Question: solve in 50 mins i will give thumb up. Q3) (1%) Consider the two-period binomial model. The stock price starts at 30 at time 0.

solve in 50 mins i will give thumb up.

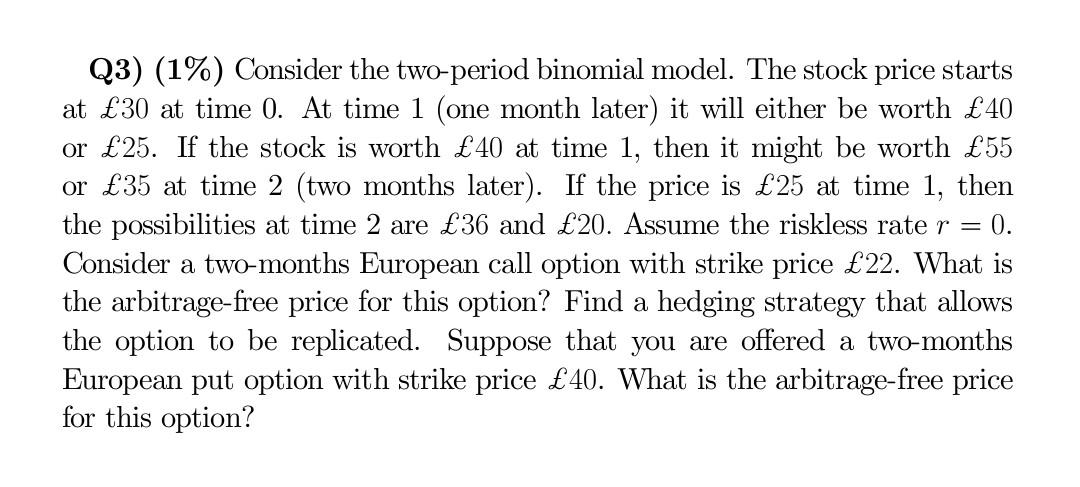

Q3) (1\%) Consider the two-period binomial model. The stock price starts at 30 at time 0. At time 1 (one month later) it will either be worth 40 or 25. If the stock is worth 40 at time 1 , then it might be worth 55 or 35 at time 2 (two months later). If the price is 25 at time 1 , then the possibilities at time 2 are 36 and 20. Assume the riskless rate r=0. Consider a two-months European call option with strike price 22. What is the arbitrage-free price for this option? Find a hedging strategy that allows the option to be replicated. Suppose that you are offered a two-months European put option with strike price 40. What is the arbitrage-free price for this option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts