I need your help to analyze financial statement and analyze ratio between two companies using 10-k form.

My companies are Apple Inc. and Microsoft Corporation.

Apple Inc. 10-k

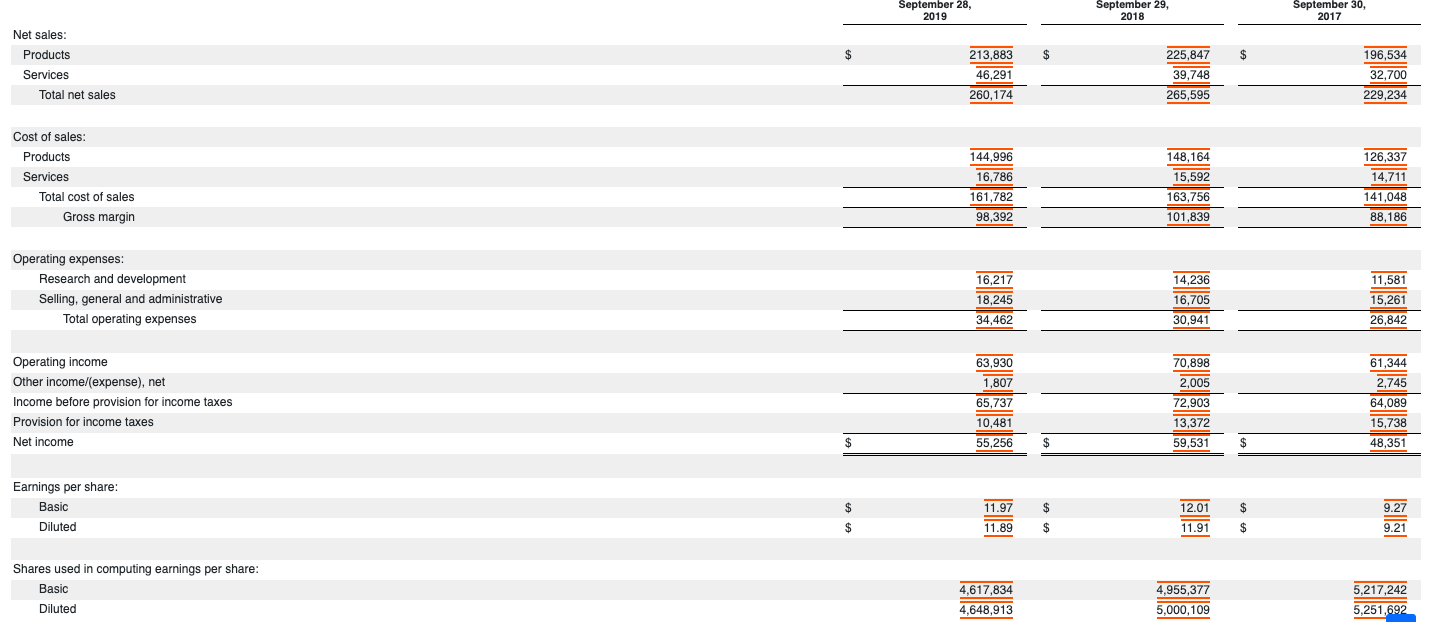

CONSOLIDATED STATEMENTS OF OPERATIONS

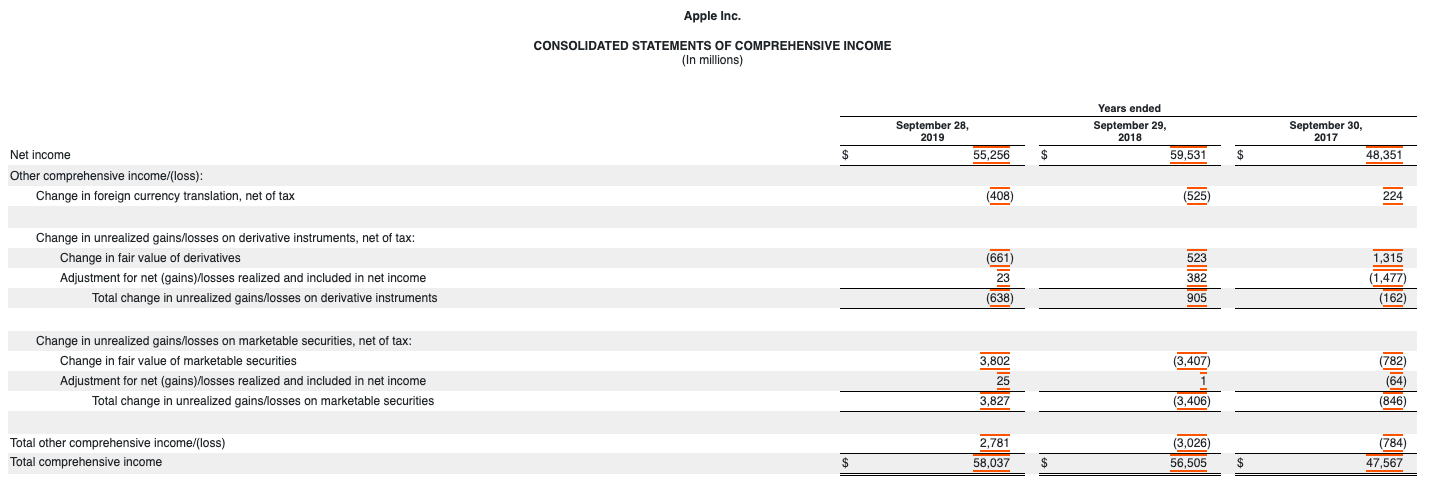

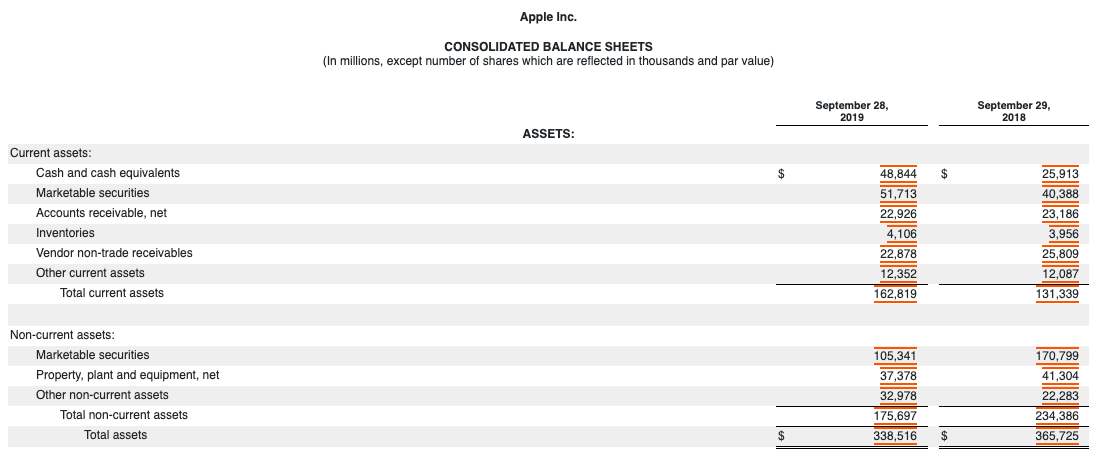

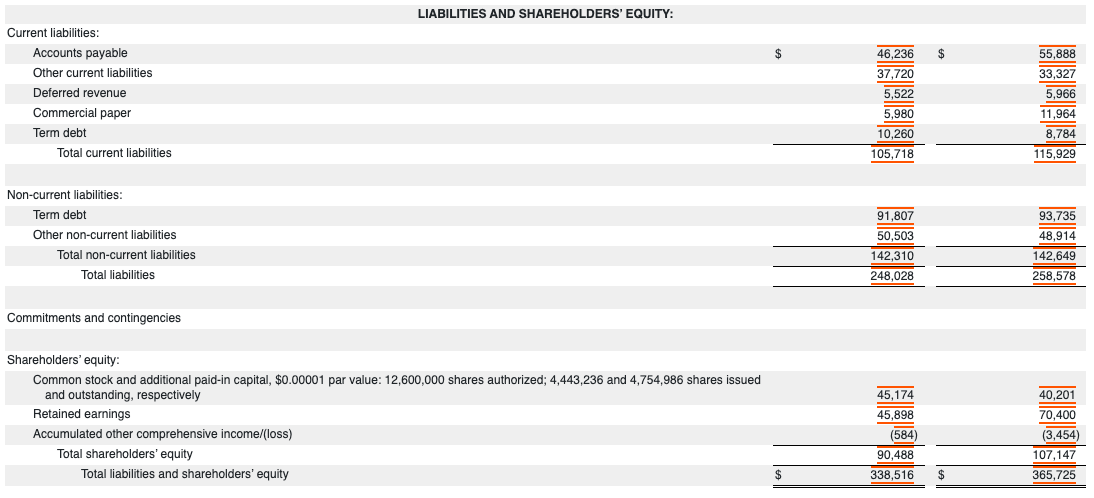

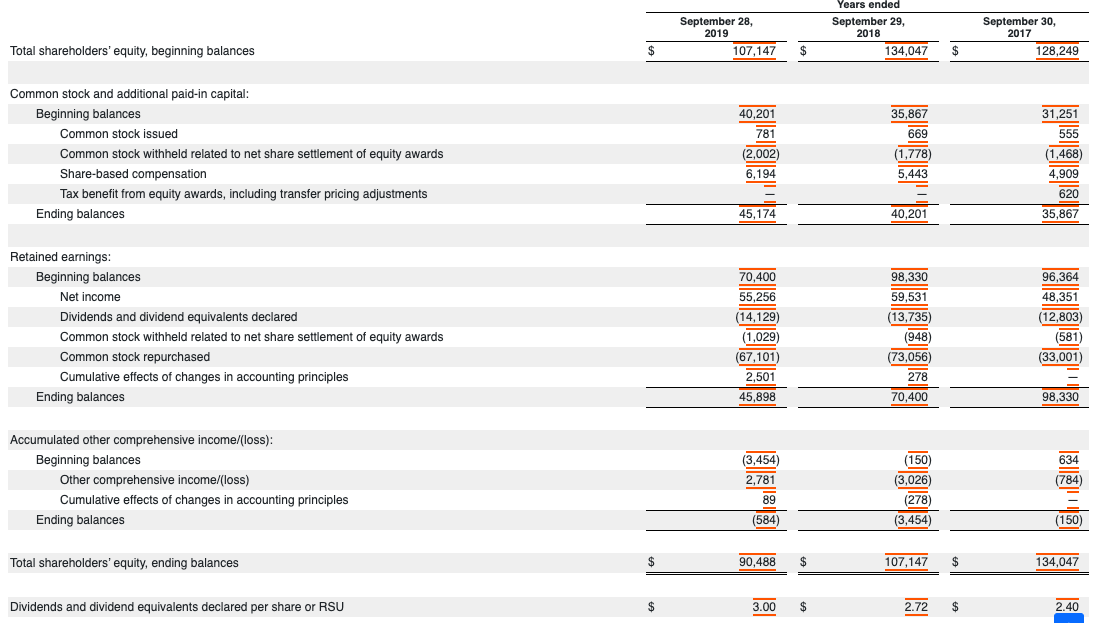

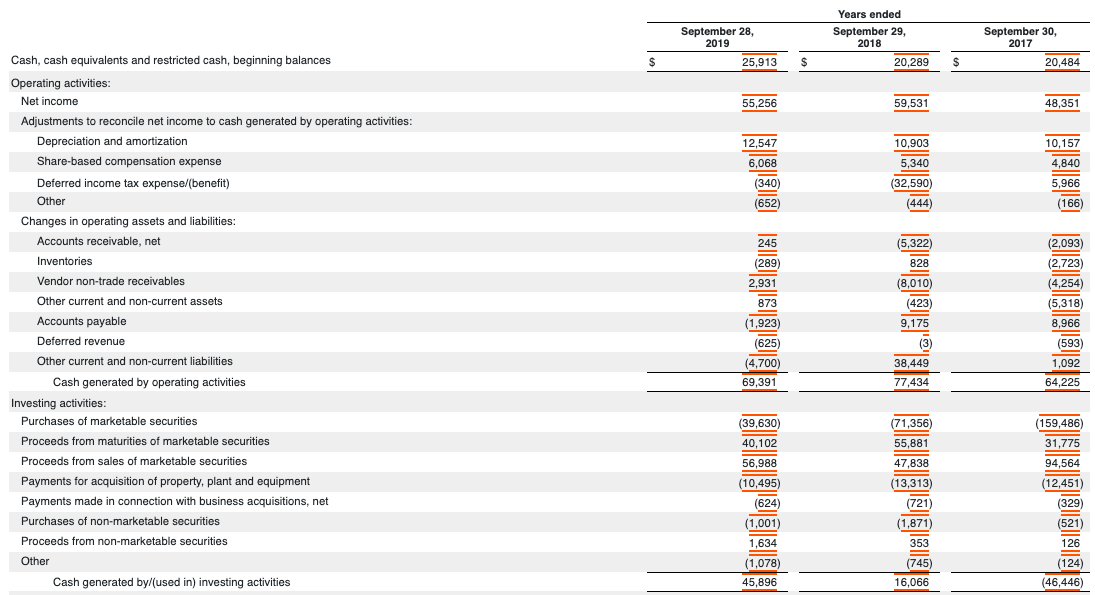

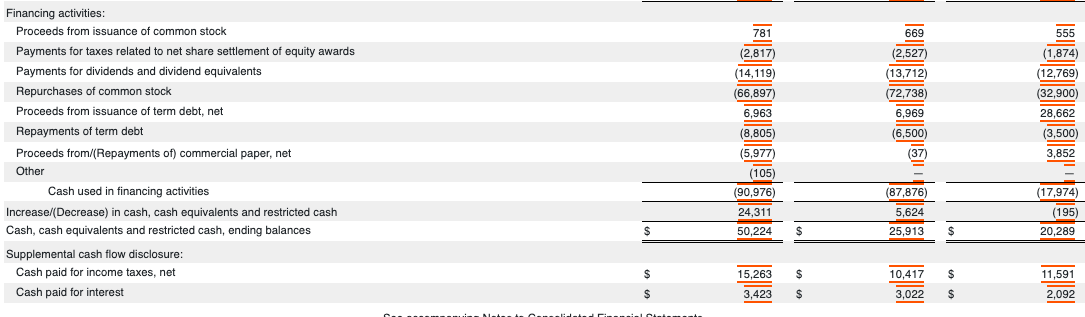

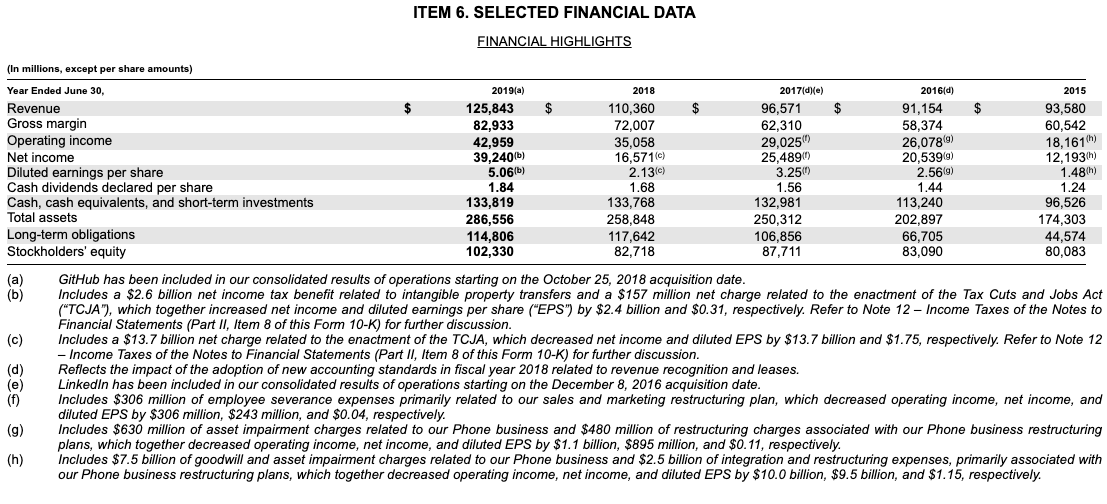

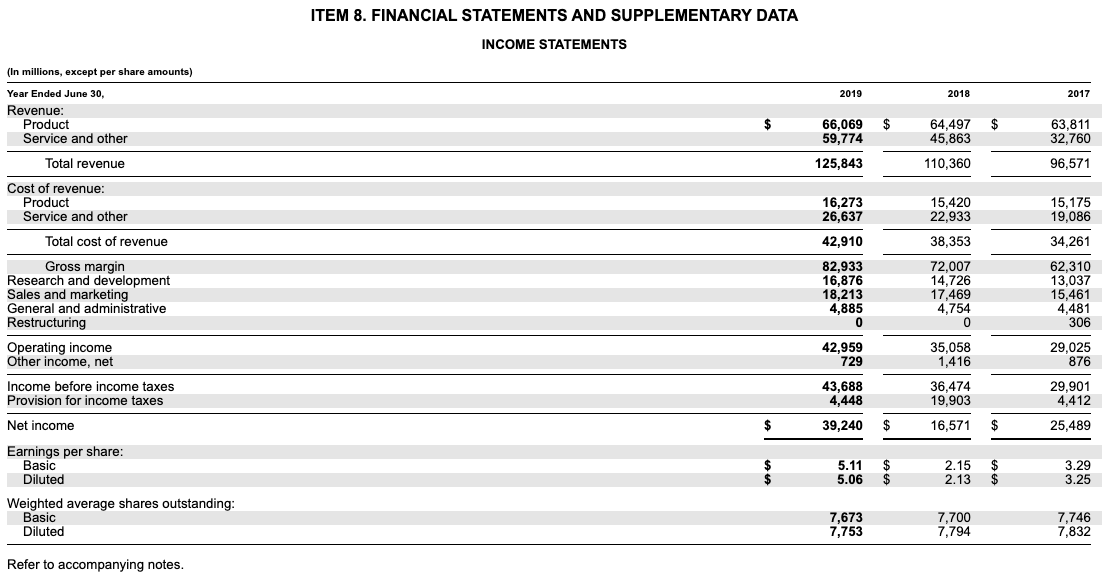

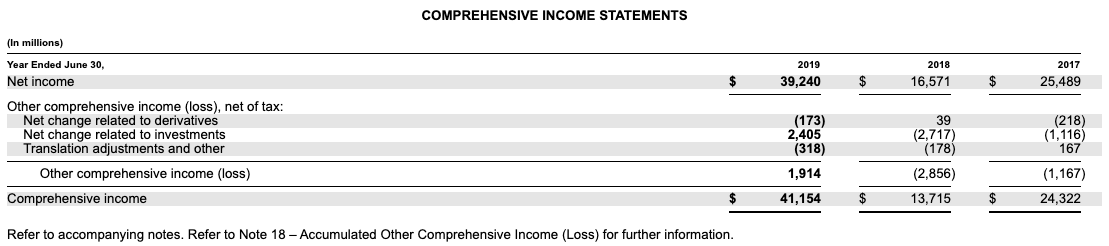

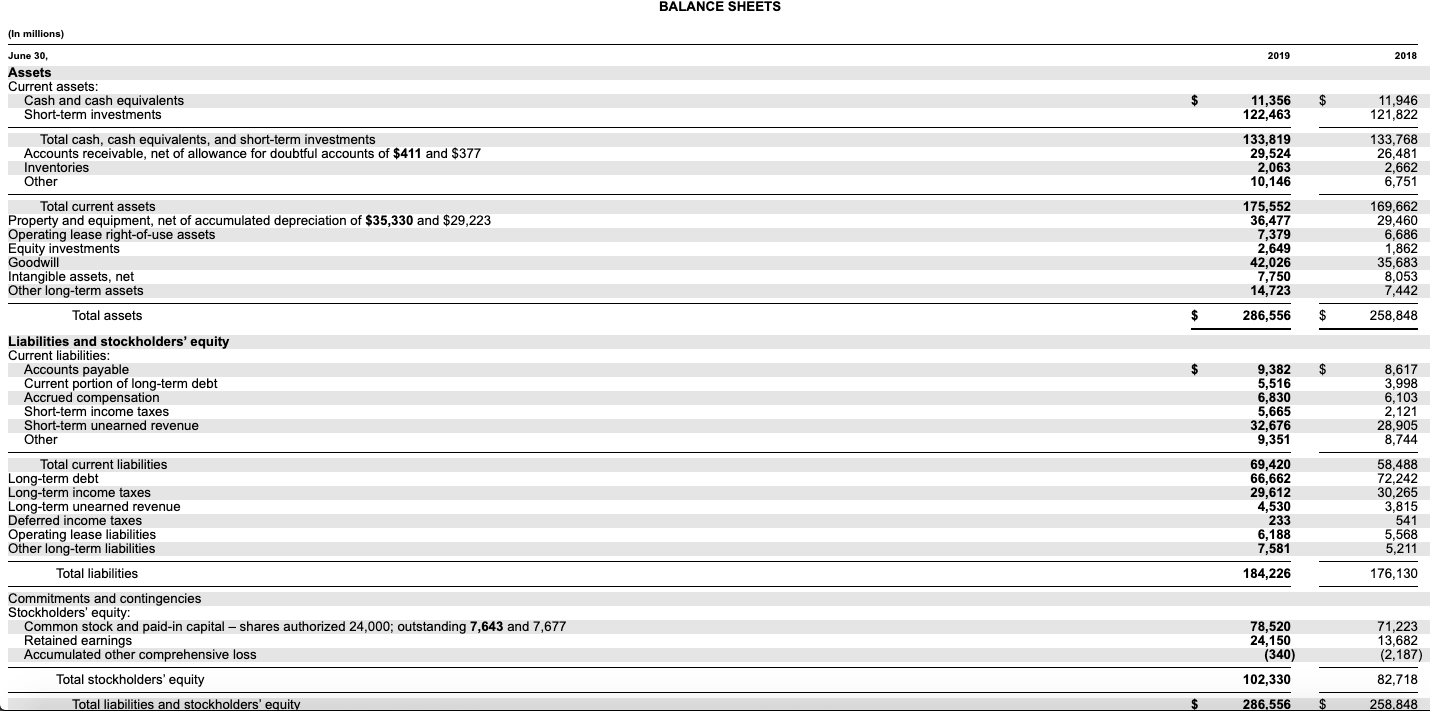

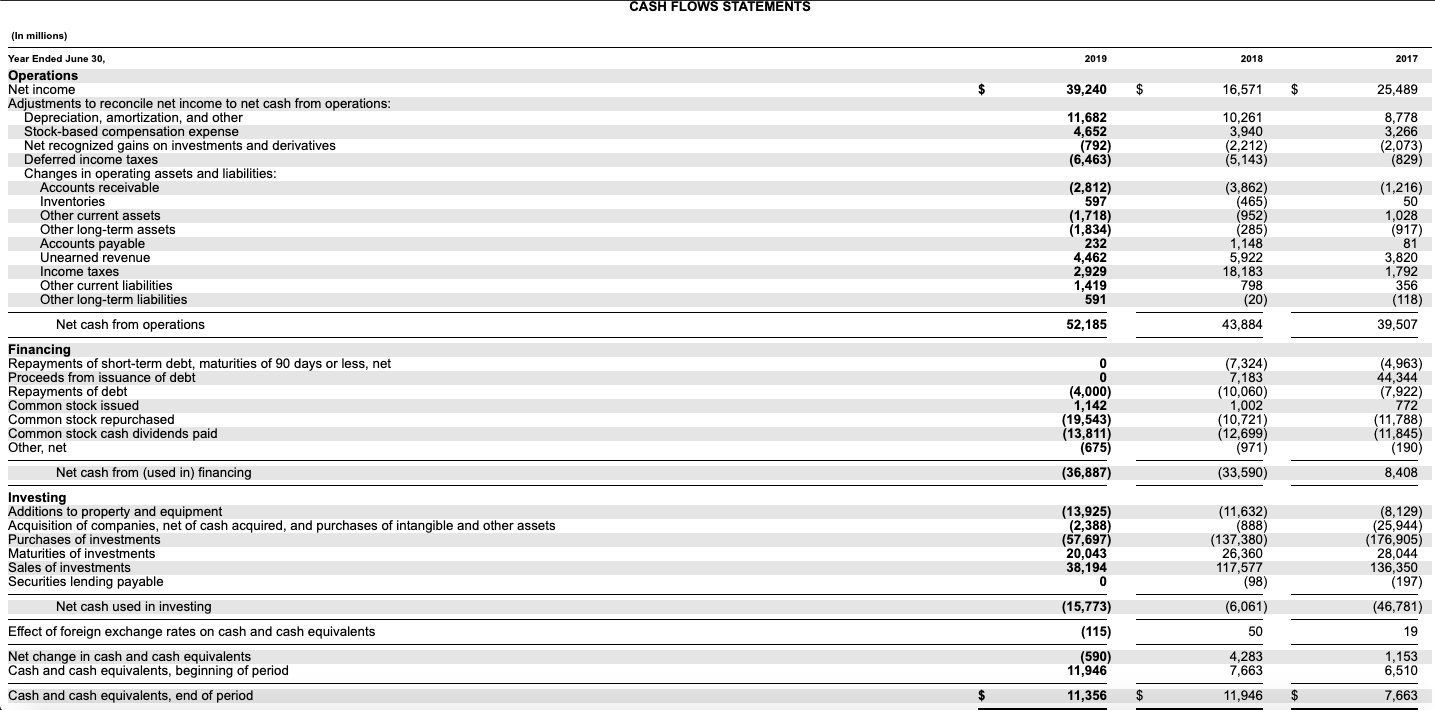

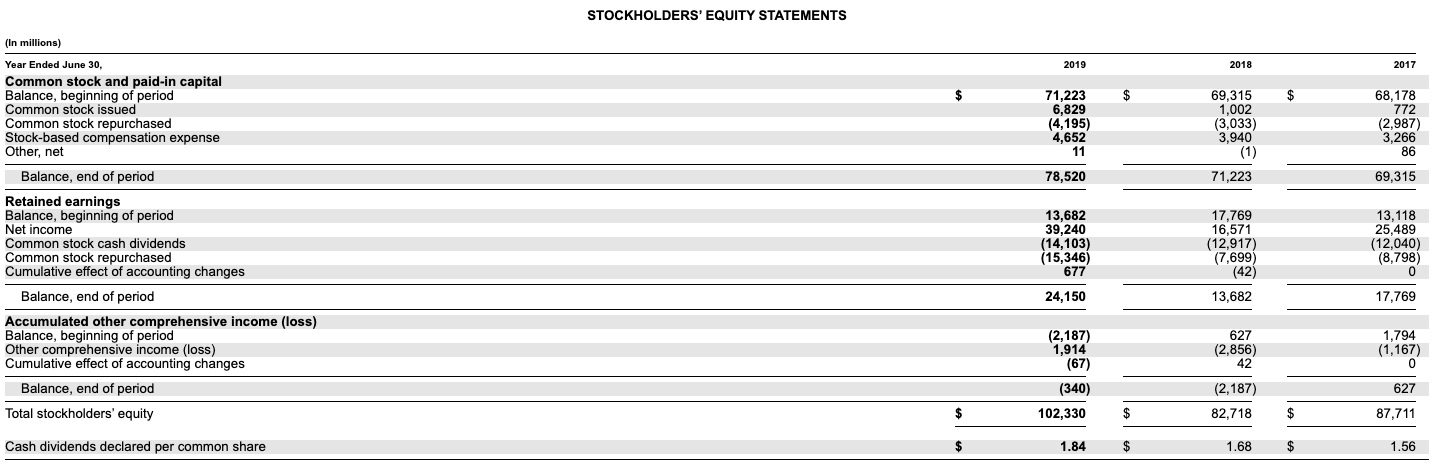

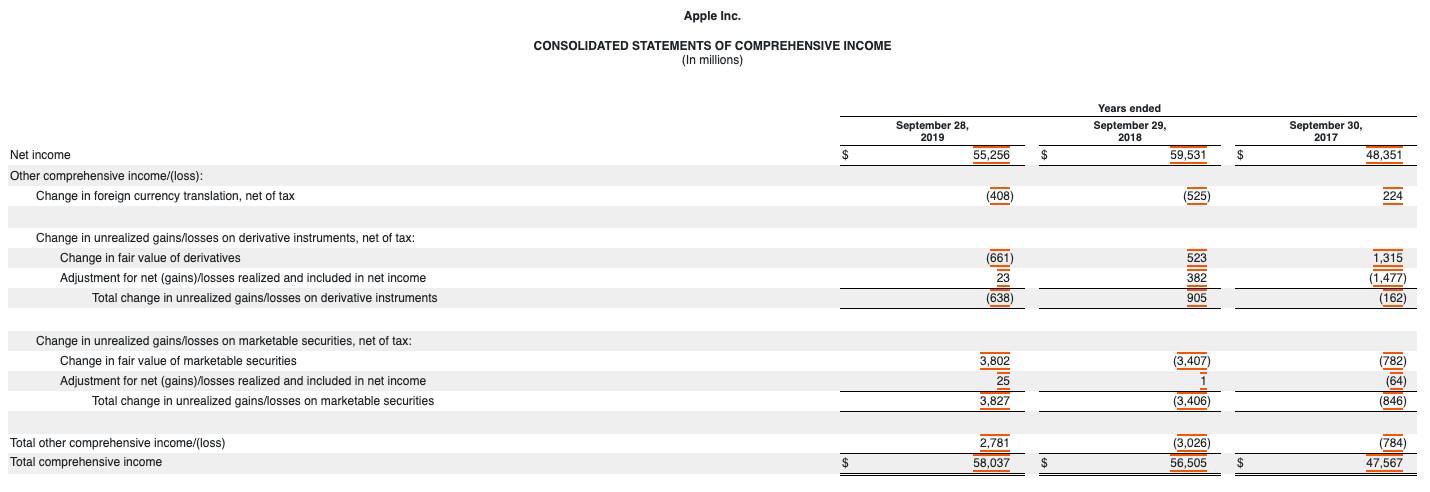

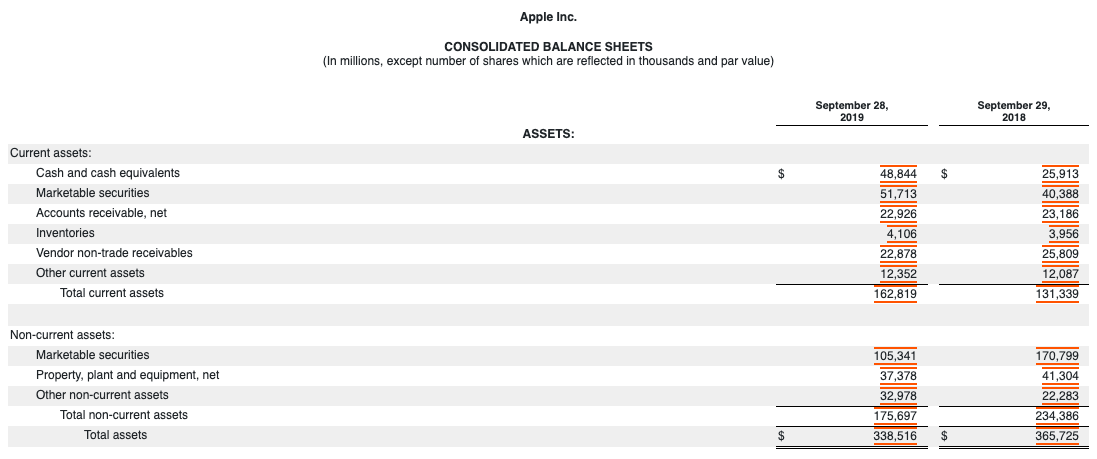

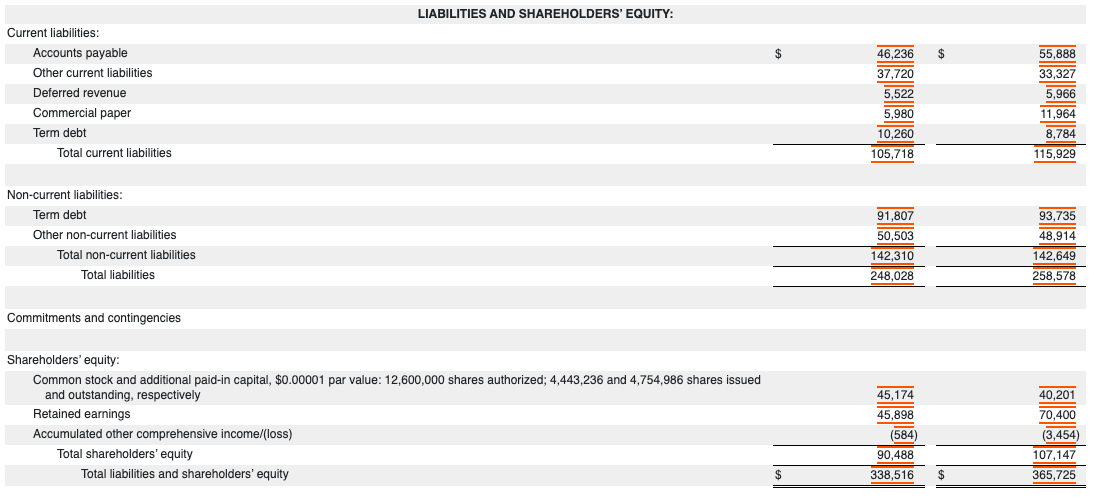

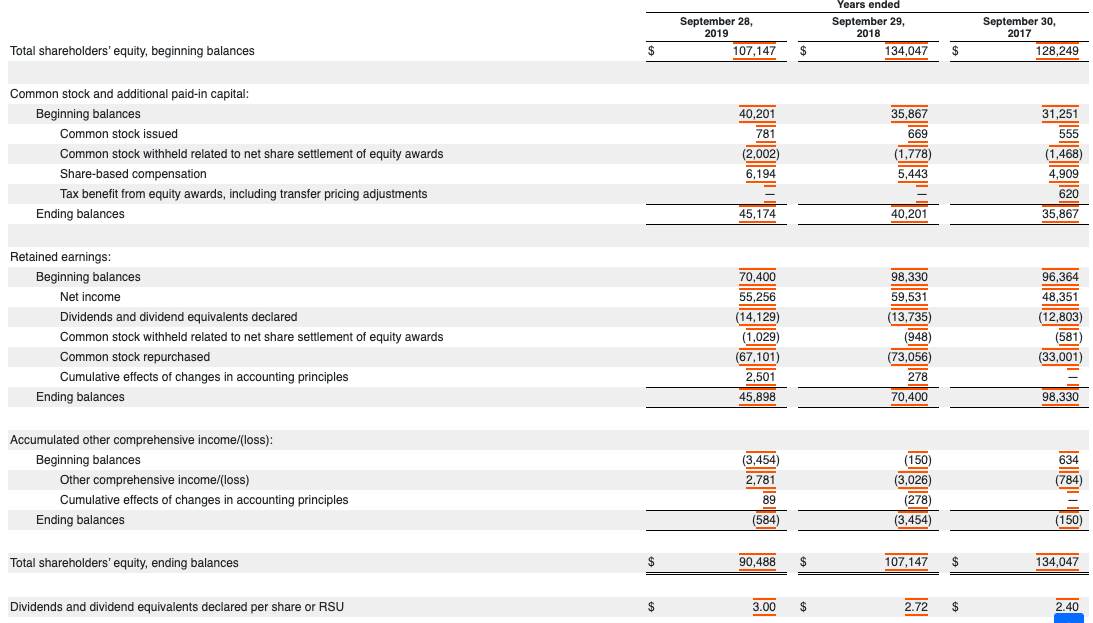

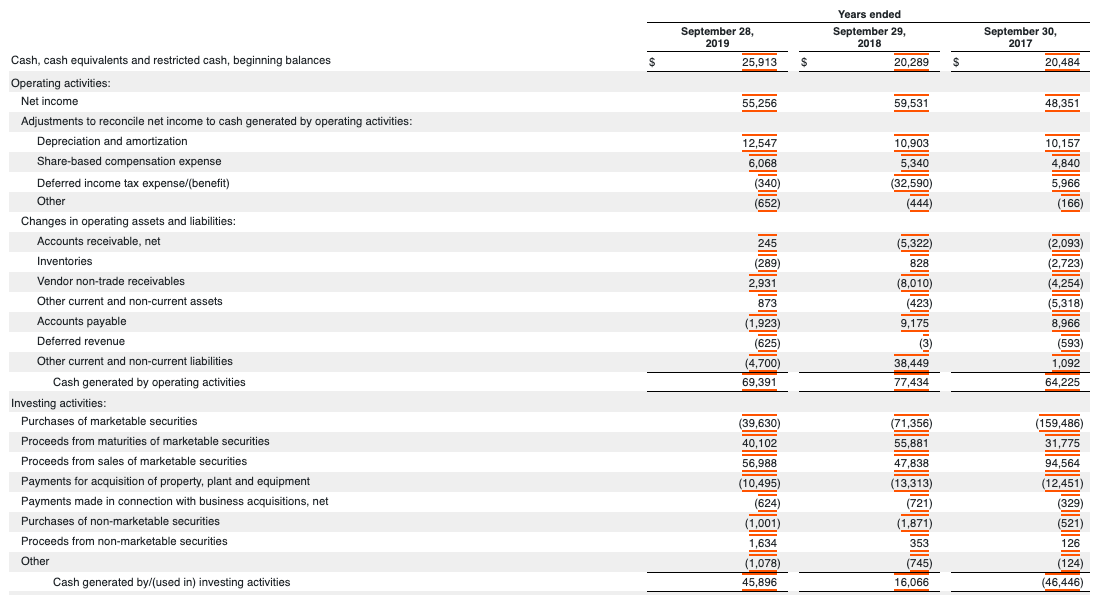

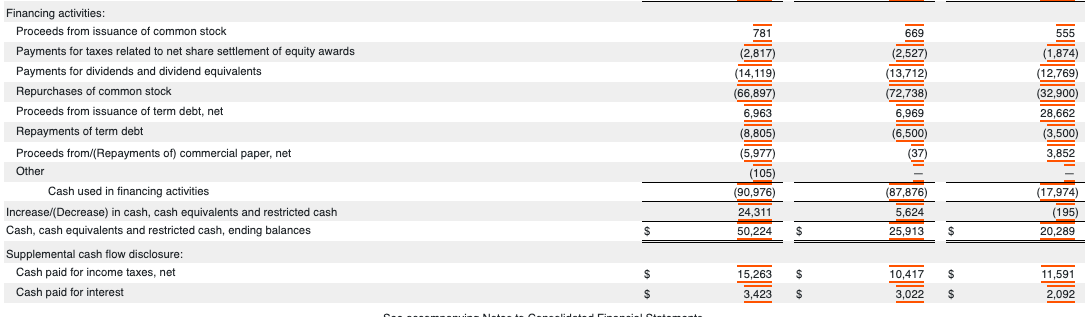

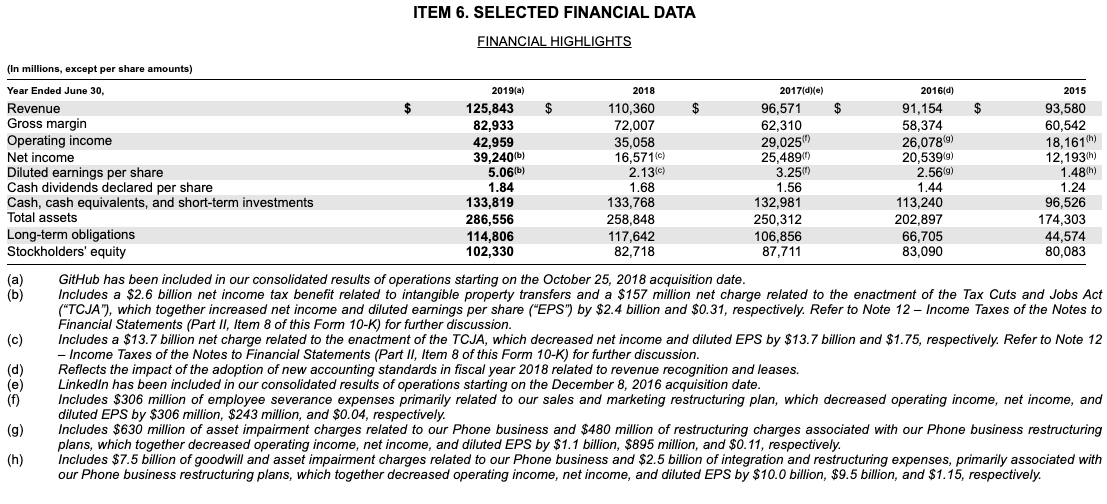

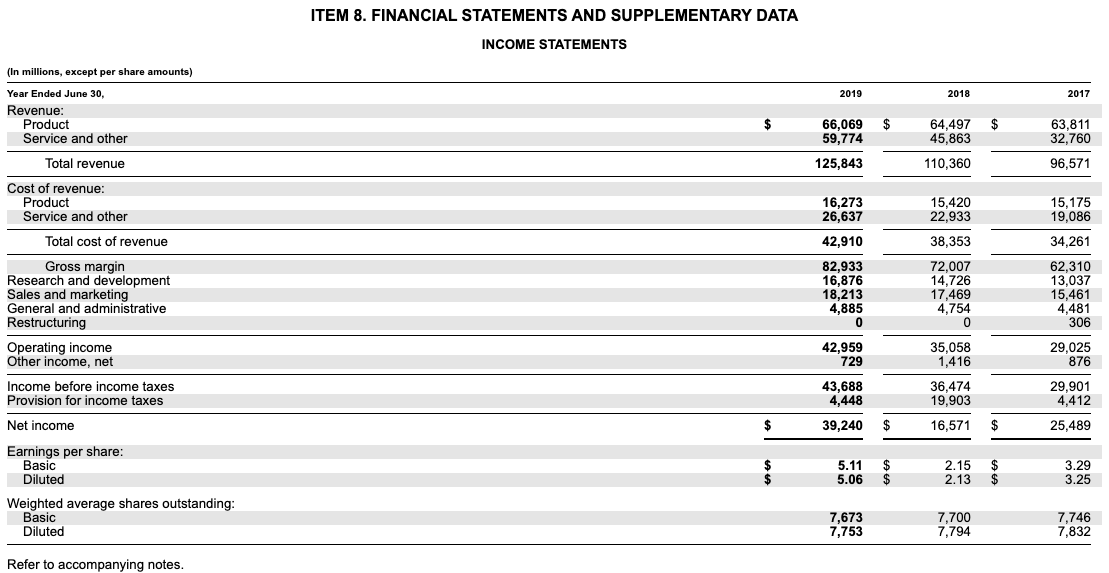

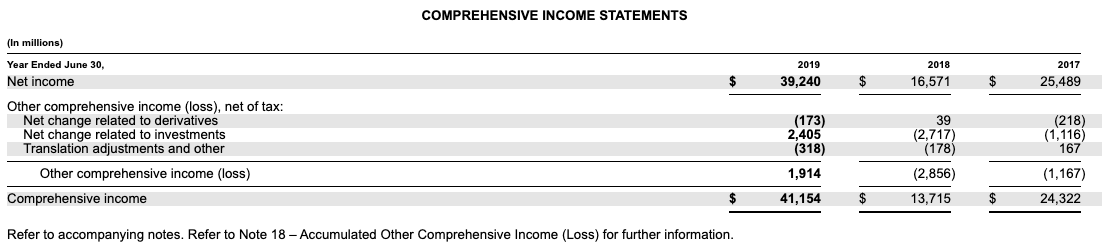

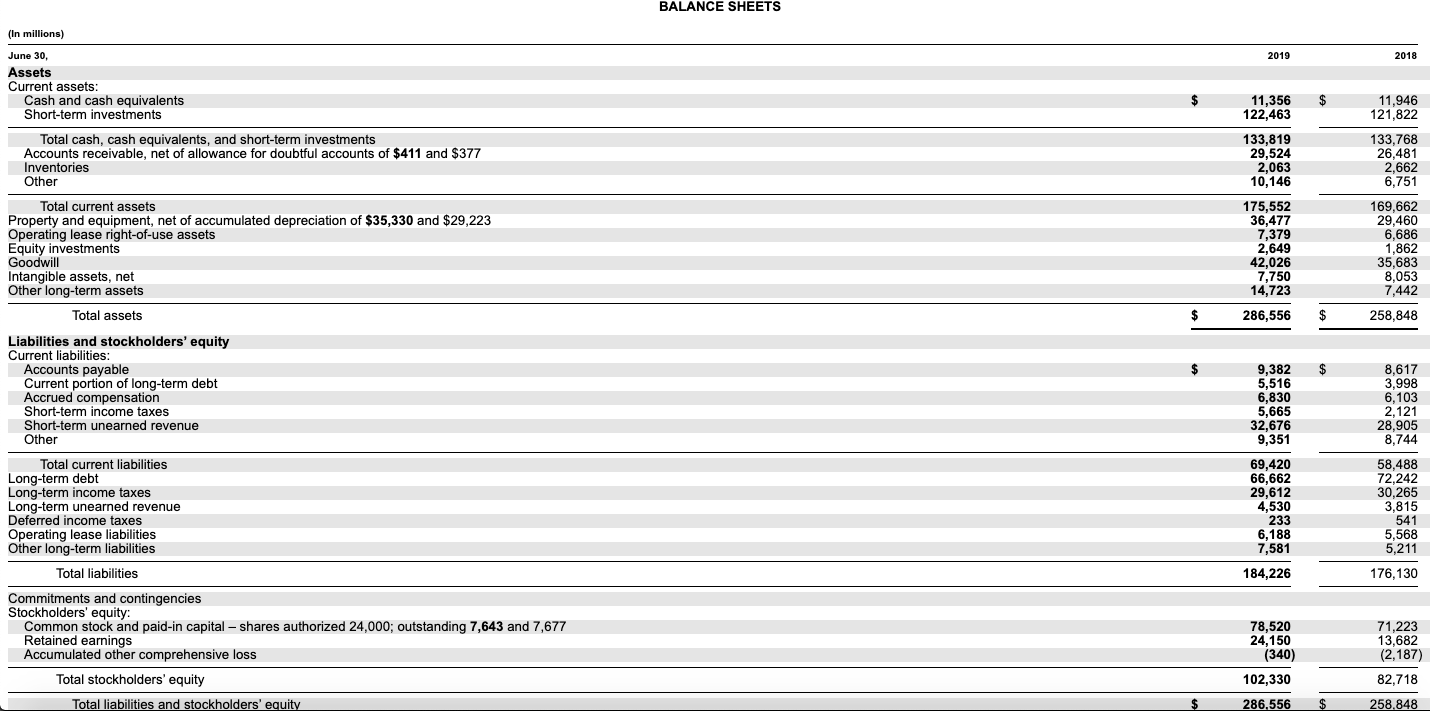

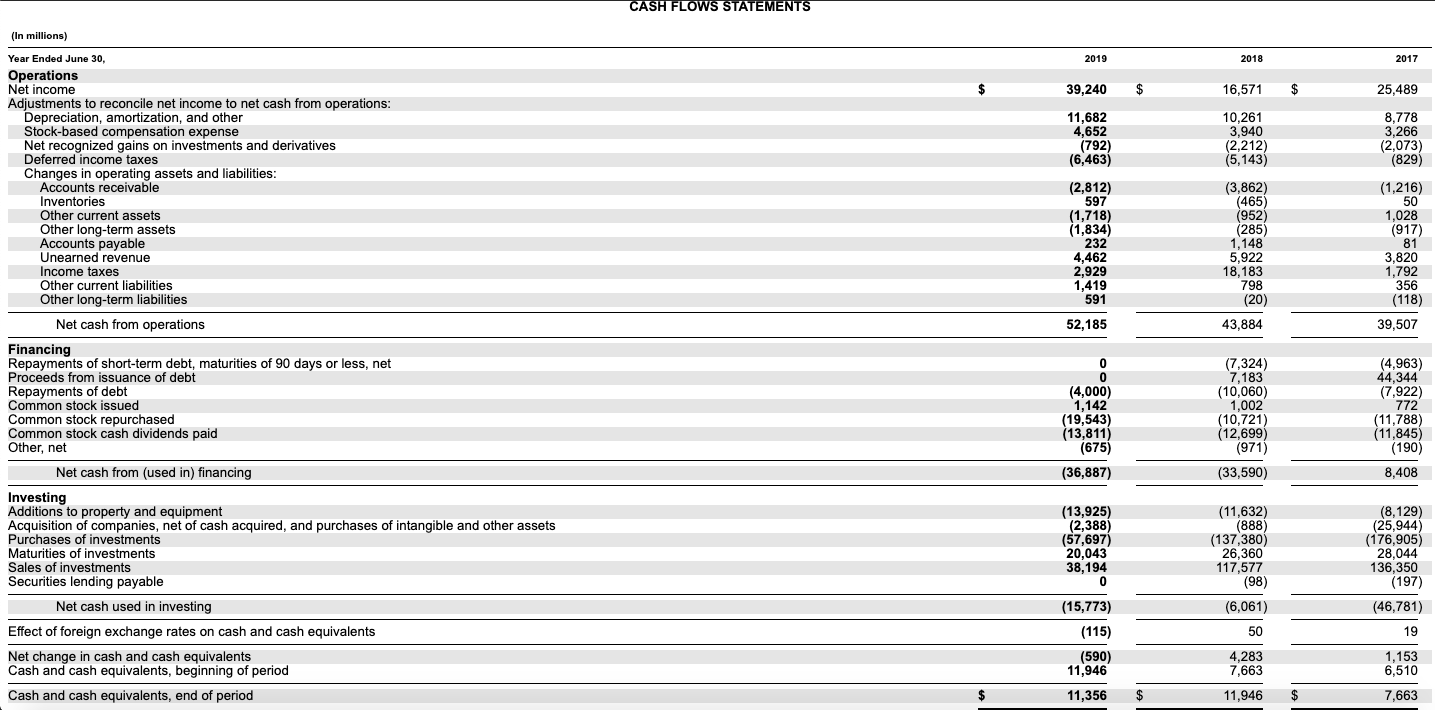

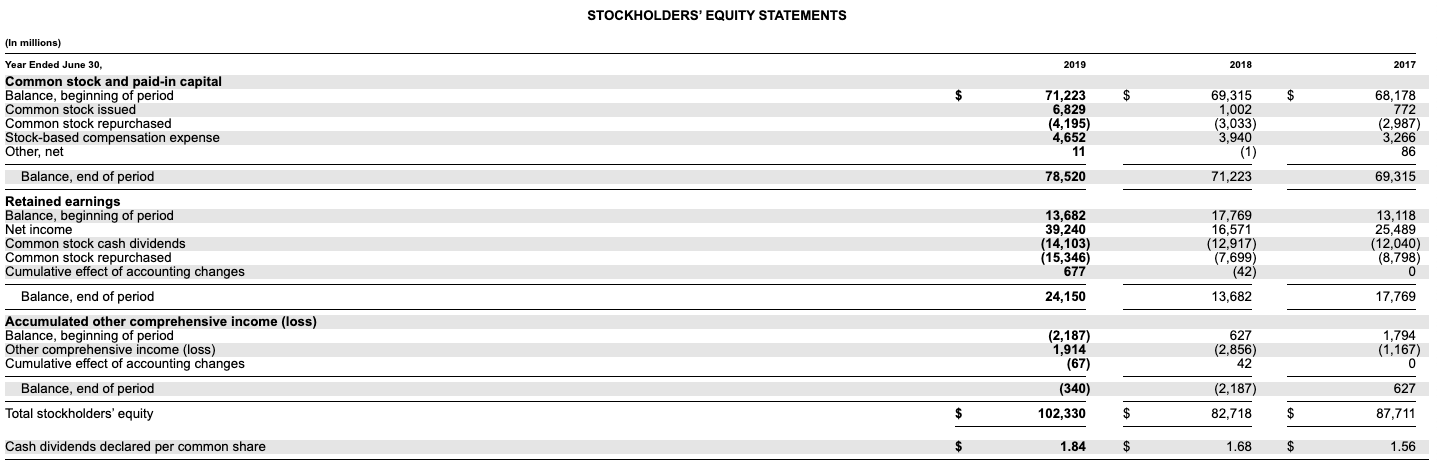

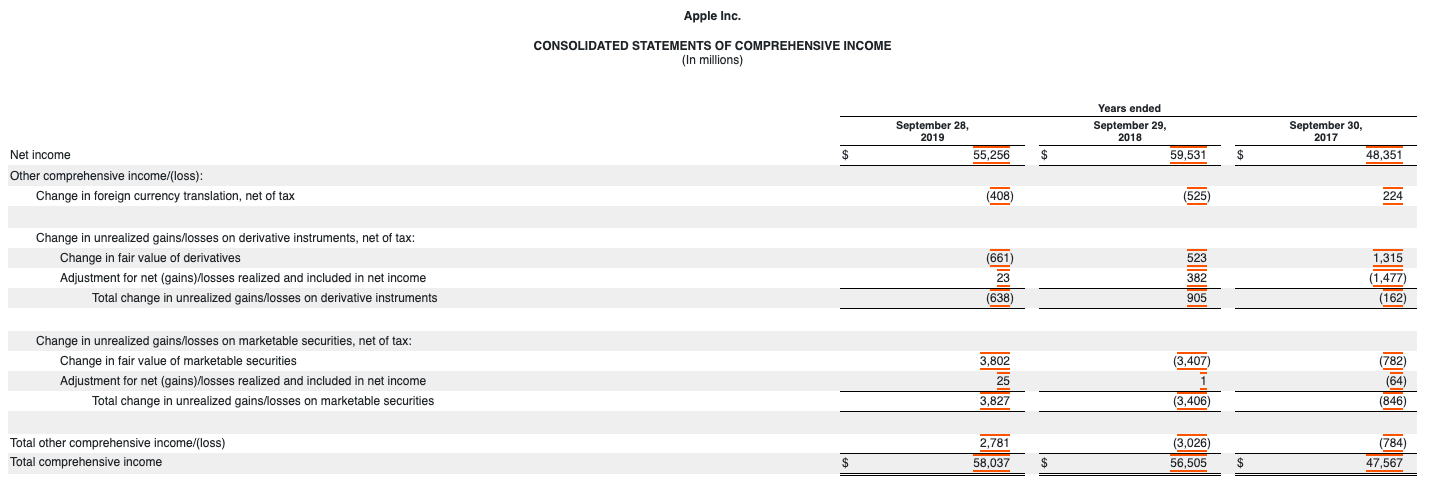

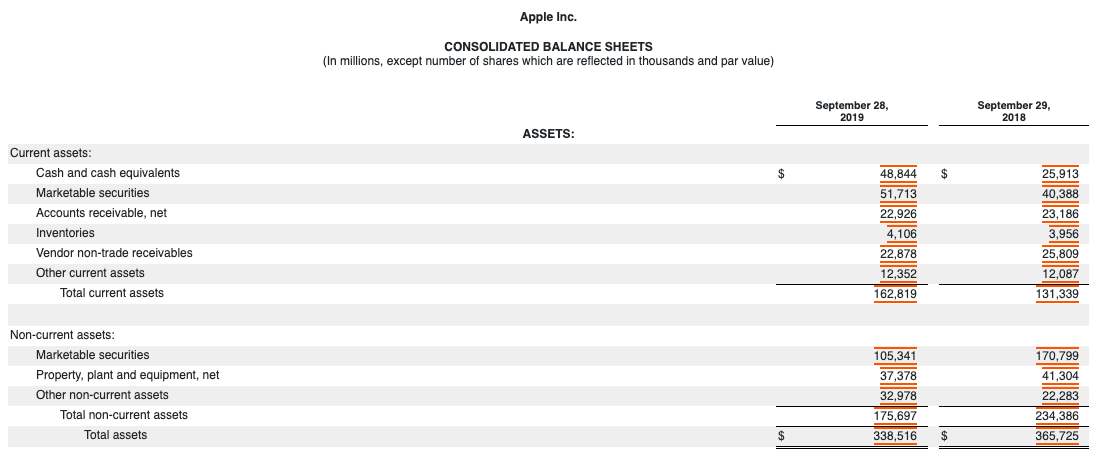

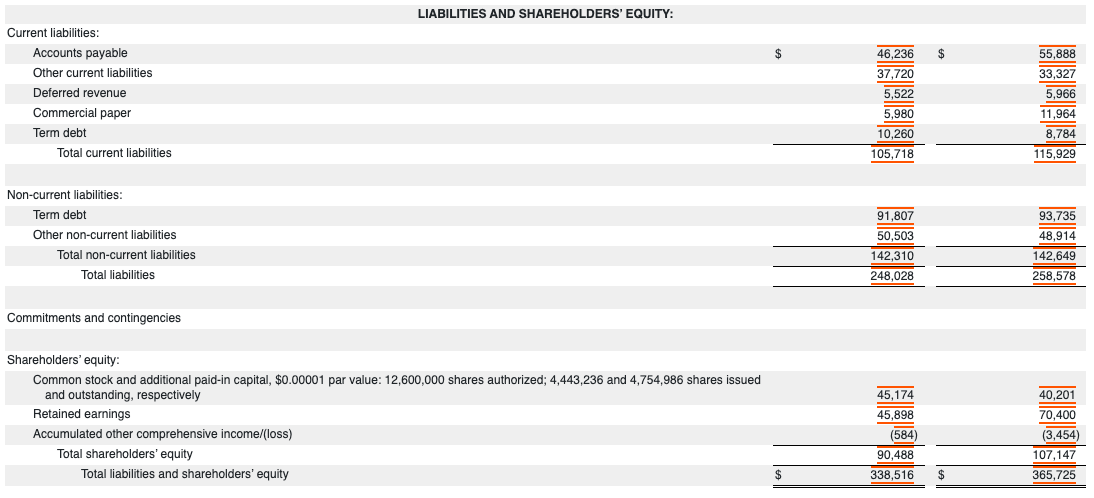

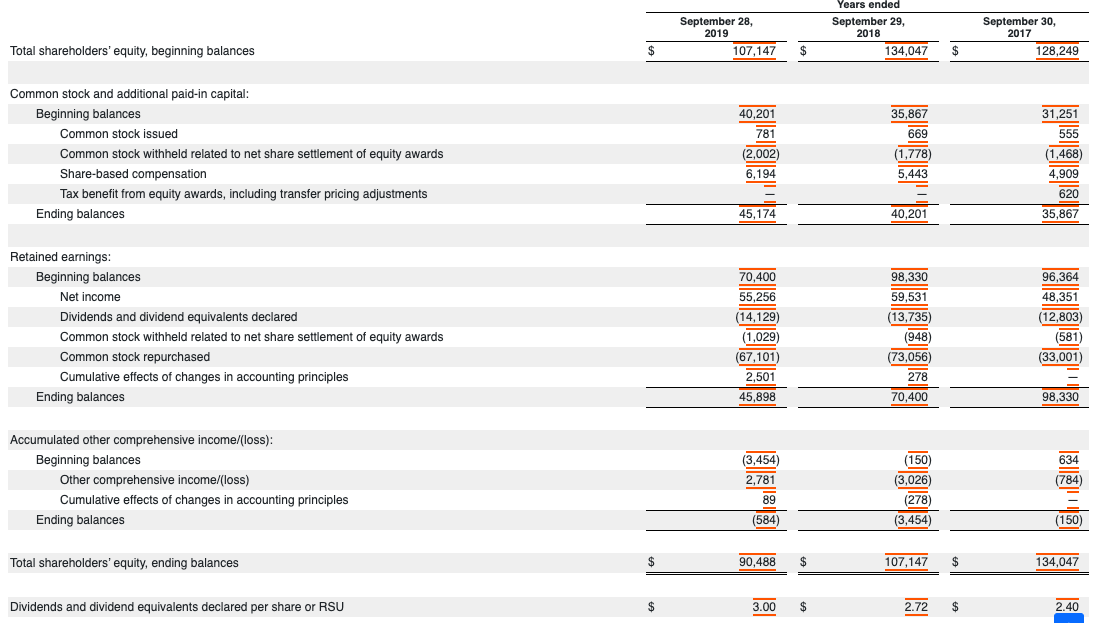

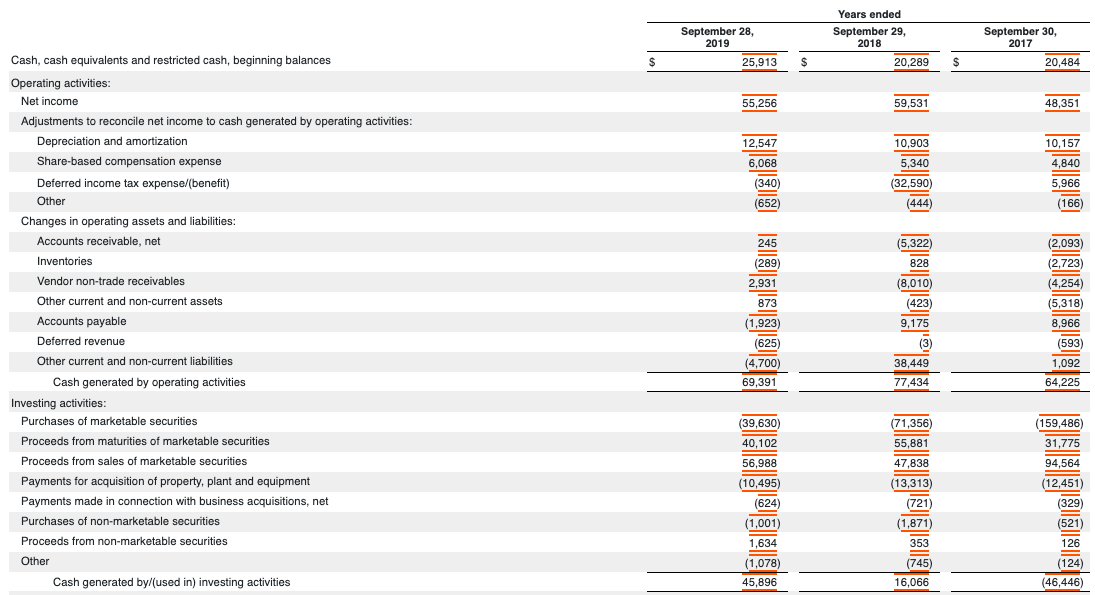

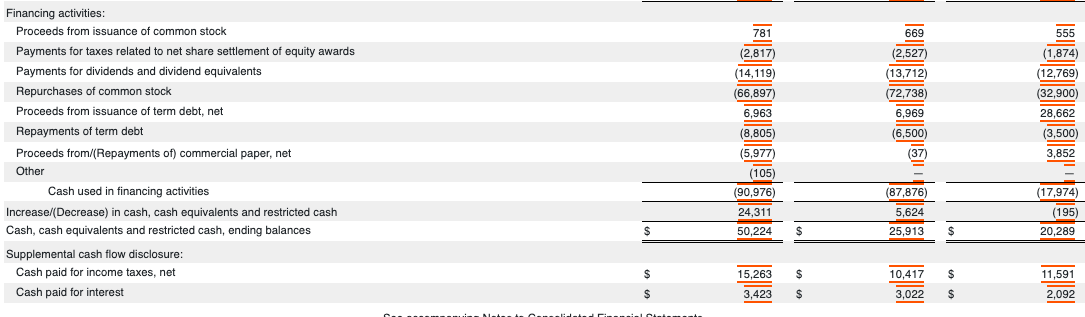

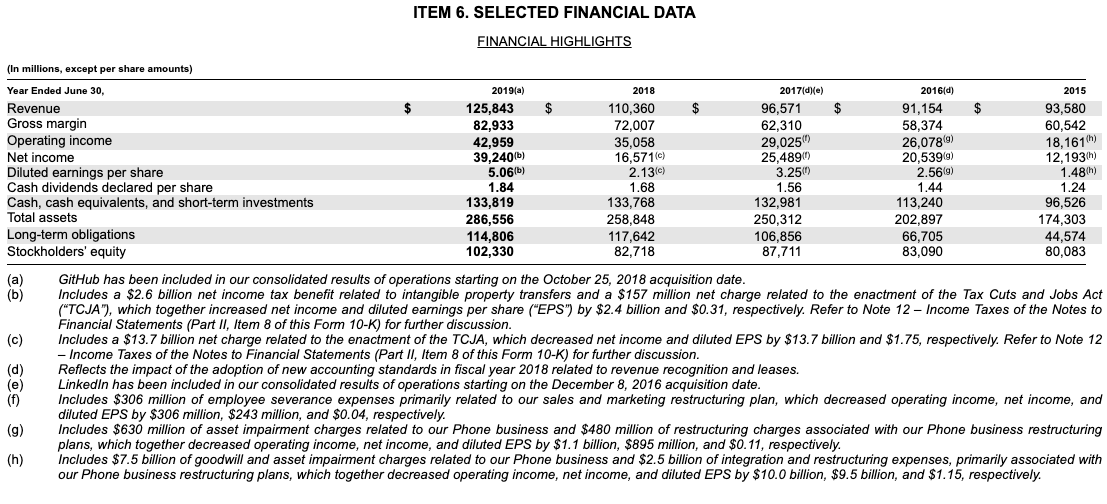

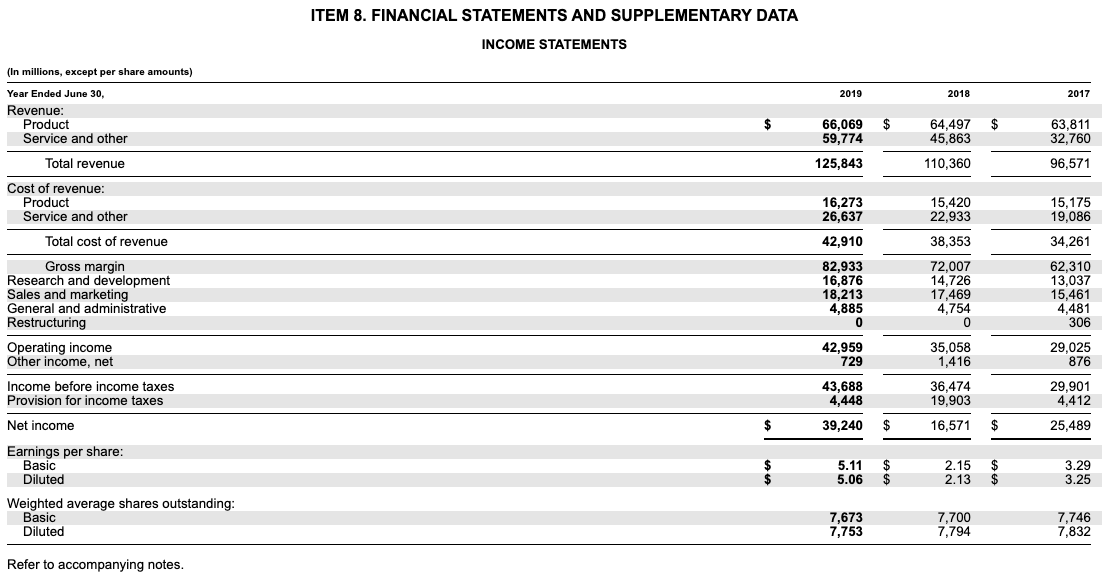

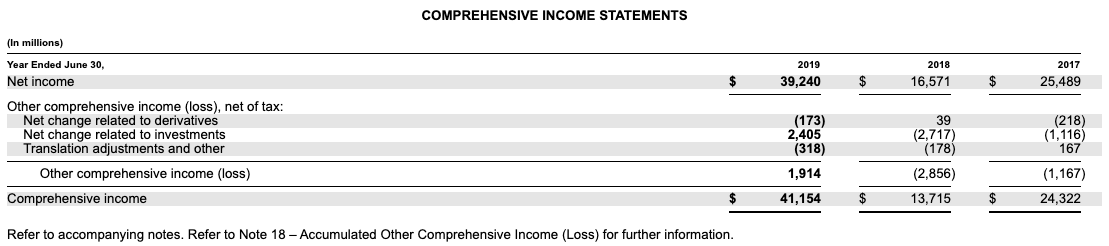

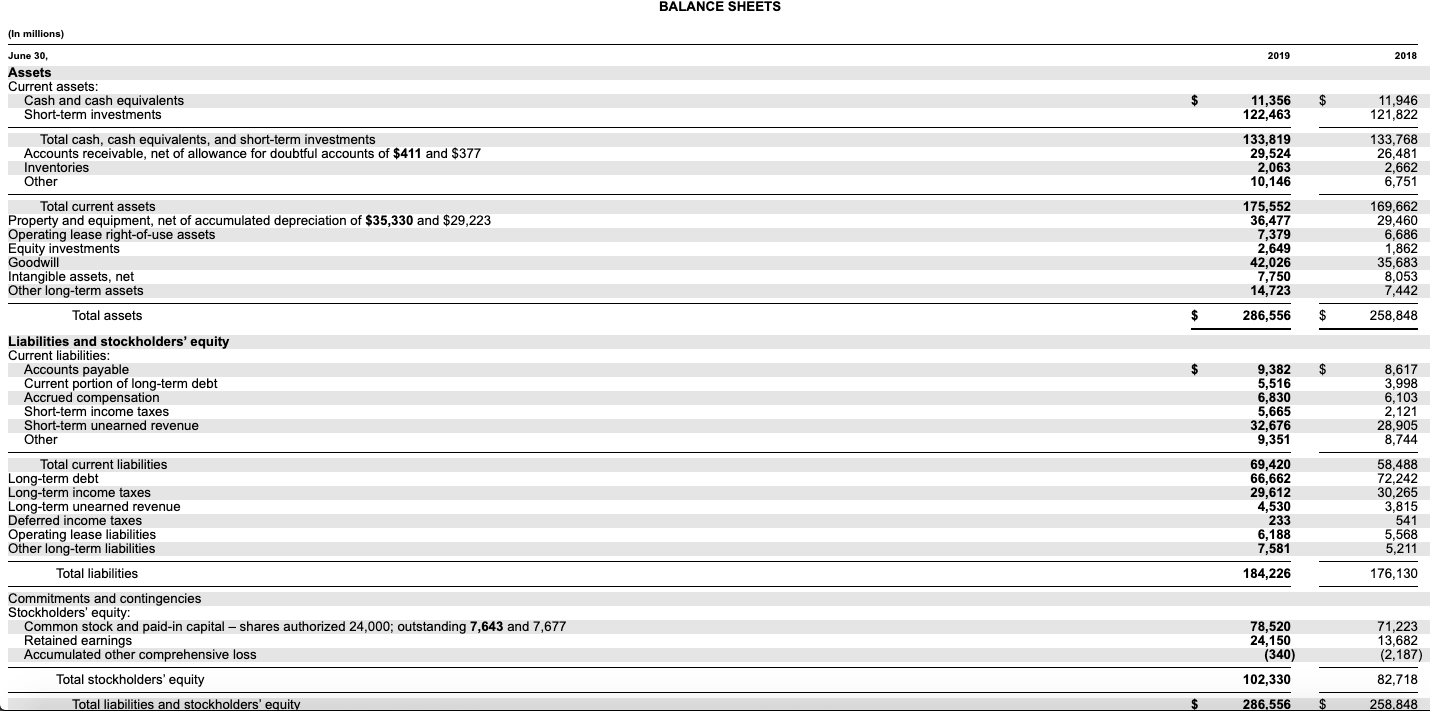

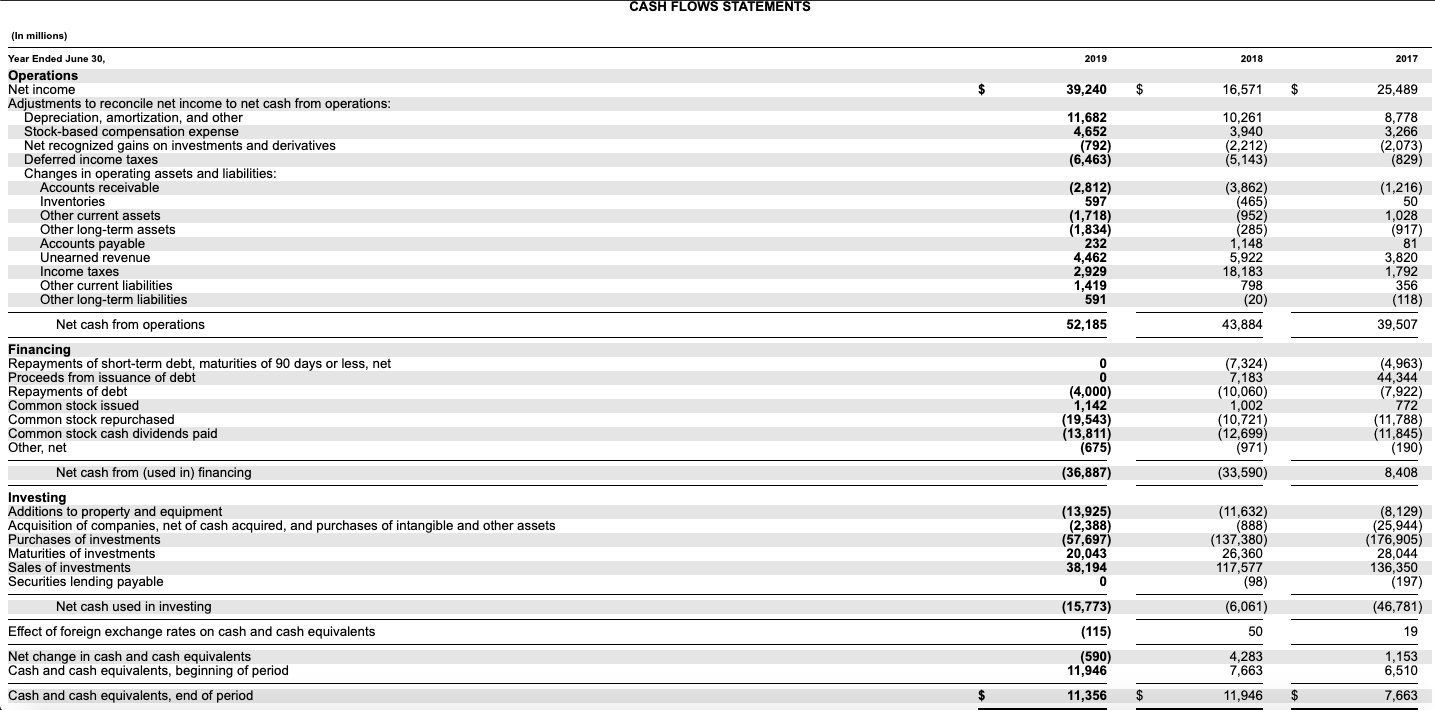

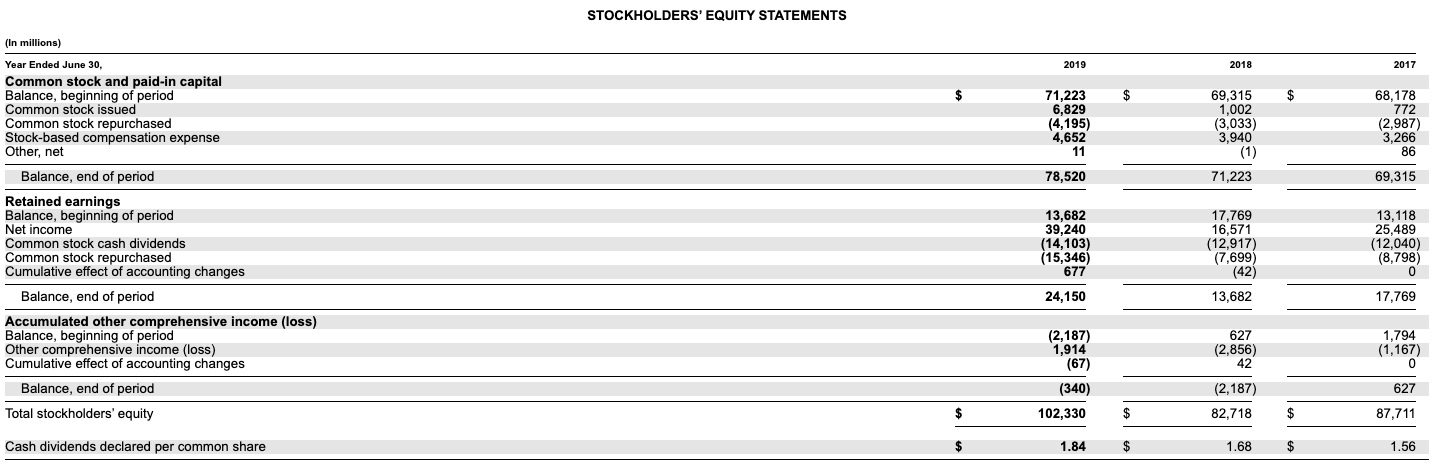

September 28, September 29, September 30, 2019 2018 2017 Net sales: Products $ 213,883 225,847 196,534 Services 46,291 39,748 32,700 Total net sales 260,174 265,595 229,234 Cost of sales: Products 144,996 148,164 126,337 Services 16,786 15,592 14,711 Total cost of sales 161,782 163,756 141,048 Gross margin 98,392 101,839 88,186 Operating expenses: Research and development 16,217 14,236 11,581 Selling, general and administrative 18,245 16,705 15,261 Total operating expenses 34,462 30,941 26,842 Operating income 63,930 70,898 61,344 Other income/(expense), net 1,807 2,005 2,745 Income before provision for income taxes 65,737 72,903 64,089 Provision for income taxes 10,481 13,372 15,738 Net income $ 65,256 59,531 $ 48,351 Earnings per share: Basic 11.97 12.01 9.27 Diluted 11.89 11.91 9.21 Shares used in computing earnings per share: Basic 4,617,834 4,955,377 5,217,242 Diluted 4,648,913 5,000, 109 5,251,692Apple Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) Years ended September 28, September 29, September 30, 2019 2018 2017 Net income $ 65,256 $ 69,531 $ 48,351 Other comprehensive income/(loss): Change in foreign currency translation, net of tax 408 525 224 Change in unrealized gains/losses on derivative instruments, net of tax: Change in fair value of derivatives (661 623 1,315 Adjustment for net (gains)/losses realized and included in net income 23 382 1,477) Total change in unrealized gains/losses on derivative instruments 638 905 162) Change in unrealized gains/losses on marketable securities, net of tax: Change in fair value of marketable securities 3.802 3,407 782 Adjustment for net (gains)/losses realized and included in net income 25 64) Total change in unrealized gains/losses on marketable securities 3,827 3,406) 846 Total other comprehensive income/(loss) 2,781 (3,026) (784) Total comprehensive income $ 58,037 56,505 $ 47,567Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) September 28, September 29, 2019 2018 ASSETS: Current assets: Cash and cash equivalents $ 48,844 $ 25,913 Marketable securities 51,713 40,388 Accounts receivable, net 22,926 23,186 Inventories 4,106 3,956 Vendor non-trade receivables 22,878 25,809 Other current assets 12,352 12,087 Total current assets 162,819 131,339 Non-current assets: Marketable securities 105,341 170,799 Property, plant and equipment, net 37,378 41,304 Other non-current assets 32,978 22,283 Total non-current assets 175,697 234,386 Total assets $ 338,516 $ 365,725LIABILITIES AND SHAREHOLDERS' EQUITY: Current liabilities: Accounts payable 46,236 $ 55,888 Other current liabilities 37,720 33,327 Deferred revenue 5,522 5,966 Commercial paper 5,980 11,964 Term debt 10,260 8,784 Total current liabilities 105,718 115,929 Non-current liabilities: Term debt 91,807 93,735 Other non-current liabilities 50,503 48,914 Total non-current liabilities 142,310 142,649 Total liabilities 248,028 258,578 Commitments and contingencies Shareholders' equity: Common stock and additional paid-in capital, $0.00001 par value: 12,600,000 shares authorized; 4,443,236 and 4,754,986 shares issued and outstanding, respectively 45,174 40,201 Retained earnings 45,898 70,400 Accumulated other comprehensive income/(loss) 584 (3,454) Total shareholders' equity 90,488 107,147 Total liabilities and shareholders' equity 338,516 $ 365,725Years ended September 28, September 29, September 30, 2019 2018 2017 Total shareholders' equity, beginning balances $ 107,147 $ 134,047 $ 128,249 Common stock and additional paid-in capital: Beginning balances 40.201 35,867 31,251 Common stock issued 781 569 655 Common stock withheld related to net share settlement of equity awards (2,002) (1,778) 1,468 Share-based compensation 6,194 5,443 4,909 Tax benefit from equity awards, including transfer pricing adjustments 620 Ending balances 45,174 40,201 35,867 Retained earnings: Beginning balances 70,400 98,330 96,364 Net income 55,256 59,531 48,351 Dividends and dividend equivalents declared 14,129 (13,735 12,803 Common stock withheld related to net share settlement of equity awards 1,029) 948 (581 Common stock repurchased (67,101 73,056 33,001 Cumulative effects of changes in accounting principles 2,501 278 Ending balances 45,898 70,400 98,330 Accumulated other comprehensive income/(loss): Beginning balances (3,454 150 634 Other comprehensive income/(loss) 2,781 (3,026 784 Cumulative effects of changes in accounting principles B9 (278) Ending balances (584 (3,454) (150 Total shareholders' equity, ending balances 90,488 107,147 $ 134,047 Dividends and dividend equivalents declared per share or RSU 3.00 $ 2.72 $ 2.40Years ended September 28, September 29, September 30, 2019 2018 2017 Cash, cash equivalents and restricted cash, beginning balances 25,913 20.289 20,484 Operating activities: Net income 55,256 59,531 48,351 Adjustments to reconcile net income to cash generated by operating activities: Depreciation and amortization 12,547 10,903 10,157 Share-based compensation expense 6,068 5,340 4,840 Deferred income tax expense/(benefit) (340 32,590) 5,966 Other 652 444 (166) Changes in operating assets and liabilities: Accounts receivable, net 245 (5,322 2,093 Inventories (289 328 (2,723 Vendor non-trade receivables 2,931 (8,010) (4,254) Other current and non-current assets 373 423 5,318 Accounts payable (1,923 9,175 8,966 Deferred revenue (625) (3) 593 Other current and non-current liabilities (4,700 38,449 1.092 Cash generated by operating activities 69,391 77,434 64,225 Investing activities: Purchases of marketable securities 39,630 71,356) 159,486) Proceeds from maturities of marketable securities 40,102 55,881 31,775 Proceeds from sales of marketable securities 56,988 47,838 94,564 Payments for acquisition of property, plant and equipment (10,495 13,313 (12,451 Payments made in connection with business acquisitions, net 624 721 329 Purchases of non-marketable securities (1,001 1,871) (521 Proceeds from non-marketable securities 1,634 353 126 Other (1,078 745 124 Cash generated by/(used in) investing activities 45,89 16.066 46,446Financing activities: Proceeds from issuance of common stock 781 569 655 Payments for taxes related to net share settlement of equity awards (2,817 2,527 (1,874) Payments for dividends and dividend equivalents 14, 119 (13,712) 12,769 Repurchases of common stock 66,897 (72,738 (32,900 Proceeds from issuance of term debt, net 6,963 6,969 28,662 Repayments of term debt (8,805 (6,500 (3,500) Proceeds from/(Repayments of) commercial paper, net (5,977 37 3,852 Other 105) Cash used in financing activities 90,976) (87,876) (17,974) Increase/(Decrease) in cash, cash equivalents and restricted cash 24,311 5,624 (195 Cash, cash equivalents and restricted cash, ending balances S 50,224 25,913 S 20,289 Supplemental cash flow disclosure: Cash paid for income taxes, net 15,263 10,417 11,59 Cash paid for interest 3,423 $ 3,022 2,092ITEM 6. SELECTED FINANCIAL DATA FINANCIAL HIGHLIGHTS (In millions, except per share amounts) Year Ended June 30, 2019(a) 2018 2017(d)(e) 2016(d) 2015 Revenue 125,843 $ 110,360 96,571 $ 91,154 $ 93,580 Gross margin 82,933 72,007 62,310 58,374 60,542 Operating income 42,959 35,058 29,025() 26,078(9) 18,161() Net income 39,240(b) 16,571(0) 25,489() 20,539(9) 12, 193(h) Diluted earnings per share 5.06(b) 2.13(9) 3.25(0) 2.56(9) 1.48(h) Cash dividends declared per share 1.84 1.68 1.56 1.44 1.24 Cash, cash equivalents, and short-term investments 133,819 133,768 132,981 113,240 96,526 Total assets 286,556 258,848 250,312 202,897 174,303 Long-term obligations 114,806 117,642 106,856 66,705 44,574 Stockholders' equity 102,330 82,718 87,711 83,090 80,083 (a) GitHub has been included in our consolidated results of operations starting on the October 25, 2018 acquisition date. (b) Includes a $2.6 billion net income tax benefit related to intangible property transfers and a $157 million net charge related to the enactment of the Tax Cuts and Jobs Act ("TCJA"), which together increased net income and diluted earnings per share ("EPS") by $2.4 billion and $0.31, respectively. Refer to Note 12 - Income Taxes of the Notes to Financial Statements (Part II, Item 8 of this Form 10-K) for further discussion. (c) Includes a $13.7 billion net charge related to the enactment of the TCJA, which decreased net income and diluted EPS by $13.7 billion and $1.75, respectively. Refer to Note 12 (d) - Income Taxes of the Notes to Financial Statements (Part II, Item 8 of this Form 10-K) for further discussion. Reflects the impact of the adoption of new accounting standards in fiscal year 2018 related to revenue recognition and leases. (e) Linkedin has been included in our consolidated results of operations starting on the December 8, 2016 acquisition date. (f) Includes $306 million of employee severance expenses primarily related to our sales and marketing restructuring plan, which decreased operating income, net income, and diluted EPS by $306 million, $243 million, and $0.04, respectively. (g) Includes $630 million of asset impairment charges related to our Phone business and $480 million of restructuring charges associated with our Phone business restructuring plans, which together decreased operating income, net income, and diluted EPS by $1.1 billion, $895 million, and $0.11, respectively. (h) Includes $7.5 billion of goodwill and asset impairment charges related to our Phone business and $2.5 billion of integration and restructuring expenses, primarily associated with our Phone business restructuring plans, which together decreased operating income, net income, and diluted EPS by $10.0 billion, $9.5 billion, and $1.15, respectively.ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA INCOME STATEMENTS (In millions, except per share amounts) Year Ended June 30, 2019 2018 2017 Revenue: Product Service and other 66,069 59,774 $ 64,497 $ 45,863 63,811 32,760 Total revenue 125,843 110,360 96,571 Cost of revenue: Product Service and other 16,273 15,420 26,637 15,175 22,933 19,086 Total cost of revenue 42,910 38,353 34,261 Gross margin Research and development 82,933 72,007 62,310 Sales and marketing 16,876 14,726 13,037 General and administrative 18,213 17,469 4,885 15,461 Restructuring 4,754 4,481 306 Operating income Other income, net 42,959 35,058 29,025 729 1,416 876 Income before income taxes Provision for income taxes 43,688 36,474 4.448 29,901 19,903 4,412 Net income 39,240 $ 16,571 $ 25,489 Earnings per share: Basic Diluted 5.11 2.15 3.29 5.06 2.13 3.25 Weighted average shares outstanding: Basic Diluted 7,673 7,753 7,700 7,794 7,746 7,832 Refer to accompanying notes.COMPREHENSIVE INCOME STATEMENTS {h millions} Year Ended June 30, 2M? Net income S 39,240 $ 16.5?1 $ 25.489 Other comprehensive income (loss), net of tax: Net change related to derivatives [173) 39 (218) Net change related to investments 2.405 (2.71?) (1.116) Translation adjustments and other (318) (1T8) 167 Other comprehensive income (loss) 1.914 (2.85m (1.18?) Comprehensive income 3 41,154 $ 13.715 $ 24.322 Refer to accompanying notes. Refer to Note 18 Accumulated Other Comprehensive Income (Loss) for further information. BALANCE SHEETS (In millions) June 30, 2019 2018 Assets Current assets: Cash and cash equivalents 11,356 $ 11,946 Short-term Inv 122,463 121,822 Total cash, cash equivalents, and short-term investments 133,819 133,768 Accounts receivable, net of allowance for doubtful accounts of $411 and $377 29,524 26,481 Inventories 2,063 Other 10,146 2,662 6,751 Total current assets 175,552 169,662 Property and equipment, net of accumulated depreciation of $35,330 and $29,223 36,477 29,460 Operating lease right-of-use assets 7,379 6,686 Equity investments 2,649 1,862 Goodwill 42,026 35,683 Intangible assets, net 7,750 14,723 8,053 Other long-term assets 7.442 Total assets $ 286,556 $ 258,848 Liabilities and stockholders' equity Current liabilities: Accounts payable $ 9,382 $ 5,516 8,617 Current portion of long-term debt 3.998 Accrued compensation 6,830 6, 103 Short-term income taxes 5,665 2,121 Short-term unearned revenue 32,676 28,905 Other 9,351 8,744 otal current liabilities 69,420 58,488 Long-term debt 66,662 Long-term income taxes 29,612 72,242 30,265 Long-term unearned revenue 4,530 3,815 Deferred income taxes 233 541 Operating lease liabilities 6,188 5,568 Other long-term liabilities 7.581 5.211 Total liabilities 184,226 176,130 Commitments and contingencies Stockholders equity: Common stock and paid-in capital - shares authorized 24,000; outstanding 7,643 and 7,677 78,520 71,223 Retained earnings 24,150 13,682 Accumulated other comprehensive loss (340) (2, 187) Total stockholders' equity 102,330 82,718 Total liabilities and stockholders' equity 286.556 $ 258.848CASH FLOWS STATEMENTS (In millions) Year Ended June 30, Operations 2019 2018 2017 Net income Adjustments to reconcile net income to net cash from operations: $ 39,240 $ 16,571 $ 25,489 Depreciation, amortization, and other Stock-based compensation expense 11,682 10,261 3,940 8,778 Net recognized gains on investments and derivatives 4,652 3.266 Deferred income taxes (792) Changes in operating assets and liabilities: (6,463) (2,212) (5,143) (2,073) (829) Accounts receivable Inventories (2,812) 597 (3,862) Other current assets (465 (1,216) 50 Other long-term assets (1,718) Accounts payable (1,834) (952 1,028 (285) (917) Unearned revenue 232 81 Income taxes 4,462 1,148 2,929 5,922 18, 183 3,820 Other current liabilities 1,792 Other long-term liabilities 1.419 798 591 356 20) (118) Net cash from operations 52,185 43,884 39,507 Financing Repayments of short-term debt, maturities of 90 days or less, net Proceeds from issuance of debt 0 0 (7,324) (4,963 Repayments of debt Common stock issued (4,000) 7,183 44,344 1,142 (10,060) (7,922) Common stock repurchased 1.002 (19,543) 772 Common stock cash dividends paid (13,811) (10,721) (11,788 Other, net (675) (12,699 (971) (11,845 (190) Net cash from (used in) financing (36,887) (33,590) 8,408 Investing Additions to property and equipment Acquisition of companies, net of cash acquired, and purchases of intangible and other assets (13,925) (2,388) (11,632) (8,129) Purchases of investments (57,697) 888 Maturities of investments 20,043 (137,380 (25,944 176,905) Sales of investments 26,360 28,044 Securities lending payable 38,194 117,577 136,350 (98) (197) Net cash used in investing (15,773) (6,061) (46,781) Effect of foreign exchange rates on cash and cash equivalents (115) 50 19 Net change in cash and cash equivalents Cash and cash equivalents, beginning of period 590) 11,946 4,283 7,663 1,153 6,510 Cash and cash equivalents, end of period $ 11,356 $ 11,946 $ 7,663STOCKHOLDERS' EQUITY STATEMENTS (In millions) Year Ended June 30, 2019 2018 2017 Common stock and paid-in capital Balance, beginning of period 71,223 $ Common stock issued 69,315 $ 68, 178 Common stock repurchased 6,829 1,002 772 Stock-based compensation expense (4,195) (3,033) 4,652 3,940 (2,987) Other, net 3,266 11 (1) 86 Balance, end of period 78,520 71,223 69,315 Retained earnings Balance, beginning of period Net income 13,682 39,240 17,769 13, 118 Common stock cash dividends 16,571 25,489 Common stock repurchased (14,103) (12,917) (12,040) Cumulative effect of accounting changes (15,346) 677 (7,699) (42) (8,798) 0 Balance, end of period 24,150 13,682 17,769 Accumulated other comprehensive income (loss) Balance, beginning of period Other comprehensive income (loss) (2, 187 ) 627 1,794 Cumulative effect of accounting changes 1,914 (67) (2,856) 42 (1,167) 0 Balance, end of period (340) 2, 187) 527 Total stockholders' equity th 102,330 $ 82,718 $ 87,711 Cash dividends declared per common share 1.84 $ 1.68 $ 1.56