I only need requirment 3,4 and 5

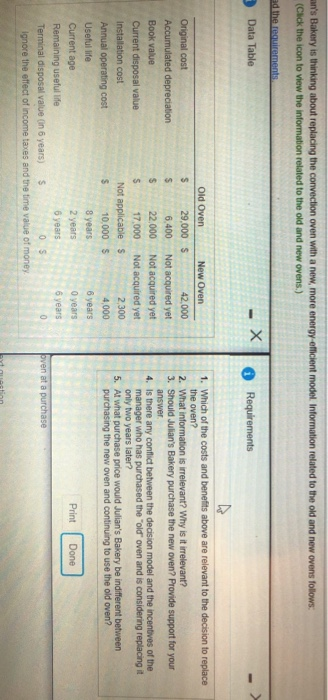

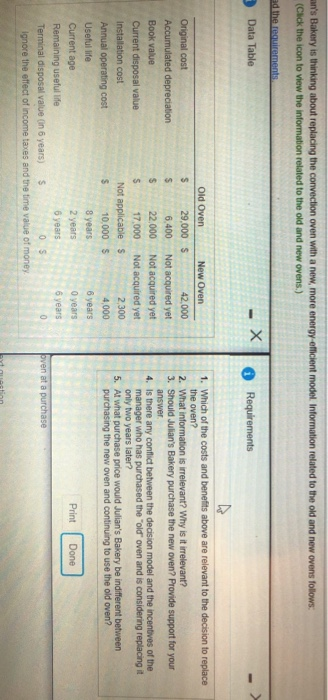

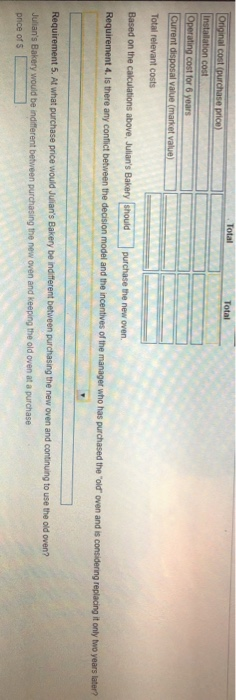

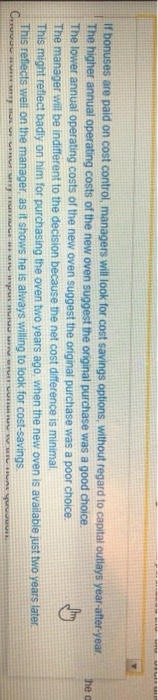

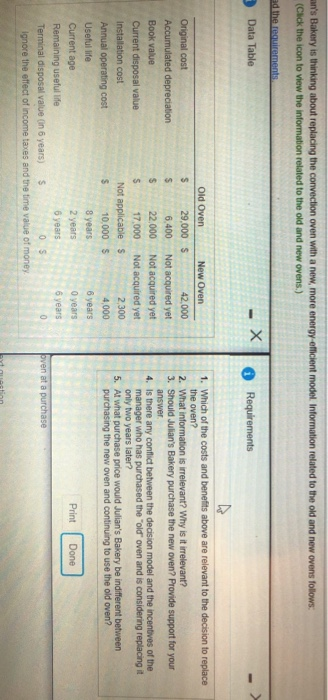

n's Bakery is thinking about replacing the convection oven with a new, more energy efficient model. Information related to the old and new ovens follows (Click the icon to view the information related to the old and new ovens.) ad the requirements Data Table 1 Requirements Old Oven New Oven Original cost $ 29,000 $ 42,000 Accumulated depreciation $ 6,400 Not acquired yet Book value $ 22,000 Not acquired yet Current disposal value $ 17.000 Not acquired yet Installation cost Not applicable $ 2,300 Annual operating cost $ 10,000 $ 4,000 Useful life 8 years 6 years Current age 2 years 0 years Remaining useful life 6 years 6 years Terminal disposal value in 6 years) $ 0 $ 0 Ignore the effect of income taxes and the time value of money. 1. Which of the costs and benefits above are relevant to the decision to replace The oven? 2. What information is irrelevant? Why is it irrelevant? 3. Should Julian's Bakery purchase the new oven? Provide support for your answer 4. Is there any conflict between the decision model and the incentives of the manager who has purchased the "old" oven and is considering replacing it only two years later? 5. At what purchase price would Julian's Bakery be indifferent between purchasing the new oven and continuing to use the old oven? Print Done pven at a purchase Total Total Original cost (purchase price) Installation cost Operating cost for 6 years Current disposal value (market value) Total relevant costs Based on the calculations above, Julian's Bakery should purchase the new oven Requirement 4. Is there any conflict between the decision model and the incentives of the manager who has purchased the old oven and is considering replacing it only two years later? Requirement 5. At what purchase price would Julian's Bakery be indifferent between purchasing the new oven and continuing to use the old oven? Julian's Bakery would be indifferent between purchasing the new oven and keeping the old oven at a purchase pnce of Thea If bonuses are paid on cost control, managers will look for cost savings options, without regard to capital outlays year-after-year The higher annual operating costs of the new oven suggest the original purchase was a good choice The lower annual operating costs of the new oven suggest the original purchase was a poor choice. The manager will be indifferent to the decision because the net cost difference is minimal This might reflect badly on him for purchasing the oven two years ago, when the new oven is available just two years later This reflects well on the manager, as it shows he is always willing to look for cost savings My My w