Question: I need to know the math behind these answers. 7. (12 points) Suppose you have sold short 900 shares of Fallcorp stock at $80 per

I need to know the math behind these answers.

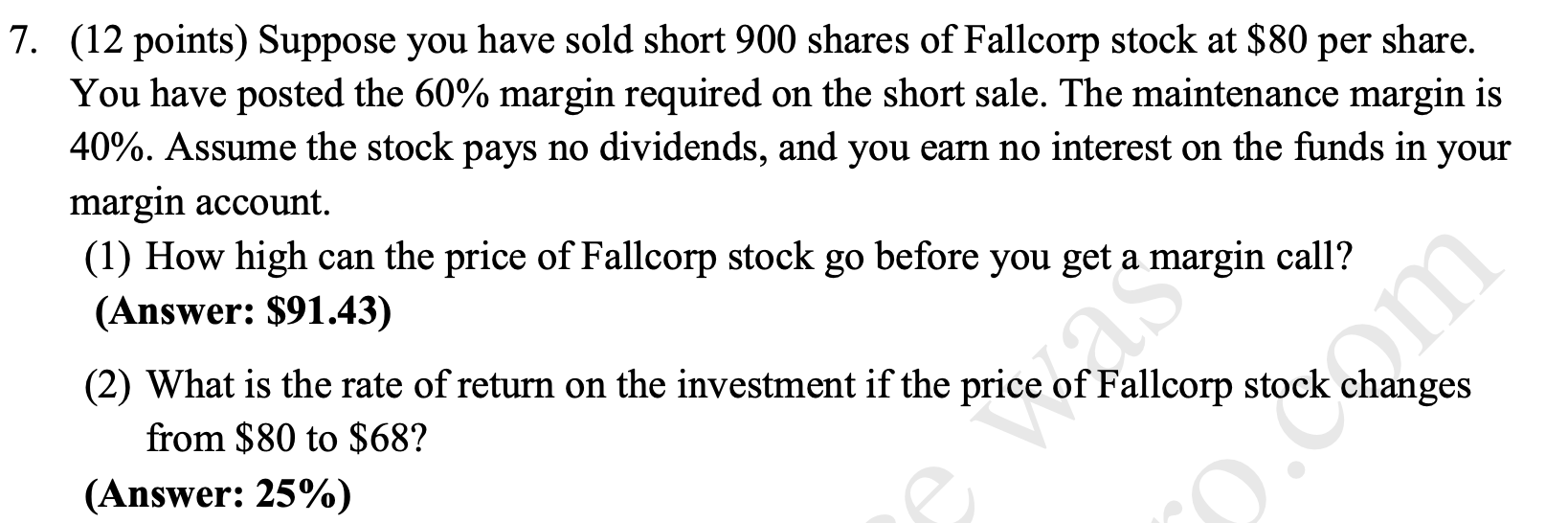

7. (12 points) Suppose you have sold short 900 shares of Fallcorp stock at $80 per share. You have posted the 60% margin required on the short sale. The maintenance margin is 40%. Assume the stock pays no dividends, and you earn no interest on the funds in your margin account. (1) How high can the price of Fallcorp stock go before you get a margin call? (Answer: $91.43) (2) What is the rate of return on the investment if the price of Fallcorp stock changes from $80 to $68? (Answer: 25%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts