I need to make sure I completed this correctly please help asap, thanks so much! :)

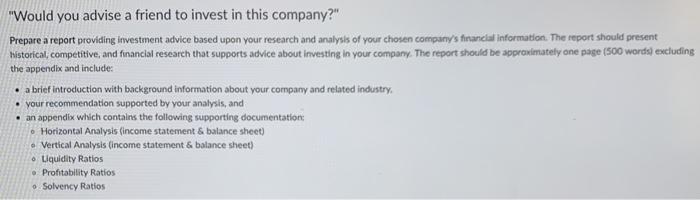

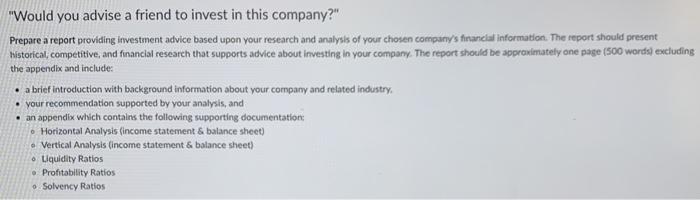

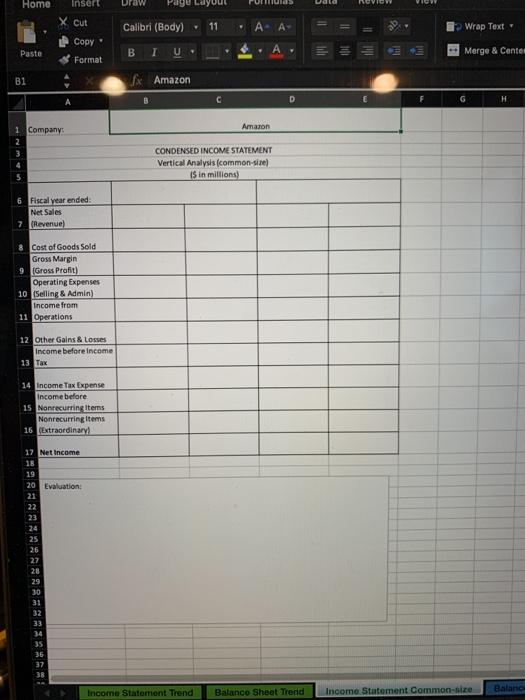

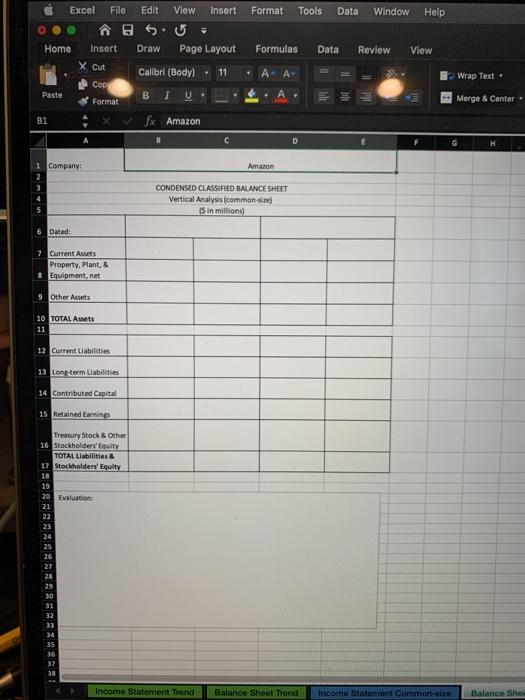

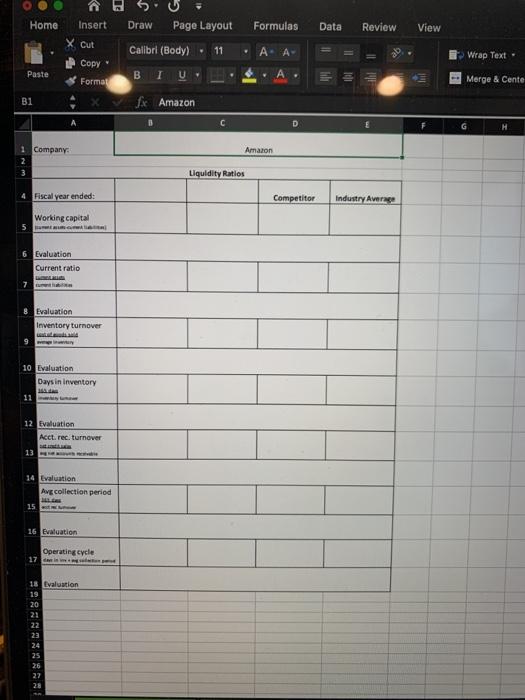

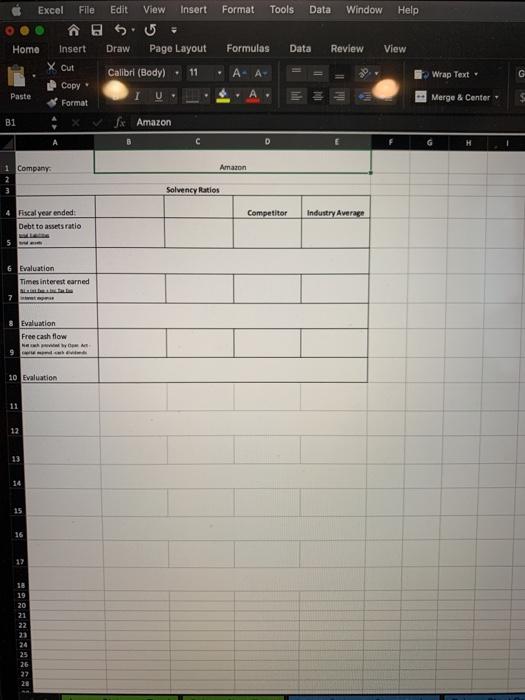

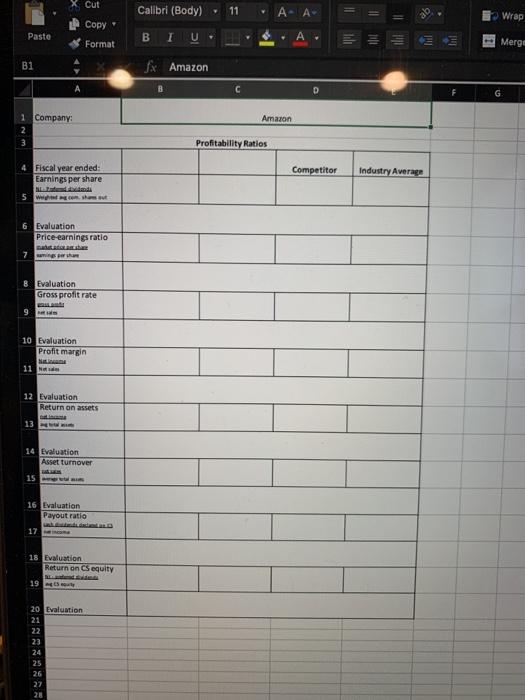

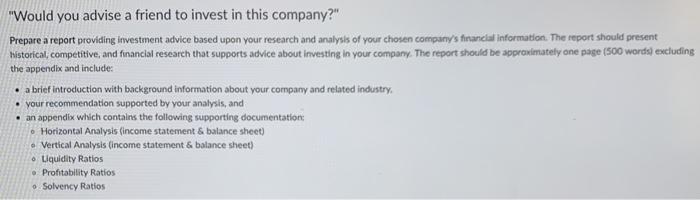

"Would you advise a friend to invest in this company?" Prepare a report providing investment advice based upon your research and analysis of your chosen company's financial information. The report should present historical , competitive and financial research that supports advice about investing in your company. The report should be approximately one page (500 words) excluding the appendix and include: a brief introduction with background information about your company and related industry, your recommendation supported by your analysis, and . an appendix which contains the following supporting documentation Horizontal Analysis (income statement & balance sheet) Vertical Analysis (income statement & balance sheet) Liquidity Ratios Profitability Ratios oSolvency Ratios Paste * Format B1 fx Amazon D A Amaton 1 Company CONDENSED INCOME STATEMENT Horizontal Analysis (trend) 5 in millions) Amount of increase or (Decrease) Percent of Increase or Decrease 6 Fiscal year ended Net Sales 7 (Revenue) 8 Cost of Goods Sold Gross Margin 9 (Gross Profit) Operating Expenses 10 Selling & Admin) Income from 11 Operations 12 Other Gains & Losses Income before income 13 Tax 14 Income Tax Expense Income before 15 Nonrecurring items Nonrecurring Items 16 Extraordinary 17 Net Income 18 19 20 21 Evaluation: 22 23 25 26 27 28 29 30 31 33 34 35 37 Income Statement Trend Balance Sheet Trend Income Statement Common size CUT Calibri (Body) 11 A- Copy Paste B I U A lil Format B1 fx Amazon B C 1 Company Amazon CONDENSED CLASSIFIED BALANCE SHEET Horizontal Analysis (trend) is in millions Amount of Increase or Decrease Percent of Increase or Decrease] 6 Dated: 7 Current Assets Property, Plant,& 8 Equipment, net 9 Other Assets 10 TOTAL Assets 11 12 Current Liabilities 13 Long-term Liabilities 14 Contributed Capital 15 Retained Earnings Treasury Stock & Other 16 Stockholders' Equity TOTAL Uabilities & 17 Stockholders' Equity 18 19 20 Evaluation: 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 Home insert Draw Pagu Layout rolls Urata NOVO VIC X Cut Calibri (Body) 11 A- A Wrap Text Paste Copy Format B I . + Merge & Center B1 f Amazon D H A Amazon Company: CONDENSED INCOME STATEMENT Vertical Analysis (common size) is in millions) Fiscal year ended: Net Sales 7 (Revenue) & Cost of Goods Sold Gross Margin 9 (Gross Profit) Operating Expenses 10 Selling & Admin) Income from 11 Operations 12 Other Gains & Losses Income before income 13 Tax 14 Income Tax Expense Income before 15 Nonrecurring items Nonrecurring items 16 (Extraordinary 17 Net Income 19 20 Evaluation: 21 22 23 24 25 26 27 29 30 33 35 36 37 38 Income Statement Trend Balance Sheet Trend Balanc Income Statement Common size Excel File Edit View Insert Format Tools Data Window Help Home Insert Draw Page Layout Formulas Data Review View X Cut Calibri (Body). 11 A Wrap Text Copy Paste B I , Format Merge & Center B1 fx Amazon D G Company Amazon CONDENSED CLASSIFIED BALANCE SHEET Vertical Analysis common- is in millions) 6 Dated: 7 Current Assets Property. Plant,& & Equipment.net 9 Other Assets 10 TOTAL AND 11 12 Current Liabilities 13 Long term Liabilities 14 Contributed Capital 15 Retained Ernie Treasury Stock & Other 16 Stockholders' Equity TOTAL Liabilities & 17 Stockholders' Equity 18 19 20 Evaluation 21 22 23 24 25 26 27 28 30 35 18 Income Statement Trend Balance Sheet Trend Income Statement Commons Balance Shes Home Insert Formulas Data Review View X cut Draw Page Layout Calibri (Body). 11 AA Wrap Text Paste Copy Forma . I U A. li IND - Merge & Cente 1 fr Amazon B D 1 Company Amazon Liquidity Ratios 4 Fiscal year ended: Competitor Industry Average Working capital 5 6 Evaluation Current ratio 8 Evaluation Inventory turnover 9 10 Evaluation Days in Inventory 12 Evaluation Acct. rec. turnover 14 Evaluation Avg collection period 15 16 Evaluation Operating cycle 17 18 Evaluation 20 22 23 24 25 26 27 28 Excel File Edit View Insert Format Tools Data Window Help Homo Insert Draw Page Layout Formulas Data Review View Xcut Calibrl (Body). 11 Wrap Text G Copy Paste Merge & Center Format B1 x vfx Amazon A C 1 Company Amazon Solvency Ratios Competitor Industry Average Fiscal year ended: Debt to assets ratio Evaluation Times interest earned 7 Evaluation Free cash flow he was 10 Evaluation 12 15 16 17 12 19 20 21 22 24 25 26 27 28 Cut Calibri (Body) 11 AA Wrap Copy Paste B IU Format A Merge B1 Jx Amazon A D G Amazon 1 Company 2 3 Profitability Ratios 4 Fiscal year ended: Earnings per share Competitor Industry Average 5 ww com shot 6 Evaluation Price-earnings ratio 7 w 8 Evaluation Gross profit rate 9 10 Evaluation Profit margin Net 11 12 Evaluation Return on assets 13 m 14 Evaluation Asset turnover 15 16 Evaluation Payout ratio 17 18 Evaluation Return on Sequity 19 - 20 Evaluation 21 22 23 24 25 26 27 "Would you advise a friend to invest in this company?" Prepare a report providing investment advice based upon your research and analysis of your chosen company's financial information. The report should present historical , competitive and financial research that supports advice about investing in your company. The report should be approximately one page (500 words) excluding the appendix and include: a brief introduction with background information about your company and related industry, your recommendation supported by your analysis, and . an appendix which contains the following supporting documentation Horizontal Analysis (income statement & balance sheet) Vertical Analysis (income statement & balance sheet) Liquidity Ratios Profitability Ratios oSolvency Ratios Paste * Format B1 fx Amazon D A Amaton 1 Company CONDENSED INCOME STATEMENT Horizontal Analysis (trend) 5 in millions) Amount of increase or (Decrease) Percent of Increase or Decrease 6 Fiscal year ended Net Sales 7 (Revenue) 8 Cost of Goods Sold Gross Margin 9 (Gross Profit) Operating Expenses 10 Selling & Admin) Income from 11 Operations 12 Other Gains & Losses Income before income 13 Tax 14 Income Tax Expense Income before 15 Nonrecurring items Nonrecurring Items 16 Extraordinary 17 Net Income 18 19 20 21 Evaluation: 22 23 25 26 27 28 29 30 31 33 34 35 37 Income Statement Trend Balance Sheet Trend Income Statement Common size CUT Calibri (Body) 11 A- Copy Paste B I U A lil Format B1 fx Amazon B C 1 Company Amazon CONDENSED CLASSIFIED BALANCE SHEET Horizontal Analysis (trend) is in millions Amount of Increase or Decrease Percent of Increase or Decrease] 6 Dated: 7 Current Assets Property, Plant,& 8 Equipment, net 9 Other Assets 10 TOTAL Assets 11 12 Current Liabilities 13 Long-term Liabilities 14 Contributed Capital 15 Retained Earnings Treasury Stock & Other 16 Stockholders' Equity TOTAL Uabilities & 17 Stockholders' Equity 18 19 20 Evaluation: 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 Home insert Draw Pagu Layout rolls Urata NOVO VIC X Cut Calibri (Body) 11 A- A Wrap Text Paste Copy Format B I . + Merge & Center B1 f Amazon D H A Amazon Company: CONDENSED INCOME STATEMENT Vertical Analysis (common size) is in millions) Fiscal year ended: Net Sales 7 (Revenue) & Cost of Goods Sold Gross Margin 9 (Gross Profit) Operating Expenses 10 Selling & Admin) Income from 11 Operations 12 Other Gains & Losses Income before income 13 Tax 14 Income Tax Expense Income before 15 Nonrecurring items Nonrecurring items 16 (Extraordinary 17 Net Income 19 20 Evaluation: 21 22 23 24 25 26 27 29 30 33 35 36 37 38 Income Statement Trend Balance Sheet Trend Balanc Income Statement Common size Excel File Edit View Insert Format Tools Data Window Help Home Insert Draw Page Layout Formulas Data Review View X Cut Calibri (Body). 11 A Wrap Text Copy Paste B I , Format Merge & Center B1 fx Amazon D G Company Amazon CONDENSED CLASSIFIED BALANCE SHEET Vertical Analysis common- is in millions) 6 Dated: 7 Current Assets Property. Plant,& & Equipment.net 9 Other Assets 10 TOTAL AND 11 12 Current Liabilities 13 Long term Liabilities 14 Contributed Capital 15 Retained Ernie Treasury Stock & Other 16 Stockholders' Equity TOTAL Liabilities & 17 Stockholders' Equity 18 19 20 Evaluation 21 22 23 24 25 26 27 28 30 35 18 Income Statement Trend Balance Sheet Trend Income Statement Commons Balance Shes Home Insert Formulas Data Review View X cut Draw Page Layout Calibri (Body). 11 AA Wrap Text Paste Copy Forma . I U A. li IND - Merge & Cente 1 fr Amazon B D 1 Company Amazon Liquidity Ratios 4 Fiscal year ended: Competitor Industry Average Working capital 5 6 Evaluation Current ratio 8 Evaluation Inventory turnover 9 10 Evaluation Days in Inventory 12 Evaluation Acct. rec. turnover 14 Evaluation Avg collection period 15 16 Evaluation Operating cycle 17 18 Evaluation 20 22 23 24 25 26 27 28 Excel File Edit View Insert Format Tools Data Window Help Homo Insert Draw Page Layout Formulas Data Review View Xcut Calibrl (Body). 11 Wrap Text G Copy Paste Merge & Center Format B1 x vfx Amazon A C 1 Company Amazon Solvency Ratios Competitor Industry Average Fiscal year ended: Debt to assets ratio Evaluation Times interest earned 7 Evaluation Free cash flow he was 10 Evaluation 12 15 16 17 12 19 20 21 22 24 25 26 27 28 Cut Calibri (Body) 11 AA Wrap Copy Paste B IU Format A Merge B1 Jx Amazon A D G Amazon 1 Company 2 3 Profitability Ratios 4 Fiscal year ended: Earnings per share Competitor Industry Average 5 ww com shot 6 Evaluation Price-earnings ratio 7 w 8 Evaluation Gross profit rate 9 10 Evaluation Profit margin Net 11 12 Evaluation Return on assets 13 m 14 Evaluation Asset turnover 15 16 Evaluation Payout ratio 17 18 Evaluation Return on Sequity 19 - 20 Evaluation 21 22 23 24 25 26 27