Answered step by step

Verified Expert Solution

Question

1 Approved Answer

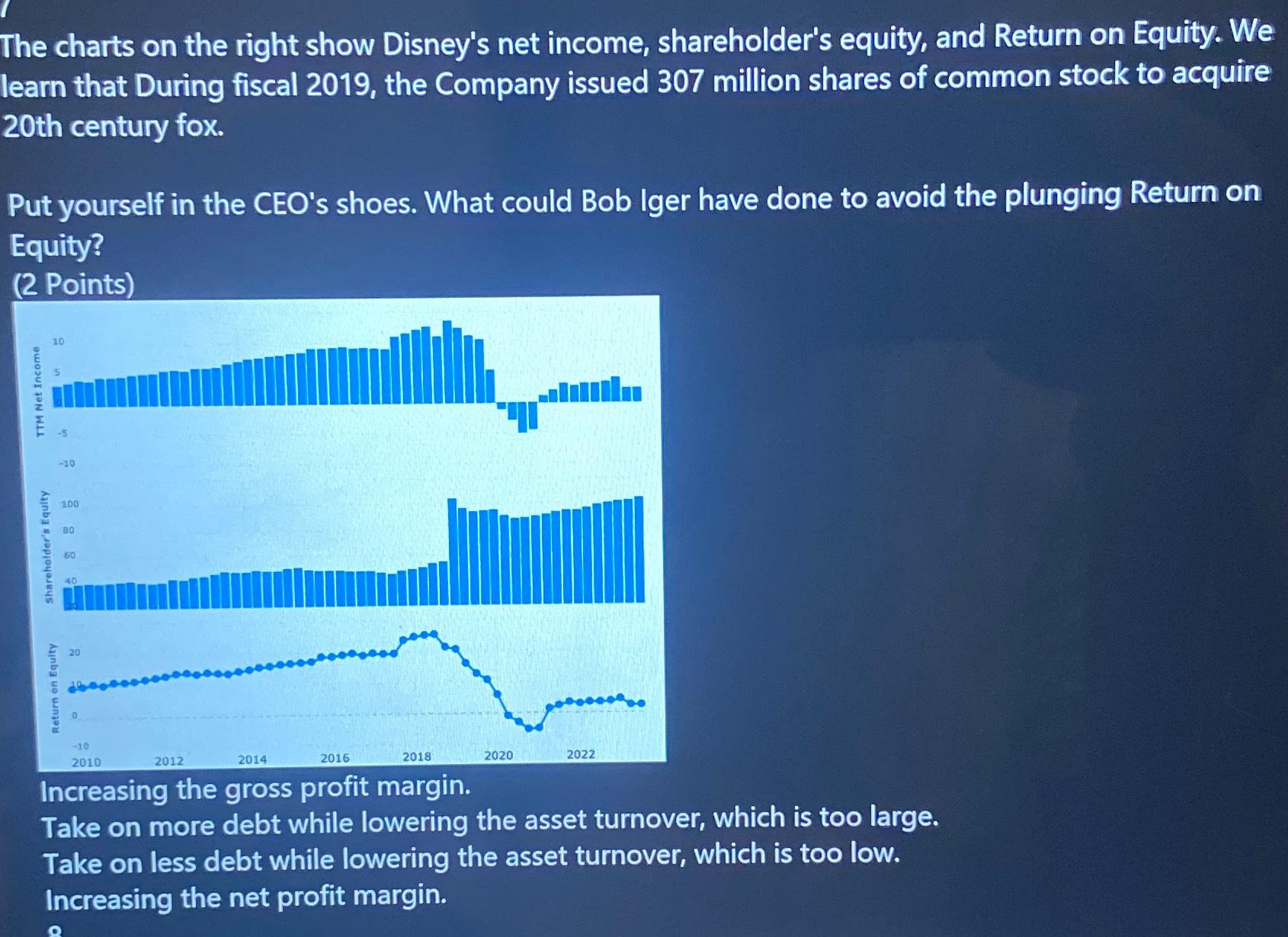

I ONLY NEED ANSWERS PLEASE TIME SENSITIVE The charts on the right show Disney's net income, shareholder's equity, and Return on Equity. We learn that

I ONLY NEED ANSWERS PLEASE TIME SENSITIVE The charts on the right show Disney's net income, shareholder's equity, and Return on Equity. We learn that During fiscal the Company issued million shares of common stock to acquire th century fox.

Put yourself in the CEO's shoes. What could Bob Iger have done to avoid the plunging Return on Equity?

Points

Increasing the gross profit margin.

Take on more debt while lowering the asset turnover, which is too large.

Take on less debt while lowering the asset turnover, which is too low.

Increasing the net profit margin.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started