i need to solve all the problems on these pic please from 1 to 19 and the instruction for these problems is on the side of the pages

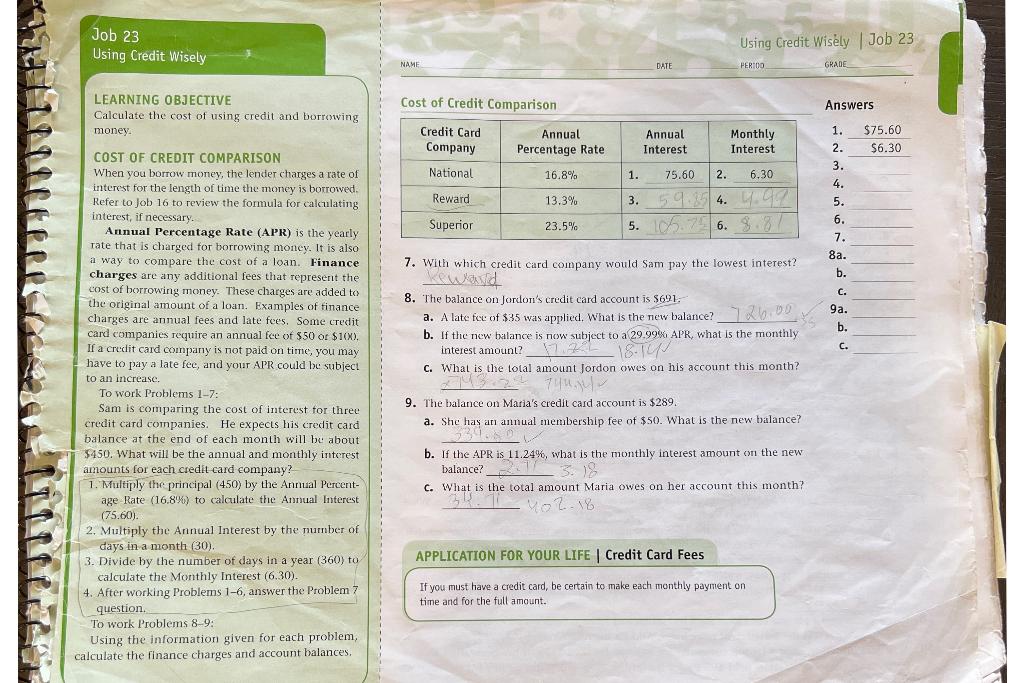

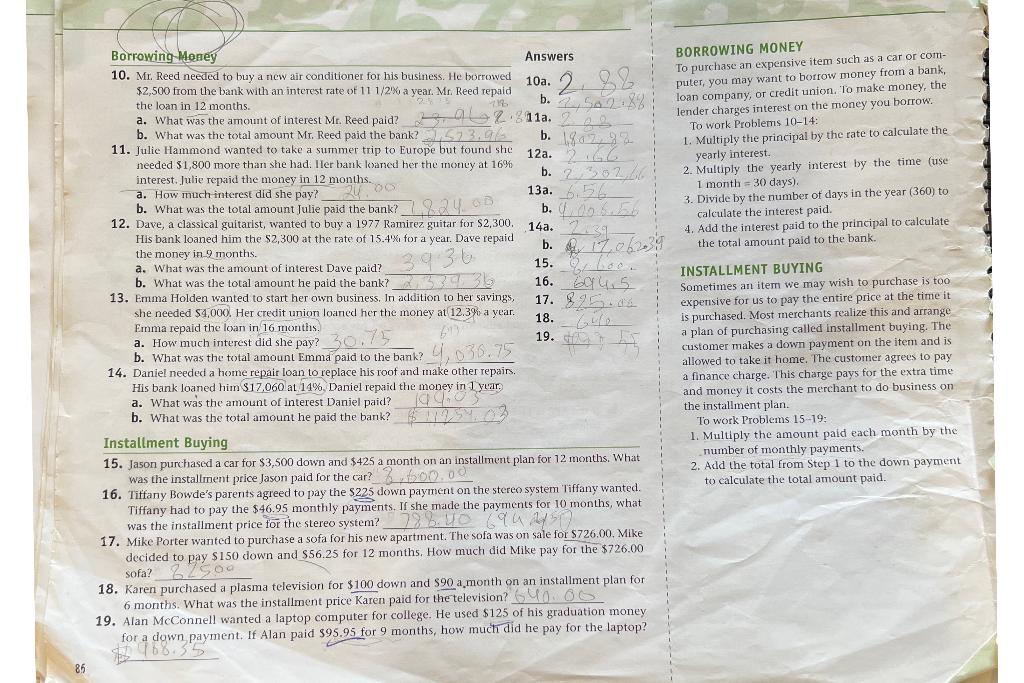

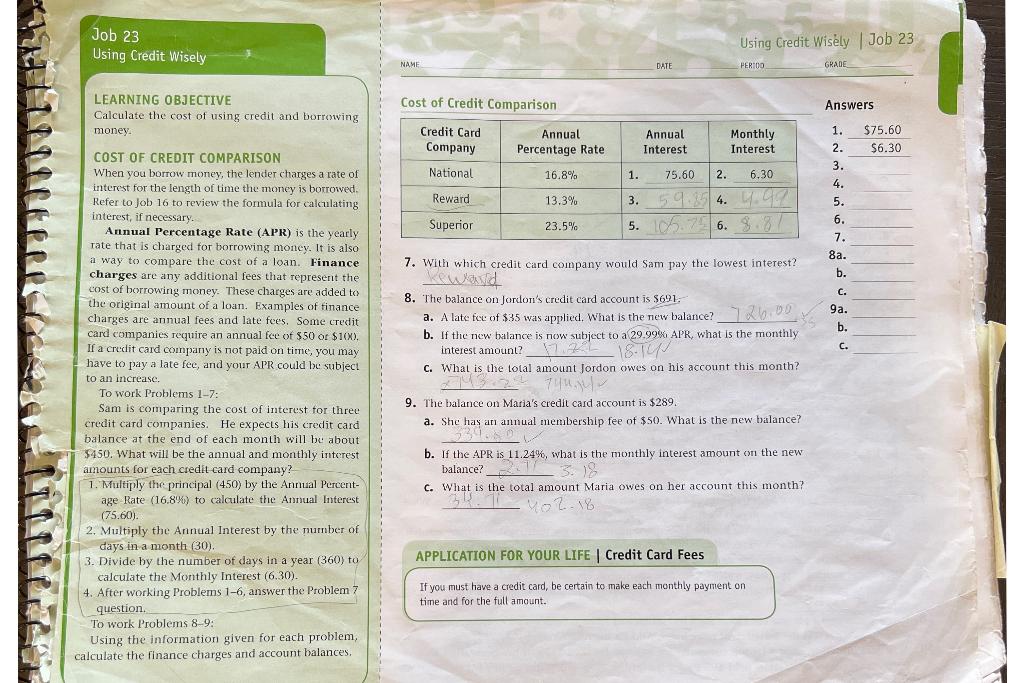

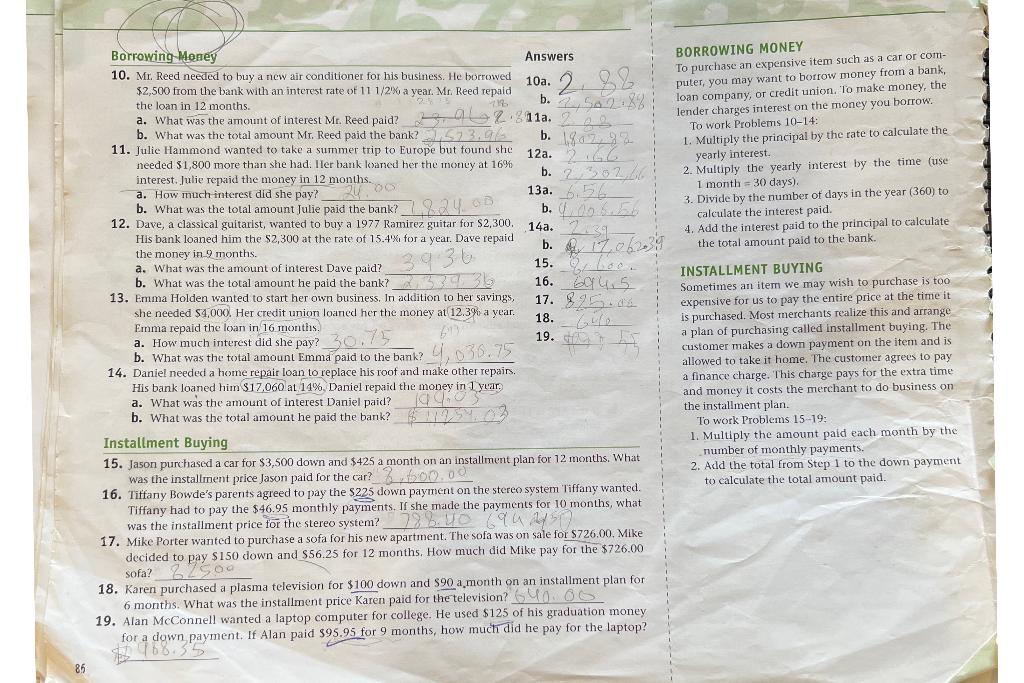

LEARNING OBJECTIVE Calculate the cost of using credit and borrowing money. COST OF CREDIT COMPARISON When you borrow money, the lender charges a rate of interest for the length of time the money is borrotved. Refer to Job 16 to review the formula for calculating interest, if necessary. Annual Percentage Rate (APR) is the yearly rate that is charged for borrowing money. It is also a way to compare the cost of a loan. Finance 7. With which credit card company would Sam pay the lowest interest? charges are any additional fees that represent the cost of borrowing money. These charges are added to the original amount of a loan. Examples of tinance 8. The balance on Jordon's credit card account is $621. charges are annual fees and late fees. Some credit a. A late fec of $35 was applied. What is the new balance? card companies require an annual fee of $50 of $100 ), b. If the new bilance is now subject to a 29,99%, APR, what is the monthly If a credit card company is not paid on time, you may interest amount? have to pay a late fee, and your APR could be subject c. What is the total amount Jordon owes on his account this month? to an increase. To work Problems 1-7: Sam is comparing the cost of interest for three 9. The balance on Maria's credit card account is $289. credit card companies. He expects his credit card a. She has an annual membership fee of $50. What is the new balance? balance at the end of each month will be about \$450. What will be the annual and monthly interest amounts for each credit card company? 1. Multiply the principal (450) by the Annual Percentage Rate (16.8%) to calculate the Annual Interest (75.60). 2. Multiply the Annual Interest by the number of days in a month (30). 3. Divide by the number of days in a year (360) to calculate the Monthly Interest (6.30). 4. After working Problems 1-6, answer the Problem 7 question. To work Problems 8-9: Using the information given for each problem, calculate the finance charges and account balances. Borrowing 4 dertey Answers BORROWING MONEY 10. Mr. Reed needed to buy a new air conditioner for his business. He borrowed To purchase an expensive item such as a car or computer, you may want to borrow money from a bank, $2,500 from the bank with an interest rate of 111/29 a year. Mr. Reed repaid the loan in 12 months. b. a. What was the amount of interest Mr. Reed paid? To work Problems 10-14: b. What was the total amount Mr. Reed paid the bank? b. 11. Julie Hammond wanted to take a summer trip to Europe but found she 1. Multiply the principal by the rate to calculate the yearly interest. needed $1,800 more than she had. Her bank loaned her the money at 16% b. interest. Julie repaid the money in 12 months. 2. Multiply the yearly interest by the time (use 1 month =30 days). a. How much interest did she pay? 13 . b. What was the total amount Julie paid the bank? b. 3. Divide by the number of days in the year (360) to calculate the interest paid. 12. Dave, a classical guitarist, wanted to buy a 1977 Ramirez guitar for $2,300,14a. His bank loaned him the $2,300 at the rate of 15.4% for a year. Dave repaid the money in-9 months. b. QA 17,0,39 4. Add the interest paid to thount paid to the bank. a. What was the amount of interest Dave paid? INSTALLMENT BUYING b. What was the total amount he paid the bank? Sometimes an item we may wish to purchase is too 13. Emma Holden wanted to start her own business. In addition to her savings, she needed $4,000. Her credit union loaned her the money at 12.39 a year. Emma repaid the loan in 16 months. a. How much interest did she pay? b. What was the total amount Emma paid to the bank? 14. Daniel needed a home repair loan to replace his roof and make other repairs. His bank loaned him $17,060 at 14%. Daniel repaid the money in 1 year. a. What was the amount of interest Daniel paid? b. What was the total amount he paid the bank? Instaltment Buying 15. Jason purchased a car for $3,500 down and $425 a month on an installment plan for 12 months. What was the installment price Jason paid for the car? 16. Tiffany Bowde's parents agreed to pay the $225 down payment on the stereo system liffany wanted. Tiffany had to pay the $46.95 monthly payments. If she made the payments for 10 months, what was the installment price for the stereo system? 17. Mike Porter wanted to purchase a sofa for his new apartment. The sofa was on sale for $726.00. Mike decided to pay $150 down and $56.25 for 12 months. How much did Mike pay for the $726.00 sofa? 18. Karen purchased a plasma television for $100 down and $90 a month on an installment plan for 6 months. What was the installment price Karen paid for the television? 19. Alan McConnell wanted a laptop computer for college. He used $125 of his graduation money for a down payment. If Alan paid $95.95 for 9 months, how much did he pay for the laptop? LEARNING OBJECTIVE Calculate the cost of using credit and borrowing money. COST OF CREDIT COMPARISON When you borrow money, the lender charges a rate of interest for the length of time the money is borrotved. Refer to Job 16 to review the formula for calculating interest, if necessary. Annual Percentage Rate (APR) is the yearly rate that is charged for borrowing money. It is also a way to compare the cost of a loan. Finance 7. With which credit card company would Sam pay the lowest interest? charges are any additional fees that represent the cost of borrowing money. These charges are added to the original amount of a loan. Examples of tinance 8. The balance on Jordon's credit card account is $621. charges are annual fees and late fees. Some credit a. A late fec of $35 was applied. What is the new balance? card companies require an annual fee of $50 of $100 ), b. If the new bilance is now subject to a 29,99%, APR, what is the monthly If a credit card company is not paid on time, you may interest amount? have to pay a late fee, and your APR could be subject c. What is the total amount Jordon owes on his account this month? to an increase. To work Problems 1-7: Sam is comparing the cost of interest for three 9. The balance on Maria's credit card account is $289. credit card companies. He expects his credit card a. She has an annual membership fee of $50. What is the new balance? balance at the end of each month will be about \$450. What will be the annual and monthly interest amounts for each credit card company? 1. Multiply the principal (450) by the Annual Percentage Rate (16.8%) to calculate the Annual Interest (75.60). 2. Multiply the Annual Interest by the number of days in a month (30). 3. Divide by the number of days in a year (360) to calculate the Monthly Interest (6.30). 4. After working Problems 1-6, answer the Problem 7 question. To work Problems 8-9: Using the information given for each problem, calculate the finance charges and account balances. Borrowing 4 dertey Answers BORROWING MONEY 10. Mr. Reed needed to buy a new air conditioner for his business. He borrowed To purchase an expensive item such as a car or computer, you may want to borrow money from a bank, $2,500 from the bank with an interest rate of 111/29 a year. Mr. Reed repaid the loan in 12 months. b. a. What was the amount of interest Mr. Reed paid? To work Problems 10-14: b. What was the total amount Mr. Reed paid the bank? b. 11. Julie Hammond wanted to take a summer trip to Europe but found she 1. Multiply the principal by the rate to calculate the yearly interest. needed $1,800 more than she had. Her bank loaned her the money at 16% b. interest. Julie repaid the money in 12 months. 2. Multiply the yearly interest by the time (use 1 month =30 days). a. How much interest did she pay? 13 . b. What was the total amount Julie paid the bank? b. 3. Divide by the number of days in the year (360) to calculate the interest paid. 12. Dave, a classical guitarist, wanted to buy a 1977 Ramirez guitar for $2,300,14a. His bank loaned him the $2,300 at the rate of 15.4% for a year. Dave repaid the money in-9 months. b. QA 17,0,39 4. Add the interest paid to thount paid to the bank. a. What was the amount of interest Dave paid? INSTALLMENT BUYING b. What was the total amount he paid the bank? Sometimes an item we may wish to purchase is too 13. Emma Holden wanted to start her own business. In addition to her savings, she needed $4,000. Her credit union loaned her the money at 12.39 a year. Emma repaid the loan in 16 months. a. How much interest did she pay? b. What was the total amount Emma paid to the bank? 14. Daniel needed a home repair loan to replace his roof and make other repairs. His bank loaned him $17,060 at 14%. Daniel repaid the money in 1 year. a. What was the amount of interest Daniel paid? b. What was the total amount he paid the bank? Instaltment Buying 15. Jason purchased a car for $3,500 down and $425 a month on an installment plan for 12 months. What was the installment price Jason paid for the car? 16. Tiffany Bowde's parents agreed to pay the $225 down payment on the stereo system liffany wanted. Tiffany had to pay the $46.95 monthly payments. If she made the payments for 10 months, what was the installment price for the stereo system? 17. Mike Porter wanted to purchase a sofa for his new apartment. The sofa was on sale for $726.00. Mike decided to pay $150 down and $56.25 for 12 months. How much did Mike pay for the $726.00 sofa? 18. Karen purchased a plasma television for $100 down and $90 a month on an installment plan for 6 months. What was the installment price Karen paid for the television? 19. Alan McConnell wanted a laptop computer for college. He used $125 of his graduation money for a down payment. If Alan paid $95.95 for 9 months, how much did he pay for the laptop