I neef the answers fast please. Will leave a like.

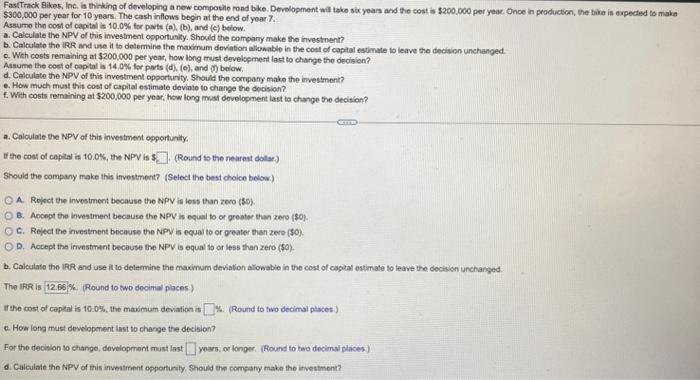

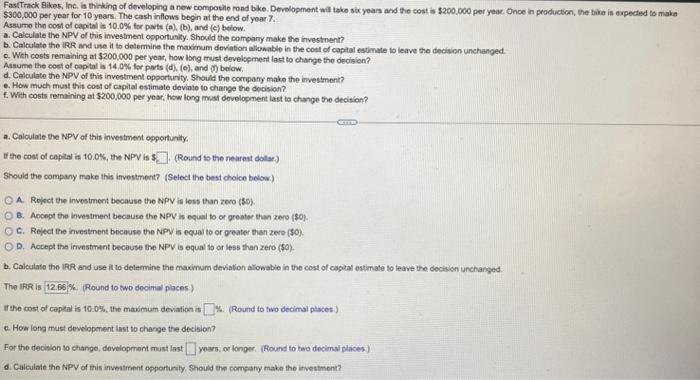

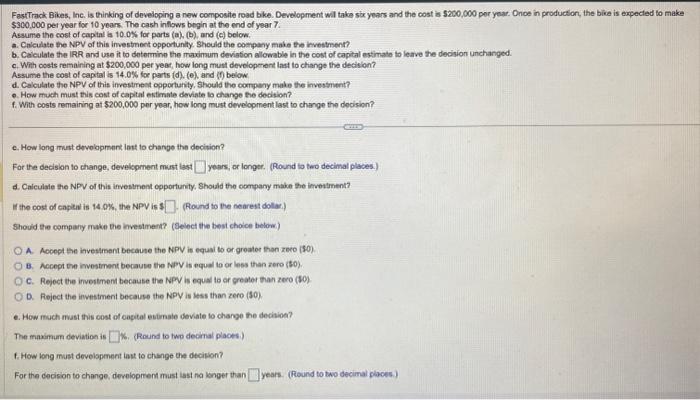

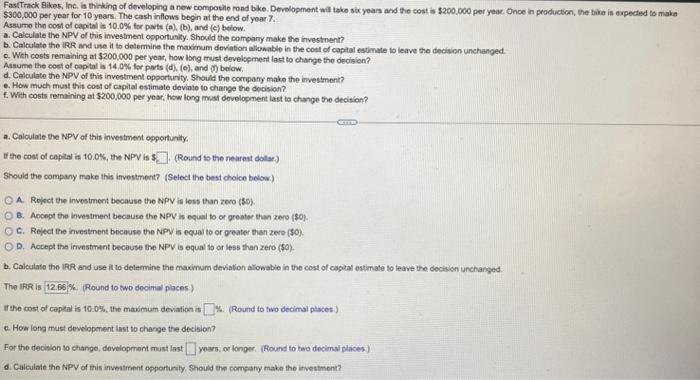

Fastrack Bikes, Inc, is thinking of developing a new compotho road bke. Development wil toke six years and the cost is $200,000 per yeac Once in production, the bike is expected to make $300,000 per year for 10 years. The cash inflows begin at the end of year 7. Assume the cost of capital it 10.0% for paits (n), (b), and (c) below. a. Calculate the NPV of this investment opportunily. Should the company make the investment? b. Calculate the IRR and use it to delemine the maximum deviation allowable in the cott of captal estimate to leave the decision unchanged. c. Wish costs remaining at $200,000 per yoar, how long must development last to change the decision? Assume the coet of capital is 14.0\%, for parts (d), (o), and (1) below. d. Celculate the NPV of this investment opporturity. Should the cornpany make the investment? e. How much must this cost of capital estimate deviate to change the dodisian? f. With costs remaining at $200,000 per year, how long must dovelocment last to change the decition? a. Calculate the NPV of this investment opportunity, If the cost of copital it 10.0K, the NPV is 3 (Round to the nearest doltac) Should the company make this investment? (Select the best choice beiow.) A. Roject the investment because the NPV is less than zero (50). B. Accopt the invesiment because the NPV is equal to or oreater than zero (\$0). c. Reject the investment because the NPV is equal to or geater then zero (50). b. Accept the investment because the NPV is equal ts or less than zero (50). b. Calculate the IRR and use it to determine the maximum deviation allowable in the cost of cagital estimate to leave the decision unchanged. The IfR is K. (Round to two decimal places) If the cost of cepital is 10.0%, the maximum deviation is 4. (Round to two decimal places:) c. How long must development last to change the decision? For the decision to change, dovelopment must last years. or longer, (Found to teo decimsi places) d. Calculate the NPY of this investrrnnt opportuaty. Should the company make the investment? FastTrack Bikes, Ine. is thinking of developing a new composite road bike. Development wil take six years and the cost is 5200,000 per year. Onoe in productor, the bike is expected to make $300,000 per year for 10 years. The cash inflows begin at the end of year 7. Assume the cost of capital is 10.06s for parts (a), (b), and (c) below. a. Criculate the NPV of this investment opportunity. Should the company maie the investment? b. Caiculate the IRR and use it to determine the maximum deviation allowable in the cost of capital estimato to leave the decision unchanged. c. With costs remaining at $200,000 per yeas, how long must developmont last to change the decision? Assume the cost of captal is 14.0% for parts (d). (e), and (9) below. d. Calculate the NPV of this investment opportunity, Should the conmeny male the investment? e. How much must this cost of capital estimate deviate to change the dedition? f. With costs remaining at $200,000 per year, how long must development last to change the decision? c. How long must devolopment lost to change the decition? For the decision to change, development must last years, or longer. (Round is two decimal places.) d. Caiculale the NPV of this investment opporturity, Should the oompany make the ieveitment? If the cost of capite is 140%, the NPV is 1 (Rlound to the nearest dollac.) Should the company make the ivesiment? (Seiect the best choice below) A. Aocept the investrnent because the NPV is equal to or greater than zeco (50). B. Nccept the investment because the NPV is equal to or less than zere (50). c. Reject the investment because the NPV is equal to ar greater than zero (50). D. Reject the investment becauce the NPV is less than zero (30). e. How much mast this cost of eapital evinale deviate to change the decisiod? The maximum deviation is 16. (Round to two decimal places.) f. How long must development iast to chunge the decition