Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I only need hep with questions for problem number one. I need help with all the formulas for problem one, homework questions 1-7 on problem

I only need hep with questions for problem number one. I need help with all the formulas for problem one, homework questions 1-7 on problem 1 which is due today. My apologies. I tried to complete it on my own.

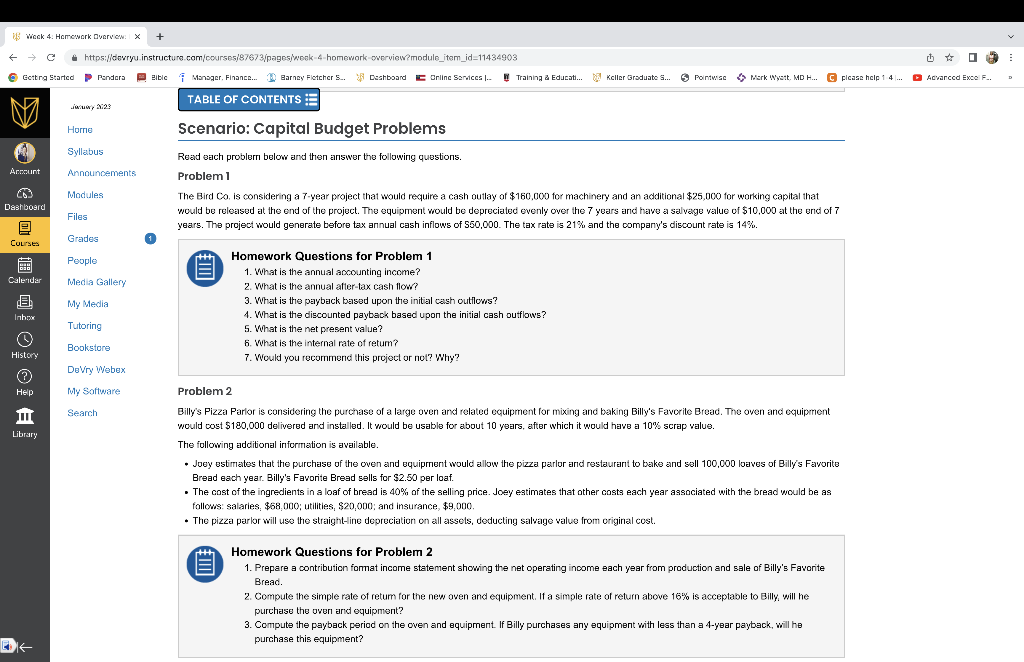

Read each problern below and then answer the following questions. Problem 1 The Bird Co, is considering a 7 -year project that would require a cash outlay of $160,000 for machinery and an additional $25,000 for working capital that would be released at the end of the project. The equipment would be depreciated evenly over the 7 years and have a salvage value of $10,000 at the end of 7 years. The project would generate tefore tax annual cash inflows of 550,000 . The tax rate is 21% and the company's discount rate is 14%. Homework Questions for Problem 1 1. What is the annual ancounting income? 2. What is the annual after-tax cash flow? 3. What is the payback based upon the initial cash outlows? 4. What is the discounted paytack based upon the initial cash outflows? 5. What is the net present value? 6. What is the internal rate of retum? 7. Would you recommend this project or not? Why? Problem 2 Billys Pizza Parlor is considering the purchase of a large oven and related equipment for mixing and baking Billy's Faverite Bread. The oven and cquipment would cost $180,000 delivered and installed. It would be usable for about 10 years, after which it would have a 10% scrap walue. The following additional irformation is available. - Joey estimates that the purchase of the cven and equiprnent would allow the pizza parlor and restaurarit to hake and sell 100,000 loaves of Billys Favorite Bread each year. Billy's Favorite Bread sells for $2.50 per loaf. - The cost of the ingredients in a loaf of bread is 40% of the selling price. Joey estimates that other costs each year associated with the bread would be as follows: salaries, $68,000; utilities, $20,000; and insurance, $9,000. - The pizza parlor will use the straight-line depreciation on all assels, deducting salwage value from original cost. Homework Questions for Problem 2 1. Prepare a contribution format income statement showing the net operating income each year from production and sale of Billy's Favorite Bread. 2. Compute the simple rate of retum for the new oven and equipment. If a simple rate of return above 16% is acceptable to Billy, will he purchase the over and equipment? 3. Compute the payback period on the oven and equipment. If Billy purchases any equipment with less than a 4 -year paytack, will he purchase this equipmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started