Answered step by step

Verified Expert Solution

Question

1 Approved Answer

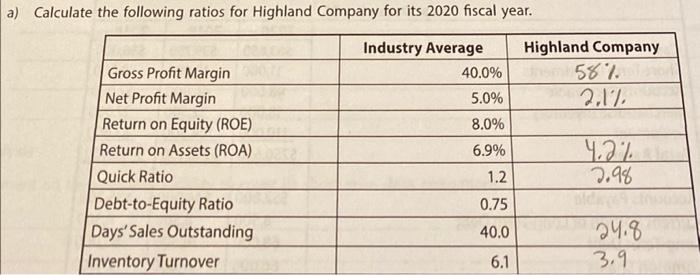

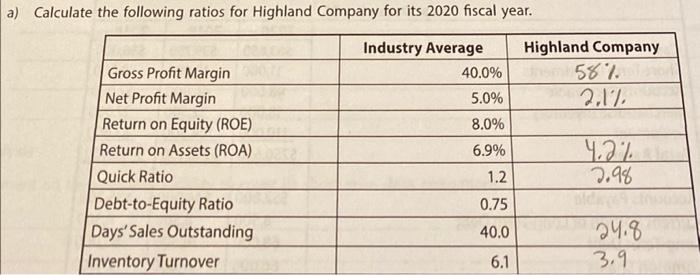

I need to know how to calculate Return On Equity and Debt to Equity ratios with the given income statement and balnce sheet. we were

I need to know how to calculate Return On Equity and Debt to Equity ratios with the given income statement and balnce sheet. we were given the correct answers which is the picture below. j just don't know how to get to said answer.

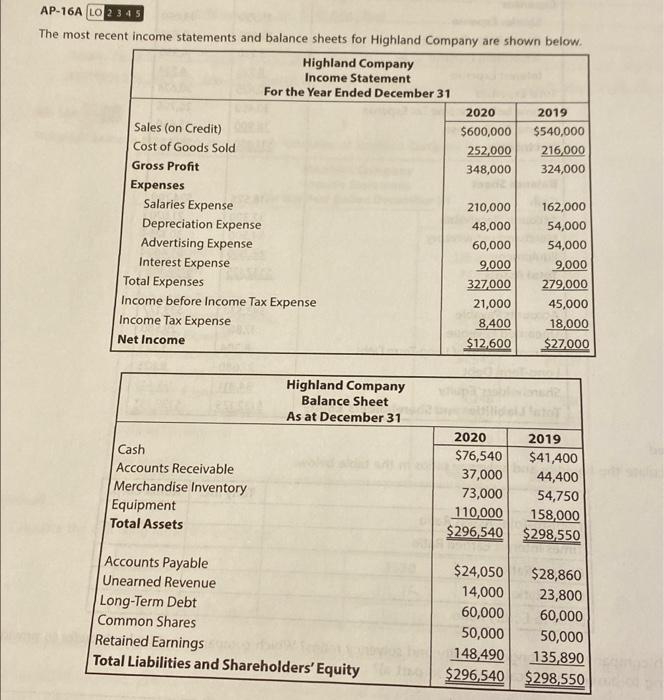

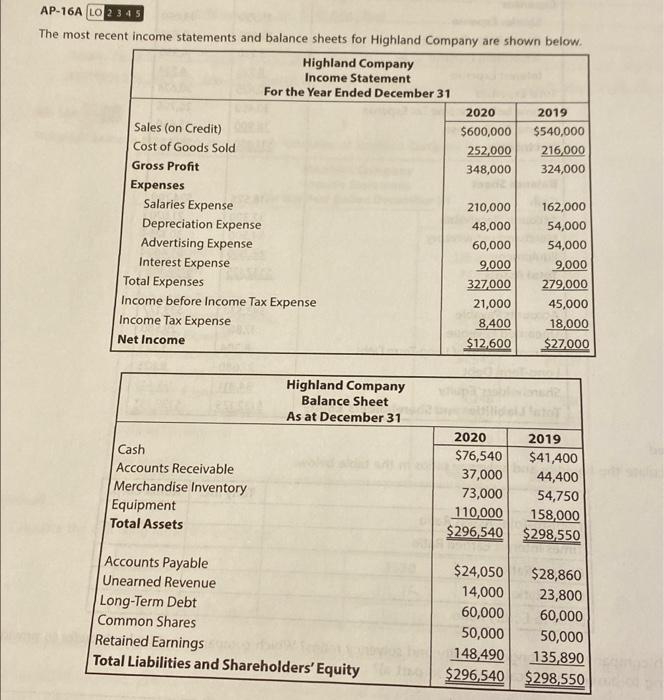

I need to know how to calculate Return On Equity and Debt to Equity ratios with the given income statement and balnce sheet. we were given the correct answers which is the picture below. j just don't know how to get to said answer.  AP-16A LO 2 3 4 5 The most recent income statements and balance sheets for Highland Company are shown below. Highland Company Income Statement For the Year Ended December 31 2020 2019 Sales (on Credit) $600,000 $540,000 Cost of Goods Sold 252,000 216,000 Gross Profit 348,000 324,000 Expenses Salaries Expense 210,000 162,000 Depreciation Expense 48,000 54,000 Advertising Expense 60,000 54,000 Interest Expense 9,000 9,000 Total Expenses 327,000 279,000 Income before Income Tax Expense 21,000 45,000 Income Tax Expense 8,400 18,000 Net Income $12,600 $27,000 Highland Company Balance Sheet As at December 31 Cash Accounts Receivable Merchandise Inventory Equipment Total Assets 2020 $76,540 37,000 73,000 110,000 $296,540 2019 $41,400 44,400 54,750 158,000 $298.550 Accounts Payable Unearned Revenue Long-Term Debt Common Shares Retained Earnings Total Liabilities and Shareholders' Equity $24,050 14,000 60,000 50,000 148,490 $296,540 $28,860 23,800 60,000 50,000 135,890 $298,550 a) Calculate the following ratios for Highland Company for its 2020 fiscal year. Highland Company 567. 2.17 Gross Profit Margin Net Profit Margin Return on Equity (ROE) Return on Assets (ROA) Quick Ratio Debt-to-Equity Ratio Days' Sales Outstanding Inventory Turnover Industry Average 40.0% 5.0% 8.0% 6.9% 1.2 4.22 2.98 0.75 40.0 24.8 3.9 6.1 ed lculate the following ratios for Highland Company for its 2020 fiscal year. Industry Average 40.096 5.096 8.096 Gross Profit Margin Net Profit Margin Return on Equity (ROE) Return on Assets (ROA) Quick Ratio Debt-to-Equity Ratio Days' Sales Outstanding Inventory Turnover 6.996 Highland Company 58.096 2.19 6.696 4.296 2.98 0.49 24.8 3.9 1.2 0.75 40.0 6.1

AP-16A LO 2 3 4 5 The most recent income statements and balance sheets for Highland Company are shown below. Highland Company Income Statement For the Year Ended December 31 2020 2019 Sales (on Credit) $600,000 $540,000 Cost of Goods Sold 252,000 216,000 Gross Profit 348,000 324,000 Expenses Salaries Expense 210,000 162,000 Depreciation Expense 48,000 54,000 Advertising Expense 60,000 54,000 Interest Expense 9,000 9,000 Total Expenses 327,000 279,000 Income before Income Tax Expense 21,000 45,000 Income Tax Expense 8,400 18,000 Net Income $12,600 $27,000 Highland Company Balance Sheet As at December 31 Cash Accounts Receivable Merchandise Inventory Equipment Total Assets 2020 $76,540 37,000 73,000 110,000 $296,540 2019 $41,400 44,400 54,750 158,000 $298.550 Accounts Payable Unearned Revenue Long-Term Debt Common Shares Retained Earnings Total Liabilities and Shareholders' Equity $24,050 14,000 60,000 50,000 148,490 $296,540 $28,860 23,800 60,000 50,000 135,890 $298,550 a) Calculate the following ratios for Highland Company for its 2020 fiscal year. Highland Company 567. 2.17 Gross Profit Margin Net Profit Margin Return on Equity (ROE) Return on Assets (ROA) Quick Ratio Debt-to-Equity Ratio Days' Sales Outstanding Inventory Turnover Industry Average 40.0% 5.0% 8.0% 6.9% 1.2 4.22 2.98 0.75 40.0 24.8 3.9 6.1 ed lculate the following ratios for Highland Company for its 2020 fiscal year. Industry Average 40.096 5.096 8.096 Gross Profit Margin Net Profit Margin Return on Equity (ROE) Return on Assets (ROA) Quick Ratio Debt-to-Equity Ratio Days' Sales Outstanding Inventory Turnover 6.996 Highland Company 58.096 2.19 6.696 4.296 2.98 0.49 24.8 3.9 1.2 0.75 40.0 6.1

I need to know how to calculate Return On Equity and Debt to Equity ratios with the given income statement and balnce sheet. we were given the correct answers which is the picture below. j just don't know how to get to said answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started