I NEED URGENT HELP WITH THIS QUESTION!!!

I NEED URGENT HELP WITH THIS QUESTION!!!

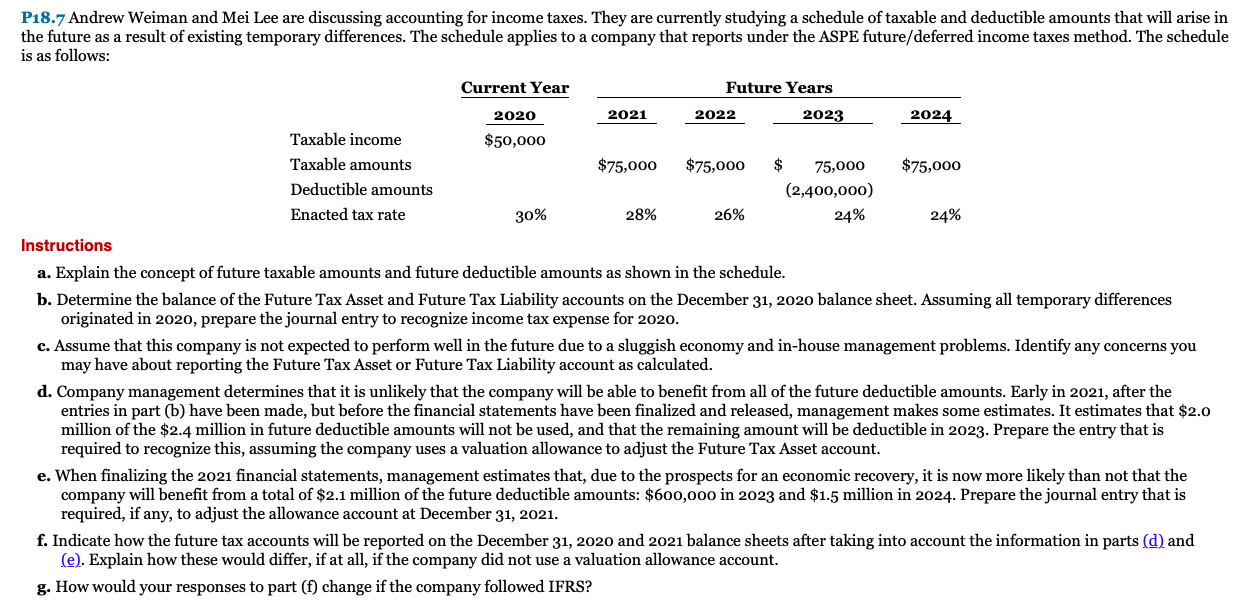

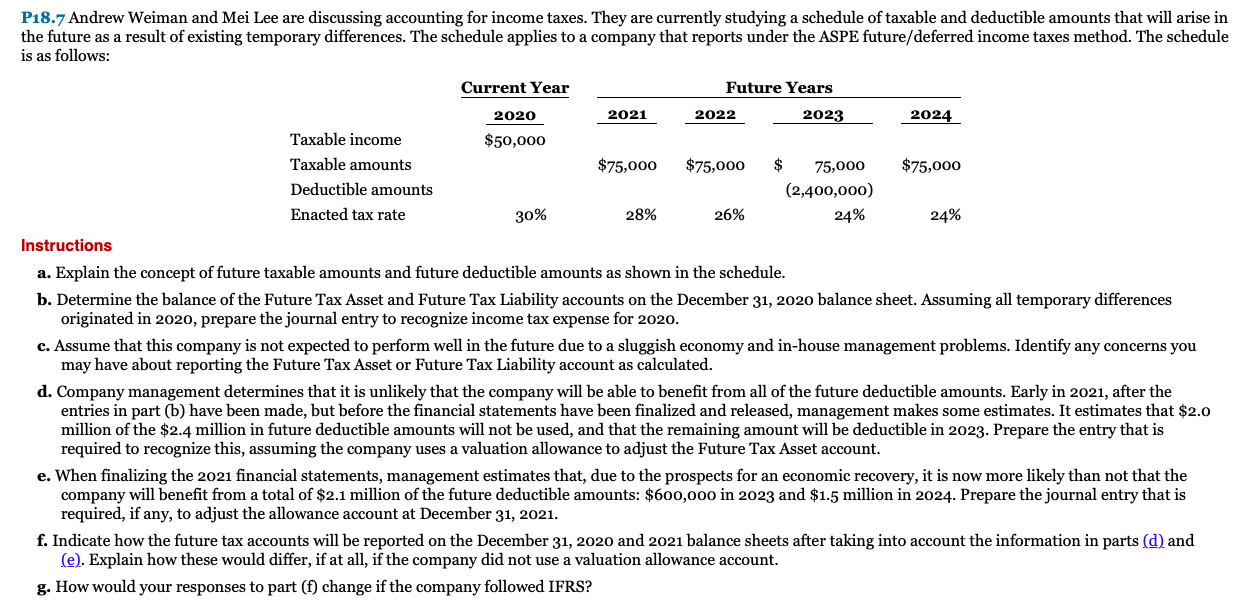

P18.7 Andrew Weiman and Mei Lee are discussing accounting for income taxes. They are currently studying a schedule of taxable and deductible amounts that will arise in the future as a result of existing temporary differences. The schedule applies to a company that reports under the ASPE future/deferred income taxes method. The schedule is as follows: Current Year Future Years 2021 2022 2023 2024 2020 $50,000 $75,000 $75,000 $75,000 Taxable income Taxable amounts Deductible amounts Enacted tax rate $ 75,000 (2,400,000) 24% 30% 28% 26% 24% Instructions a. Explain the concept of future taxable amounts and future deductible amounts as shown in the schedule. b. Determine the balance of the Future Tax Asset and Future Tax Liability accounts on the December 31, 2020 balance sheet. Assuming all temporary differences originated in 2020, prepare the journal entry to recognize income tax expense for 2020. c. Assume that this company is not expected to perform well in the future due to a sluggish economy and in-house management problems. Identify any concerns you may have about reporting the Future Tax Asset or Future Tax Liability account as calculated. d. Company management determines that it is unlikely that the company will be able to benefit from all of the future deductible amounts. Early in 2021, after the entries in part (b) have been made, but before the financial statements have been finalized and released, management makes some estimates. It estimates that $2.0 million of the $2.4 million in future deductible amounts will not be used, and that the remaining amount will be deductible in 2023. Prepare the entry that is required to recognize this, assuming the company uses a valuation allowance to adjust the Future Tax Asset account. e. When finalizing the 2021 financial statements, management estimates that, due to the prospects for an economic recovery, it is now more likely than not that the company will benefit from a total of $2.1 million of the future deductible amounts: $600,000 in 2023 and $1.5 million in 2024. Prepare the journal entry that is required, if any, to adjust the allowance account at December 31, 2021. f. Indicate how the future tax accounts will be reported on the December 31, 2020 and 2021 balance sheets after taking into account the information in parts (d) and (e). Explain how these would differ, if at all, if the company did not use a valuation allowance account. g. How would your responses to part (f) change if the company followed IFRS? P18.7 Andrew Weiman and Mei Lee are discussing accounting for income taxes. They are currently studying a schedule of taxable and deductible amounts that will arise in the future as a result of existing temporary differences. The schedule applies to a company that reports under the ASPE future/deferred income taxes method. The schedule is as follows: Current Year Future Years 2021 2022 2023 2024 2020 $50,000 $75,000 $75,000 $75,000 Taxable income Taxable amounts Deductible amounts Enacted tax rate $ 75,000 (2,400,000) 24% 30% 28% 26% 24% Instructions a. Explain the concept of future taxable amounts and future deductible amounts as shown in the schedule. b. Determine the balance of the Future Tax Asset and Future Tax Liability accounts on the December 31, 2020 balance sheet. Assuming all temporary differences originated in 2020, prepare the journal entry to recognize income tax expense for 2020. c. Assume that this company is not expected to perform well in the future due to a sluggish economy and in-house management problems. Identify any concerns you may have about reporting the Future Tax Asset or Future Tax Liability account as calculated. d. Company management determines that it is unlikely that the company will be able to benefit from all of the future deductible amounts. Early in 2021, after the entries in part (b) have been made, but before the financial statements have been finalized and released, management makes some estimates. It estimates that $2.0 million of the $2.4 million in future deductible amounts will not be used, and that the remaining amount will be deductible in 2023. Prepare the entry that is required to recognize this, assuming the company uses a valuation allowance to adjust the Future Tax Asset account. e. When finalizing the 2021 financial statements, management estimates that, due to the prospects for an economic recovery, it is now more likely than not that the company will benefit from a total of $2.1 million of the future deductible amounts: $600,000 in 2023 and $1.5 million in 2024. Prepare the journal entry that is required, if any, to adjust the allowance account at December 31, 2021. f. Indicate how the future tax accounts will be reported on the December 31, 2020 and 2021 balance sheets after taking into account the information in parts (d) and (e). Explain how these would differ, if at all, if the company did not use a valuation allowance account. g. How would your responses to part (f) change if the company followed IFRS

I NEED URGENT HELP WITH THIS QUESTION!!!

I NEED URGENT HELP WITH THIS QUESTION!!!