I need to know all 10 help please!

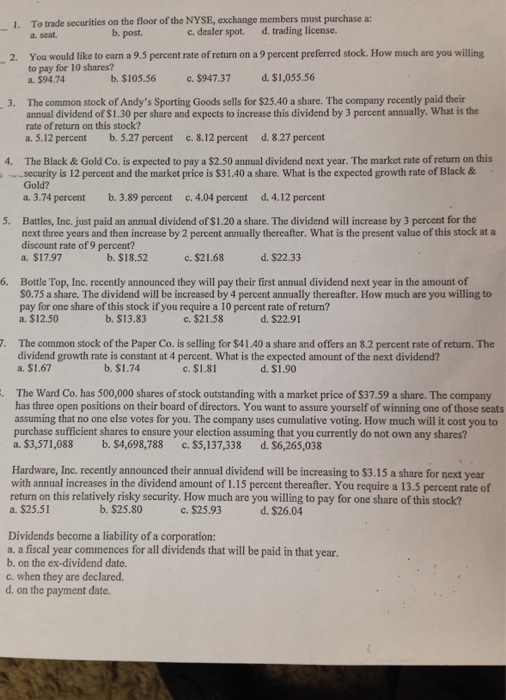

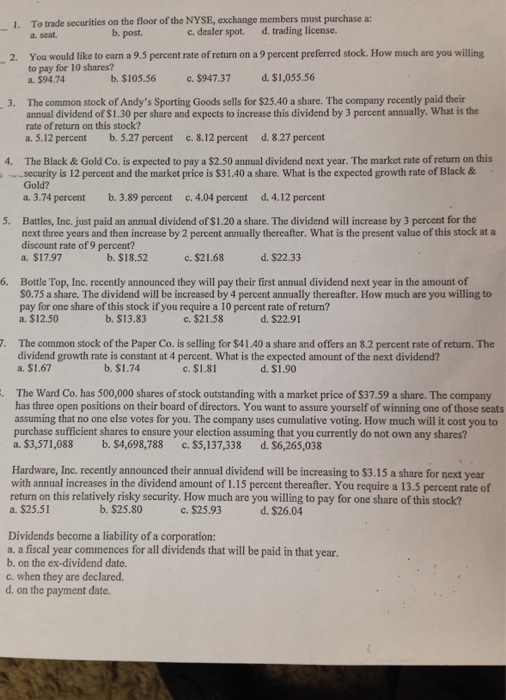

To trade securities on the floor of the NYSE, exchange members must purchase a: You would like to earn a 9.5 percent rate of return on a 9 percent preferred stock. How much are you willing to pay for 10 shares? The common stock of Andy's Sporting Goods sells for $25.40 a share. The company recently paid their annual dividend of $ 1.30 per share and expects to increase this dividend by 3 percent annually. What is the rate of return on this stock? The Black & Gold Co. is expected to pay a $2.50 annual dividend next year. The market rate of return on this security is 12 percent and the market price is $31.40 a share. What is the expected growth rate of Black & Gold? Battles. Inc. just paid an annual dividend of $1.20 a share. The dividend will increase by 3 percent for the next three years and then increase by 2 percent annually thereafter. What is the present value of this stock at a discount rate of 9 percent? Bottle Top. Inc. recently announced they will pay their first annual dividend next year in the amount of $0.75 a share. The dividend will be increased by 4 percent annually thereafter. How much are you willing to pay for one share of this stock if you require a 10 percent rate of return? The common stock of the Paper Co. is selling for $41.40 a share and offers an 8.2 percent rate of return. The dividend growth rate is constant at 4 percent. What is the expected amount of the next dividend? The Ward Co. has 500,000 shares of stock outstanding with a market price of $37.59 a share. The company has three open positions on their board of directors. You want to assure yourself of winning one of those scats assuming that no one else votes for you. The company uses cumulative voting. How much will it cost you to purchase sufficient shares to ensure your election assuming that you currently do not own any shares? Hardware, Inc. recently announced their annual dividend will be increasing to $3.15 a share for next year with annual increases in the dividend amount of 1.15 percent thereafter. You require a 13.5 percent rate of return on this relatively risky security. How much arc you willing to pay for one share of this stock? Dividends become a liability of a corporation

I need to know all 10 help please!

I need to know all 10 help please!