Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I only need help with answers 7-10. On 1/1/2018, Sam's Sporting Goods has the following account balances 62,000 23,000 2,100 35,200 100,000 Cash Accounts Receivable

I only need help with answers 7-10.

I only need help with answers 7-10.

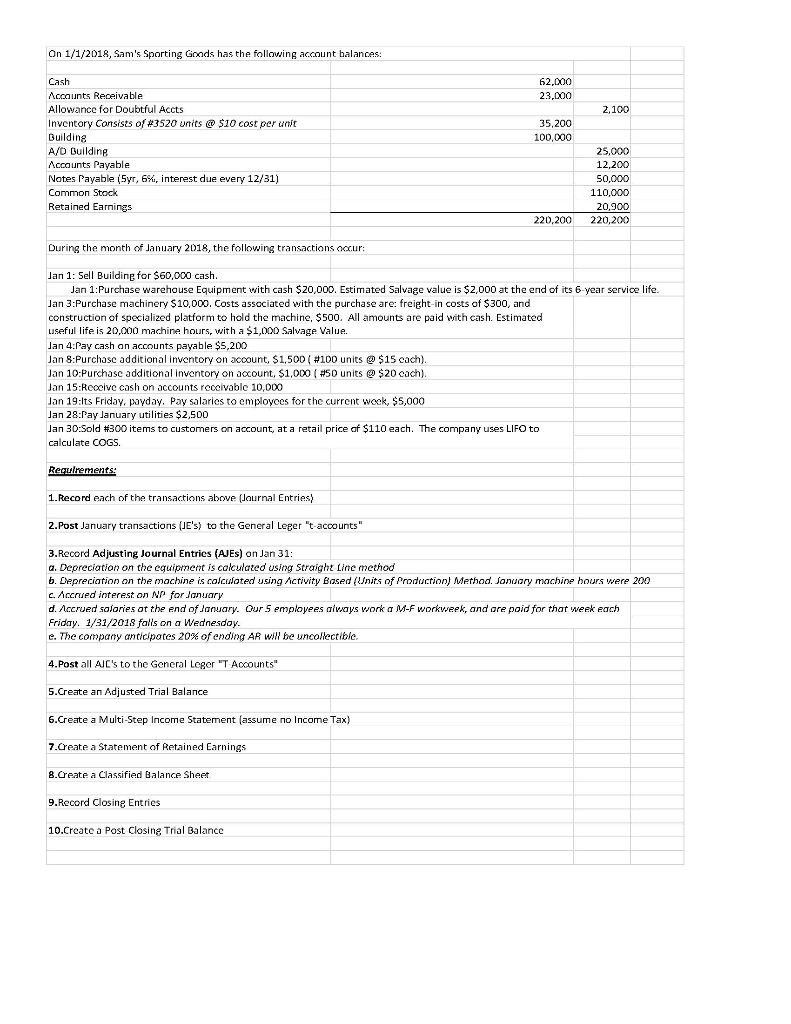

On 1/1/2018, Sam's Sporting Goods has the following account balances 62,000 23,000 2,100 35,200 100,000 Cash Accounts Receivable Allowance for Doubtful Accts Inventory Consists of #3520 urtits @ $10 cost per unit Building A/D Building Accounts Payable Notes Payable (Syr, 6%, interest due every 12/31) Common Stock Retained Earnings 25,000 12,200 50,000 110,000 20,900 220,200 220,200 During the month of January 2018, the following transactions occur: Jan 1: Sell Building for $60,000 cash. Jan 1:Purchase warehouse Equipment with cash $20,000. Estimated Salvage value is $2,000 at the end of its 6-year service life. Jan 3:Purchase machinery $10,000. Costs associated with the purchase are: freight-in costs of $300, and construction of specialized platform to hold the machine, $500. All amounts are paid with cash. Estimated useful life is 20.000 machine hours, with a $1,000 Salvage Value. Jan 4:Pay cash an accounts payable $5,200 Jan 8:Purchasc additional inventory on acoount, $1,500 (#100 units @ $15 cach). Jan 10:Purchase additional inventory on account, $1,000 (#50 units @ $20 cach). Jan 15:Rcocive cash on accounts receivable 10,000 Jan 19:Its Friday, payday. Pay salaries to employees for the current wook, $5,000 Jan 28:Pay January utilities $2,500 Jan 30:Sold 300 items to customers on account, at a retail price of $110 each. The company uses LIFO to calculate COGS Requirements: 1. Record each of the transactions above (Journal Entries) 2.Post January transactions (JE's) to the General Leger 't accounts 3. Record Adjusting Journal Entries (AJES) on Jan 31: a. Depreciation on the equipment is calculated using Straight line method b. Depreciation on the machine is calculated using Activity Based (Units of Production) Method. January machine hours were 200 c. Accrued interest on NP for January d. Accrued solaries at the end of January. Our employees always work a M-F workweek, and are poid for that week each Friday. 1/31/2018 falls on a Wednesday. e. The company anticipates 20% of ending AR will be uncollectible. 4.Post all Alc's to the General Leger "T Accounts 5.Create an Adjusted Trial Balance 6. Create a Multi-Step Income Statement (assume no Income Tax) 7.Create a Statement of Retained Earnings 8.Create a Classified Balance Sheet 9. Record Closing Entries 10.Create a Post Closing Trial Balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started