I only need number 12!!!

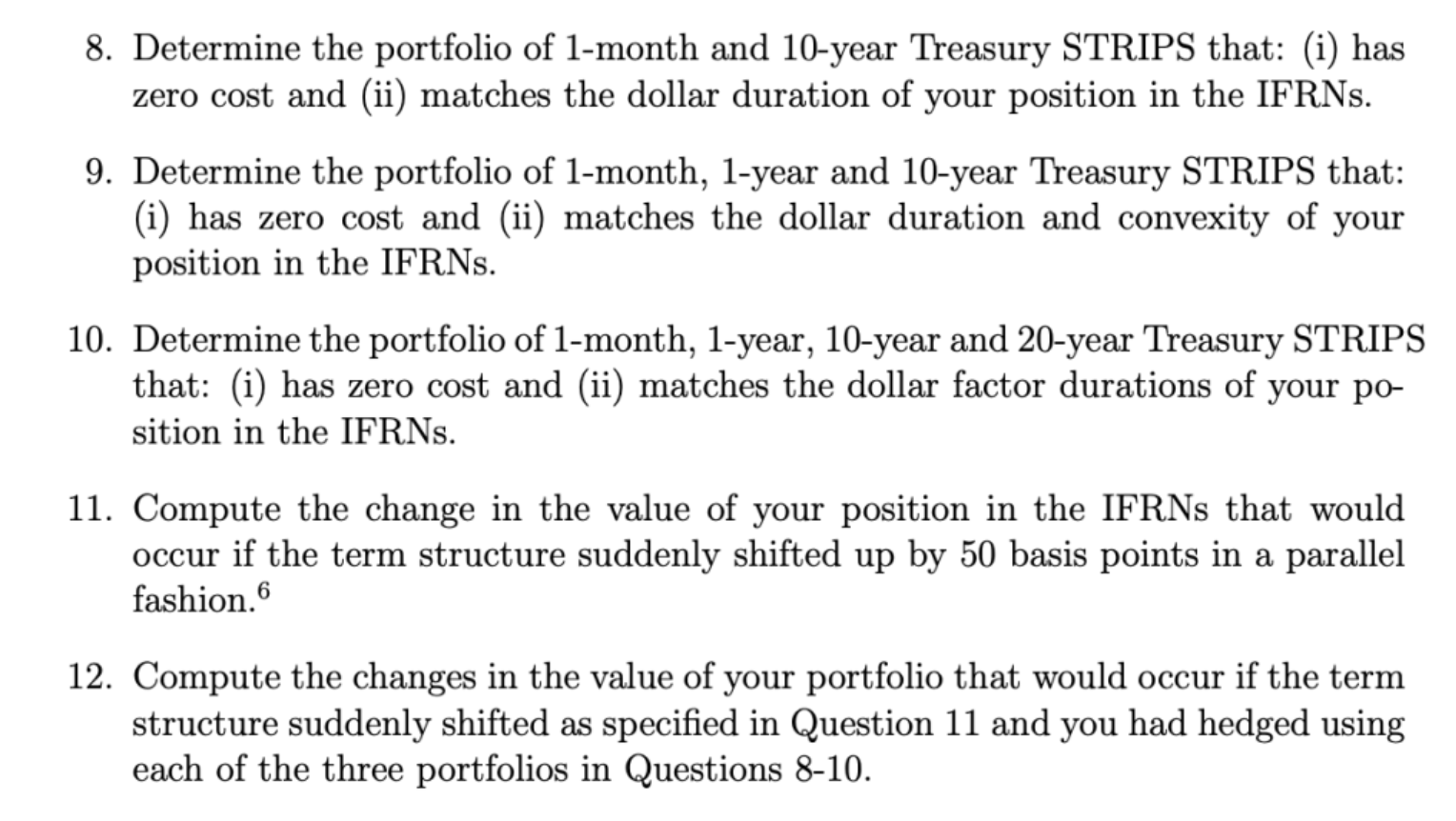

Background On February 15, 2011, the Federal Home Loan Mortgage Corporation (Freddie Mac) issued a class of 30-year mortgage backed securities that made monthly coupon pay- ments at a floating rate equal to 84.62999971% 12.99999996 ~ 1- month LIBOR, subject to a minimum of 0% and a maximum of 84.62999971%. Although the securities were guaranteed by Freddie Mac and thus could be as- sumed to involve no default risk, they involved significant prepayment risk, since the timing of the principal payments depended on the prepayments on the underlying mortgage pool. In this Assignment, you will be asked to price and hedge a vanilla inverse floater structured similarly to the Freddie Mac securities mentioned above, but ignoring both the uncertainty regarding the timing of the principal payments and the upper and lower bounds on the coupon rate.1 The Inverse Floating Rate Notes It is February 15, 2011. You have just invested in the Inverse Floating Rate Notes (IFRNs) described in the simplified Term Sheet in Figure 1. The total face value of the IFRNs in your portfolio is $100,000. 1 You will be asked to price the actual Freddie Mac securities in Assignment 3. Working Assumptions Throughout this Assignment assume that: The IFRNs involve no default risk. The monthly coupon payments on the IFRNs are at a regular interval of 112 years. The term structure of Treasury rates on February 15, 2011 is as estimated in the FEDS 2006-28 paper.2 The spread between the 1-month USD LIBOR rate and the monthly com- pounded 1-month Treasury rate is constant at the level determined in Ques- tion 4 below. Questions Answer the following questions making sure to clearly explain the procedure you followed to determine your answers. 8. Determine the portfolio of 1-month and 10-year Treasury STRIPS that: (i) has zero cost and (ii) matches the dollar duration of your position in the IFRNs. 9. Determine the portfolio of 1-month, 1-year and 10-year Treasury STRIPS that: (i) has zero cost and (ii) matches the dollar duration and convexity of your position in the IFRNs. 10. Determine the portfolio of 1-month, 1-year, 10-year and 20-year Treasury STRIPS that: (i) has zero cost and (ii) matches the dollar factor durations of your po- sition in the IFRNs. 11. Compute the change in the value of your position in the IFRNs that would occur if the term structure suddenly shifted up by 50 basis points in a parallel fashion. 12. Compute the changes in the value of your portfolio that would occur if the term structure suddenly shifted as specified in Question 11 and you had hedged using each of the three portfolios in Questions 8-10. Background On February 15, 2011, the Federal Home Loan Mortgage Corporation (Freddie Mac) issued a class of 30-year mortgage backed securities that made monthly coupon pay- ments at a floating rate equal to 84.62999971% 12.99999996 ~ 1- month LIBOR, subject to a minimum of 0% and a maximum of 84.62999971%. Although the securities were guaranteed by Freddie Mac and thus could be as- sumed to involve no default risk, they involved significant prepayment risk, since the timing of the principal payments depended on the prepayments on the underlying mortgage pool. In this Assignment, you will be asked to price and hedge a vanilla inverse floater structured similarly to the Freddie Mac securities mentioned above, but ignoring both the uncertainty regarding the timing of the principal payments and the upper and lower bounds on the coupon rate.1 The Inverse Floating Rate Notes It is February 15, 2011. You have just invested in the Inverse Floating Rate Notes (IFRNs) described in the simplified Term Sheet in Figure 1. The total face value of the IFRNs in your portfolio is $100,000. 1 You will be asked to price the actual Freddie Mac securities in Assignment 3. Working Assumptions Throughout this Assignment assume that: The IFRNs involve no default risk. The monthly coupon payments on the IFRNs are at a regular interval of 112 years. The term structure of Treasury rates on February 15, 2011 is as estimated in the FEDS 2006-28 paper.2 The spread between the 1-month USD LIBOR rate and the monthly com- pounded 1-month Treasury rate is constant at the level determined in Ques- tion 4 below. Questions Answer the following questions making sure to clearly explain the procedure you followed to determine your answers. 8. Determine the portfolio of 1-month and 10-year Treasury STRIPS that: (i) has zero cost and (ii) matches the dollar duration of your position in the IFRNs. 9. Determine the portfolio of 1-month, 1-year and 10-year Treasury STRIPS that: (i) has zero cost and (ii) matches the dollar duration and convexity of your position in the IFRNs. 10. Determine the portfolio of 1-month, 1-year, 10-year and 20-year Treasury STRIPS that: (i) has zero cost and (ii) matches the dollar factor durations of your po- sition in the IFRNs. 11. Compute the change in the value of your position in the IFRNs that would occur if the term structure suddenly shifted up by 50 basis points in a parallel fashion. 12. Compute the changes in the value of your portfolio that would occur if the term structure suddenly shifted as specified in Question 11 and you had hedged using each of the three portfolios in Questions 8-10