Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need to know how to get to the answer, step by step. Thank you A rookie quarterback is in the process of negotiating his

I need to know how to get to the answer, step by step. Thank you

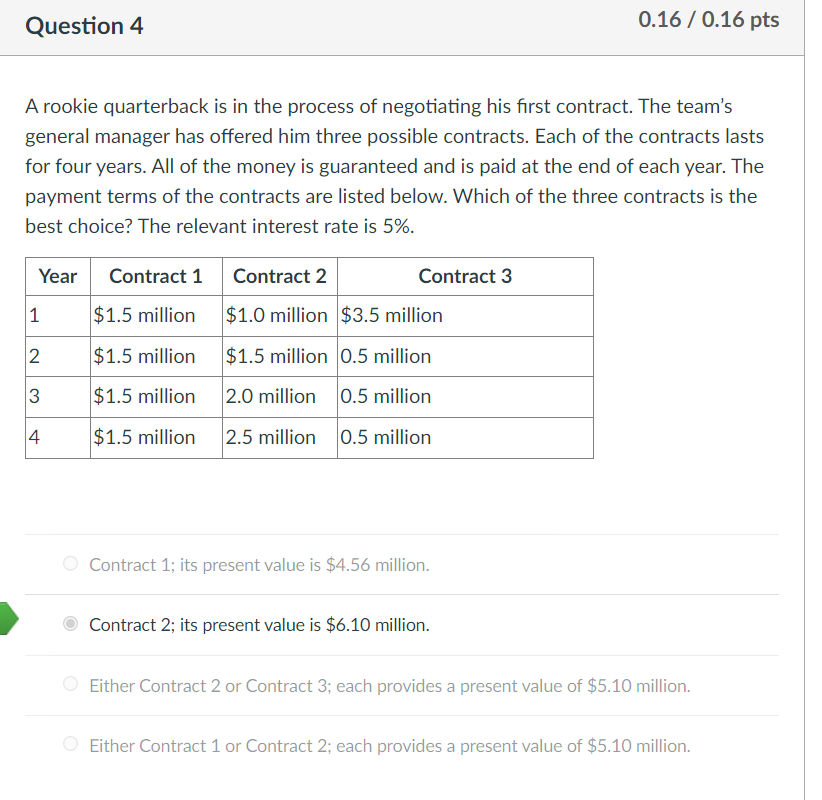

A rookie quarterback is in the process of negotiating his first contract. The team's general manager has offered him three possible contracts. Each of the contracts lasts for four years. All of the money is guaranteed and is paid at the end of each year. The payment terms of the contracts are listed below. Which of the three contracts is the best choice? The relevant interest rate is 5%. Contract 1; its present value is $4.56 million. Contract 2; its present value is $6.10 million. Either Contract 2 or Contract 3; each provides a present value of $5.10 million. Either Contract 1 or Contract 2; each provides a present value of $5.10 millionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started