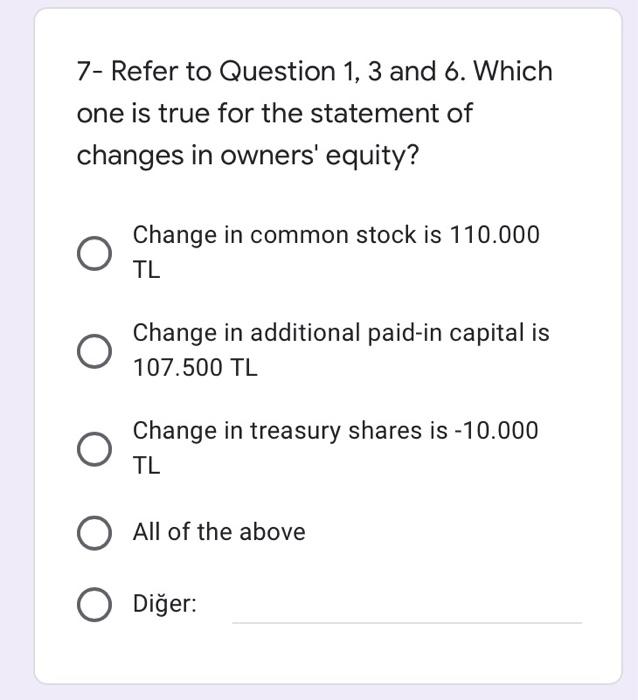

i nerd question 7. i shared question 1,3 and 6

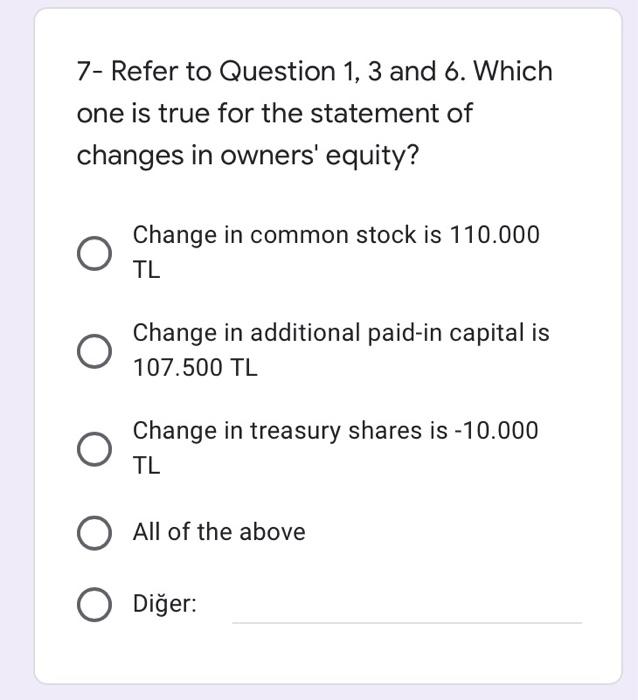

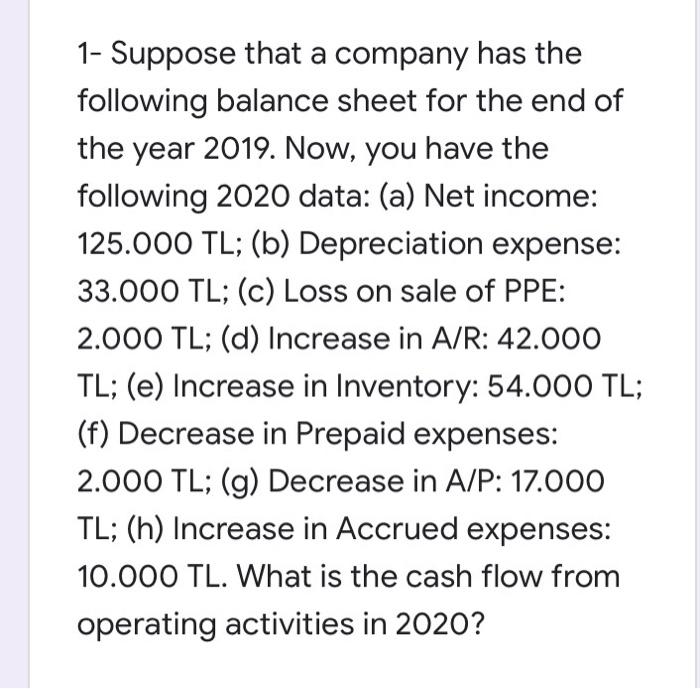

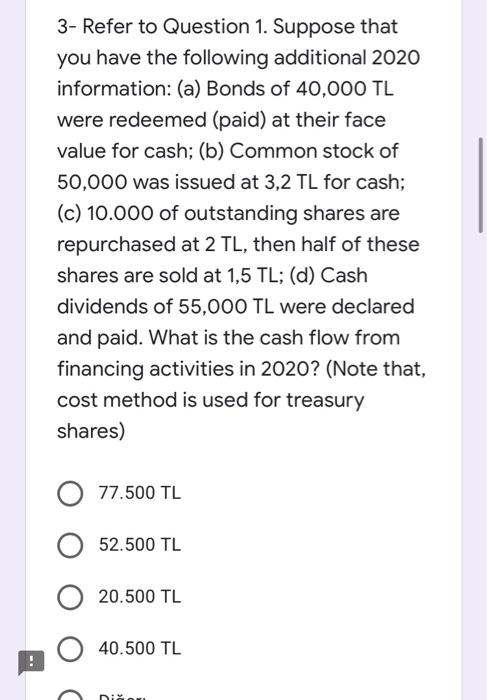

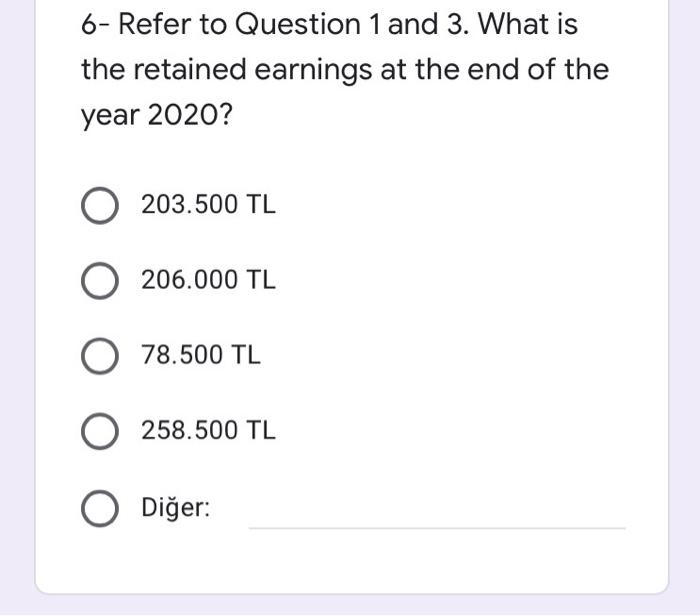

7- Refer to Question 1, 3 and 6. Which one is true for the statement of changes in owners' equity? Change in common stock is 110.000 TL Change in additional paid-in capital is 107.500 TL O Change in treasury shares is -10.000 TL All of the above Dier: 1- Suppose that a company has the following balance sheet for the end of the year 2019. Now, you have the following 2020 data: (a) Net income: 125.000 TL; (b) Depreciation expense: 33.000 TL; (c) Loss on sale of PPE: 2.000 TL; (d) Increase in A/R: 42.000 TL; (e) Increase in Inventory: 54.000 TL; (f) Decrease in Prepaid expenses: 2.000 TL; (g) Decrease in A/P: 17.000 TL; (h) Increase in Accrued expenses: 10.000 TL. What is the cash flow from operating activities in 2020? 2019 Cash 37.000,00 26.000,00 A/R Inventory Prepaid Expenses PPE 6.000,00 338.000,00 21.000,00 Accum. Dep. (-) TOTAL 386.000,00 40.000,00 A/P Accrued expenses Bonds payable Common stock (1 TL par) Retained earnings 150.000,00 60.000,00 136.000,00 386.000,00 TOTAL 59.000 TL 66.000 TL O 54.000 TL 65.000 TL Dier: 3- Refer to Question 1. Suppose that you have the following additional 2020 information: (a) Bonds of 40,000 TL were redeemed (paid) at their face value for cash; (b) Common stock of 50,000 was issued at 3,2 TL for cash; (c) 10.000 of outstanding shares are repurchased at 2 TL, then half of these shares are sold at 1,5 TL; (d) Cash dividends of 55,000 TL were declared and paid. What is the cash flow from financing activities in 2020? (Note that, cost method is used for treasury shares) 77.500 TL 52.500 TL 20.500 TL ! 40.500 TL Dinam 6- Refer to Question 1 and 3. What is the retained earnings at the end of the year 2020? 203.500 TL 206.000 TL O 78.500 TL 258.500 TL O Dier 7- Refer to Question 1, 3 and 6. Which one is true for the statement of changes in owners' equity? Change in common stock is 110.000 TL Change in additional paid-in capital is 107.500 TL O Change in treasury shares is -10.000 TL All of the above Dier: 1- Suppose that a company has the following balance sheet for the end of the year 2019. Now, you have the following 2020 data: (a) Net income: 125.000 TL; (b) Depreciation expense: 33.000 TL; (c) Loss on sale of PPE: 2.000 TL; (d) Increase in A/R: 42.000 TL; (e) Increase in Inventory: 54.000 TL; (f) Decrease in Prepaid expenses: 2.000 TL; (g) Decrease in A/P: 17.000 TL; (h) Increase in Accrued expenses: 10.000 TL. What is the cash flow from operating activities in 2020? 2019 Cash 37.000,00 26.000,00 A/R Inventory Prepaid Expenses PPE 6.000,00 338.000,00 21.000,00 Accum. Dep. (-) TOTAL 386.000,00 40.000,00 A/P Accrued expenses Bonds payable Common stock (1 TL par) Retained earnings 150.000,00 60.000,00 136.000,00 386.000,00 TOTAL 59.000 TL 66.000 TL O 54.000 TL 65.000 TL Dier: 3- Refer to Question 1. Suppose that you have the following additional 2020 information: (a) Bonds of 40,000 TL were redeemed (paid) at their face value for cash; (b) Common stock of 50,000 was issued at 3,2 TL for cash; (c) 10.000 of outstanding shares are repurchased at 2 TL, then half of these shares are sold at 1,5 TL; (d) Cash dividends of 55,000 TL were declared and paid. What is the cash flow from financing activities in 2020? (Note that, cost method is used for treasury shares) 77.500 TL 52.500 TL 20.500 TL ! 40.500 TL Dinam 6- Refer to Question 1 and 3. What is the retained earnings at the end of the year 2020? 203.500 TL 206.000 TL O 78.500 TL 258.500 TL O Dier