i only need part 4 a paragraph answer

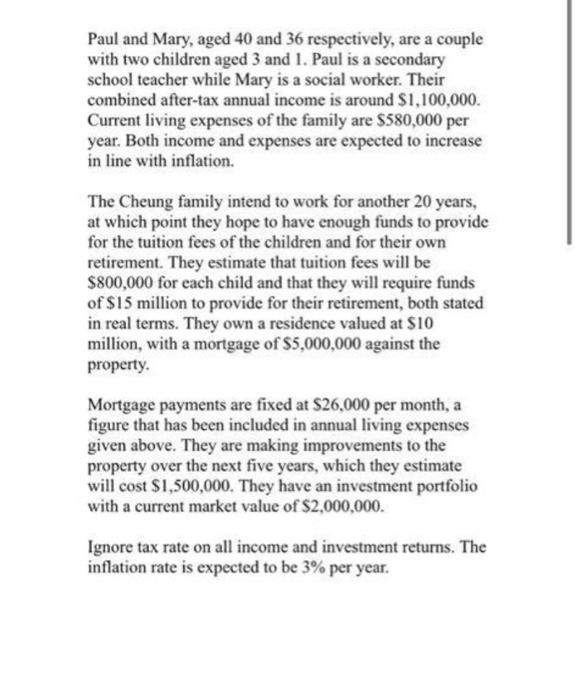

will cost $1,500,000. They have an investment portfolio with a current market value of $2,000,000. Ignore tax rate on all income and investment returns. The inflation rate is expected to be 3% per year. You are required to discuss the following items in your report: Create a financial plan for Paul and Mary according to the above-mentioned goals and objectives. The financial plan should include your comments and recommendation for: i. Short, Intermediate and Long-Term Goals ii. Return requirement iii. Risk tolerance, including a discussion of the types of risk they may face iv. Liquidity consideration v. Time horizon vi. The investment vehicles in the portfolio vii. The change of portfolio over time. (Note: it is up to you to decide which investment vehicles you think most appropriate. It may be stocks, bonds, real estate, and mutual funds) In your plan, you should describe what specific actions you recommend to Paul and Mary so that they can achieve their goals. You must also apply the knowledge and skills you learnt from this course for this plan. Paul and Mary, aged 40 and 36 respectively, are a couple with two children aged 3 and 1. Paul is a secondary school teacher while Mary is a social worker. Their combined after-tax annual income is around $1,100,000. Current living expenses of the family are $580,000 per year. Both income and expenses are expected to increase in line with inflation. The Cheung family intend to work for another 20 years, at which point they hope to have enough funds to provide for the tuition fees of the children and for their own retirement. They estimate that tuition fees will be $800,000 for each child and that they will require funds of $15 million to provide for their retirement, both stated in real terms. They own a residence valued at $10 million, with a mortgage of $5,000,000 against the property Mortgage payments are fixed at $26,000 per month, a figure that has been included in annual living expenses given above. They are making improvements to the property over the next five years, which they estimate will cost $1,500,000. They have an investment portfolio with a current market value of $2,000,000. Ignore tax rate on all income and investment returns. The inflation rate is expected to be 3% per year