Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I only need help with e,f, and g. Please show all work and equations. here are the answers I got for the rest of the

I only need help with e,f, and g. Please show all work and equations. here are the answers I got for the rest of the problem

I only need help with e,f, and g. Please show all work and equations. here are the answers I got for the rest of the problem

a) 1,304.75

b) 774.31

c) 954.02

d) 150,000

Thank you!:)

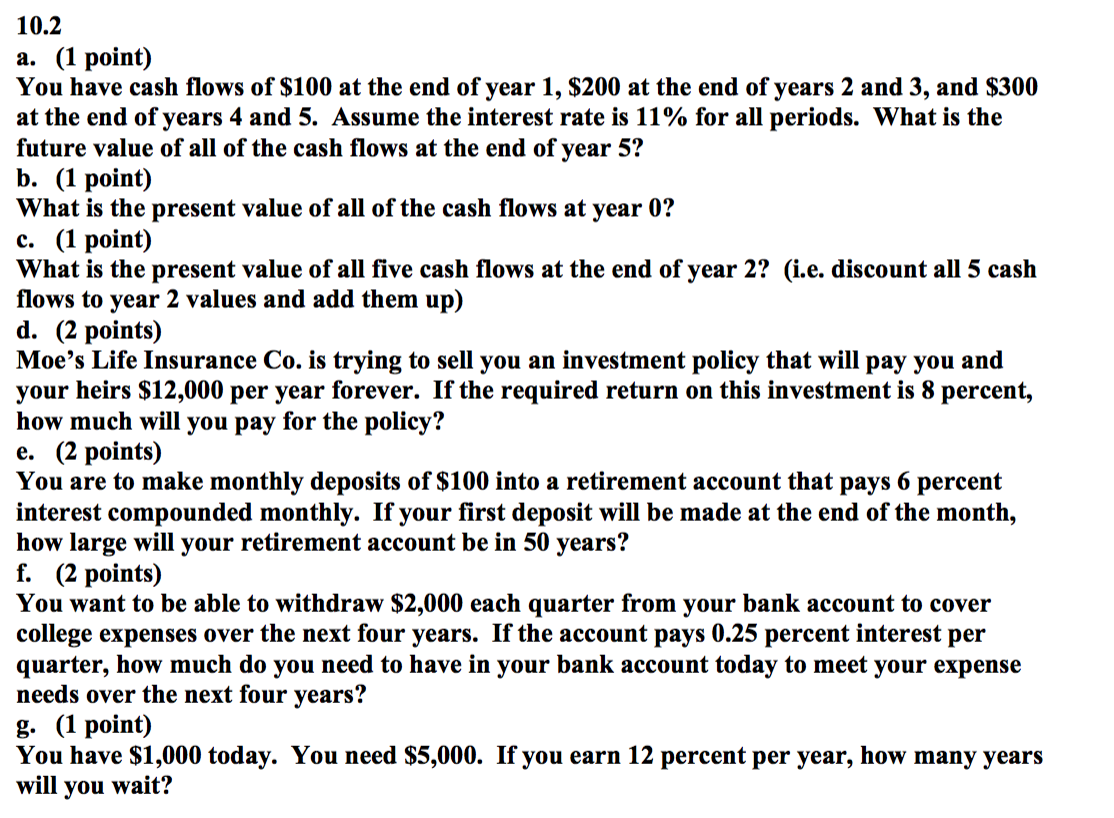

10.2 a. (1 point) You have cash flows of $100 at the end of year 1, $200 at the end of years 2 and 3, and $300 at the end of years 4 and 5. Assume the interest rate is 11% for all periods. What is the future value of all of the cash flows at the end of year 5? b. (1 point) What is the present value of all of the cash flows at year 0? c. (1 point) What is the present value of all five cash flows at the end of year 2? (i.e. discount all 5 cash flows to year 2 values and add them up) d. (2 points) Moe's Life Insurance Co. is trying to sell you an investment policy that will pay you and your heirs $12,000 per year forever. If the required return on this investment is 8 percent, how much will you pay for the policy? e. (2 points) You are to make monthly deposits of $100 into a retirement account that pays 6 percent interest compounded monthly. If your first deposit will be made at the end of the month, how large will your retirement account be in 50 years? f. (2 points) You want to be able to withdraw $2,000 each quarter from your bank account to cover college expenses over the next four years. If the account pays 0.25 percent interest per quarter, how much do you need to have in your bank account today to meet your expense needs over the next four years? g. (1 point) You have $1,000 today. You need $5,000. If you earn 12 percent per year, how many years will you waitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started