Answered step by step

Verified Expert Solution

Question

1 Approved Answer

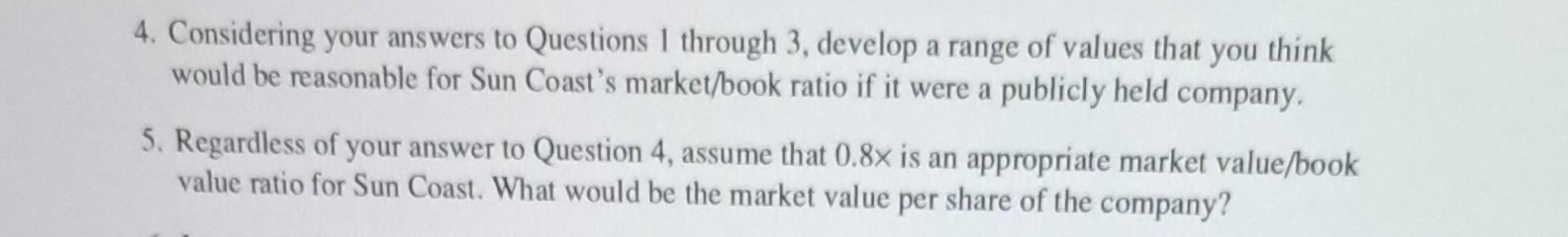

I only need qiestions 4 and 5 4. Considering your answers to Questions 1 through 3 , develop a range of values that you think

I only need qiestions 4 and 5

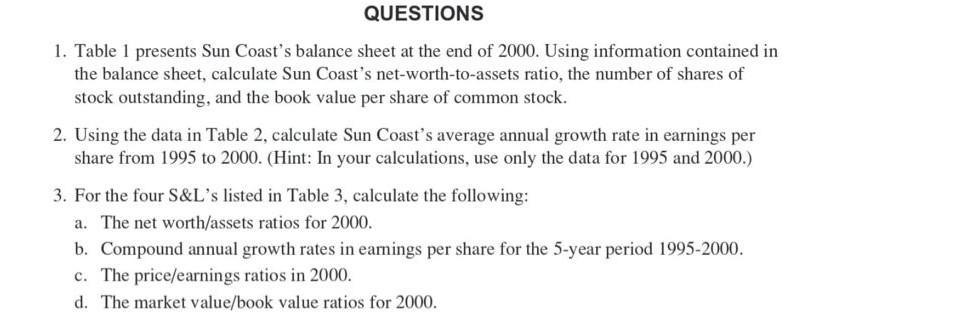

4. Considering your answers to Questions 1 through 3 , develop a range of values that you think would be reasonable for Sun Coast's market/book ratio if it were a publicly held company. 5. Regardless of your answer to Question 4 , assume that 0.8 is an appropriate market value/book value ratio for Sun Coast. What would be the market value per share of the company? 1. Table 1 presents Sun Coast's balance sheet at the end of 2000 . Using information contained in the balance sheet, calculate Sun Coast's net-worth-to-assets ratio, the number of shares of stock outstanding, and the book value per share of common stock. 2. Using the data in Table 2, calculate Sun Coast's average annual growth rate in earnings per share from 1995 to 2000 . (Hint: In your calculations, use only the data for 1995 and 2000.) 3. For the four S\&L's listed in Table 3, calculate the following: a. The net worth/assets ratios for 2000 . b. Compound annual growth rates in earnings per share for the 5-year period 1995-2000. c. The price/earnings ratios in 2000 . d. The market value/book value ratios for 2000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started