I need to write up a case study considering the following questions. HELP.

Prepare "Metabical: Pricing, Packaging and Demand Forecasting Case. Questions for consideration:

- Calculate the 5-year unit demand forecast for Metabical using each of the three approaches considered by Printup. Assume that we have decided to package the product as a 4-week supply.

- Plot a price thermometer for Metabical. What are the arguments for setting the Metabical price high (towards the "ceiling") or low (towards the "floor")?

- Using your demand forecast from Question 1 above and the suggestions provided on the provided financial analysis template download download, what is the revenue, gross

- margin, and ROI for each price alternative and forecast scenario? Based on this analysis and any other relevant factors, what price do you recommend for a 4-week supply of Metabical? Why?

Case images bellow

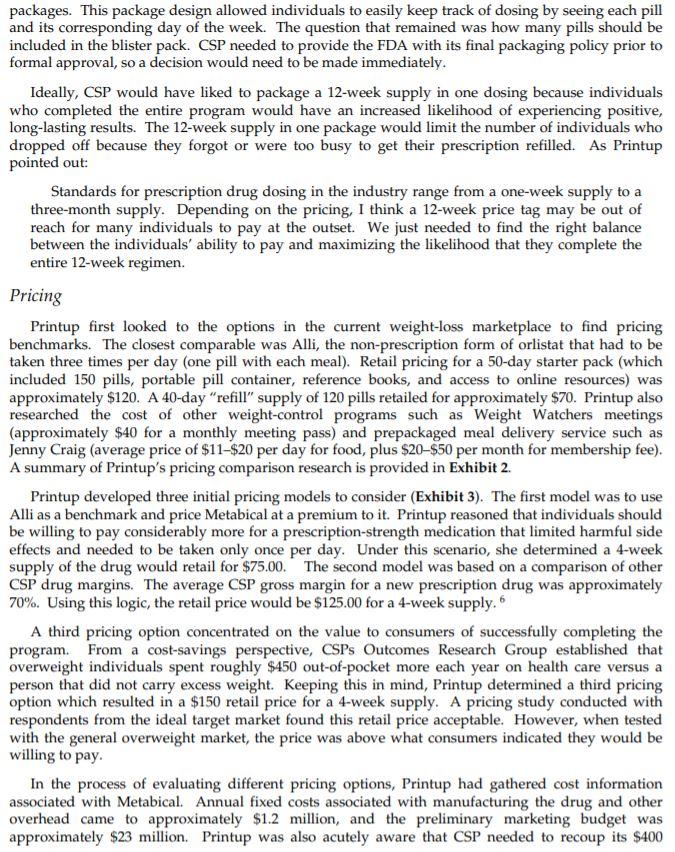

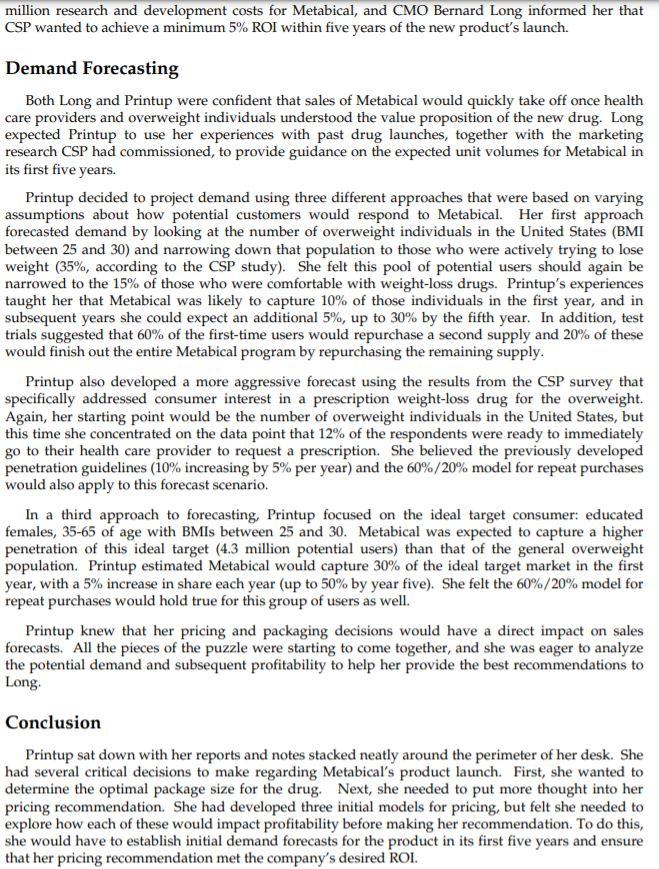

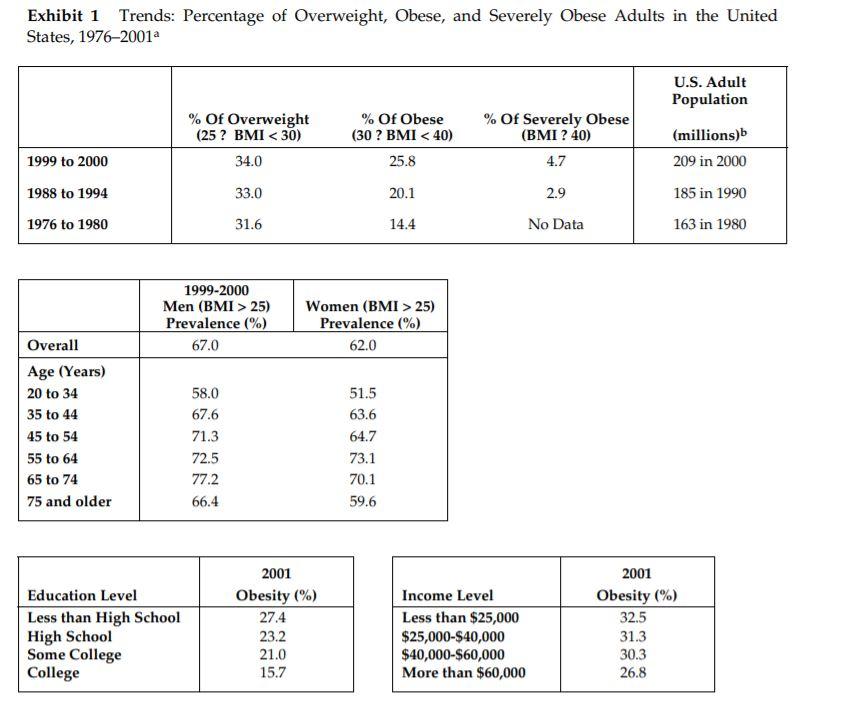

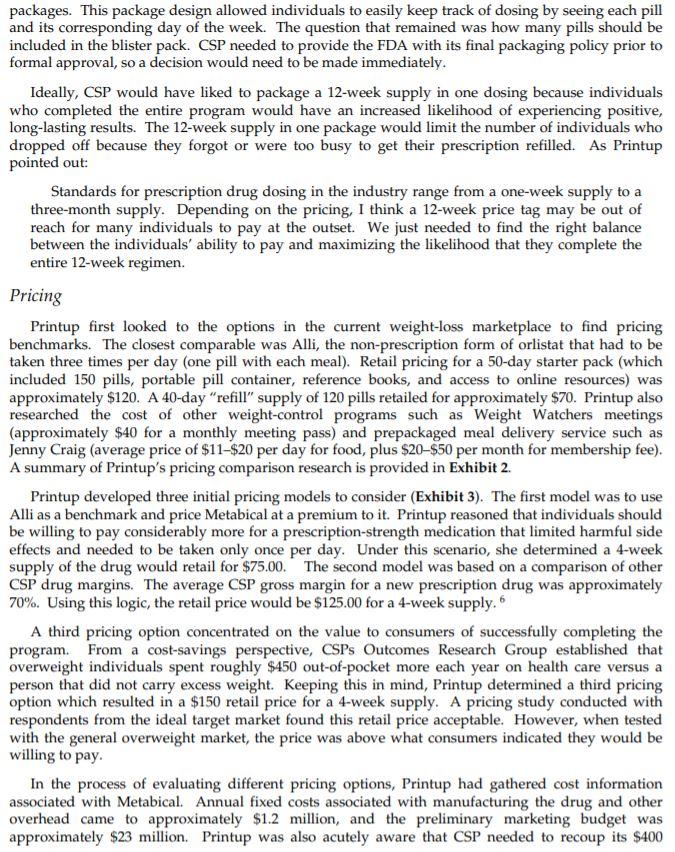

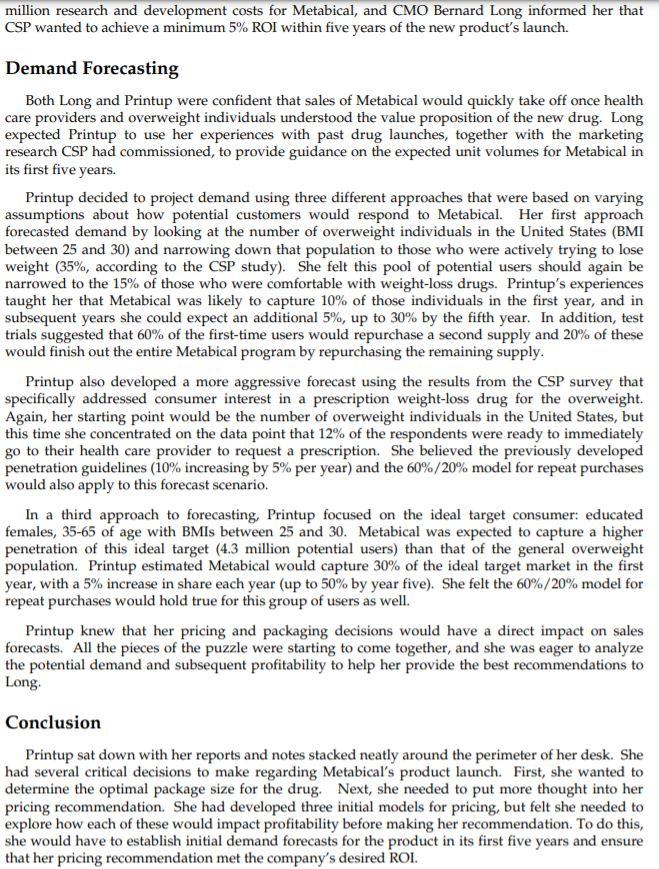

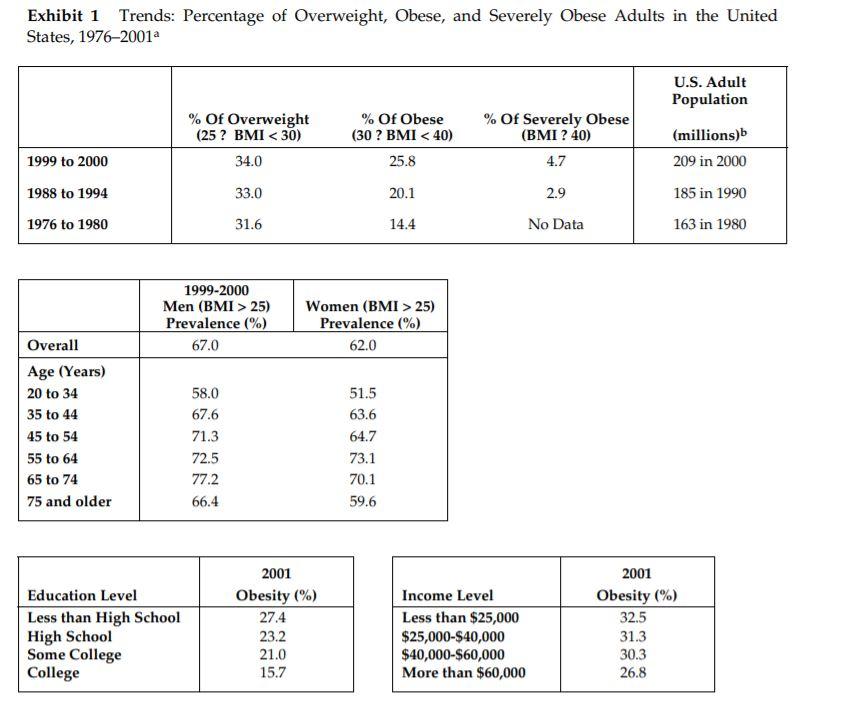

Metabical: Pricing, Packaging, and Demand Forecasting for a New Weight-Loss Drug In April 2008, after 10 years of testing and $400 million in research and development costs, Cambridge Sciences Pharmaceuticals' (CSP) newest prescription drug, Metabical (pronounced Meh- tuh-bye-cal), was about to receive its coveted Food and Drug Administration (FDA) approval. CSP was an international healthcare company with over $25 billion in sales in 2007. The company, based in Cambridge, Massachusetts, focused on developing, manufacturing, and marketing products that treated metabolic disorders, gastrointestinal diseases, and immune deficiencies, as well as other chronic and acute medical conditions. Metabical was part of a strategic initiative that would allow CSP to enter the $3.74 billion market for weight-control products in the United States. CSP's chief marketing officer, Bernard Long, said of the new product: Metabical is revolutionary. It will be the first and only prescription drug to receive FDA approval to meet the needs of the millions of individuals struggling with moderate weight-loss goals. Previous prescription weight-loss drugs had negative side effects that, in the agency's judgment, outweighed the benefits provided to individuals who were not considered obese. Metabical will be approved for use by those looking to shed between 10 to 30 pounds. Initial reviews from the medical community indicate a strong endorsement of Metabical. Our product will offer moderately overweight adults a medically proven, effective method to reach a desirable weight and improve their overall health. Barbara Printup, senior director of marketing for CSP, was in charge of managing the upcoming January 2009 launch of Metabical in the United States. Printup had spent over 20 years in the pharmaceutical industry and specialized in developing marketing strategies for new drugs. She had According to Mintel Interational Group's Weight Control Products - US - March 2007 Report, total U.S. retail sales of weight control products in 2007 were estimated at $3.717 billion. just concluded work on her sixth new-drug campaign, Zimistat, which was CSP's most successful product launch to date. It was now nine months from launch, and Printup was eager to finalize her launch plan in anticipation of the FDA's formal announcement of approval. In addition to developing initial demand forecasts for the product, she still had to determine the optimal packaging and pricing strategy for the drug. Obesity Epidemic in the United States The alarming rise in overweight Americans was of grave concern to those in the government and medical communities. According to the Centers for Disease Control and Prevention (CDC), heart disease, high blood pressure, type two diabetes, cancer, gallbladder disease, osteoarthritis, sleep apnea, and respiratory problems were just a few of the negative health risks that were directly linked to excess weight. The Surgeon General issued a warning that "even moderate weight excess (10 to 20 pounds for a person of average height) increases the risk of death, particularly among adults aged 30 to 64 years." In 1998, The National Institutes of Health (NIH) abandoned traditional height/weight charts to determine healthy weight and adopted the Body Mass Index (BMI) scale. The BMI scale calculated the relationship between weight and height associated with body fat and health risk, and was appropriate for both men and women. Three categories of excess weight were established for this scale. Those adults with BMIs over 25 were considered "overweight"; adults with BMIs over 30 were categorized as "obese"; and those with BMIs over 40 were categorized as "severely (or morbidly) obese." That excess weight was a growing problem in the United States could be seen in almost every demographic. By 2008, over 65% of the 230 million adults in the United States were considered overweight, obese, or severely obese. Excess weight affected both men and women, young and old, rich and poor, educated and non-educated. Exhibit 1 presents statistics on the pervasiveness of overweight and obese individuals in the United States. Competitive Landscape: Weight-Loss Options Weight-loss options ranged from prescription drugs to over-the-counter (OTC) remedies to various diet and exercise plans. Prescription weight-loss drugs were approved for use in both obese (BMI 2 30) and severely obese (BMI > 40) individuals. There were two categories of prescription diet drugs: appetite suppressants and fat-absorbing blockers. Sibutramine hydrochloride monohydrate (marketed as Meridia) worked to suppress appetite through increasing levels of serotonin and catecholamine in the body. However, serious potential side effects of this drug included hypertension, tachycardia, heart palpitations, seizures, and serotonin syndrome (a potentially life-threatening condition caused by elevated serotonin levels in the body). Orlistat (marketed as Xenical) blocked the body's absorption of fat. Potential side effects included liver damage, kidney stones, severe stomach pain, and gallbladder disease. Due to the serious side effects associated with both types of drugs, they were prescribed for use only by obese and severely obese individuals (BMI > 30). There were no prescription-drug options available specifically for the overweight segment (BMI between 25 and 30) in 2008. While a plethora of over-the-counter weight-loss solutions existed, only the OTC drug Alli was approved by the FDA for weight-loss use. Alli users took one pill with each meal. Alli was a reduced-strength version of the prescription drug orlistat and shared many of its negative side effects. Printup learned FDA regulators were reviewing over 30 reports of liver damage in patients taking Alli and Xenical between 1999 and 2008, including six cases of liver failure. All other OTC weight-loss solutions (e.g., hoodia, chromium, green tea extract, conjugated linoleic acid, chitosan, bitter orange, etc.) were categorized as herbal or dietary supplements by the FDA and were therefore unregulated by the agency. Various entities in the weight-loss industry had faced safety concerns, and over the years, some had been accused of deceptive marketing claims that dampened enthusiasm for the products. Since herbal remedies and dietary supplements did not require stringent FDA testing and approval, health complications from their use might not be discovered until after the product was widely in use. In one high profile example, the dietary supplement ephedra was linked to several cases of sudden cardiac death and other serious health risks. Consequently, the FDA instituted an outright ban on the purchase or sale of ephedra. Such events hurt industry credibility. In early 2007, the Federal Trade Commission required manufacturers of popular OTC weight-loss drugs TrimSpa, Xenadrine EFX, CortiSlim, and One-A- Day WeightSmart, to pay $25 million to settle allegations that the products' weight-loss claims were unsubstantiated. Due to the lack of regulation and safety concerns associated with OTC weight-loss drugs, many overweight individuals gravitated to other options such as diet plans (e.g., Atkins Nutritional Approach, The Zone Diet), exercise plans (e.g., fitness trainers at local gyms), meal replacement products (e.g., Slimfast), weight management support programs/meetings (e.g., Weight Watchers), and pre-portioned packaged food delivery services (e.g., Jenny Craig Direct, Nutrisystem). All of these conditions resulted in an attractive business opportunity for CSP. Long felt Metabical was well-positioned to capture share from those overweight individuals who were dissatisfied with current offerings. Metabical CSP's Metabical would be the first prescription drug approved specifically for overweight individuals (i.e., those with a BMI between 25 and 30). Individuals in this category had weight-loss goals of approximately 10 to 30 pounds. Metabical's formulation was not very effective in helping obese individuals lose weight and was therefore not recommended for their use. Metabical was a dual-layer, controlled-release formulation. The first layer contained an appetite suppressant, calosera, while the second layer contained a fat blocker and calorie absorption agent, meditonan. CSP's research and development team created these two ingredients and felt they were far superior to the current obesity drugs orlistat and sibutramine. Calosera and meditonan worked in low-dose levels and therefore were shown to have less adverse impact on heart, liver or gallbladder functions than orlistat and sibutramine. The main negative side effects of Metabical were experienced when users consumed high levels of fat and calories. These side effects were similar to the gastrointestinal discomfort of orlistat, only less severe. The FDA would only approve Metabical as a prescription medication (vs. OTC drug) due to the therapeutic strength of the ingredients calosera and meditonan. CSP researchers felt this formulation was essential to provide an aggressive treatment for weight loss. Clinical trials showed Metabical to be effective in helping overweight individuals lose weight. These studies found that overweight individuals with BMIs of 28 to 30 lost an average of 26 pounds when taking Metabical compared with an average loss of 6 pounds for those in a control group who took a placebo. For subjects with BMIs of 25 to 28, weight loss averaged 15 pounds for Metabical users versus an average of 2 pounds for those in the control group. Because Metabical had some negative side effects from excess fat and calories in the diet, it also helped with behavior modification and healthier eating habits. On average, individuals who took Metabical maintained weight loss levels within 10% of the clinical trials results for at least three years. Results from an extensive marketing survey of overweight individuals commissioned by CSP in 20075 revealed considerable interest in a prescription drug for moderate weight-loss goals. Highlights from the survey included the fact that 70% of the respondents were not satisfied with their current weight, 35% were actively trying to lose weight, and 15% of that number were comfortable using drugs to help reach their weight-loss goals. When respondents were asked specifically about a prescription weight-loss drug for overweight individuals, 12% said they would immediately make an appointment with their health care provider and request a prescription. In principle, Metabical would be attractive to all overweight individuals, but Printup established a primary target audience for the purpose of developing a communications strategy. Although there was a higher prevalence of overweight men (67%) than women (62%), and although obesity was more prevalent for those with less education, the ideal Metabical consumer was found to be overweight females, age 35 to 65, who were college-educated. Through comprehensive analysis of market data and CSP consumer studies, Printup concluded this target consumer was more health- conscious and visited the doctor more often. Moreover, the best consumers for Metabical were people who did not chase every new fad diet, and this target group was found to be most interested in protecting their health and raising self-esteem. Printup's research suggested approximately 4.3 million women fell into this target population. Packaging and Pricing Packaging and pricing Metabical were two critical launch-strategy decisions. Unlike other drugs in CSP's portfolio, most health insurance carriers were not expected to reimburse patients for Metabical costs. Initial reports found that few prescription drug plans would cover them. Printup was aware of the current standard in which many health insurance plans excluded anti-obesity drugs from coverage. As a result, Printup put a lot of thought into how many pills should be included in a package and how that package should be priced. Packaging In the FDA trials, the majority of individuals reached their weight-loss goals by week 12 and realized only minimal weight loss after that, so CSP expected the drug to be approved as a 12-week treatment plan. Because of its low-dose formulation, individuals needed to take Metabical at the same time every day. To be fully effective, the drug had to be a constant presence in the blood stream; if individuals skipped a day, effectiveness was significantly reduced. Therefore, CSP determined the optimal package would be a days-of-the-week, "blister"-style package similar to birth-control packages. This package design allowed individuals to easily keep track of dosing by seeing each pill and its corresponding day of the week. The question that remained was how many pills should be included in the blister pack. CSP needed to provide the FDA with its final packaging policy prior to formal approval, so a decision would need to be made immediately. Ideally, CSP would have liked to package a 12-week supply in one dosing because individuals who completed the entire program would have an increased likelihood of experiencing positive, long-lasting results. The 12-week supply in one package would limit the number of individuals who dropped off because they forgot or were too busy to get their prescription refilled. As Printup pointed out: Standards for prescription drug dosing in the industry range from a one-week supply to a three-month supply. Depending on the pricing, I think a 12-week price tag may be out of reach for many individuals to pay at the outset. We just needed to find the right balance between the individuals' ability to pay and maximizing the likelihood that they complete the entire 12-week regimen. Pricing Printup first looked to the options in the current weight-loss marketplace to find pricing benchmarks. The closest comparable was Alli, the non-prescription form of orlistat that had to be taken three times per day (one pill with each meal). Retail pricing for a 50-day starter pack (which included 150 pills, portable pill container, reference books, and access to online resources) was approximately $120. A 40-day "refill" supply of 120 pills retailed for approximately $70. Printup also researched the cost of other weight-control programs such as Weight Watchers meetings (approximately $40 for a monthly meeting pass) and prepackaged meal delivery service such as Jenny Craig (average price of $11-$20 per day for food, plus $20-$50 per month for membership fee). A summary of Printup's pricing comparison research is provided in Exhibit 2. Printup developed three initial pricing models to consider (Exhibit 3). The first model was to use Alli as a benchmark and price Metabical at a premium to it. Printup reasoned that individuals should be willing to pay considerably more for a prescription-strength medication that limited harmful side effects and needed to be taken only once per day. Under this scenario, she determined a 4-week supply of the drug would retail for $75.00. The second model was based on a comparison of other CSP drug margins. The average CSP gross margin for a new prescription drug was approximately 70%. Using this logic, the retail price would be $125.00 for a 4-week supply. A third pricing option concentrated on the value to consumers of successfully completing the program. From a cost-savings perspective, CSPs Outcomes Research Group established that overweight individuals spent roughly $450 out-of-pocket more each year on health care versus a person that did not carry excess weight. Keeping this in mind, Printup determined a third pricing option which resulted in a $150 retail price for a 4-week supply. A pricing study conducted with respondents from the ideal target market found this retail price acceptable. However, when tested with the general overweight market, the price was above what consumers indicated they would be willing to pay. In the process of evaluating different pricing options, Printup had gathered cost information associated with Metabical. Annual fixed costs associated with manufacturing the drug and other overhead came to approximately $1.2 million, and the preliminary marketing budget was approximately $23 million. Printup was also acutely aware that CSP needed to recoup its $400 million research and development costs for Metabical, and CMO Bernard Long informed her that CSP wanted to achieve a minimum 5% ROI within five years of the new product's launch. Demand Forecasting Both Long and Printup were confident that sales of Metabical would quickly take off once health care providers and overweight individuals understood the value proposition of the new drug. Long expected Printup to use her experiences with past drug launches, together with the marketing research CSP had commissioned, to provide guidance on the expected unit volumes for Metabical in its first five years. Printup decided to project demand using three different approaches that were based on varying assumptions about how potential customers would respond to Metabical. Her first approach forecasted demand by looking at the number of overweight individuals in the United States (BMI between 25 and 30) and narrowing down that population to those who were actively trying to lose weight (35%, according to the CSP study). She felt this pool of potential users should again be narrowed to the 15% of those who were comfortable with weight-loss drugs. Printup's experiences taught her that Metabical was likely to capture 10% of those individuals in the first year, and in subsequent years she could expect an additional 5%, up to 30% by the fifth year. In addition, test trials suggested that 60% of the first-time users would repurchase a second supply and 20% of these would finish out the entire Metabical program by repurchasing the remaining supply. Printup also developed a more aggressive forecast using the results from the CSP survey that specifically addressed consumer interest in a prescription weight-loss drug for the overweight. Again, her starting point would be the number of overweight individuals in the United States, but this time she concentrated on the data point that 12% of the respondents were ready to immediately go to their health care provider to request a prescription. She believed the previously developed penetration guidelines (10% increasing by 5% per year) and the 60%/20% model for repeat purchases would also apply to this forecast scenario. In a third approach to forecasting, Printup focused on the ideal target consumer: educated females, 35-65 of age with BMIs between 25 and 30. Metabical was expected to capture a higher penetration of this ideal target (4.3 million potential users) than that of the general overweight population. Printup estimated Metabical would capture 30% of the ideal target market in the first year, with a 5% increase in share each year (up to 50% by year five). She felt the 60%/20% model for repeat purchases would hold true for this group of users as well. Printup knew that her pricing and packaging decisions would have a direct impact on sales forecasts. All the pieces of the puzzle were starting to come together, and she was eager to analyze the potential demand and subsequent profitability to help her provide the best recommendations to Long Conclusion Printup sat down with her reports and notes stacked neatly around the perimeter of her desk. She had several critical decisions to make regarding Metabical's product launch. First, she wanted to determine the optimal package size for the drug. Next, she needed to put more thought into her pricing recommendation. She had developed three initial models for pricing, but felt she needed to explore how each of these would impact profitability before making her recommendation. To do this, she would have to establish initial demand forecasts for the product in its first five years and ensure that her pricing recommendation met the company's desired ROI. Exhibit 1 Trends: Percentage of Overweight, Obese, and Severely Obese Adults in the United States, 1976-2001a % Of Overweight (25 ? BMI 25) Prevalence (%) 67.0 Women (BMI > 25) Prevalence (%) 62.0 Overall Age (Years) 20 to 34 35 to 44 45 to 54 55 to 64 65 to 74 75 and older 58.0 67.6 71.3 72.5 77.2 66.4 51.5 63.6 64.7 73.1 70.1 59.6 Education Level Less than High School High School Some College College 2001 Obesity (%) 27.4 23.2 21.0 15.7 Income Level Less than $25,000 $25,000-$40,000 $40,000-$60,000 More than $60,000 2001 Obesity (%) 32.5 31.3 30.3 26.8 Exhibit 2 Weight-Loss Options: Price Comparison Summary Option Approximate Retail Price Description Non-prescription, FDA-approved weight loss drug for overweight individuals Alli $190 for three-month supply OTC drugs Herbal remedy, no FDA approval $300 for three-month supply Weight Watchers $120 for three months Jenny Craig Weight-control program and meetings Diet and weight-control program that included prepackaged, delivered meals and support $1,000-$1,600 for three months of program (includes food) Gym Membership Access to workout facilities $245 for three month membership and initiation fee a Alli price comparison included initial starter pack and 90-day supply of pills. OTC drug pricing based off MSRP; however deep discounts were usually available. Weight Watchers price included monthly meeting pass and access to internet tools. Jenny Craig price included membership fees and prepackaged food (replaced -50% - 75% of the client's normal food purchases). Average gym membership price included one-time initiation fee of approximately $125. Exhibit 3 Pricing Options: 4-Week Supply Retail price Retail gross margin Manufacturer price Variable cost Manufacturer gross margin Option 1 $ 75.00 $ 25.00 $ 50.00 $ 25,20 $ 24.80 50% Option 2 $ 125.00 $ 41.67 $ 83.33 $ 25,20 Option 3 $ 150.00 $ 50.00 $ 100.00 $ 25,20 $ 58.13 70% $ 74.80 75% Metabical: Pricing, Packaging, and Demand Forecasting for a New Weight-Loss Drug In April 2008, after 10 years of testing and $400 million in research and development costs, Cambridge Sciences Pharmaceuticals' (CSP) newest prescription drug, Metabical (pronounced Meh- tuh-bye-cal), was about to receive its coveted Food and Drug Administration (FDA) approval. CSP was an international healthcare company with over $25 billion in sales in 2007. The company, based in Cambridge, Massachusetts, focused on developing, manufacturing, and marketing products that treated metabolic disorders, gastrointestinal diseases, and immune deficiencies, as well as other chronic and acute medical conditions. Metabical was part of a strategic initiative that would allow CSP to enter the $3.74 billion market for weight-control products in the United States. CSP's chief marketing officer, Bernard Long, said of the new product: Metabical is revolutionary. It will be the first and only prescription drug to receive FDA approval to meet the needs of the millions of individuals struggling with moderate weight-loss goals. Previous prescription weight-loss drugs had negative side effects that, in the agency's judgment, outweighed the benefits provided to individuals who were not considered obese. Metabical will be approved for use by those looking to shed between 10 to 30 pounds. Initial reviews from the medical community indicate a strong endorsement of Metabical. Our product will offer moderately overweight adults a medically proven, effective method to reach a desirable weight and improve their overall health. Barbara Printup, senior director of marketing for CSP, was in charge of managing the upcoming January 2009 launch of Metabical in the United States. Printup had spent over 20 years in the pharmaceutical industry and specialized in developing marketing strategies for new drugs. She had According to Mintel Interational Group's Weight Control Products - US - March 2007 Report, total U.S. retail sales of weight control products in 2007 were estimated at $3.717 billion. just concluded work on her sixth new-drug campaign, Zimistat, which was CSP's most successful product launch to date. It was now nine months from launch, and Printup was eager to finalize her launch plan in anticipation of the FDA's formal announcement of approval. In addition to developing initial demand forecasts for the product, she still had to determine the optimal packaging and pricing strategy for the drug. Obesity Epidemic in the United States The alarming rise in overweight Americans was of grave concern to those in the government and medical communities. According to the Centers for Disease Control and Prevention (CDC), heart disease, high blood pressure, type two diabetes, cancer, gallbladder disease, osteoarthritis, sleep apnea, and respiratory problems were just a few of the negative health risks that were directly linked to excess weight. The Surgeon General issued a warning that "even moderate weight excess (10 to 20 pounds for a person of average height) increases the risk of death, particularly among adults aged 30 to 64 years." In 1998, The National Institutes of Health (NIH) abandoned traditional height/weight charts to determine healthy weight and adopted the Body Mass Index (BMI) scale. The BMI scale calculated the relationship between weight and height associated with body fat and health risk, and was appropriate for both men and women. Three categories of excess weight were established for this scale. Those adults with BMIs over 25 were considered "overweight"; adults with BMIs over 30 were categorized as "obese"; and those with BMIs over 40 were categorized as "severely (or morbidly) obese." That excess weight was a growing problem in the United States could be seen in almost every demographic. By 2008, over 65% of the 230 million adults in the United States were considered overweight, obese, or severely obese. Excess weight affected both men and women, young and old, rich and poor, educated and non-educated. Exhibit 1 presents statistics on the pervasiveness of overweight and obese individuals in the United States. Competitive Landscape: Weight-Loss Options Weight-loss options ranged from prescription drugs to over-the-counter (OTC) remedies to various diet and exercise plans. Prescription weight-loss drugs were approved for use in both obese (BMI 2 30) and severely obese (BMI > 40) individuals. There were two categories of prescription diet drugs: appetite suppressants and fat-absorbing blockers. Sibutramine hydrochloride monohydrate (marketed as Meridia) worked to suppress appetite through increasing levels of serotonin and catecholamine in the body. However, serious potential side effects of this drug included hypertension, tachycardia, heart palpitations, seizures, and serotonin syndrome (a potentially life-threatening condition caused by elevated serotonin levels in the body). Orlistat (marketed as Xenical) blocked the body's absorption of fat. Potential side effects included liver damage, kidney stones, severe stomach pain, and gallbladder disease. Due to the serious side effects associated with both types of drugs, they were prescribed for use only by obese and severely obese individuals (BMI > 30). There were no prescription-drug options available specifically for the overweight segment (BMI between 25 and 30) in 2008. While a plethora of over-the-counter weight-loss solutions existed, only the OTC drug Alli was approved by the FDA for weight-loss use. Alli users took one pill with each meal. Alli was a reduced-strength version of the prescription drug orlistat and shared many of its negative side effects. Printup learned FDA regulators were reviewing over 30 reports of liver damage in patients taking Alli and Xenical between 1999 and 2008, including six cases of liver failure. All other OTC weight-loss solutions (e.g., hoodia, chromium, green tea extract, conjugated linoleic acid, chitosan, bitter orange, etc.) were categorized as herbal or dietary supplements by the FDA and were therefore unregulated by the agency. Various entities in the weight-loss industry had faced safety concerns, and over the years, some had been accused of deceptive marketing claims that dampened enthusiasm for the products. Since herbal remedies and dietary supplements did not require stringent FDA testing and approval, health complications from their use might not be discovered until after the product was widely in use. In one high profile example, the dietary supplement ephedra was linked to several cases of sudden cardiac death and other serious health risks. Consequently, the FDA instituted an outright ban on the purchase or sale of ephedra. Such events hurt industry credibility. In early 2007, the Federal Trade Commission required manufacturers of popular OTC weight-loss drugs TrimSpa, Xenadrine EFX, CortiSlim, and One-A- Day WeightSmart, to pay $25 million to settle allegations that the products' weight-loss claims were unsubstantiated. Due to the lack of regulation and safety concerns associated with OTC weight-loss drugs, many overweight individuals gravitated to other options such as diet plans (e.g., Atkins Nutritional Approach, The Zone Diet), exercise plans (e.g., fitness trainers at local gyms), meal replacement products (e.g., Slimfast), weight management support programs/meetings (e.g., Weight Watchers), and pre-portioned packaged food delivery services (e.g., Jenny Craig Direct, Nutrisystem). All of these conditions resulted in an attractive business opportunity for CSP. Long felt Metabical was well-positioned to capture share from those overweight individuals who were dissatisfied with current offerings. Metabical CSP's Metabical would be the first prescription drug approved specifically for overweight individuals (i.e., those with a BMI between 25 and 30). Individuals in this category had weight-loss goals of approximately 10 to 30 pounds. Metabical's formulation was not very effective in helping obese individuals lose weight and was therefore not recommended for their use. Metabical was a dual-layer, controlled-release formulation. The first layer contained an appetite suppressant, calosera, while the second layer contained a fat blocker and calorie absorption agent, meditonan. CSP's research and development team created these two ingredients and felt they were far superior to the current obesity drugs orlistat and sibutramine. Calosera and meditonan worked in low-dose levels and therefore were shown to have less adverse impact on heart, liver or gallbladder functions than orlistat and sibutramine. The main negative side effects of Metabical were experienced when users consumed high levels of fat and calories. These side effects were similar to the gastrointestinal discomfort of orlistat, only less severe. The FDA would only approve Metabical as a prescription medication (vs. OTC drug) due to the therapeutic strength of the ingredients calosera and meditonan. CSP researchers felt this formulation was essential to provide an aggressive treatment for weight loss. Clinical trials showed Metabical to be effective in helping overweight individuals lose weight. These studies found that overweight individuals with BMIs of 28 to 30 lost an average of 26 pounds when taking Metabical compared with an average loss of 6 pounds for those in a control group who took a placebo. For subjects with BMIs of 25 to 28, weight loss averaged 15 pounds for Metabical users versus an average of 2 pounds for those in the control group. Because Metabical had some negative side effects from excess fat and calories in the diet, it also helped with behavior modification and healthier eating habits. On average, individuals who took Metabical maintained weight loss levels within 10% of the clinical trials results for at least three years. Results from an extensive marketing survey of overweight individuals commissioned by CSP in 20075 revealed considerable interest in a prescription drug for moderate weight-loss goals. Highlights from the survey included the fact that 70% of the respondents were not satisfied with their current weight, 35% were actively trying to lose weight, and 15% of that number were comfortable using drugs to help reach their weight-loss goals. When respondents were asked specifically about a prescription weight-loss drug for overweight individuals, 12% said they would immediately make an appointment with their health care provider and request a prescription. In principle, Metabical would be attractive to all overweight individuals, but Printup established a primary target audience for the purpose of developing a communications strategy. Although there was a higher prevalence of overweight men (67%) than women (62%), and although obesity was more prevalent for those with less education, the ideal Metabical consumer was found to be overweight females, age 35 to 65, who were college-educated. Through comprehensive analysis of market data and CSP consumer studies, Printup concluded this target consumer was more health- conscious and visited the doctor more often. Moreover, the best consumers for Metabical were people who did not chase every new fad diet, and this target group was found to be most interested in protecting their health and raising self-esteem. Printup's research suggested approximately 4.3 million women fell into this target population. Packaging and Pricing Packaging and pricing Metabical were two critical launch-strategy decisions. Unlike other drugs in CSP's portfolio, most health insurance carriers were not expected to reimburse patients for Metabical costs. Initial reports found that few prescription drug plans would cover them. Printup was aware of the current standard in which many health insurance plans excluded anti-obesity drugs from coverage. As a result, Printup put a lot of thought into how many pills should be included in a package and how that package should be priced. Packaging In the FDA trials, the majority of individuals reached their weight-loss goals by week 12 and realized only minimal weight loss after that, so CSP expected the drug to be approved as a 12-week treatment plan. Because of its low-dose formulation, individuals needed to take Metabical at the same time every day. To be fully effective, the drug had to be a constant presence in the blood stream; if individuals skipped a day, effectiveness was significantly reduced. Therefore, CSP determined the optimal package would be a days-of-the-week, "blister"-style package similar to birth-control packages. This package design allowed individuals to easily keep track of dosing by seeing each pill and its corresponding day of the week. The question that remained was how many pills should be included in the blister pack. CSP needed to provide the FDA with its final packaging policy prior to formal approval, so a decision would need to be made immediately. Ideally, CSP would have liked to package a 12-week supply in one dosing because individuals who completed the entire program would have an increased likelihood of experiencing positive, long-lasting results. The 12-week supply in one package would limit the number of individuals who dropped off because they forgot or were too busy to get their prescription refilled. As Printup pointed out: Standards for prescription drug dosing in the industry range from a one-week supply to a three-month supply. Depending on the pricing, I think a 12-week price tag may be out of reach for many individuals to pay at the outset. We just needed to find the right balance between the individuals' ability to pay and maximizing the likelihood that they complete the entire 12-week regimen. Pricing Printup first looked to the options in the current weight-loss marketplace to find pricing benchmarks. The closest comparable was Alli, the non-prescription form of orlistat that had to be taken three times per day (one pill with each meal). Retail pricing for a 50-day starter pack (which included 150 pills, portable pill container, reference books, and access to online resources) was approximately $120. A 40-day "refill" supply of 120 pills retailed for approximately $70. Printup also researched the cost of other weight-control programs such as Weight Watchers meetings (approximately $40 for a monthly meeting pass) and prepackaged meal delivery service such as Jenny Craig (average price of $11-$20 per day for food, plus $20-$50 per month for membership fee). A summary of Printup's pricing comparison research is provided in Exhibit 2. Printup developed three initial pricing models to consider (Exhibit 3). The first model was to use Alli as a benchmark and price Metabical at a premium to it. Printup reasoned that individuals should be willing to pay considerably more for a prescription-strength medication that limited harmful side effects and needed to be taken only once per day. Under this scenario, she determined a 4-week supply of the drug would retail for $75.00. The second model was based on a comparison of other CSP drug margins. The average CSP gross margin for a new prescription drug was approximately 70%. Using this logic, the retail price would be $125.00 for a 4-week supply. A third pricing option concentrated on the value to consumers of successfully completing the program. From a cost-savings perspective, CSPs Outcomes Research Group established that overweight individuals spent roughly $450 out-of-pocket more each year on health care versus a person that did not carry excess weight. Keeping this in mind, Printup determined a third pricing option which resulted in a $150 retail price for a 4-week supply. A pricing study conducted with respondents from the ideal target market found this retail price acceptable. However, when tested with the general overweight market, the price was above what consumers indicated they would be willing to pay. In the process of evaluating different pricing options, Printup had gathered cost information associated with Metabical. Annual fixed costs associated with manufacturing the drug and other overhead came to approximately $1.2 million, and the preliminary marketing budget was approximately $23 million. Printup was also acutely aware that CSP needed to recoup its $400 million research and development costs for Metabical, and CMO Bernard Long informed her that CSP wanted to achieve a minimum 5% ROI within five years of the new product's launch. Demand Forecasting Both Long and Printup were confident that sales of Metabical would quickly take off once health care providers and overweight individuals understood the value proposition of the new drug. Long expected Printup to use her experiences with past drug launches, together with the marketing research CSP had commissioned, to provide guidance on the expected unit volumes for Metabical in its first five years. Printup decided to project demand using three different approaches that were based on varying assumptions about how potential customers would respond to Metabical. Her first approach forecasted demand by looking at the number of overweight individuals in the United States (BMI between 25 and 30) and narrowing down that population to those who were actively trying to lose weight (35%, according to the CSP study). She felt this pool of potential users should again be narrowed to the 15% of those who were comfortable with weight-loss drugs. Printup's experiences taught her that Metabical was likely to capture 10% of those individuals in the first year, and in subsequent years she could expect an additional 5%, up to 30% by the fifth year. In addition, test trials suggested that 60% of the first-time users would repurchase a second supply and 20% of these would finish out the entire Metabical program by repurchasing the remaining supply. Printup also developed a more aggressive forecast using the results from the CSP survey that specifically addressed consumer interest in a prescription weight-loss drug for the overweight. Again, her starting point would be the number of overweight individuals in the United States, but this time she concentrated on the data point that 12% of the respondents were ready to immediately go to their health care provider to request a prescription. She believed the previously developed penetration guidelines (10% increasing by 5% per year) and the 60%/20% model for repeat purchases would also apply to this forecast scenario. In a third approach to forecasting, Printup focused on the ideal target consumer: educated females, 35-65 of age with BMIs between 25 and 30. Metabical was expected to capture a higher penetration of this ideal target (4.3 million potential users) than that of the general overweight population. Printup estimated Metabical would capture 30% of the ideal target market in the first year, with a 5% increase in share each year (up to 50% by year five). She felt the 60%/20% model for repeat purchases would hold true for this group of users as well. Printup knew that her pricing and packaging decisions would have a direct impact on sales forecasts. All the pieces of the puzzle were starting to come together, and she was eager to analyze the potential demand and subsequent profitability to help her provide the best recommendations to Long Conclusion Printup sat down with her reports and notes stacked neatly around the perimeter of her desk. She had several critical decisions to make regarding Metabical's product launch. First, she wanted to determine the optimal package size for the drug. Next, she needed to put more thought into her pricing recommendation. She had developed three initial models for pricing, but felt she needed to explore how each of these would impact profitability before making her recommendation. To do this, she would have to establish initial demand forecasts for the product in its first five years and ensure that her pricing recommendation met the company's desired ROI. Exhibit 1 Trends: Percentage of Overweight, Obese, and Severely Obese Adults in the United States, 1976-2001a % Of Overweight (25 ? BMI 25) Prevalence (%) 67.0 Women (BMI > 25) Prevalence (%) 62.0 Overall Age (Years) 20 to 34 35 to 44 45 to 54 55 to 64 65 to 74 75 and older 58.0 67.6 71.3 72.5 77.2 66.4 51.5 63.6 64.7 73.1 70.1 59.6 Education Level Less than High School High School Some College College 2001 Obesity (%) 27.4 23.2 21.0 15.7 Income Level Less than $25,000 $25,000-$40,000 $40,000-$60,000 More than $60,000 2001 Obesity (%) 32.5 31.3 30.3 26.8 Exhibit 2 Weight-Loss Options: Price Comparison Summary Option Approximate Retail Price Description Non-prescription, FDA-approved weight loss drug for overweight individuals Alli $190 for three-month supply OTC drugs Herbal remedy, no FDA approval $300 for three-month supply Weight Watchers $120 for three months Jenny Craig Weight-control program and meetings Diet and weight-control program that included prepackaged, delivered meals and support $1,000-$1,600 for three months of program (includes food) Gym Membership Access to workout facilities $245 for three month membership and initiation fee a Alli price comparison included initial starter pack and 90-day supply of pills. OTC drug pricing based off MSRP; however deep discounts were usually available. Weight Watchers price included monthly meeting pass and access to internet tools. Jenny Craig price included membership fees and prepackaged food (replaced -50% - 75% of the client's normal food purchases). Average gym membership price included one-time initiation fee of approximately $125. Exhibit 3 Pricing Options: 4-Week Supply Retail price Retail gross margin Manufacturer price Variable cost Manufacturer gross margin Option 1 $ 75.00 $ 25.00 $ 50.00 $ 25,20 $ 24.80 50% Option 2 $ 125.00 $ 41.67 $ 83.33 $ 25,20 Option 3 $ 150.00 $ 50.00 $ 100.00 $ 25,20 $ 58.13 70% $ 74.80 75%