Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I only need A here. Thank you! Reconsider the determination of the hedge ratio in the two-state model where we showed that one-third share of

I only need A here. Thank you!

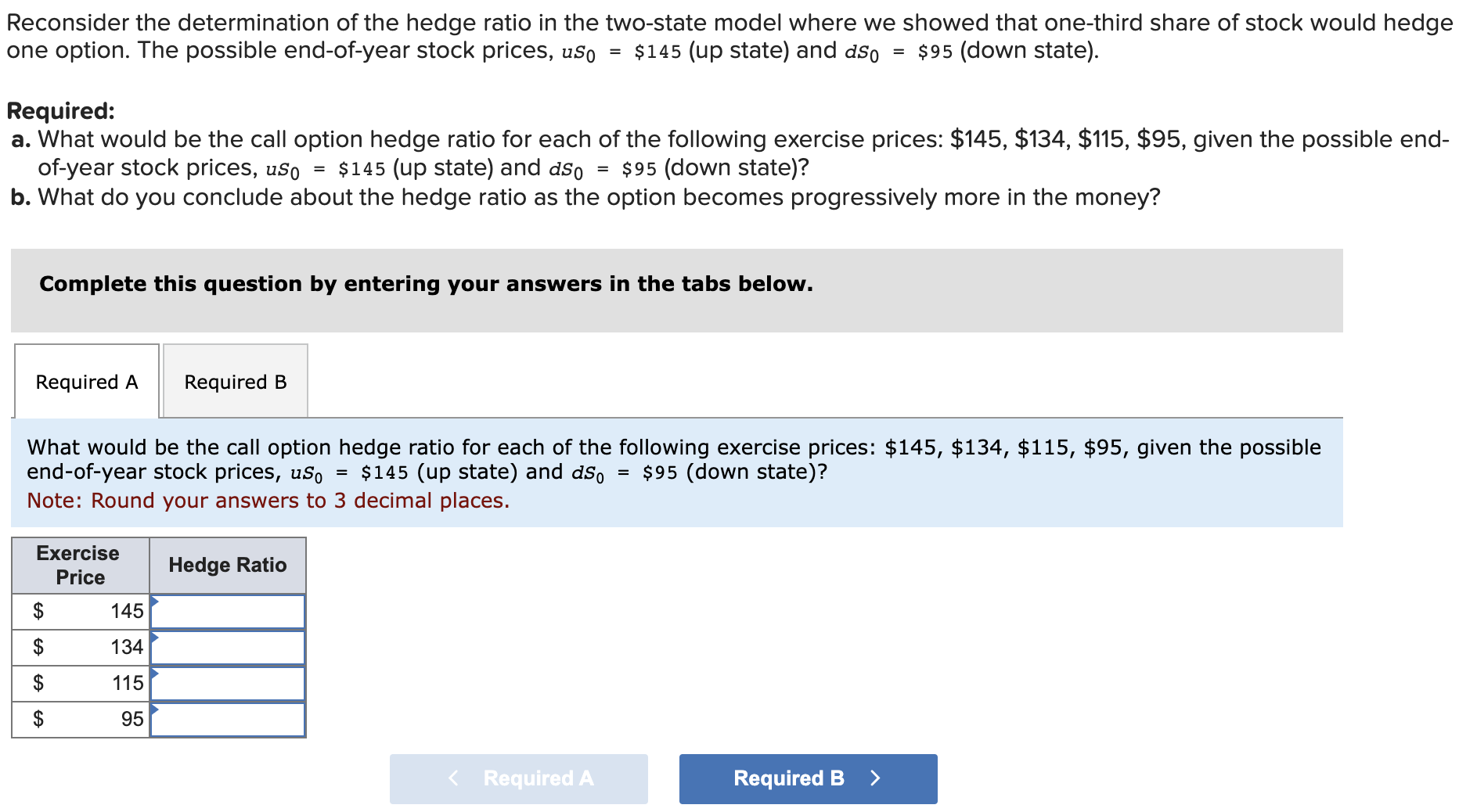

Reconsider the determination of the hedge ratio in the two-state model where we showed that one-third share of stock would hec one option. The possible end-of-year stock prices, us0=$145 (up state) and ds0=$95 (down state). Required: a. What would be the call option hedge ratio for each of the following exercise prices: $145,$134,$115,$95, given the possible of-year stock prices, us =$145 (up state) and dS0=$95 (down state)? b. What do you conclude about the hedge ratio as the option becomes progressively more in the money? Complete this question by entering your answers in the tabs below. What would be the call option hedge ratio for each of the following exercise prices: $145,$134,$115,$95, given the possible end-of-year stock prices, uS0=$145 (up state) and dS0=$95 (down state)? Note: Round your answers to 3 decimal placesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started