I only need help with Inventory (#2) and the questions associated. I've attached the entire spreadsheet to include all the numbers in case it makes things easier.

Explain how the build up of Inventory and the impact on year to year changes in cash and discuss on Economic Order Quantity for Inventory Management. 1. You built up/have more inventory on hand in 2017. 2. Explain Economic Order Quantity (EOQ)

Thanks in advance!

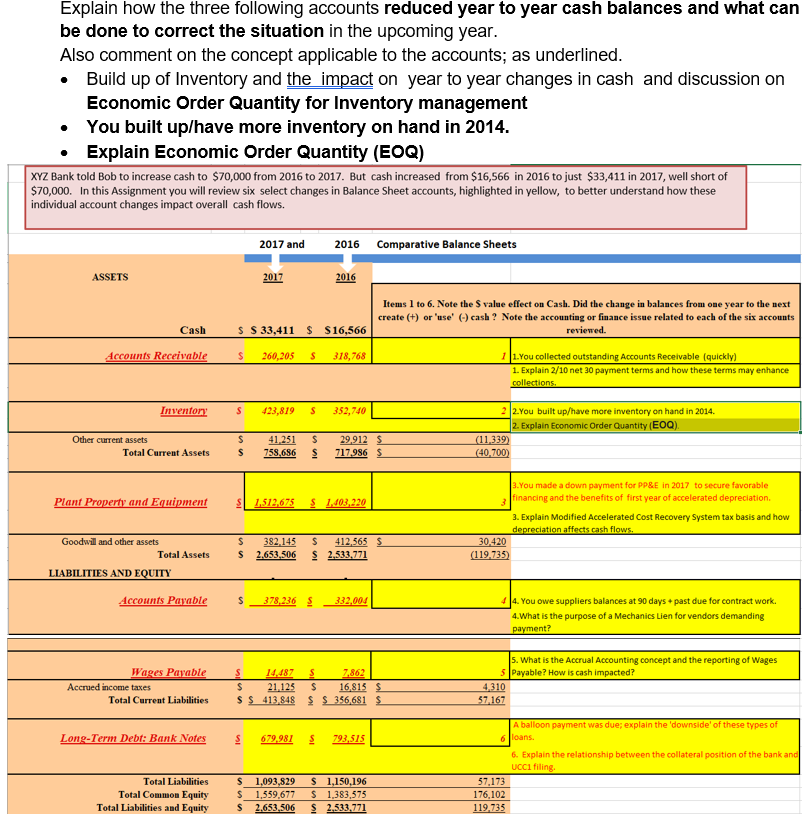

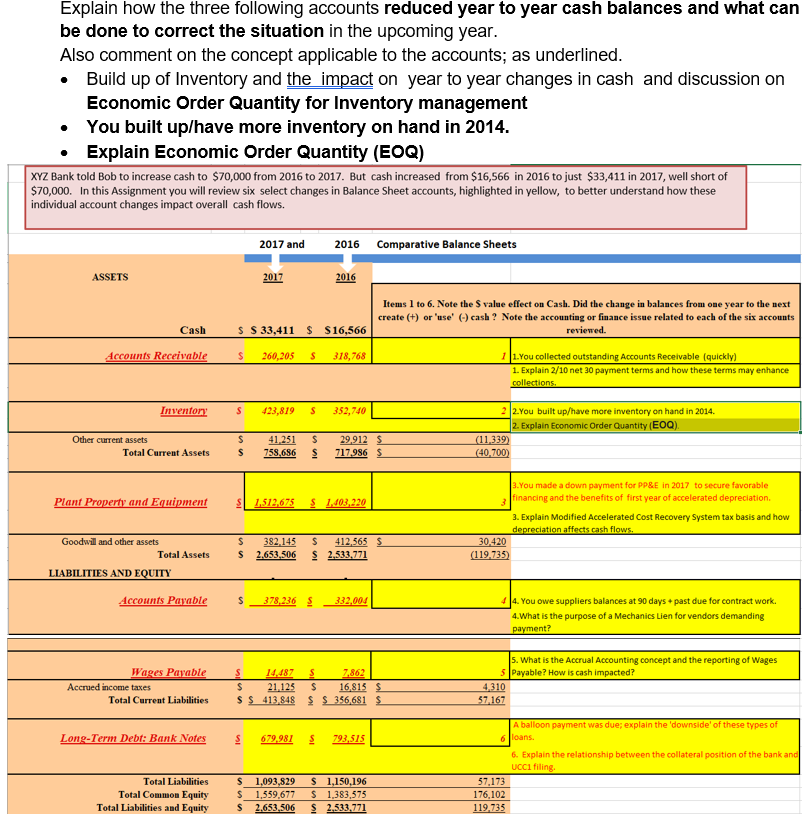

Explain how the three following accounts reduced year to year cash balances and what can be done to correct the situation in the upcoming year. Also comment on the concept applicable to the accounts; as underlined. Build up of Inventory and the impact on year to year changes in cash and discussion on Economic Order Quantity for Inventory management You built up/have more inventory on hand in 2014. Explain Economic Order Quantity (EOQ) XYZ Bank told Bob to increase cash to $70,000 from 2016 to 2017. But cash increased from $16,566 in 2016 to just $33,411 in 2017, well short of $70,000. In this Assignment you will review six select changes in Balance Sheet accounts, highlighted in yellow, to better understand how these individual account changes impact overall cash flows. 2017 and 2016 Comparative Balance Sheets ASSETS 2017 2016 Items 1 to 6. Note the S value effect on Cash. Did the change in balances from one year to the next create (+) or 'use" (.) cash? Note the accounting or finance issue related to each of the six accounts reviewed. Cash S S 33,411 $ $16,566 Accounts Receivable S 260,205 S 318,768 11. You collected outstanding Accounts Receivable (quickly) 1. Explain 2/10 net 30 payment terms and how these terms may enhance collections. Inventory s 423,819 s 352,740 22.You built up/have more inventory on hand in 2014. 2. Explain Economic Order Quantity (EOQ) (11.339) (40.700) Other current assets Total Current Assets S S 41.251 758.686 $ s 29.912 5 717.986 $ Plant Property and Equipment 1,512,675 $ 1,103,220 3.You made a down payment for PP&E in 2017 to secure favorable financing and the benefits of first year of accelerated depreciation. 3. Explain Modified Accelerated Cost Recovery System tax basis and how depreciation affects cash flows. 30,420 (119,735) Goodwill and other assets Total Assets S S 382.145 2.653 306 $ 412,565 $ $ 2.533.771 LIABILITIES AND EQUITY Accounts Payable $ 378 236 $ 332,004 44. You owe suppliers balances at 90 days + past due for contract work. 4. What is the purpose of a Mechanics Lien for vendors demanding payment? Wages Payable Accrued income taxes Total Current Liabilities S 14.187 5 7,862 S 21.125 $ 16,815$ S S 413,848 $ $ 356,681 $ 5. What is the Accrual Accounting concept and the reporting of Wages 5 Payable? How is cash impacted? 4,310 57167 Long-Term Debt: Bank Notes A balloon payment was due; explain the 'downside of these types of 6 loans. $ 679.981 793,515 Total Liabilities Total Common Equity Total Liabilities and Equity S 1,093,829 $ 1,559,677 S 2.653.506 $ 1,150.196 $ 1,383,575 $ 2.533.771 6. Explain the relationship between the collateral position of the bank and UCC filing, 57.173 176,102 119.735 Explain how the three following accounts reduced year to year cash balances and what can be done to correct the situation in the upcoming year. Also comment on the concept applicable to the accounts; as underlined. Build up of Inventory and the impact on year to year changes in cash and discussion on Economic Order Quantity for Inventory management You built up/have more inventory on hand in 2014. Explain Economic Order Quantity (EOQ) XYZ Bank told Bob to increase cash to $70,000 from 2016 to 2017. But cash increased from $16,566 in 2016 to just $33,411 in 2017, well short of $70,000. In this Assignment you will review six select changes in Balance Sheet accounts, highlighted in yellow, to better understand how these individual account changes impact overall cash flows. 2017 and 2016 Comparative Balance Sheets ASSETS 2017 2016 Items 1 to 6. Note the S value effect on Cash. Did the change in balances from one year to the next create (+) or 'use" (.) cash? Note the accounting or finance issue related to each of the six accounts reviewed. Cash S S 33,411 $ $16,566 Accounts Receivable S 260,205 S 318,768 11. You collected outstanding Accounts Receivable (quickly) 1. Explain 2/10 net 30 payment terms and how these terms may enhance collections. Inventory s 423,819 s 352,740 22.You built up/have more inventory on hand in 2014. 2. Explain Economic Order Quantity (EOQ) (11.339) (40.700) Other current assets Total Current Assets S S 41.251 758.686 $ s 29.912 5 717.986 $ Plant Property and Equipment 1,512,675 $ 1,103,220 3.You made a down payment for PP&E in 2017 to secure favorable financing and the benefits of first year of accelerated depreciation. 3. Explain Modified Accelerated Cost Recovery System tax basis and how depreciation affects cash flows. 30,420 (119,735) Goodwill and other assets Total Assets S S 382.145 2.653 306 $ 412,565 $ $ 2.533.771 LIABILITIES AND EQUITY Accounts Payable $ 378 236 $ 332,004 44. You owe suppliers balances at 90 days + past due for contract work. 4. What is the purpose of a Mechanics Lien for vendors demanding payment? Wages Payable Accrued income taxes Total Current Liabilities S 14.187 5 7,862 S 21.125 $ 16,815$ S S 413,848 $ $ 356,681 $ 5. What is the Accrual Accounting concept and the reporting of Wages 5 Payable? How is cash impacted? 4,310 57167 Long-Term Debt: Bank Notes A balloon payment was due; explain the 'downside of these types of 6 loans. $ 679.981 793,515 Total Liabilities Total Common Equity Total Liabilities and Equity S 1,093,829 $ 1,559,677 S 2.653.506 $ 1,150.196 $ 1,383,575 $ 2.533.771 6. Explain the relationship between the collateral position of the bank and UCC filing, 57.173 176,102 119.735