Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need to know how this person collected these dats its for Norman harvey company simplify it for me how and where he got the

i need to know how this person collected these dats its for Norman harvey company

simplify it for me how and where he got the percentage for current and non current liabilities

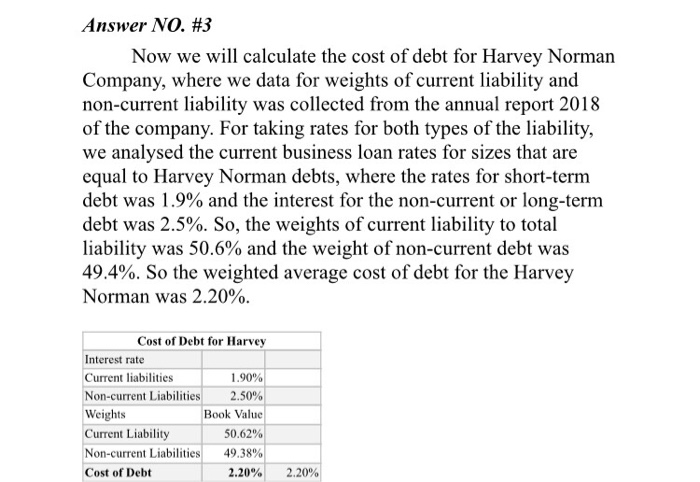

Answer NO. #3 Now we will calculate the cost of debt for Harvey Norman Company, where we data for weights of current liability and non-current liability was collected from the annual report 2018 of the company. For taking rates for both types of the liability, we analysed the current business loan rates for sizes that are equal to Harvey Norman debts, where the rates for short-term debt was 1.9% and the interest for the non-current or long-term debt was 2.5%. So, the weights of current liability to total liability was 50.6% and the weight of non-current debt was 49.4%. So the weighted average cost of debt for the Harvey Norman was 2.20%. Cost of Debt for Harvey Interest rate Current liabilities Non-current Liabilities Weights Current Liability Non-current Liabilities Cost of Debt 1.90% 2.50% Book Value 50.62% 49.38% 2.20% 2.20% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started