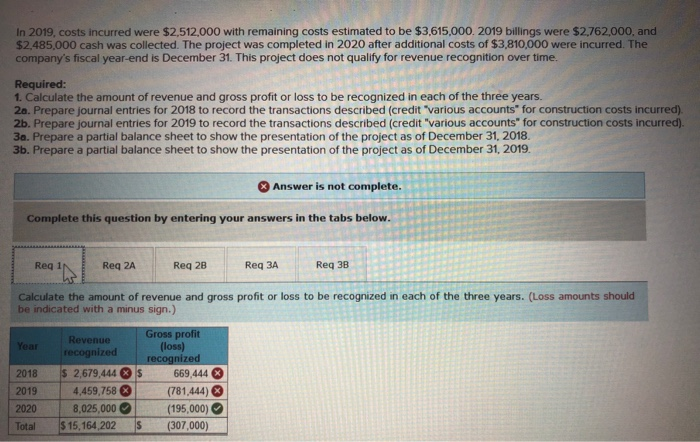

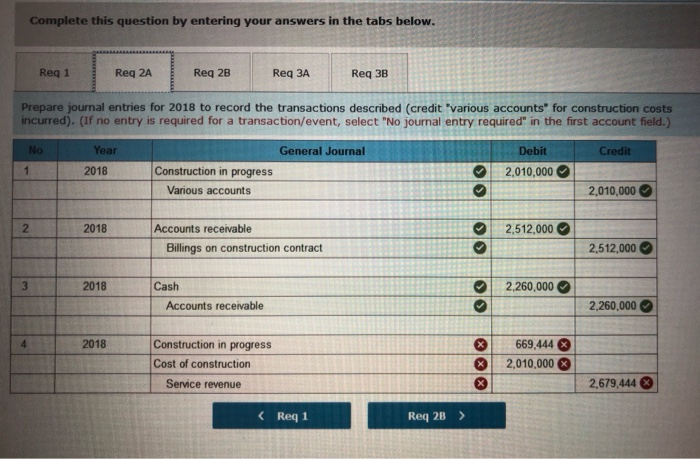

I only need help with the ones that are wrong!! In sections 2A & 2B it says to record expected loss for journal entry #4.

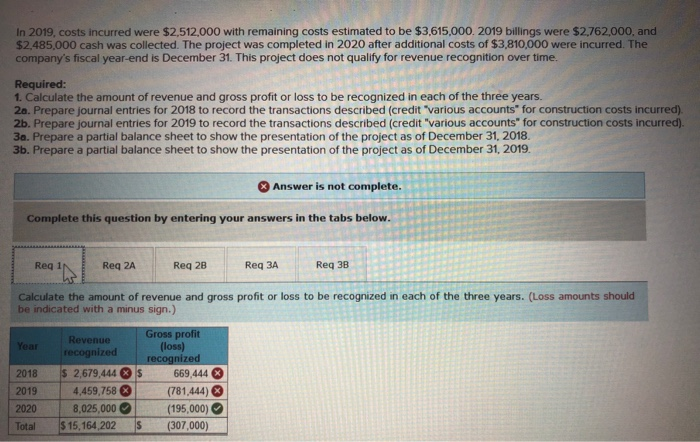

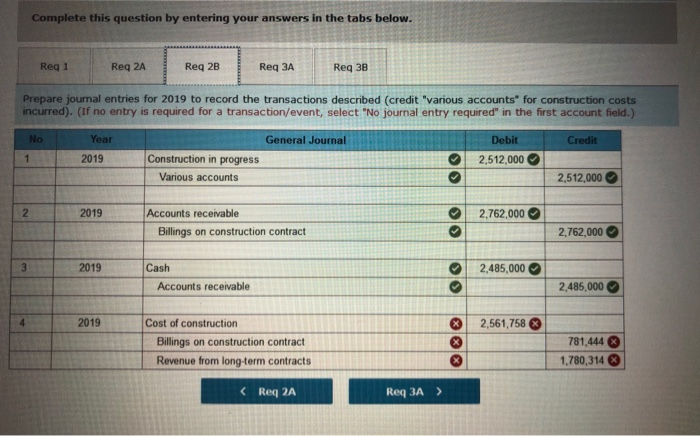

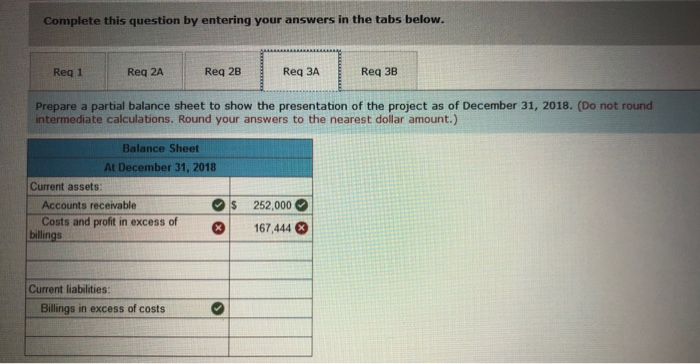

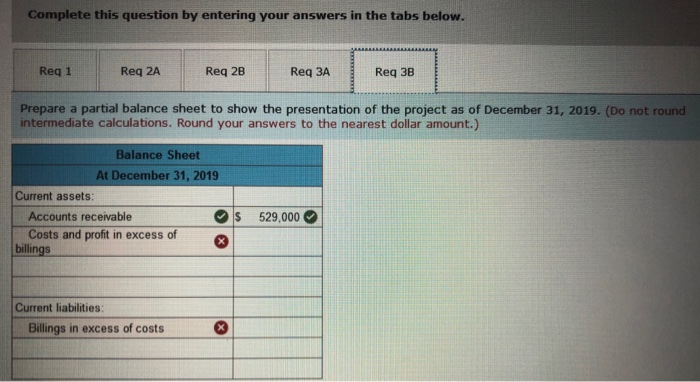

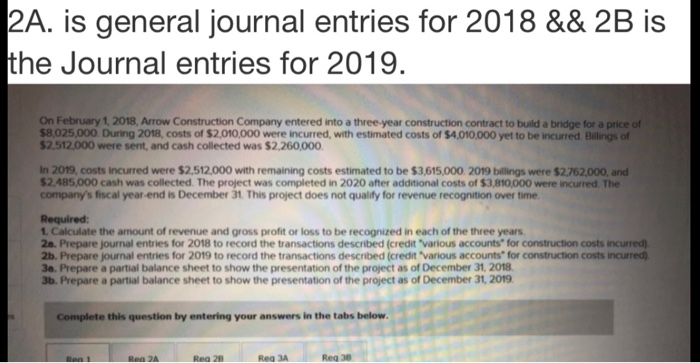

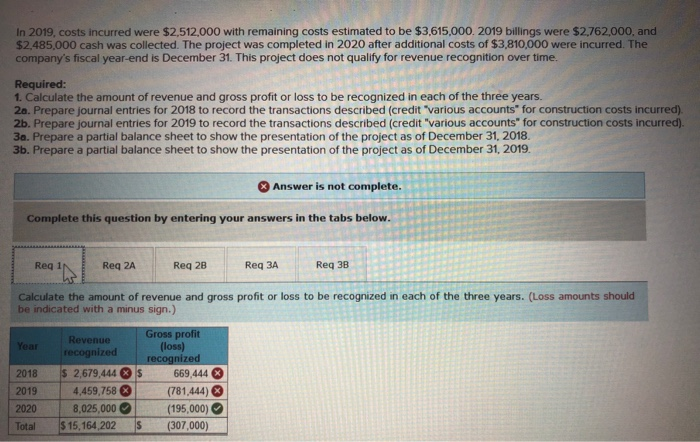

In 2019. costs incurred were $2.512,000 with remaining costs estimated to be $3.615,000. 2019 billings were $2.762.000 and $2,485,000 cash was collected. The project was completed in 2020 after additional costs of $3,810,000 were incurred. The company's fiscal year-end is December 31. This project does not qualify for revenue recognition over time. Required: 1. Calculate the amount of revenue and gross profit or loss to be recognized in each of the three years. 20. Prepare journal entries for 2018 to record the transactions described (credit "various accounts for construction costs incurred) 2b. Prepare journal entries for 2019 to record the transactions described (credit "various accounts for construction costs incurred). 3a. Prepare a partial balance sheet to show the presentation of the project as of December 31, 2018 3b. Prepare a partial balance sheet to show the presentation of the project as of December 31, 2019 Answer is not complete. Complete this question by entering your answers in the tabs below. Req IN Req 2A Req 2B Req 3A Req 3B Calculate the amount of revenue and gross profit or loss to be recognized in each of the three years. (Loss amounts should be indicated with a minus sign.) Year 2018 2019 2020 Total Revenue recognized $ 2,679,444 * 4,459,758 8,025,000 $15,164 202 S Gross profit (loss) recognized $ 669,444 (781,444) (195,000) (307,000) Complete this question by entering your answers in the tabs below. Reg 1 Req 2A Reg 2B Req Req 3B Prepare journal entries for 2018 to record the transactions described (credit 'various accounts for construction costs incurred). (if no entry is required for a transaction/event, select "No journal entry required" in the first account field. Credit No 1 Year 2018 General Journal Construction in progress Various accounts Debit 2,010,000 2,010,000 2018 2,512,000 Accounts receivable Billings on construction contract 2,512,000 2018 Cash 2,260,000 Accounts receivable 2,260,000 2018 Construction in progress Cost of construction 669,444 % 2,010,000 Service revenue 2,679,444 (Reg 1 Req 2B > Complete this question by entering your answers in the tabs below. Req1 Reg 2A Req 2B Req Req 38 Prepare journal entries for 2019 to record the transactions described (credit "various accounts for construction costs incurred). (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. - No Credit Year 2019 General Journal Construction in progress Various accounts Debit 2,512,000 2,512,000 2019 2,762,000 Accounts receivable Billings on construction contract 2,762,000 2019 2,485,000 Cash Accounts receivable 2.485.000 2019 2,561,758 Cost of construction Billings on construction contract Revenue from long-term contracts 781,444 1,780,314 X Complete this question by entering your answers in the tabs below. Req 1 Req 2A Req 2B Req Req 3B Prepare a partial balance sheet to show the presentation of the project as of December 31, 2018. (Do not round intermediate calculations. Round your answers to the nearest dollar amount.) Balance Sheet At December 31, 2018 Current assets: Accounts receivable S S Costs and profit in excess of billings 252,000 167,444 Current liabilities: Billings in excess of costs Complete this question by entering your answers in the tabs below. Req 1 Req 2A Req 2B Req Req 3B Prepare a partial balance sheet to show the presentation of the project as of December 31, 2019. (Do not round intermediate calculations. Round your answers to the nearest dollar amount.) Balance Sheet At December 31, 2019 Current assets: Accounts receivable Costs and profit in excess of billings $ 529,000 Current liabilities Billings in excess of costs 2A. is general journal entries for 2018 && 2B is the Journal entries for 2019. On February 1, 2018 Arrow Construction Company entered into a three-year construction contract to build a bridge for a price of $8,025,000. During 2018, costs of $2,010,000 were incurred, with estimated costs of $4.010,000 yet to be incurred Billings of $2,512,000 were sent, and cash collected was $2,260,000 In 2019, costs incurred were $2,512,000 with remaining costs estimated to be $3,615,000. 2019 billings were $2762000. and $2.485,000 cash was collected. The project was completed in 2020 after additional costs of $3,810,000 were incurred The company's fiscal year-end is December 31. This project does not qualify for revenue recognition over time. Required: 1. Calculate the amount of revenue and gross profit or loss to be recognized in each of the three years 20. Prepare journal entries for 2018 to record the transactions described credit various accounts for construction costs incurred 2b. Prepare journal entries for 2019 to record the transactions described (credit various accounts for construction costs incurred 3o. Prepare a partial balance sheet to show the presentation of the project as of December 31, 2018 3b. Prepare a partial balance sheet to show the presentation of the project as of December 31, 2019 Complete this question by entering your answers in the tabs below. BABA Rea 28 Rea A Reg.38