Answered step by step

Verified Expert Solution

Question

1 Approved Answer

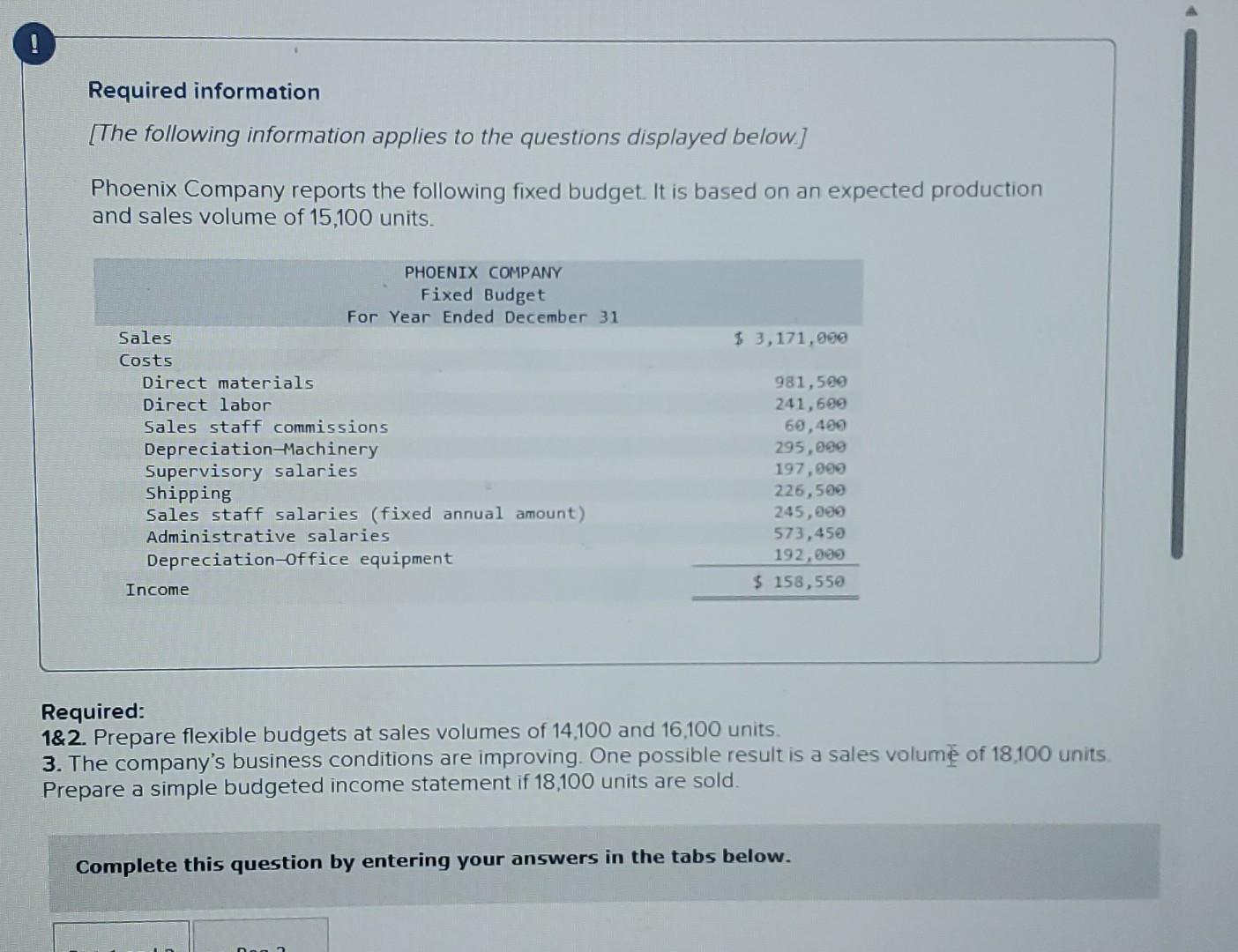

Required information [The following information applies to the questions displayed below] Phoenix Company reports the following fixed budget It is based on an expected production

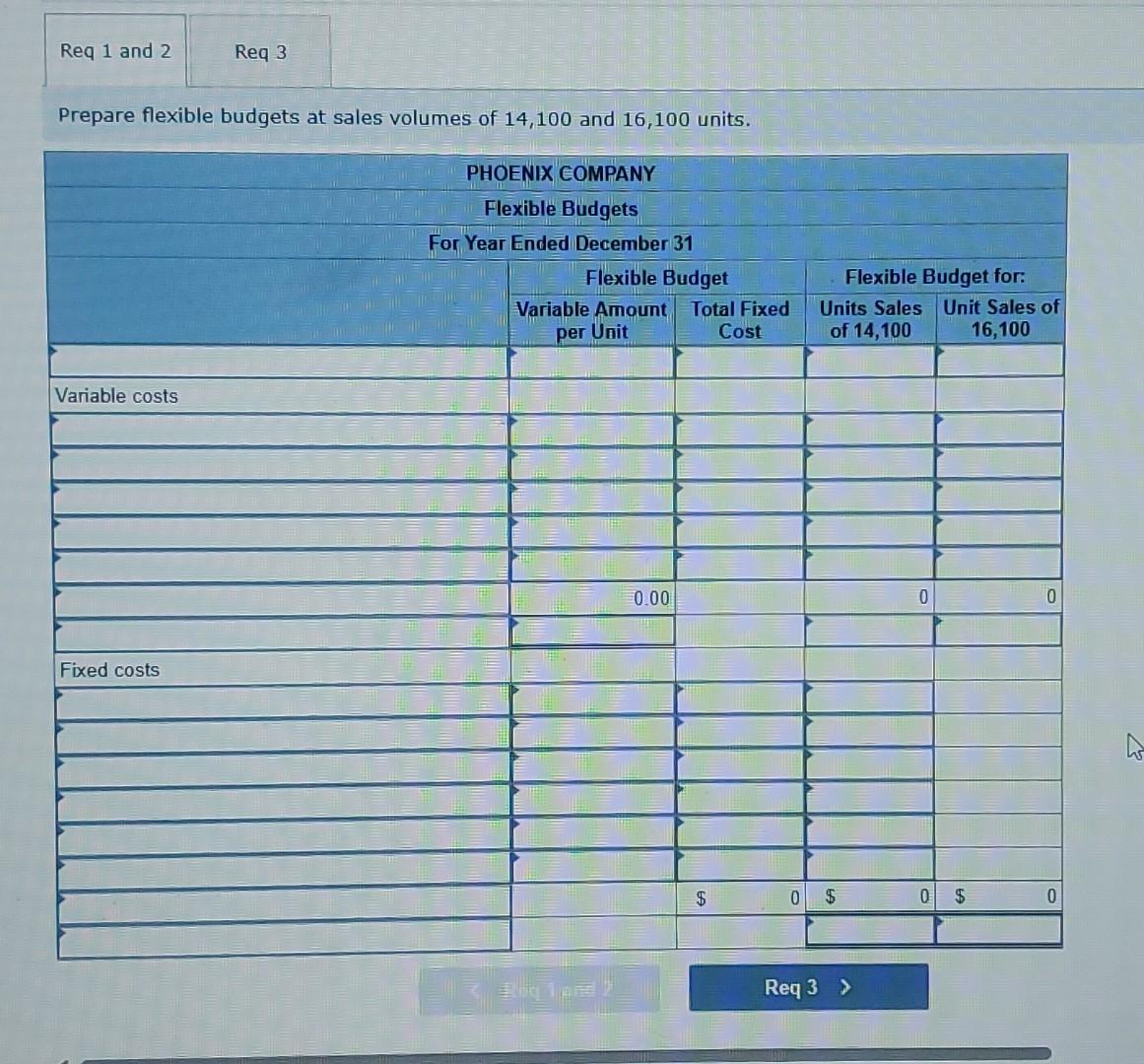

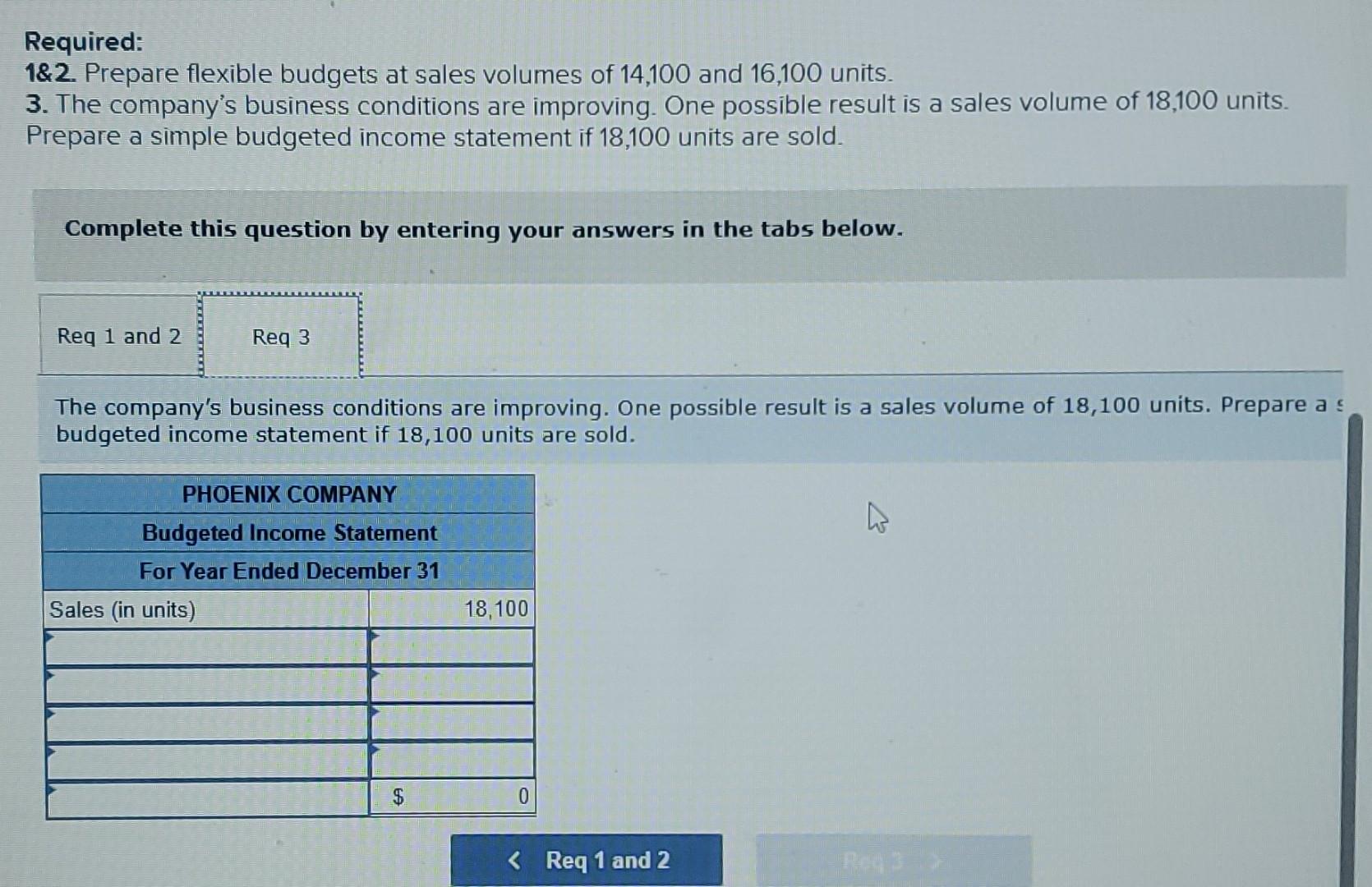

Required information [The following information applies to the questions displayed below] Phoenix Company reports the following fixed budget It is based on an expected production and sales volume of 15,100 units. Required: 1\&2. Prepare flexible budgets at sales volumes of 14,100 and 16,100 units. 3. The company's business conditions are improving. One possible result is a sales volume of 18,100 units Prepare a simple budgeted income statement if 18,100 units are sold. Complete this question by entering your answers in the tabs below. Prepare flexible budgets at sales volumes of 14,100 and 16,100 units. Required: 1\&2. Prepare flexible budgets at sales volumes of 14,100 and 16,100 units. 3. The company's business conditions are improving. One possible result is a sales volume of 18,100 units. Prepare a simple budgeted income statement if 18,100 units are sold. Complete this question by entering your answers in the tabs below. The company's business conditions are improving. One possible result is a sales volume of 18,100 units. Prepare a budgeted income statement if 18,100 units are sold

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started