Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i only need help on the ones i have question marks beside them Use the following tables to calculate the ratios below. Also discuss what

i only need help on the ones i have question marks beside them

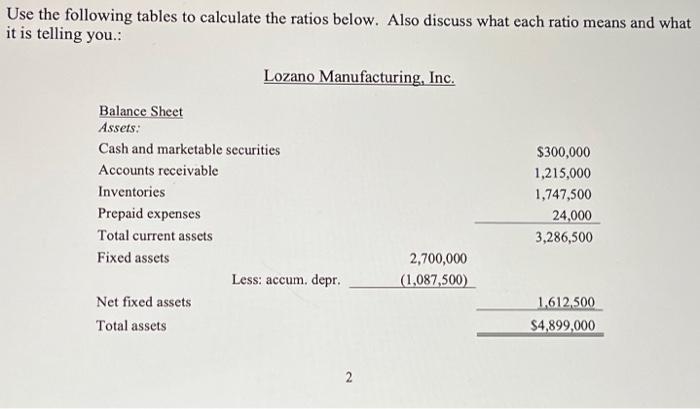

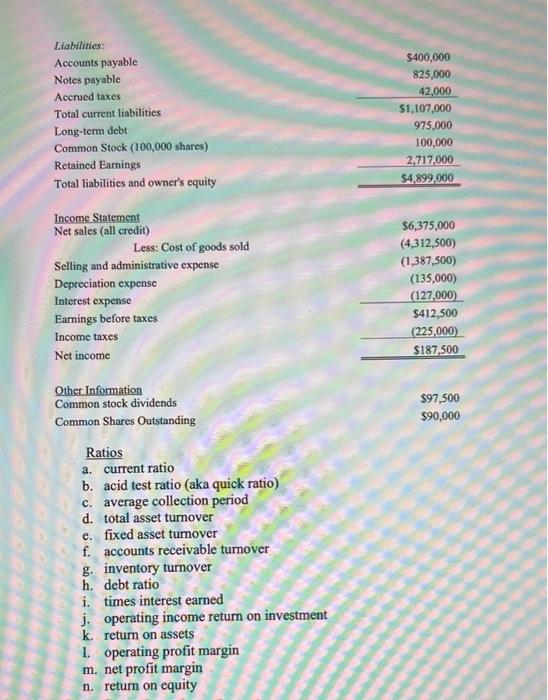

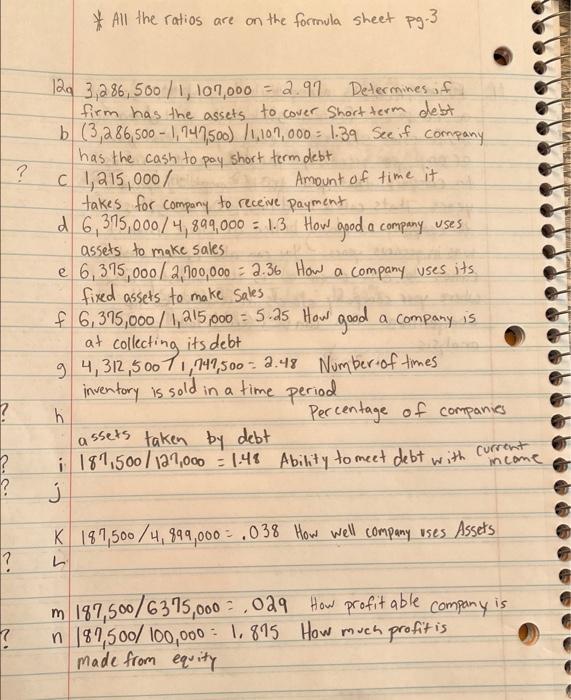

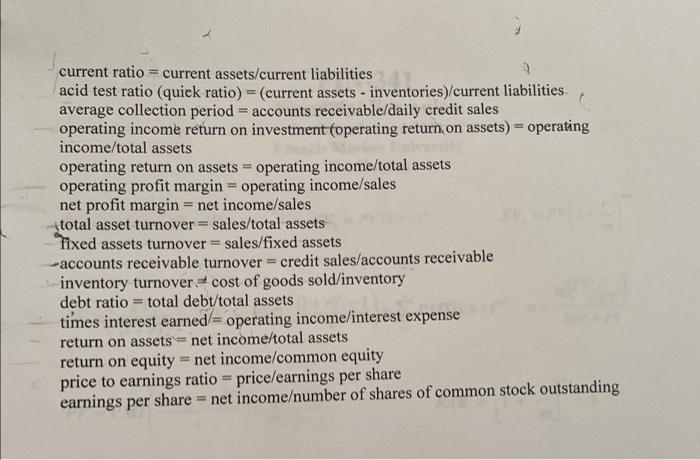

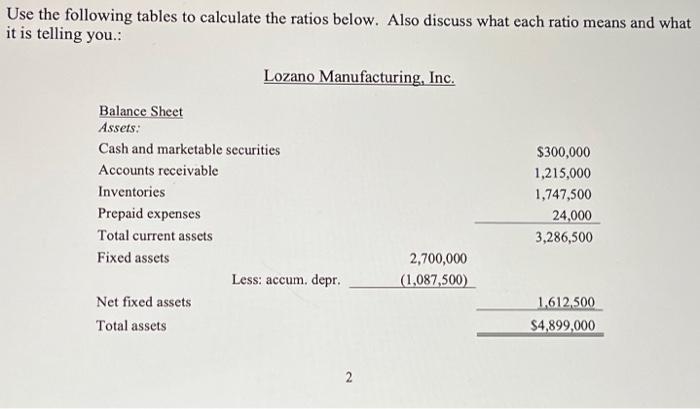

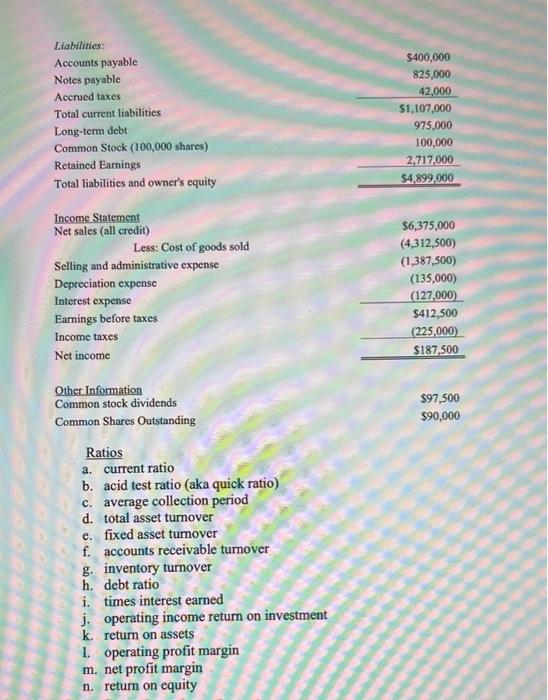

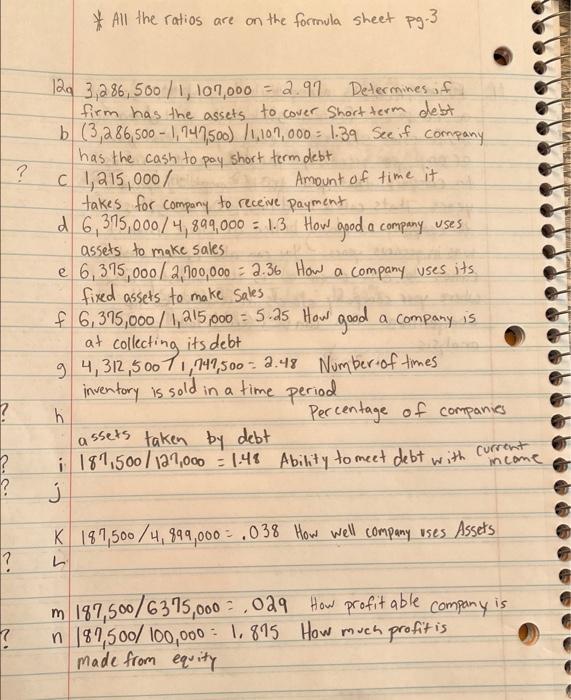

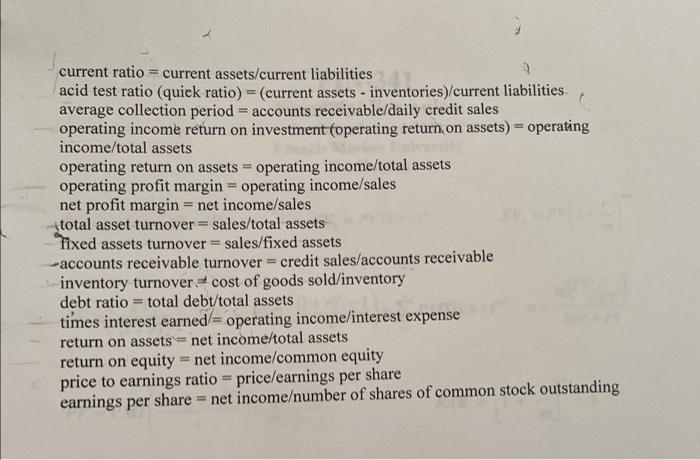

Use the following tables to calculate the ratios below. Also discuss what each ratio means and what it is telling you.: Lozano Manufacturing, Inc. Balance Sheet Assets: Cash and marketable securities $300,000 Accounts receivable 1,215,000 Inventories 1,747,500 Prepaid expenses 24,000 Total current assets 3,286,500 Fixed assets 2,700,000 (1,087,500) Net fixed assets 1,612,500 Total assets $4,899,000 Less: accum. depr. 2 Liabilities: Accounts payable Notes payable Accrued taxes Total current liabilities Long-term debt Common Stock (100,000 shares) Retained Earnings Total liabilities and owner's equity Income Statement Net sales (all credit) Selling and administrative expense Depreciation expense Interest expense Earnings before taxes Income taxes Net income Other Information Common stock dividends Common Shares Outstanding Ratios a. current ratio b. acid test ratio (aka quick ratio) c. average collection period d. total asset turnover e. fixed asset turnover f. accounts receivable turnover g. inventory turnover h. debt ratio i. times interest earned j. operating income return on investment k. return on assets 1. operating profit margin m. net profit margin n. return on equity Less: Cost of goods sold $400,000 825,000 42,000 $1,107,000 975,000 100,000 2,717,000 $4,899,000 $6,375,000 (4,312,500) (1,387,500) (135,000) (127,000) $412,500 (225,000) $187,500 $97,500 $90,000 ? ? All the ratios are on the formula sheet pg.3 120 3,286, 500/1, 107,000 = 2.97. = 2.97 Determines if firm has the assets to cover Short term debt. b(3,286,500 -1,147,500) /1,107,000 = 1.39 See if company has the cash to pay short term debt C1,215,000/ ? Amount of time it. takes for company to receive payment. d 6,375,000/4,899,000 = 1.3 How good a company uses. assets to make sales. e 6,315,000/2,100,000 = 2.36 How a company uses its fixed assets to make Sales 6,375,000/1,215,000 = 5.25 How good a company is at collecting its debt 94,312,500 11,747,500 2.48 Number of times. inventory is sold in a time period. h Percentage of companies assets taken by debt i 181,500/127,000 = 1.48 Ability to meet debt with current me income j K 187,500/4, 899,000.038 How well company uses Assets L m 187,500/6375,000,029 How profitable How profitable company is 187,500/100,000: 1, 815 How much profit is made from equity n ? current ratio current assets/current liabilities 3 acid test ratio (quick ratio) = (current assets - inventories)/current liabilities. average collection period = accounts receivable/daily credit sales. operating income return on investment (operating return on assets) = operating income/total assets operating return on assets operating income/total assets operating profit margin = operating income/sales net profit margin = net income/sales total asset turnover = sales/total assets fixed assets turnover sales/fixed assets = accounts receivable turnover credit sales/accounts receivable inventory turnover cost of goods sold/inventory debt ratio total debt/total assets times interest earned/= operating income/interest expense return on assets net income/total assets. return on equity = net income/common equity price to earnings ratio = price/earnings per share earnings per share= net incomeumber of shares of common stock outstanding

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started