I need your help tutors*

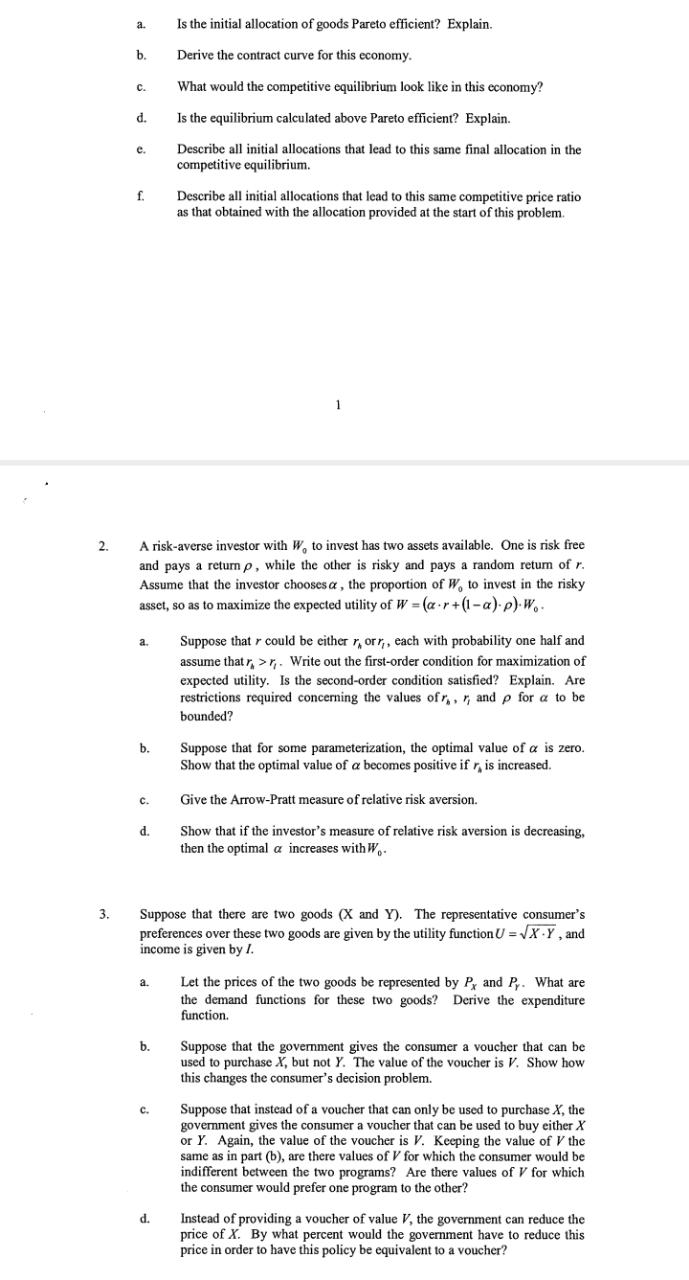

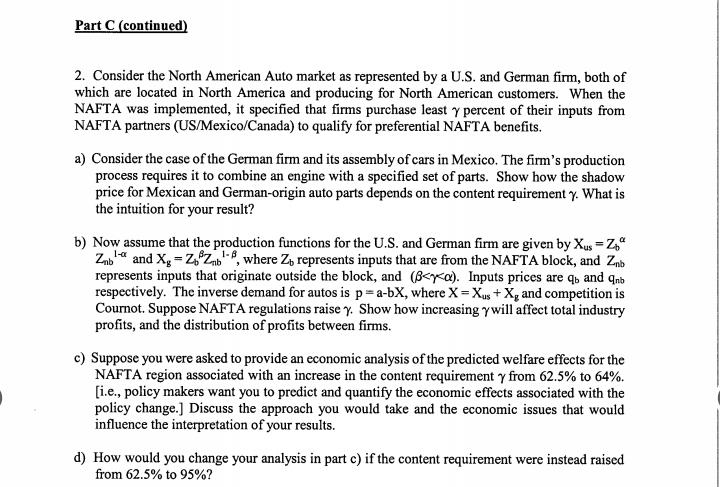

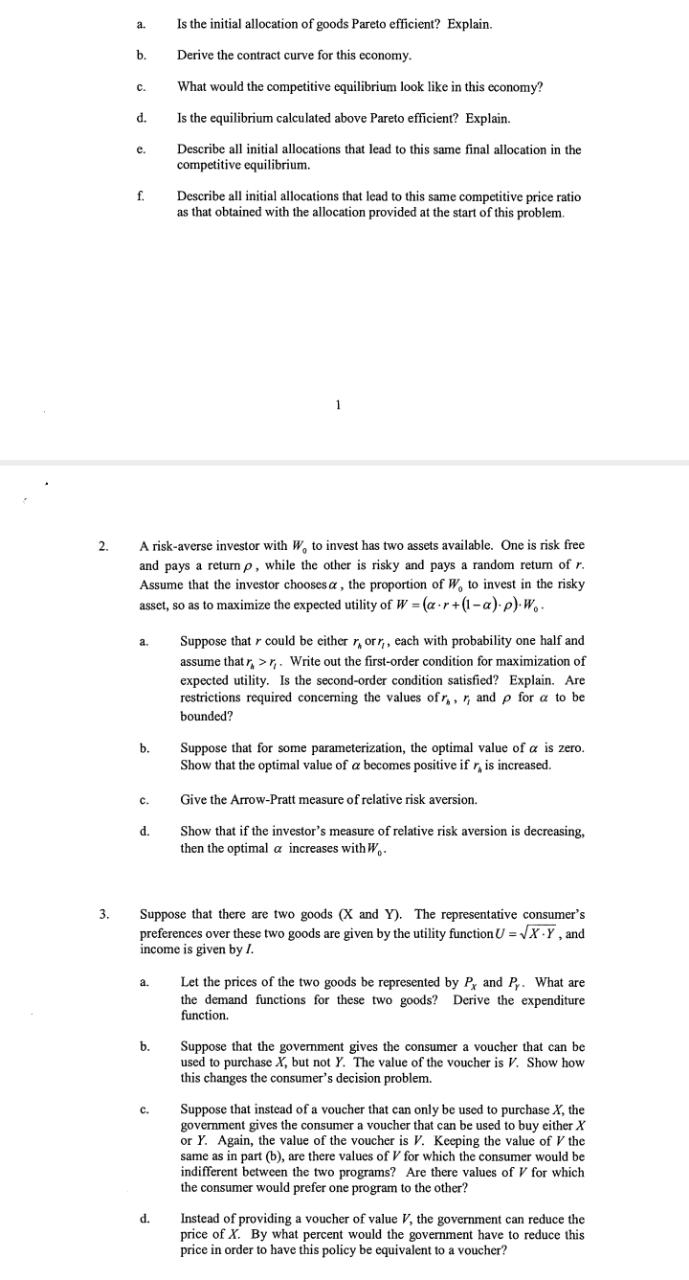

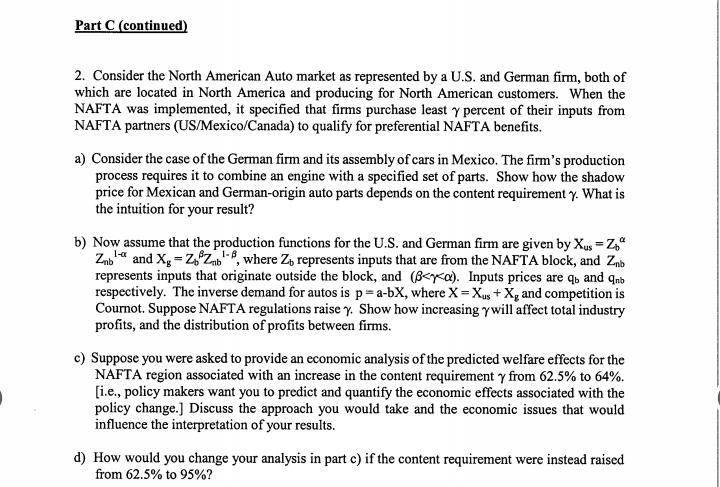

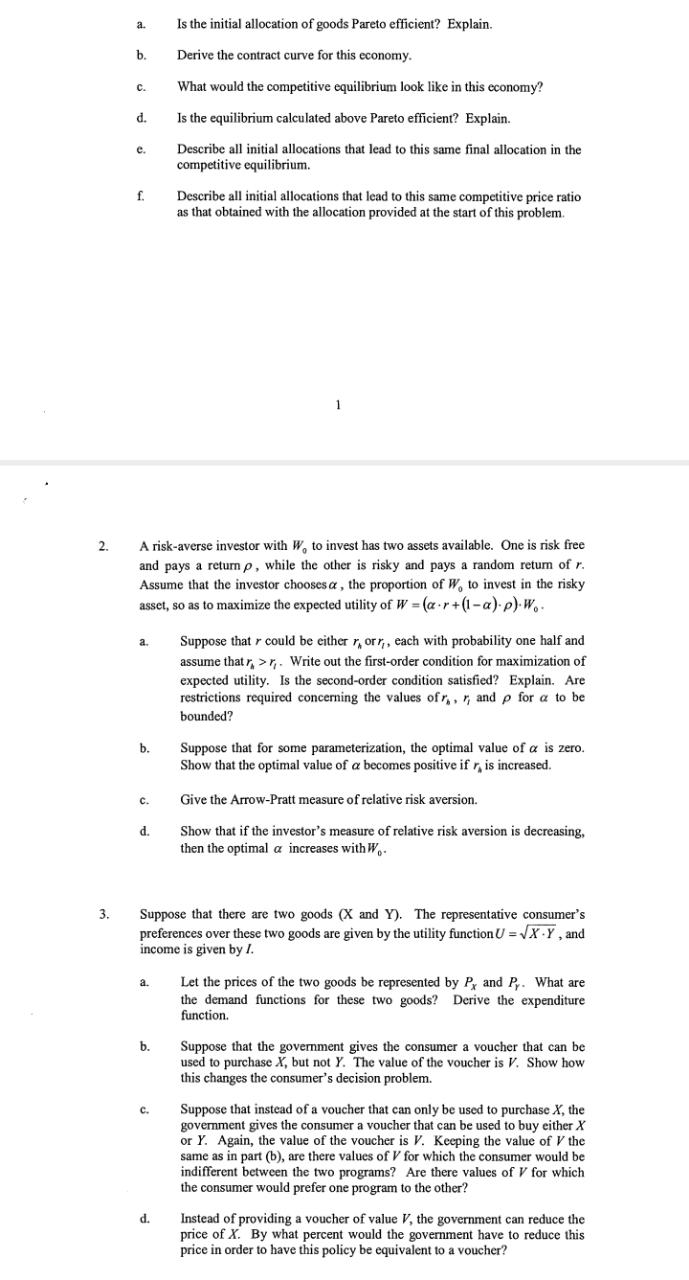

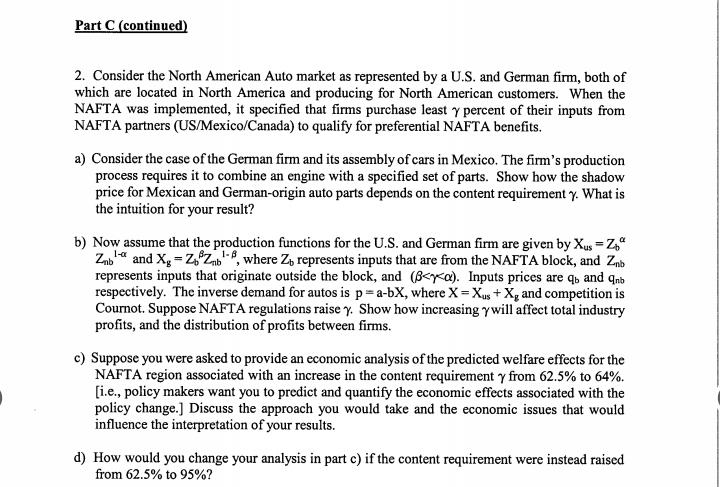

a. Is the initial allocation of goods Pareto efficient? Explain. b. Derive the contract curve for this economy. C. What would the competitive equilibrium look like in this economy? d. Is the equilibrium calculated above Pareto efficient? Explain. C. Describe all initial allocations that lead to this same final allocation in the competitive equilibrium. f. Describe all initial allocations that lead to this same competitive price ratio as that obtained with the allocation provided at the start of this problem. 2. A risk-averse investor with W. to invest has two assets available. One is risk free and pays a return p, while the other is risky and pays a random return of r. Assume that the investor chooses a , the proportion of W. to invest in the risky asset, so as to maximize the expected utility of W = (a.r + (1-a).p).W.. a. Suppose that r could be either r, orr,, each with probability one half and assume that r, > r, . Write out the first-order condition for maximization of expected utility. Is the second-order condition satisfied? Explain. Are restrictions required concerning the values off , r, and p for a to be bounded? b. Suppose that for some parameterization, the optimal value of a is zero. Show that the optimal value of a becomes positive if r is increased. C. Give the Arrow-Pratt measure of relative risk aversion. d. Show that if the investor's measure of relative risk aversion is decreasing, then the optimal a increases with W.. 3. Suppose that there are two goods (X and Y). The representative consumer's preferences over these two goods are given by the utility function U = VX .Y , and income is given by /. a. Let the prices of the two goods be represented by Px and P. What are the demand functions for these two goods? Derive the expenditure function. b. Suppose that the government gives the consumer a voucher that can be used to purchase X, but not Y. The value of the voucher is V. Show how this changes the consumer's decision problem. C. Suppose that instead of a voucher that can only be used to purchase X, the government gives the consumer a voucher that can be used to buy either X or Y. Again, the value of the voucher is V. Keeping the value of I' the same as in part (b), are there values of I for which the consumer would be indifferent between the two programs? Are there values of I for which the consumer would prefer one program to the other? d. Instead of providing a voucher of value , the government can reduce the price of X. By what percent would the government have to reduce this price in order to have this policy be equivalent to a voucher?Part C (continued) 2. Consider the North American Auto market as represented by a U.S. and German firm, both of which are located in North America and producing for North American customers. When the NAFTA was implemented, it specified that firms purchase least y percent of their inputs from NAFTA partners (US/Mexico/Canada) to qualify for preferential NAFTA benefits. a) Consider the case of the German firm and its assembly of cars in Mexico. The firm's production process requires it to combine an engine with a specified set of parts. Show how the shadow price for Mexican and German-origin auto parts depends on the content requirement y. What is the intuition for your result? b) Now assume that the production functions for the U.S. and German firm are given by Xus = Z." Zab and X, = Zo Zab ", where Zo represents inputs that are from the NAFTA block, and Znb represents inputs that originate outside the block, and (B

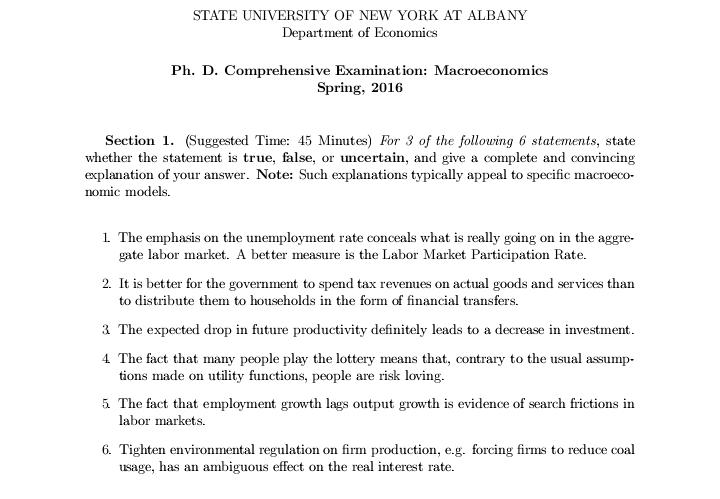

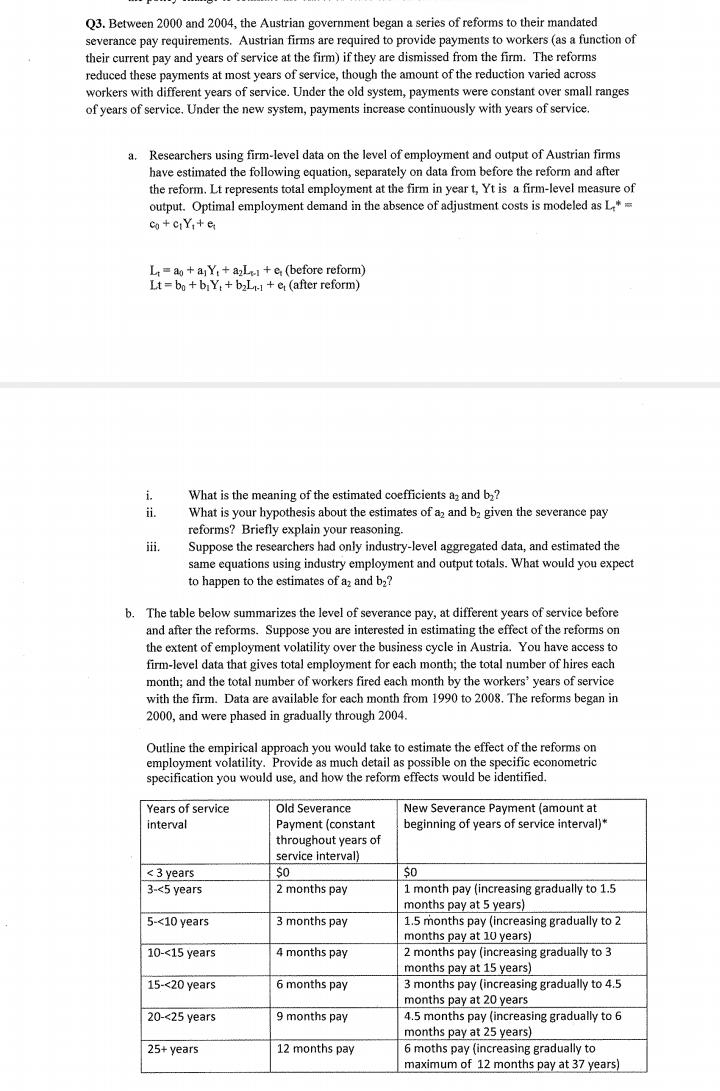

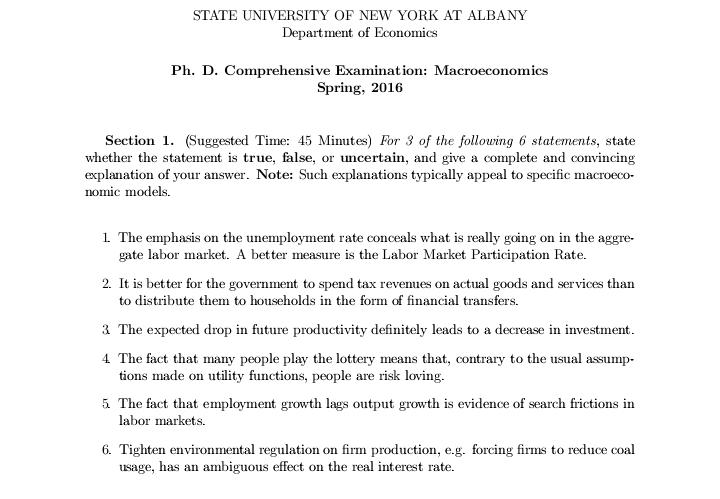

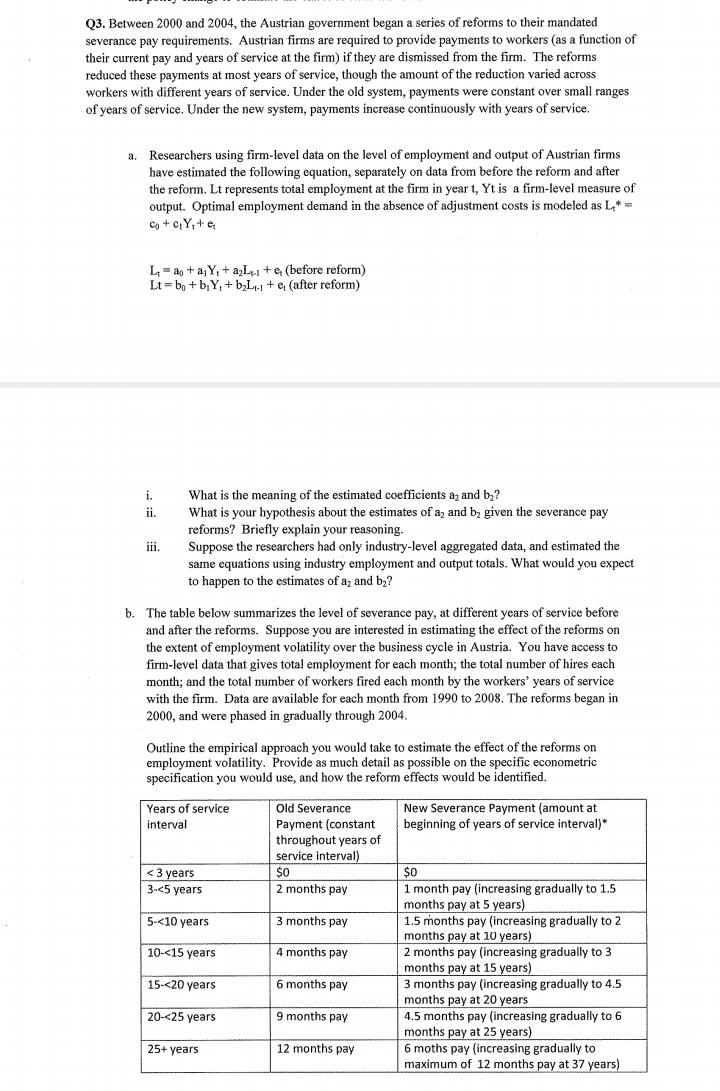

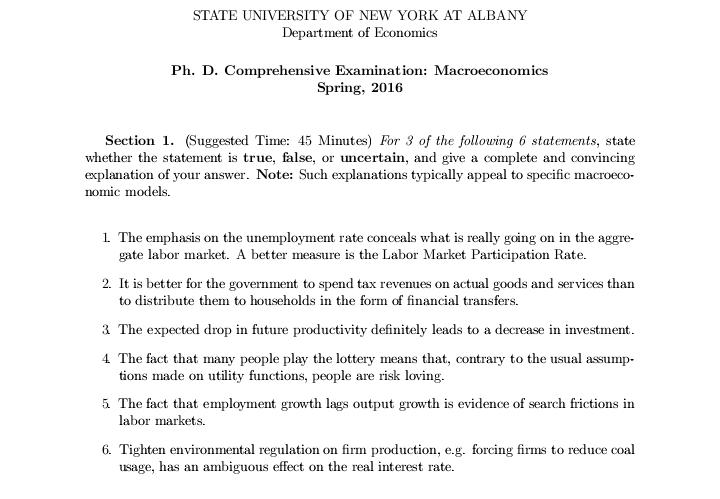

Bu(a), BE (0, 1). Each household has an initial capital ko > 0 at time 0, and one unit of productive time in each period that can be devoted to work. Final output is produced using capital and labor, according to a production function, F, which has the standard properties discussed in class, most notably, it is increasing in both arguments and exhibits CRS. This technology is owned by firms (whose measure does not really matter because of the CRS assumption). Output can be consumed (c) or invested (i,). Households own the capital (so they make the investment decision), and they rent it out to firms. Let 6 E (0, 1) denote the depreciation rate of capital. Households own the firms, i.e., they are claimants to the firms' profits, but these profits will be zero in equilibrium. The function it also has the usual nice properties, which I will not spell out here since you will not need them explicitly. In this economy there is a government that collects taxes and (for simplicity ) throws the tax revenues into the ocean. The government can implement one of the follwoing two alternative taxation systems, let us call them System A and System B. System A is a proportional tax, 7 6 0, 1], on agents' capital income. In other words, if the government implements System A, it collects a fraction 7 of all the income that agents earn by renting out their capital to firms. System B is a proportional tax, 7 6 [0, 1), on agents' investment. In other words, if the government implements System B, it collects a fraction + of all the resources that agents choose to allocate into investment. a) Write down the problem of the household recursively, under both taxation systems. Pay special attention to the budget constraints. These constraints will not be the same under the two specifications. Also, notice that I am not asking you to define a RCE in detail; just state the representative agent's problem within a RCE environment. b) Describe the steady state equilibrium capital stock under taxation System A, for any given 7 E [0, 1). Denote this object by KA(T). c) Describe the steady state equilibrium capital stock under taxation System B, for any given T e [0, 1). Denote this object by KE(T). d) Assume that F(K, N) = Ko Ni-s, a E (0, 1). Provide closed form solutions for the terms KA(T), KB(T), described in parts (b),(c)." e) Plot the terms K), KB, calculated in part (d), against + 6 [0, 1] and in the same graph. Discuss shortly. "Here, the firms face a static problem. I am not asking you to explicitly spell it out, but this problem is critical for the determination of the various prices. "Hint: Here, it is more convenient to work directly with F, ie., do not work with the auxiliary function f that we introduced in the lectures. 5 f) Describe the governemnt's total tax revenue in steady state under System B, Ts. Plot To as a function of the tax rate 7 (this is the so-called Laffer curve). Discuss the shape (i.e., the monotonicity) of the Laffer curve for the various values of a and T