I only need answer for these questions below. do not solve all of them. please I will appreciate it. 1 to 6. with explanation and easy to follow please.

Questions:

1) Discuss each step you have taken to prepare the acquisition analysis. Include all relevant account names, amounts and explanations of calculations.

2) Discuss the accounting adjustments required to account for the fair value adjustment of inventories at the acquisition date.

3) At the acquisition date, Billy Ltd recorded a Dividend payable for $8,000. Discuss how you have treated this item in the acquisition analysis and the worksheet. Provide an explanation as to your actions.

4) Discuss the accounting processes, calculations and consolidation entries you have made for the Machine and all the related accounts.

5) explain the purpose of the 'Transfer from BCVR' account and all consolidation entries which you have posted to this account.

6) Joel Ltd provided Billy Ltd with a loan for $326,000 on 31 December 2019. Explain the accounting processes, calculations and consolidation entries you have provided to account for the loan and interest.

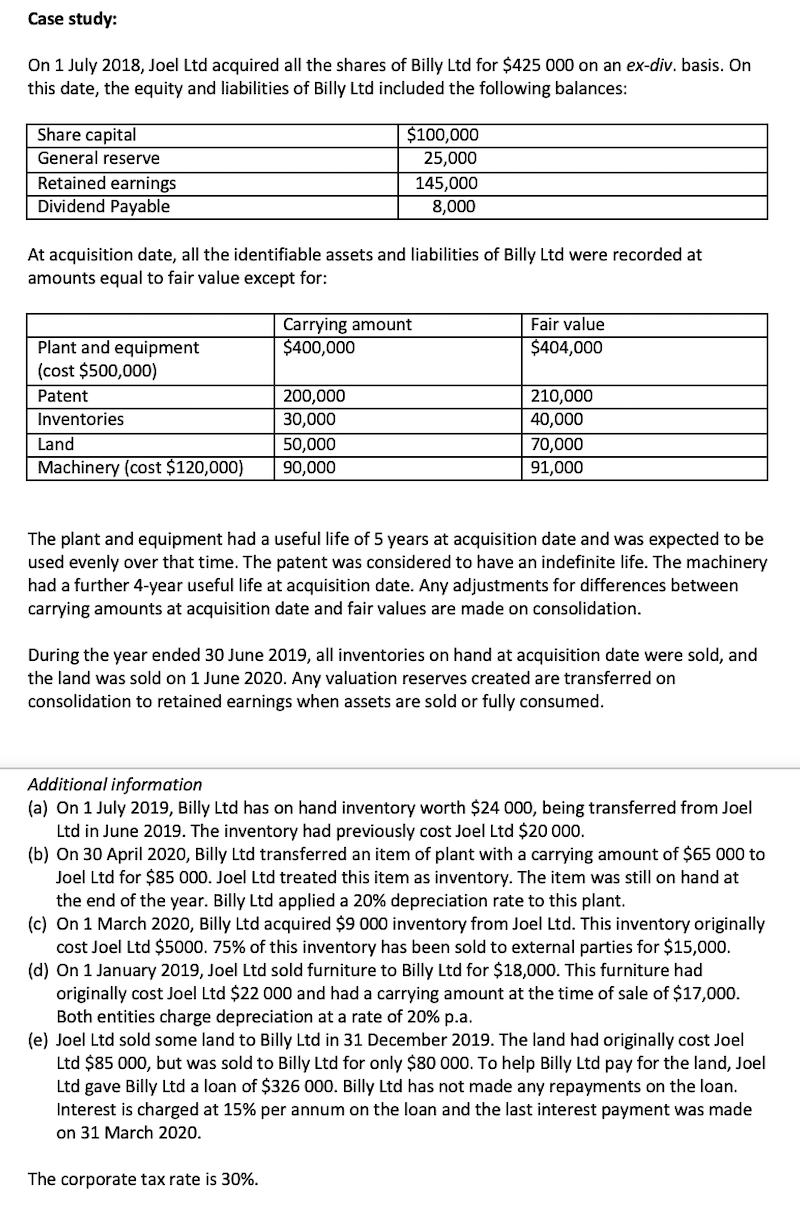

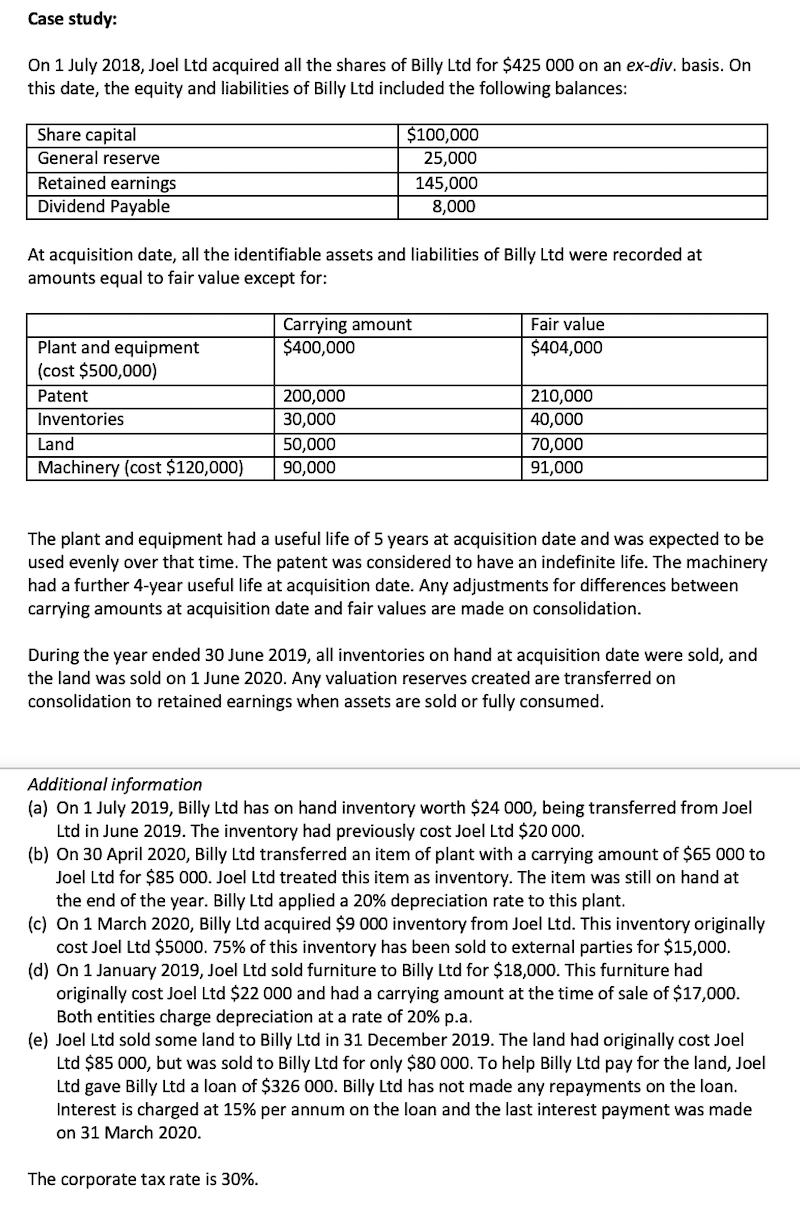

Case study: On 1 July 2018, Joel Ltd acquired all the shares of Billy Ltd for $425 000 on an ex-div. basis. On this date, the equity and liabilities of Billy Ltd included the following balances: Share capital General reserve Retained earnings Dividend Payable $100,000 25,000 145,000 8,000 At acquisition date, all the identifiable assets and liabilities of Billy Ltd were recorded at amounts equal to fair value except for: Carrying amount $400,000 Fair value $404,000 Plant and equipment (cost $500,000) Patent Inventories Land Machinery (cost $120,000) 200,000 30,000 50,000 90,000 210,000 40,000 70,000 91,000 The plant and equipment had a useful life of 5 years at acquisition date and was expected to be used evenly over that time. The patent was considered to have an indefinite life. The machinery had a further 4-year useful life at acquisition date. Any adjustments for differences between carrying amounts at acquisition date and fair values are made on consolidation. During the year ended 30 June 2019, all inventories on hand at acquisition date were sold, and the land was sold on 1 June 2020. Any valuation reserves created are transferred on consolidation to retained earnings when assets are sold or fully consumed. Additional information (a) On 1 July 2019, Billy Ltd has on hand inventory worth $24 000, being transferred from Joel Ltd in June 2019. The inventory had previously cost Joel Ltd $20 000. (b) On 30 April 2020, Billy Ltd transferred an item of plant with a carrying amount of $65 000 to Joel Ltd for $85 000. Joel Ltd treated this item as inventory. The item was still on hand at the end of the year. Billy Ltd applied a 20% depreciation rate to this plant. (c) On 1 March 2020, Billy Ltd acquired $9 000 inventory from Joel Ltd. This inventory originally cost Joel Ltd $5000. 75% of this inventory has been sold to external parties for $15,000. (d) On 1 January 2019, Joel Ltd sold furniture to Billy Ltd for $18,000. This furniture had originally cost Joel Ltd $22 000 and had a carrying amount at the time of sale of $17,000. Both entities charge depreciation at a rate of 20% p.a. (e) Joel Ltd sold some land to Billy Ltd in 31 December 2019. The land had originally cost Joel Ltd $85 000, but was sold to Billy Ltd for only $80 000. To help Billy Ltd pay for the land, Joel Ltd gave Billy Ltd a loan of $326 000. Billy Ltd has not made any repayments on the loan. Interest is charged at 15% per annum on the loan and the last interest payment was made on 31 March 2020. The corporate tax rate is 30%. Case study: On 1 July 2018, Joel Ltd acquired all the shares of Billy Ltd for $425 000 on an ex-div. basis. On this date, the equity and liabilities of Billy Ltd included the following balances: Share capital General reserve Retained earnings Dividend Payable $100,000 25,000 145,000 8,000 At acquisition date, all the identifiable assets and liabilities of Billy Ltd were recorded at amounts equal to fair value except for: Carrying amount $400,000 Fair value $404,000 Plant and equipment (cost $500,000) Patent Inventories Land Machinery (cost $120,000) 200,000 30,000 50,000 90,000 210,000 40,000 70,000 91,000 The plant and equipment had a useful life of 5 years at acquisition date and was expected to be used evenly over that time. The patent was considered to have an indefinite life. The machinery had a further 4-year useful life at acquisition date. Any adjustments for differences between carrying amounts at acquisition date and fair values are made on consolidation. During the year ended 30 June 2019, all inventories on hand at acquisition date were sold, and the land was sold on 1 June 2020. Any valuation reserves created are transferred on consolidation to retained earnings when assets are sold or fully consumed. Additional information (a) On 1 July 2019, Billy Ltd has on hand inventory worth $24 000, being transferred from Joel Ltd in June 2019. The inventory had previously cost Joel Ltd $20 000. (b) On 30 April 2020, Billy Ltd transferred an item of plant with a carrying amount of $65 000 to Joel Ltd for $85 000. Joel Ltd treated this item as inventory. The item was still on hand at the end of the year. Billy Ltd applied a 20% depreciation rate to this plant. (c) On 1 March 2020, Billy Ltd acquired $9 000 inventory from Joel Ltd. This inventory originally cost Joel Ltd $5000. 75% of this inventory has been sold to external parties for $15,000. (d) On 1 January 2019, Joel Ltd sold furniture to Billy Ltd for $18,000. This furniture had originally cost Joel Ltd $22 000 and had a carrying amount at the time of sale of $17,000. Both entities charge depreciation at a rate of 20% p.a. (e) Joel Ltd sold some land to Billy Ltd in 31 December 2019. The land had originally cost Joel Ltd $85 000, but was sold to Billy Ltd for only $80 000. To help Billy Ltd pay for the land, Joel Ltd gave Billy Ltd a loan of $326 000. Billy Ltd has not made any repayments on the loan. Interest is charged at 15% per annum on the loan and the last interest payment was made on 31 March 2020. The corporate tax rate is 30%