Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I only have 2 questions left I eould appreciate it if you could answer all.of them please. Saved Help Save & Exit Subm A partial

I only have 2 questions left I eould appreciate it if you could answer all.of them please.

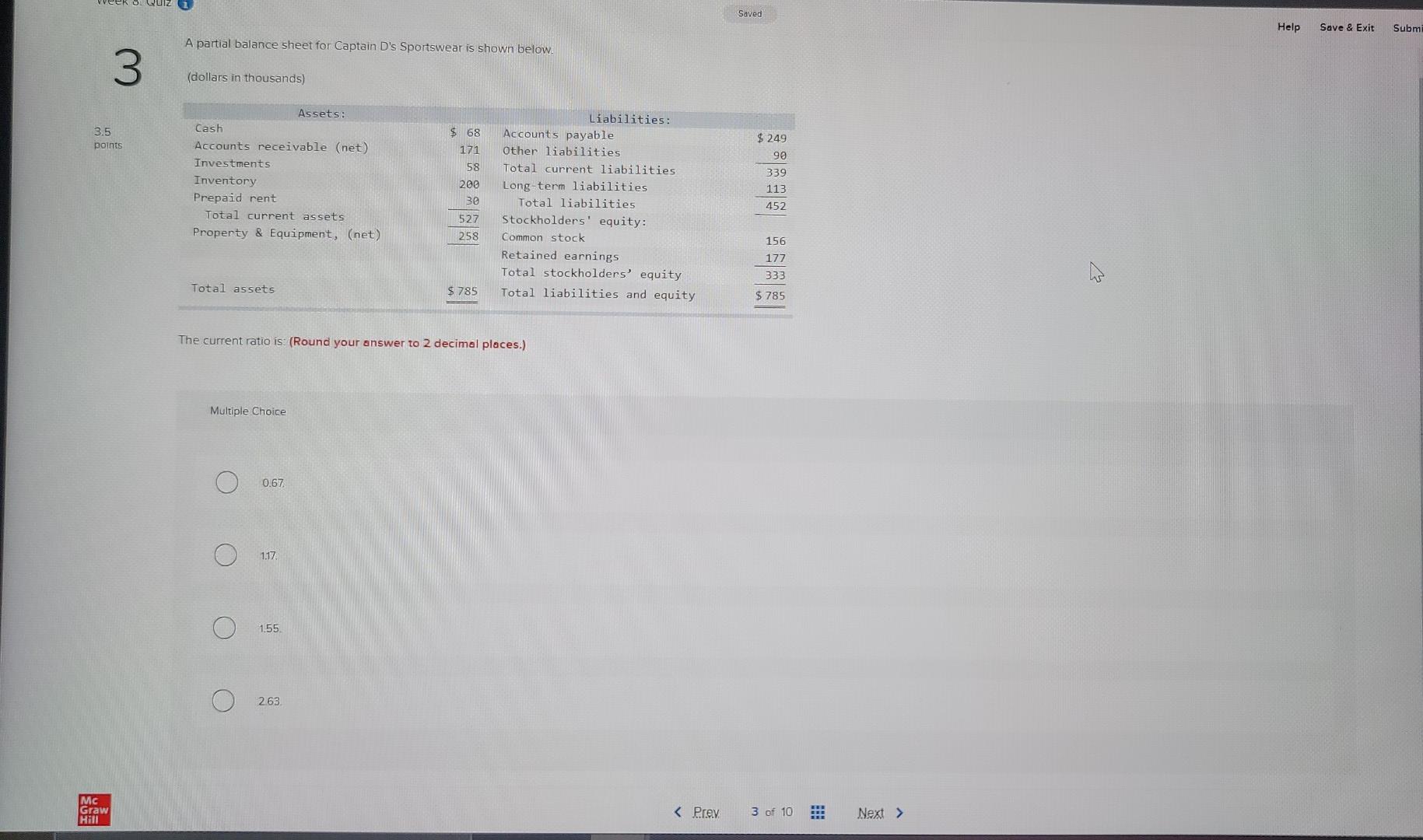

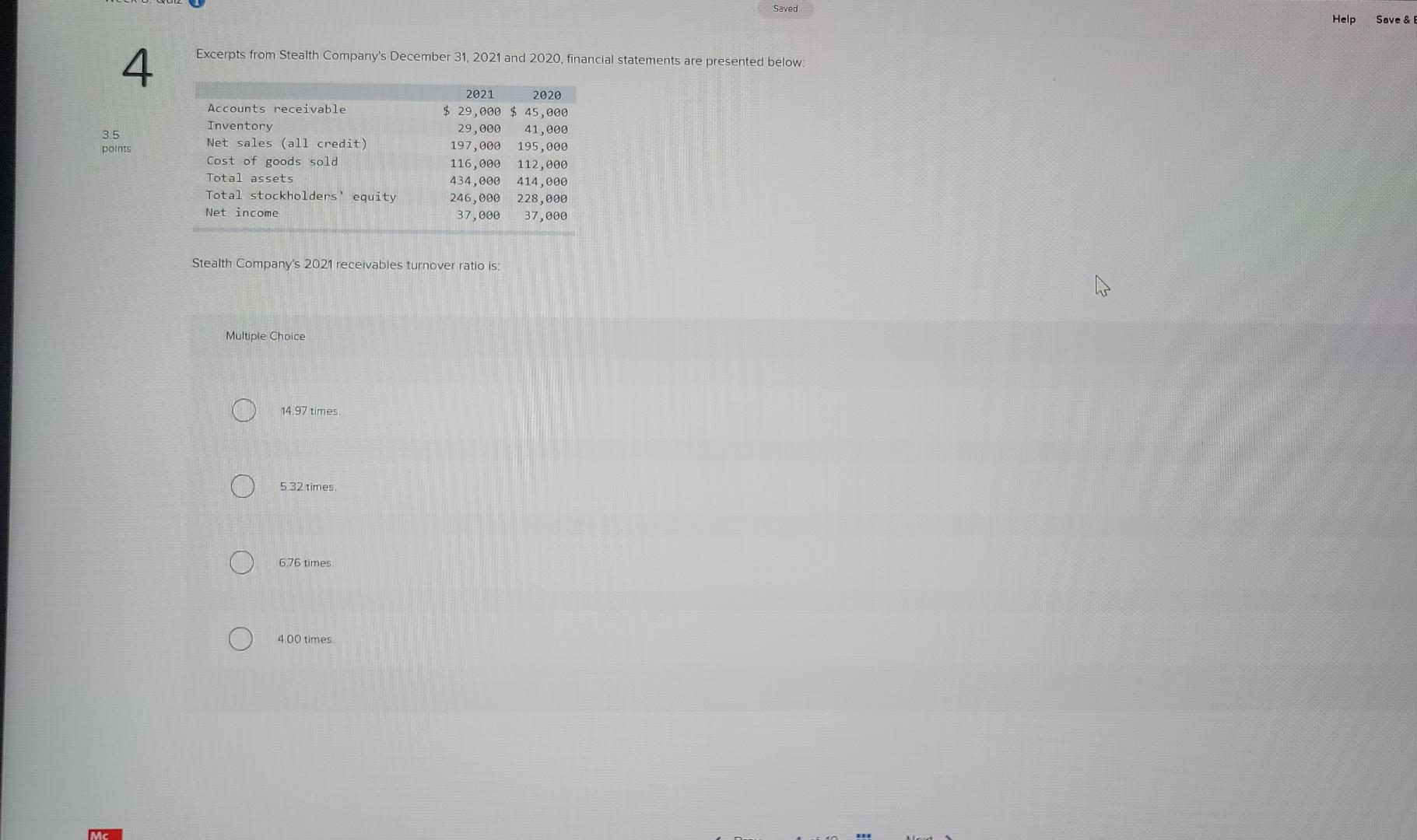

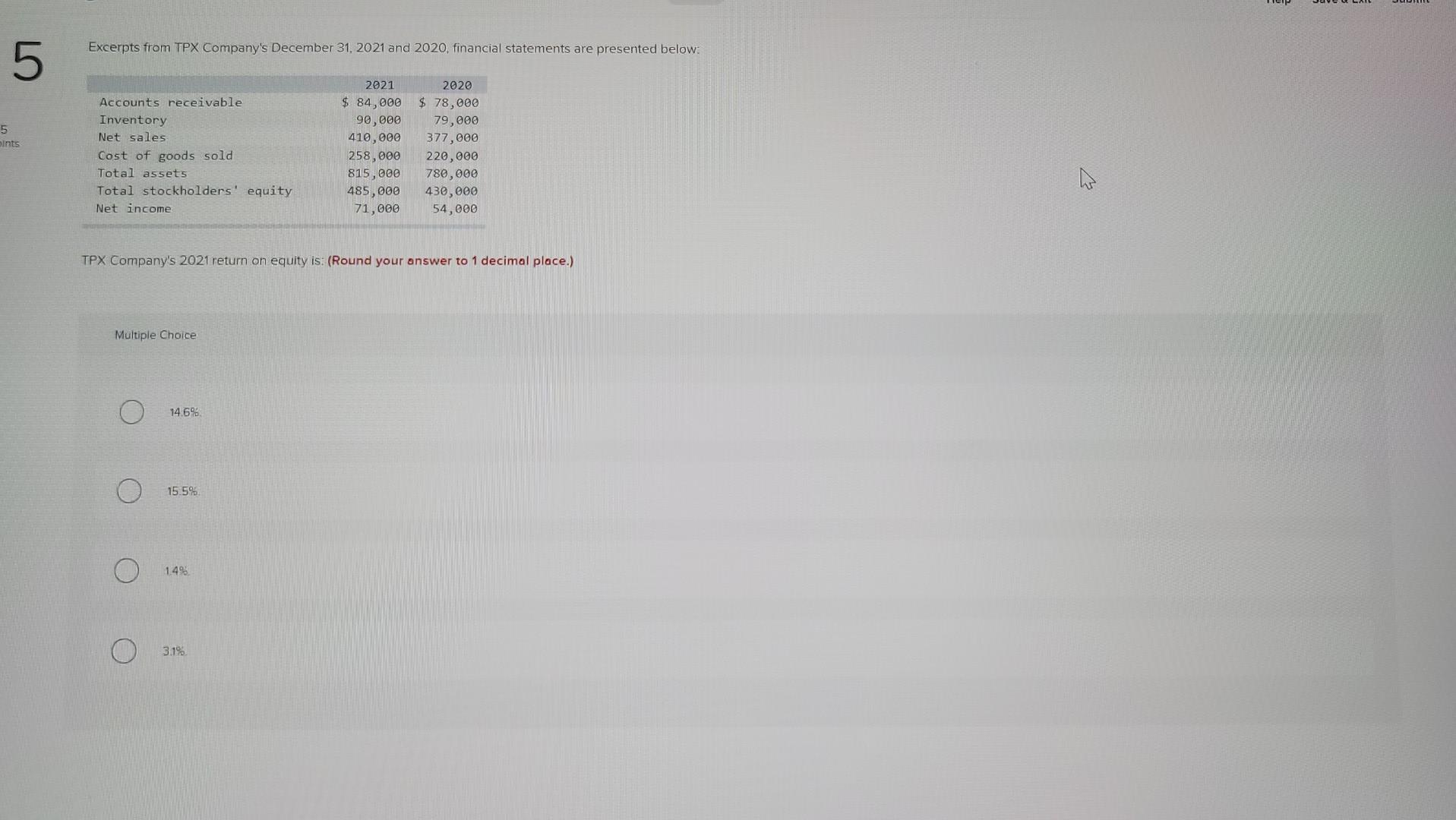

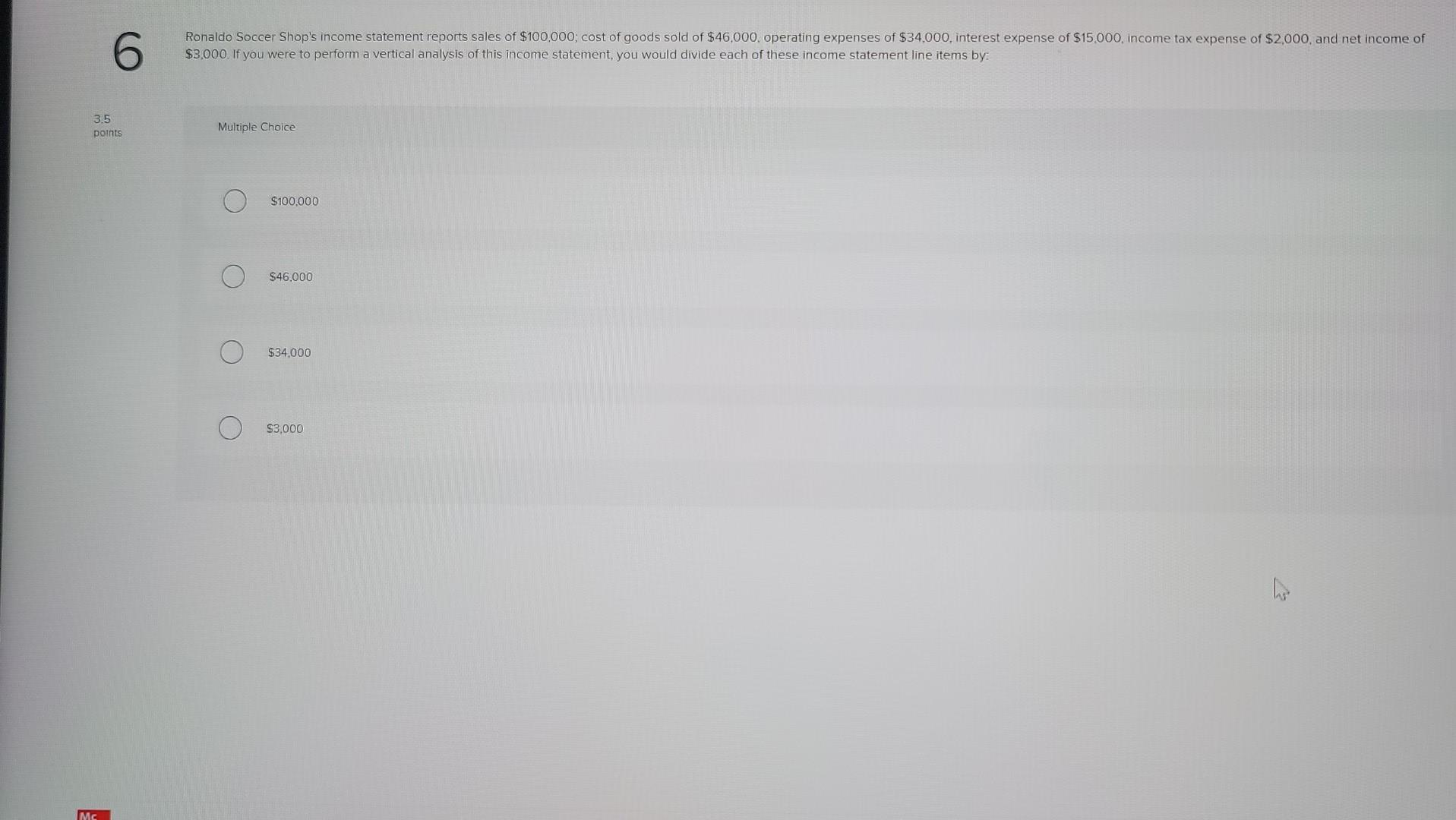

Saved Help Save & Exit Subm A partial balance sheet for Captain D's Sportswear is shown below. 3 (dollars in thousands) 3.5 points Assets: Cash Accounts receivable (net) Investments Inventory Prepaid rent Total current assets Property & Equipment, (net) $ 68 171 58 200 30 527 258 $ 249 90 339 113 Liabilities: Accounts payable Other liabilities Total current liabilities Long-term liabilities Total liabilities Stockholders' equity: Common stock Retained earnings Total stockholders' equity Total liabilities and equity 452 156 177 333 Total assets $ 785 $ 785 The current ratio is: (Round your answer to 2 decimal places.) Multiple Choice o 0.67. 0 1.17 1.55 O 2.63 O Mc Graw Hill Saved Help Save & E Excerpts from Stealth Company's December 31, 2021 and 2020, financial statements are presented below: 4 3.5 points Accounts receivable Inventory Net sales (all credit) Cost of goods sold Total assets Total stockholders' equity Net income 2021 2020 $ 29,000 $ 45,000 29,000 41,000 197,000 195,000 116,000 112,000 434,000 414,000 246,000 228,000 37,000 37,000 Stealth Company's 2021 receivables turnover ratio is: Multiple Choice 14.97 times 5.32 times o 6.76 times 4.00 times O Mc Excerpts from TPX Company's December 31, 2021 and 2020, financial statements are presented below: 5 5 oints Accounts receivable Inventory Net sales Cost of goods sold Total assets Total stockholders' equity Net income 2021 $ 84,000 90,000 410,000 258,000 815,000 485,000 71,000 2020 $ 78,000 79,000 377,000 220,000 780,000 430,000 54,000 TPX Company's 2021 return on equity is: (Round your answer to 1 decimal place.) Multiple Choice 74.6% 15.5% O 1.4% O 3.1% O 6 Ronaldo Soccer Shop's income statement reports sales of $100,000; cost of goods sold of $46,000, operating expenses of $34.000, interest expense of $15.000, income tax expense of $2,000, and net income of $3,000. If you were to perform a vertical analysis of this income statement, you would divide each of these income statement line items by: 3.5 points Multiple Choice $100,000 $46.000 $34.000 $3,000 MSStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started