I need to use Wave Accounting, I need help

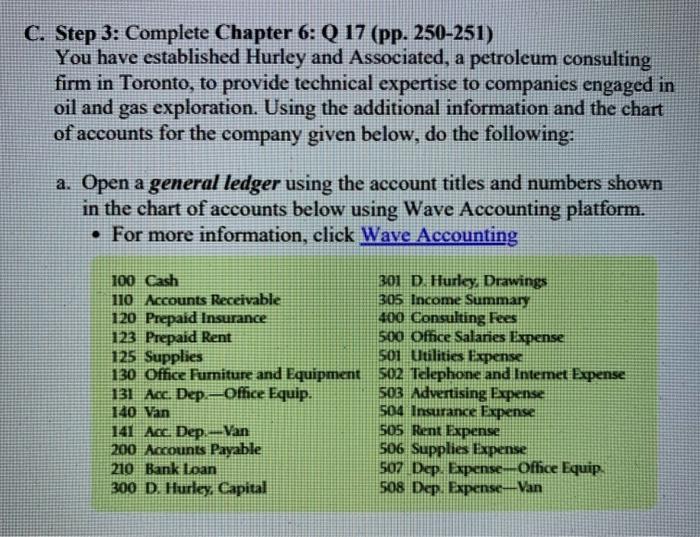

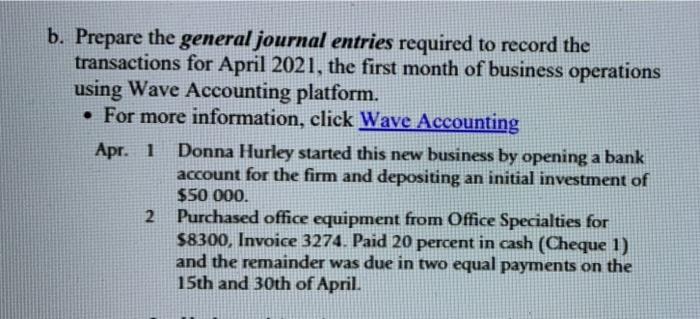

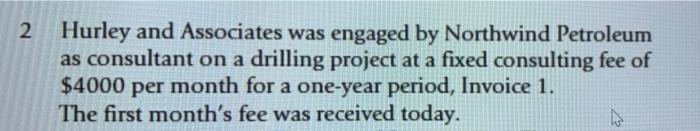

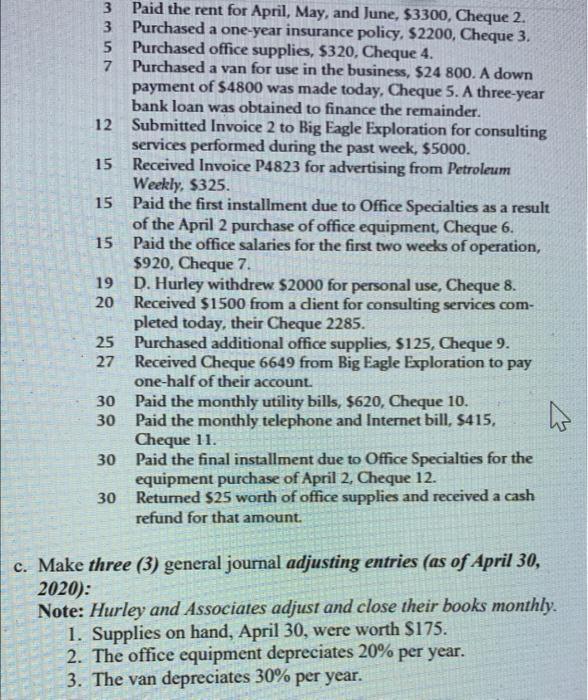

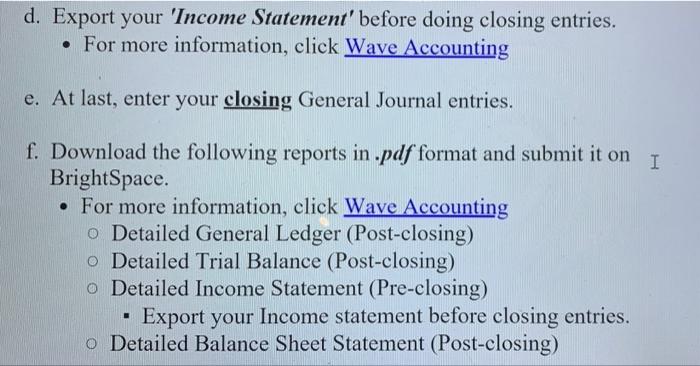

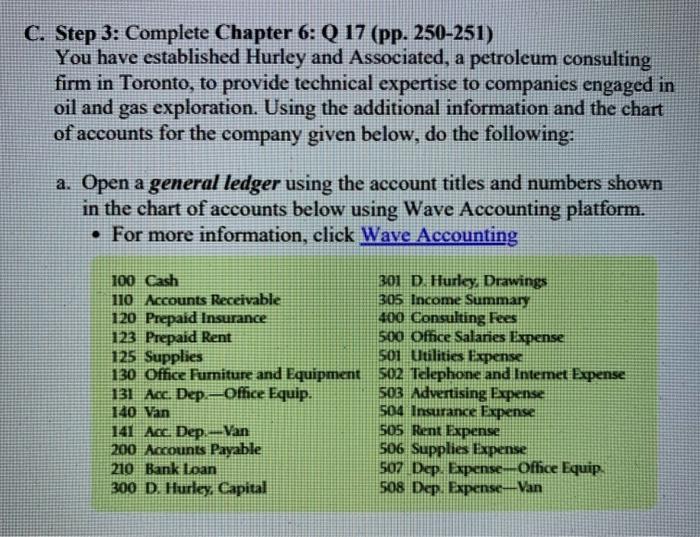

C. Step 3: Complete Chapter 6: Q 17 (pp. 250-251) You have established Hurley and Associated, a petroleum consulting firm in Toronto, to provide technical expertise to companies engaged in oil and gas exploration. Using the additional information and the chart of accounts for the company given below, do the following: a. Open a general ledger using the account titles and numbers shown in the chart of accounts below using Wave Accounting platform. For more information, click Wave Accounting 100 Cash 301 D. Hurky Drawings 110 Accounts Receivable 305 Income Summary 120 Prepaid Insurance 400 Consulting Fees 123 Prepaid Rent 500 Office Salaries Expense 125 Supplies 501 Utilities Expense 130 Office Furniture and Equipment 502 Telephone and Intemet Expense 131 Acc. Dep.Office Equip. 503 Advertising Expense 140 Van 504 Insurance Expense 141 Acc. Dep, _Van 505 Rent Expense 200 Accounts Payable 506 Supplies Expense 210 Bank Loan 507 Dep. Expense-Office Equip. 300 D. Hurley. Capital 508 Dep. Expense Van b. Prepare the general journal entries required to record the transactions for April 2021, the first month of business operations using Wave Accounting platform. For more information, click Wave Accounting Apr. 1 Donna Hurley started this new business by opening a bank account for the firm and depositing an initial investment of $50 000. 2 Purchased office equipment from Office Specialties for $8300, Invoice 3274. Paid 20 percent in cash (Cheque 1) and the remainder was due in two equal payments on the 15th and 30th of April. 2 Hurley and Associates was engaged by Northwind Petroleum as consultant on a drilling project at a fixed consulting fee of $4000 per month for a one-year period, Invoice 1. The first month's fee was received today. 3 Paid the rent for April, May, and June, $3300, Cheque 2. 3 Purchased a one-year insurance policy, 52200, Cheque 3. 5 Purchased office supplies, $320, Cheque 4. 7 Purchased a van for use in the business, $24 800. A down payment of $4800 was made today, Cheque 5. A three-year bank loan was obtained to finance the remainder. 12 Submitted Invoice 2 to Big Eagle Exploration for consulting services performed during the past week, $5000. 15 Received Invoice P4823 for advertising from Petroleum Weekly, $325. 15 Paid the first installment due to Office Specialties as a result of the April 2 purchase of office equipment, Cheque 6. 15 Paid the office salaries for the first two weeks of operation, $920, Cheque 7. 19 D. Hurley withdrew $2000 for personal use, Cheque 8. 20 Received $1500 from a dient for consulting services com- pleted today, their Cheque 2285. 25 Purchased additional office supplies, $125, Cheque 9. 27 Received Cheque 6649 from Big Eagle Exploration to pay one-half of their account. 30 Paid the monthly utility bills, $620, Cheque 10. 30 Paid the monthly telephone and Internet bill, S415, Cheque 11. 30 Paid the final installment due to Office Specialties for the equipment purchase of April 2, Cheque 12. 30 Returned $25 worth of office supplies and received a cash refund for that amount. a a c. Make three (3) general journal adjusting entries (as of April 30, 2020): Note: Hurley and Associates adjust and close their books monthly. 1. Supplies on hand, April 30, were worth $175. 2. The office equipment depreciates 20% per year. 3. The van depreciates 30% per year. d. Export your 'Income Statement' before doing closing entries. For more information, click Wave Accounting e. At last, enter your closing General Journal entries. I f. Download the following reports in .pdf format and submit it on BrightSpace. For more information, click Wave Accounting o Detailed General Ledger (Post-closing) o Detailed Trial Balance (Post-closing) o Detailed Income Statement (Pre-closing) Export your Income statement before closing entries. o Detailed Balance Sheet Statement (Post-closing)