Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I neef tge answer fir question 5 not 4 Match each technique below with the application it is most suited for. A. Understand and improve

I neef tge answer fir question 5 not 4

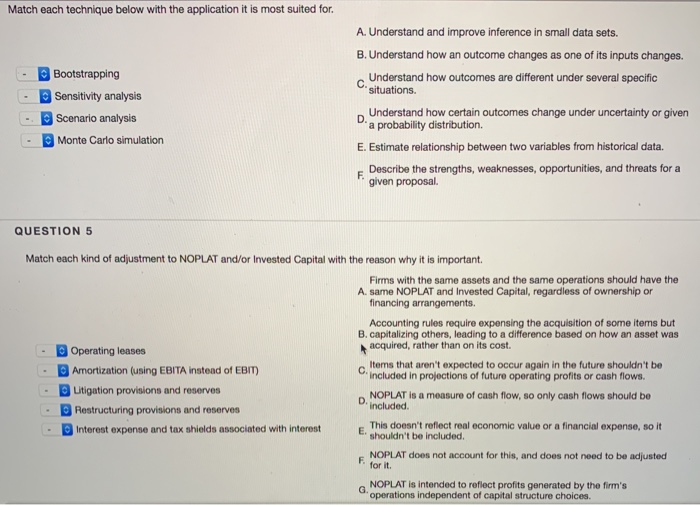

Match each technique below with the application it is most suited for. A. Understand and improve inference in small data sets. B. Understand how an outcome changes as one of its inputs changes. Understand how outcomes are different under several specific situations. - - - - Bootstrapping Sensitivity analysis Scenario analysis Monte Carlo simulation Understand how certain outcomes change under uncertainty or given a probability distribution. E. Estimate relationship between two variables from historical data. Describe the strengths, weaknesses, opportunities, and threats for a given proposal QUESTION 5 Match each kind of adjustment to NOPLAT and/or invested Capital with the reason why it is important. Firms with the same assets and the same operations should have the A. same NOPLAT and Invested Capital, regardless of ownership or financing arrangements. Accounting rules require expensing the acquisition of some items but B. capitalizing others, leading to a difference based on how an asset was acquired, rather than on its cost. - - - - - Operating leases Amortization (using EBITA instead of EBIT) Litigation provisions and reserves Restructuring provisions and reserves Interest expense and tax shields associated with interest Items that aren't expected to occur again in the future shouldn't be Included in projections of future operating profits or cash flows. NOPLAT is a measure of cash flow, so only cash flows should be included This doesn't reflect real economic value or a financial expense, so it E shouldn't be included. NOPLAT does not account for this, and does not need to be adjusted F. for it. NOPLAT is intended to reflect profits generated by the firm's operations independent of capital structure choices Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started