Answered step by step

Verified Expert Solution

Question

1 Approved Answer

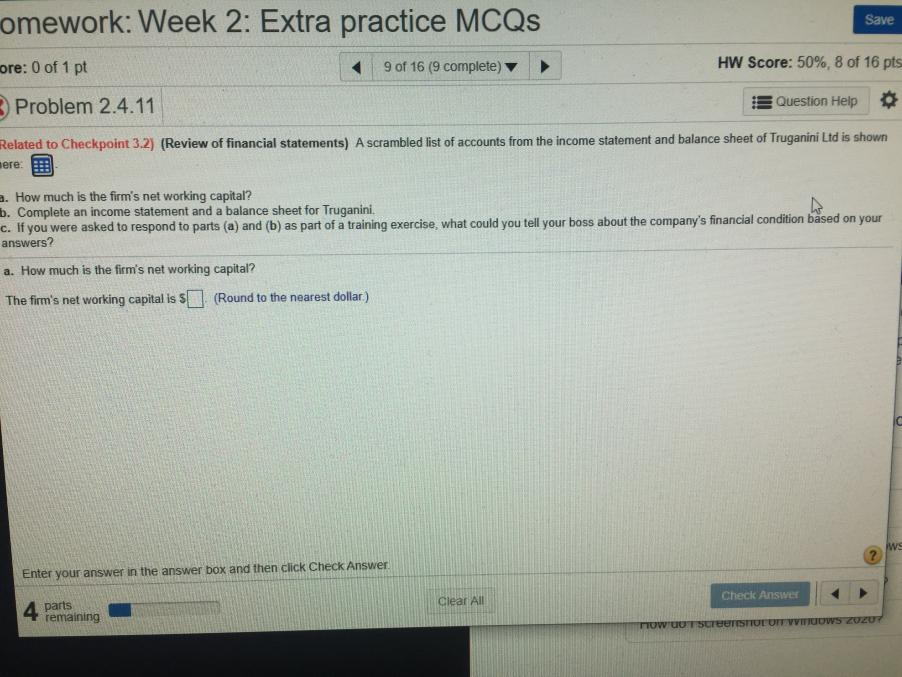

I omework: Week 2: Extra practice MCQS Save ore: 0 of 1 pt 9 of 16 (9 complete) HW Score: 50%, 8 of 16 pts

I

I

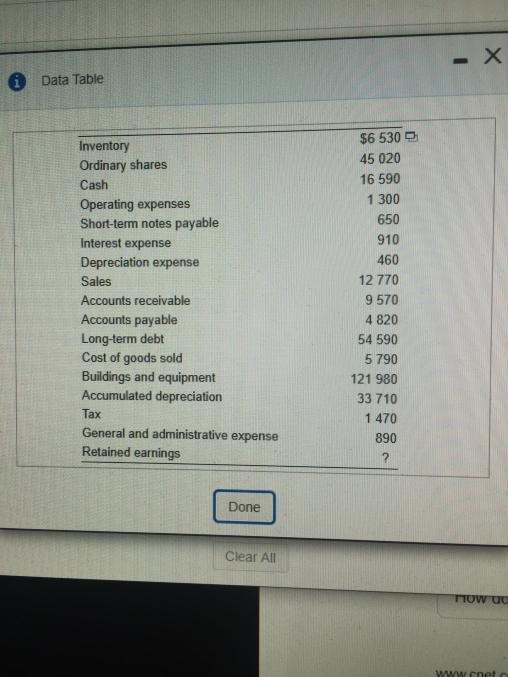

omework: Week 2: Extra practice MCQS Save ore: 0 of 1 pt 9 of 16 (9 complete) HW Score: 50%, 8 of 16 pts Problem 2.4.11 Question Help Related to Checkpoint 3.2) (Review of financial statements) A scrambled list of accounts from the income statement and balance sheet of Truganini Ltd is shown mere: a. How much is the firm's net working capital? b. Complete an income statement and a balance sheet for Truganini. c. If you were asked to respond to parts (a) and (b) as part of a training exercise, what could you tell your boss about the company's financial condition based on your answers? a. How much is the firm's net working capital? The firm's net working capital is $(Round to the nearest dollar) Enter your answer in the answer box and then click Check Answer Check Answer Clear All 4 parts remaining MUWUUTSTETISTOT UIT VITTUUWS ZUZU - X i Data Table Inventory Ordinary shares Cash Operating expenses Short-term notes payable Interest expense Depreciation expense Sales Accounts receivable Accounts payable Long-term debt Cost of goods sold Buildings and equipment Accumulated depreciation Tax General and administrative expense Retained earnings $6 530 D 45 020 16 590 1 300 650 910 460 12 770 9 570 4820 54 590 5790 121 980 33 710 1470 890 2 Done Clear All TI0W WWWnete

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started