Answered step by step

Verified Expert Solution

Question

1 Approved Answer

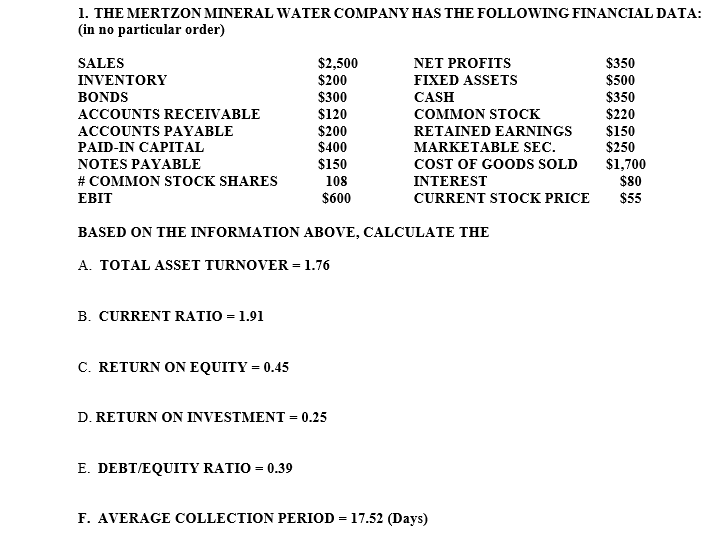

I Only Need Help With H, I, & J. 1. THE MERTZON MINERAL WATER COMPANY HAS THE FOLLOWING FINANCIAL DATA: in no particular order) SALES

I Only Need Help With H, I, & J.

1. THE MERTZON MINERAL WATER COMPANY HAS THE FOLLOWING FINANCIAL DATA: in no particular order) SALES INVENTORY BONDS ACCOUNTS RECEIVABLE ACCOUNTS PAYABLE PAID-IN CAPITAL NOTES PAYABLE # COMMON STOCK SHARES EBIT $2,500 $200 $300 $120 $200 $400 $150 108 $600 NET PROFITS FIXED ASSETS CASH COMMON STOCK RETAINED EARNINGS MARKETABLE SEC. COST OF GOODS SOLD INTEREST CURRENT STOCK PRICE $350 $500 $350 $220 $150 $250 $1,700 $80 $55 BASED ON THE INFORMATION ABOVE, CALCULATE THE A. TOTAL ASSET TURNOVER = 1.76 B. CURRENT RATIO = 1.91 C. RETURN ON EQUITY = 0.45 D. RETURN ON INVESTMENT = 0.25 E. DEBT/EQUITY RATIO = 0.39 F. AVERAGE COLLECTION PERIOD = 17.52 (Days) G. INVENTORY TURNOVER = 8.5 H. EPS I. PRICE/EARNINGS RATIO J. TIMES INTEREST EARNEDStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started