Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need trail balance and balnce sheet for the month of Decmber For this assignment i need to journalize the problems, put it in the

I need trail balance and balnce sheet for the month of Decmber

For this assignment i need to journalize the problems, put it in the general ledger and put it on the adjusted trial balance sheet. I still just need the adjusted trail balmce sheet

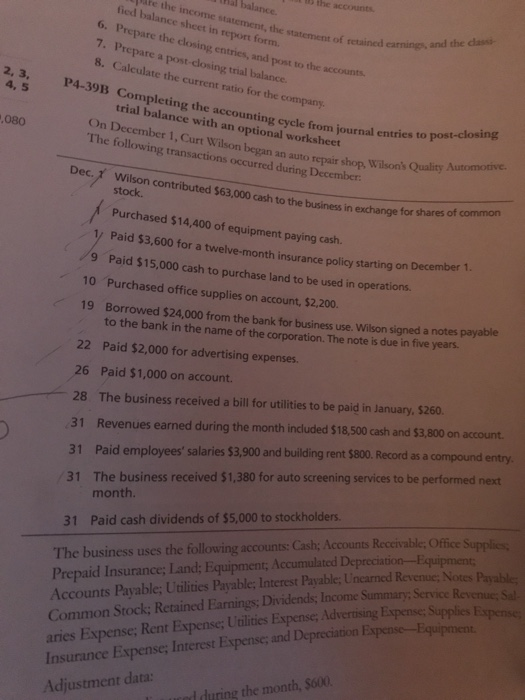

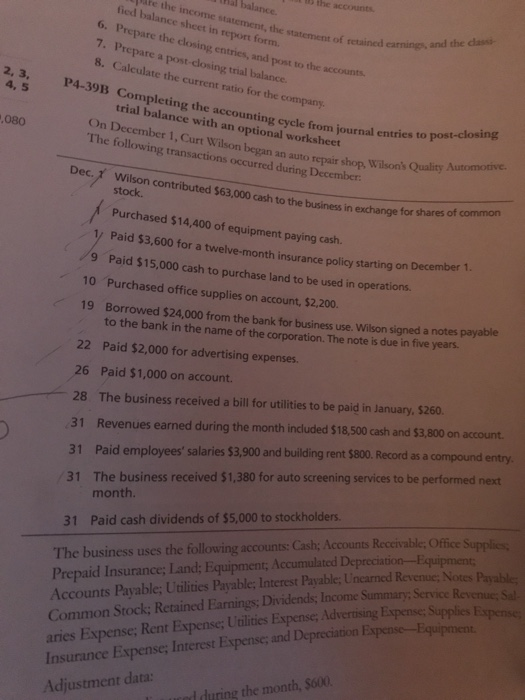

15 the accounts Tlhe the income statement, the statement of retained carnings fied balance sheet in report form. 6. Prepare the closing entries, and post to the accounts 7. Prepare a post-closing trial balance 8. Calculate the current ratio for the company. and the classs 2, 3. P4-39B Completing the accounting ce with an option yle from journal entries to post-closing journ On December 1,Curt Wilson began an auto repair shop, The following transactions occurred during December ,080 stock. 3,000 cash to the business in exchange for shares of common Purchased $14,400 of equipment paying cash. Paid $3,600 for a twelve-month insurance policy starting on December 1 9 Paid $15,000 cash to purchase land to be used in operations. 10 Purchased office supplies on account, $2,200. 19 Borrowed $24,000 from the bank for business use. Wilson signed a notes payable to the bank in the name of the corporation. The note is due in five years 22 Paid $2,000 for advertising expenses. 26 Paid $1,000 on account. 28 The business received a bill for utilities to be paid in January, S260. 31 Revenues earned during the month included $18,500 cash and $3,800 on account 31 Paid employees' salaries $3,900 and building rent $800. Record as a compound entry 31 The business received $1,380 for auto screening services to be performed next month. 31 Paid cash dividends of $5,000 to stockholders The business uses the following accounts: Cash; Accounts Receivable: Office Common Stock; Retained Earnings, Dividends Income Summary: Service Revenues sl aries Expense; Rent Expense; Ublities Expense, Advertising Expense Supplies Insurance Expense; Interest Expense, and Depreciation Expense -Equipment Adjustment data Prepaid Insurance; Land: Equipment, Accumulated Depreciation-Equipment Accounts Payable; Utilities Payable:; Interest Payable, Unearned Revenue; Notes Payable l during the month, $600. 15 the accounts Tlhe the income statement, the statement of retained carnings fied balance sheet in report form. 6. Prepare the closing entries, and post to the accounts 7. Prepare a post-closing trial balance 8. Calculate the current ratio for the company. and the classs 2, 3. P4-39B Completing the accounting ce with an option yle from journal entries to post-closing journ On December 1,Curt Wilson began an auto repair shop, The following transactions occurred during December ,080 stock. 3,000 cash to the business in exchange for shares of common Purchased $14,400 of equipment paying cash. Paid $3,600 for a twelve-month insurance policy starting on December 1 9 Paid $15,000 cash to purchase land to be used in operations. 10 Purchased office supplies on account, $2,200. 19 Borrowed $24,000 from the bank for business use. Wilson signed a notes payable to the bank in the name of the corporation. The note is due in five years 22 Paid $2,000 for advertising expenses. 26 Paid $1,000 on account. 28 The business received a bill for utilities to be paid in January, S260. 31 Revenues earned during the month included $18,500 cash and $3,800 on account 31 Paid employees' salaries $3,900 and building rent $800. Record as a compound entry 31 The business received $1,380 for auto screening services to be performed next month. 31 Paid cash dividends of $5,000 to stockholders The business uses the following accounts: Cash; Accounts Receivable: Office Common Stock; Retained Earnings, Dividends Income Summary: Service Revenues sl aries Expense; Rent Expense; Ublities Expense, Advertising Expense Supplies Insurance Expense; Interest Expense, and Depreciation Expense -Equipment Adjustment data Prepaid Insurance; Land: Equipment, Accumulated Depreciation-Equipment Accounts Payable; Utilities Payable:; Interest Payable, Unearned Revenue; Notes Payable l during the month, $600 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started