Question

I only have 1 submission left. Please help!!! PLEASE EXPLAIN HOW YOU GOT THE ANSWER 1. What is your loan amount? 2. What is your

I only have 1 submission left. Please help!!! PLEASE EXPLAIN HOW YOU GOT THE ANSWER

1. What is your loan amount?

2. What is your initial capital cost?

3. What is your annual loan payment?

4. What is your year 1 NOI?

5. What is your year 1 before tax cash flow from operations?

6. What is your going in cap rate?

7. What is the first year cash on cash return for this investment?

8. What is the first year Debt Coverage Ratio for this loan?

9. What is the first year Debt Yield for this loan?

10. What is the first year Break Even Occupancy for this loan?

11. What is your before tax cash flow from selling this building?

12.What is the before tax IRR of this investment?

13. For a 10% equity hurdle rate, what is the before tax NPV of this investment?

14. If your lender was satisfied with a 1.5 Debt Coverage Ratio (regardless of LTV), what is the maximum loan amount you could have obtained?

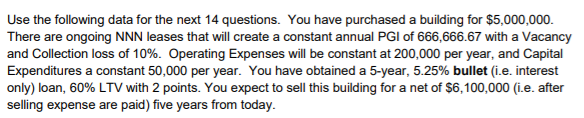

Use the following data for the next 14 questions. You have purchased a building for $5,000,000 There are ongoing NNN leases that wll create a constant annual PGI of 666,666.67 with a Vacancy and Collection loss of 10%. Operating Expenses will be constant at 200,000 per year, and Capital Expenditures a constant 50,000 per year. You have obtained a 5-year, 5.25% bullet (i.e. interest only) loan, 60% LTV with 2 points. You expect to sell this building for a net of $6,100,000 (i.e. after selling expense are paid) five years from today. Use the following data for the next 14 questions. You have purchased a building for $5,000,000 There are ongoing NNN leases that wll create a constant annual PGI of 666,666.67 with a Vacancy and Collection loss of 10%. Operating Expenses will be constant at 200,000 per year, and Capital Expenditures a constant 50,000 per year. You have obtained a 5-year, 5.25% bullet (i.e. interest only) loan, 60% LTV with 2 points. You expect to sell this building for a net of $6,100,000 (i.e. after selling expense are paid) five years from today

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started