Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I only need help with part B Last year Acme paid Ralph $15.000 to install a new air-conditioning unit at its headquarters building. The air

I only need help with part B

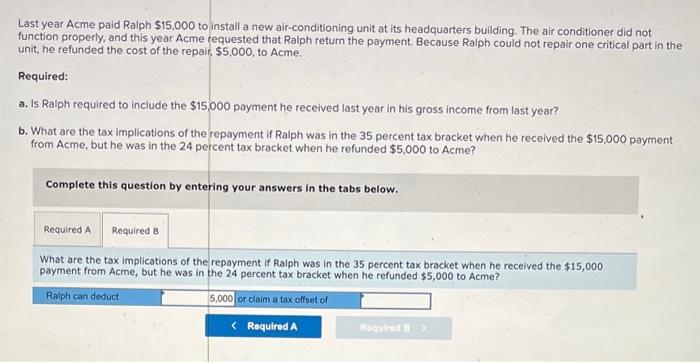

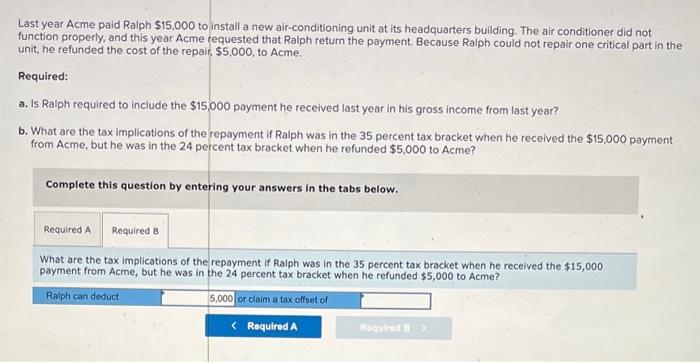

Last year Acme paid Ralph $15.000 to install a new air-conditioning unit at its headquarters building. The air conditioner did not function properly, and this year Acme requested that Ralph return the payment. Because Ralph could not repair one critical part in the unit, he refunded the cost of the repair, $5,000, to Acme. Required: a. Is Ralph required to include the $15,000 payment he received last year in his gross income from last year? b. What are the tax implications of the repayment if Ralph was in the 35 percent tax bracket when he received the $15,000 payment from Acme, but he was in the 24 percent tax bracket when he refunded $5,000 to Acme? Complete this question by entering your answers in the tabs below. What are the tax implications of the repayment if Ralph was in the 35 percent tax bracket when he received the $15,000 payment from Acme, but he was in the 24 percent tax bracket when he refunded $5,000 to Acme

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started