Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need to know how to arrive at yhe answers for 10 a-f using the given info 9. ABC Company has a target Debt Ratio

i need to know how to arrive at yhe answers for 10 a-f using the given info

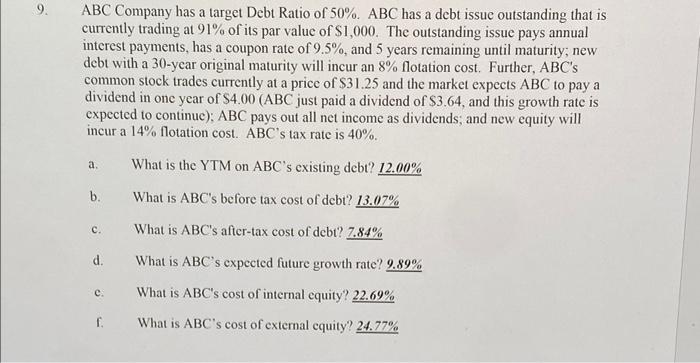

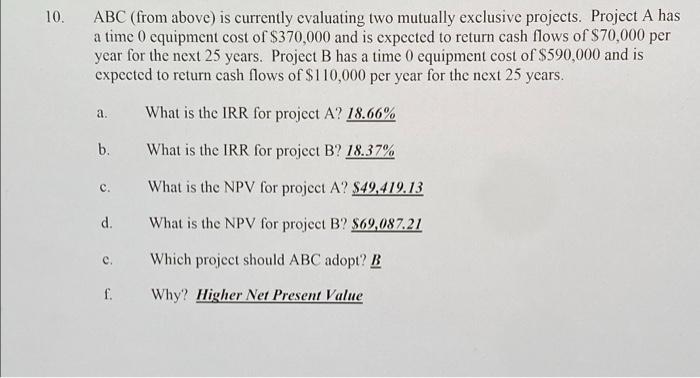

9. ABC Company has a target Debt Ratio of 50%. ABC has a debt issue outstanding that is currently trading at 91% of its par value of $1,000. The outstanding issue pays annual interest payments, has a coupon rate of 9.5%, and 5 years remaining until maturity, new debt with a 30-year original maturity will incur an 8% flotation cost. Further, ABC's common stock trades currently at a price of $31.25 and the market expects ABC to pay a dividend in one year of $4.00 (ABC just paid a dividend of $3.64, and this growth rate is expected to continue): ABC pays out all net income as dividends, and new equity will incur a 14% flotation cost. ABC's tax rate is 40%. What is the YTM on ABC's existing debt? 12.00% a. b. What is ABC's before tax cost of debt? 13.07% c. What is ABC's after-tax cost of debt? 7.84% d. What is ABC's expected future growth rate? 9.89% e What is ABC's cost of internal equity? 22.69% . What is ABC's cost of external cquity? 24.77% 10. ABC (from above) is currently evaluating two mutually exclusive projects. Project A has a time 0 quipment cost of $370,000 and is expected to return cash flows of $70,000 per year for the next 25 years. Project B has a time 0 equipment cost of $590,000 and is expected to return cash flows of $110,000 per year for the next 25 years. a. What is the IRR for project A? 18.66% b. What is the IRR for project B? 18.37% c. What is the NPV for project A? $49,419.13 d. What is the NPV for project B? $69,087.21 C. Which project should ABC adopt? B f. Why? Higher Net Present Value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started