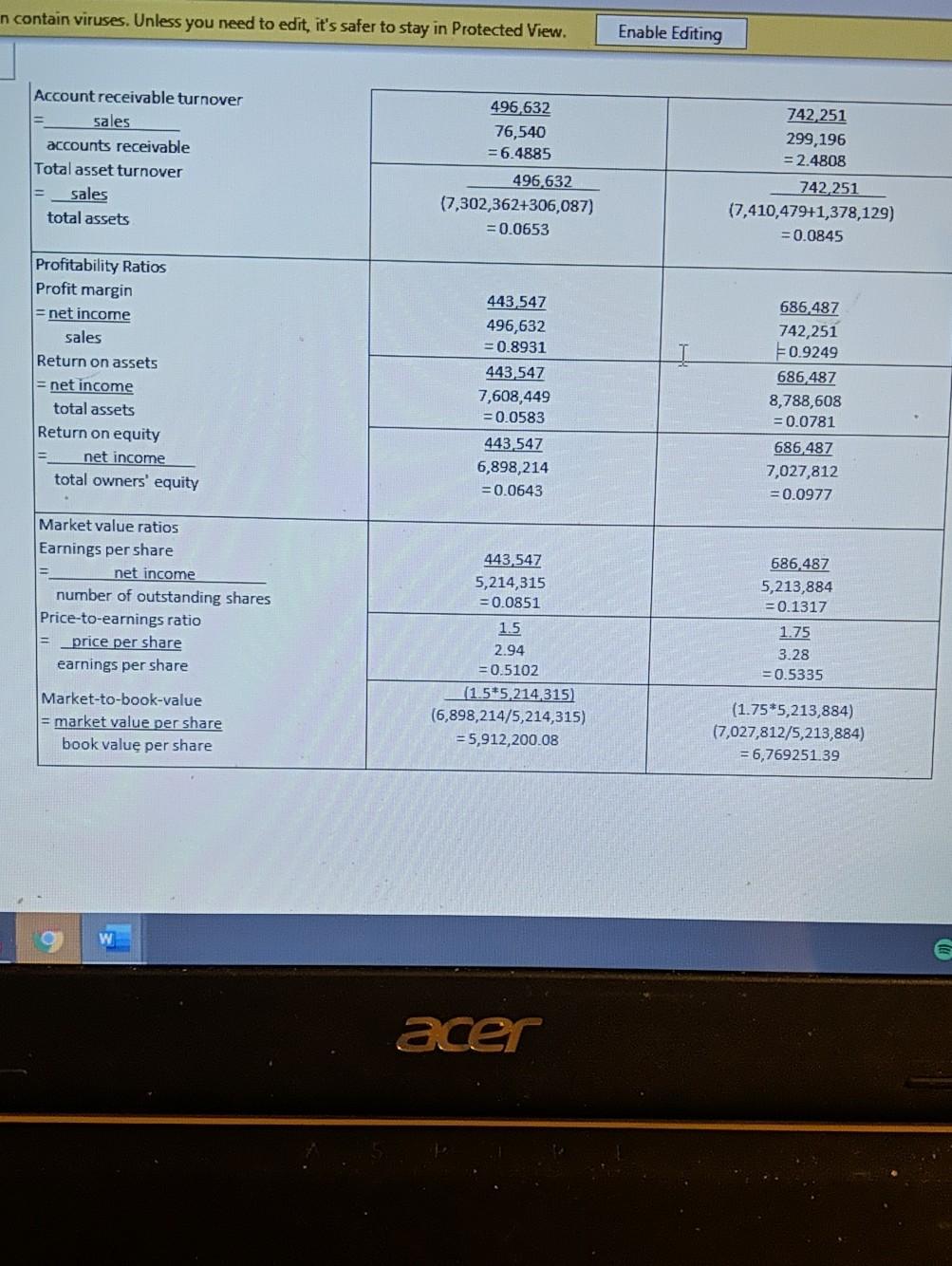

i need to interpret/explain this ratio. i calculate this by myself but i dont know how to interpret/explain the result. please help me. the question

i need to interpret/explain this ratio. i calculate this by myself but i dont know how to interpret/explain the result. please help me. the question is please interpret/explain the result

nalysis 1819 (1) - Protected View - Last saved by user - Saved to this PC- Search eferences Mailings Review View Help 2018 RM'000 contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing ASTRO MALAYSIA HOLDINGS BERHAD 2019 RM1000 Liquidity Ratios Current Ratio 306,087 = Current Asset 294,099 Current Liabilities = 1.0408 Quick ratio (acid ratio test) = (current assets - inventory) (306,087-0) current liabilities 294,099 = 1.0408 Cash ratio 65,752 cash 294,099 current liabilities = 0.2236 1,378,129 529,326 = 2.6036 (1.378 129-0) 529,326 = 2.6036 18,480 529,326 = 0.0349 Leverage Ratios Debt ratio = total assets - total equity total assets Debt-to-equity = total liabilities total equity Time interest earned = earning before interest and taxes interest expenses Cash coverage ratio = (EBIT + depreciation interest expense (7,302,362+306,087) -6,898,214 (7,302,362 +306,087) = 0.0933 (294.099 +416 136) 6,898,214 = 0.1030 932 57,061 = 0.0163 (932+ 10) 57,061 = 0.0165 (7.410.479+1 378129) - 7.027,812 (7,410,479 +378,129) = 0.2261 (529,326 +1,231,470) 7,027,812 = 0.2505 1.140 80,091 = 0.0142 (1.140+ 104) 80,091 =0.0155 0 0 Assets Management Ratios Inventory turnover = cost of goods sold inventory Days' sales in inventory 365 inventory turnover 0 acer in contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing Account receivable turnover sales accounts receivable Total asset turnover sales total assets 496,632 76,540 = 6.4885 496,632 (7,302,362+306,087) = 0.0653 742,251 299,196 = 2.4808 742,251 (7,410,47941,378,129) = 0.0845 Profitability Ratios Profit margin = net income sales Return on assets = net income total assets Return on equity net income total owners' equity 443.547 496,632 = 0.8931 443,547 7,608,449 = 0.0583 443,547 6,898,214 = 0.0643 686,487 742,251 F0.9249 686,487 8,788,608 = 0.0781 686,487 7,027,812 = 0.0977 Market value ratios Earnings per share net income number of outstanding shares Price-to-earnings ratio price per share earnings per share 443 547 5,214,315 = 0.0851 1.5 2.94 = 0.5102 (1.5*5,214,315) (6,898,214/5,214,315) = 5,912,200.08 686 487 5,213,884 = 0.1317 1.75 3.28 = 0.5335 Market-to-book-value = market value per share book value per share (1.75*5,213,884) (7,027,812/5,213,884) = 6,769251.39 acerStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started