Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I only need the answer to part 3, the first 2 parts are for rederence. STEP 1013 Suppose that Nevada Co, a US-based MNC, makes

I only need the answer to part 3, the first 2 parts are for rederence.

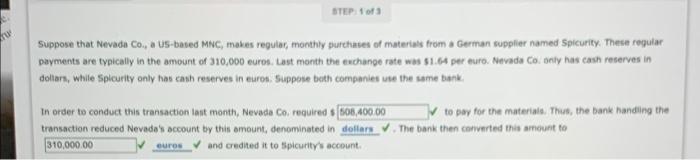

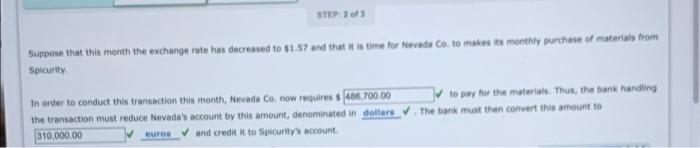

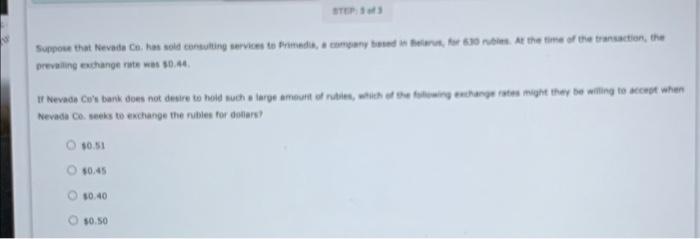

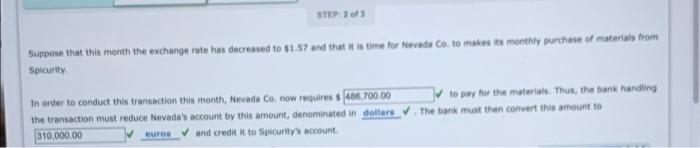

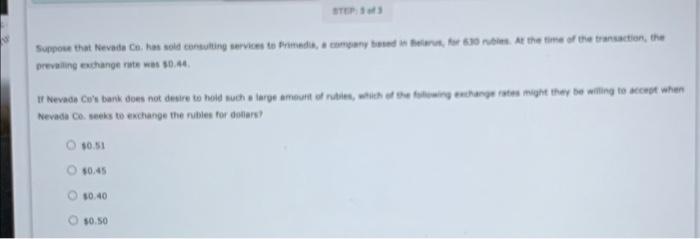

STEP 1013 Suppose that Nevada Co, a US-based MNC, makes regular monthly purchases of materials from German supplier named Spicurity. These regular payments are typically in the amount of 310,000 euros. Last month the exchange rate was $1.64 per euro. Nevada Co only has cash reserves in dollars, while Spleurly only has canh reserves in euron. Suppose beth companies use the same bank In order to conduct this transaction last month, Nevada Co, required $ 108,400.00 to pay for the material. Thus, the bank handing the transaction reduced Nevada's account by this amount, denominated in dollars. The bank then converted this amount to 310,000.00 and credited it to Spicurity account sures STEP 23 Suppose that this month the exchange rate has decreased to $1.57 and that it is time for Nevada Co to makes its monthly purchase of materials from Spicurity In order to conduct this transaction this month, Nevada Co now requires 486.700.00 to pay for the materials. Thus, the bank handling the transaction must reduce Nevada's account by this amount, denominated in dollars. The bank must then convert the amount to 310,000.00 euros and credit it to Spicurity's account TER Support that Nevada O has sold consulting services to Predia, company and there, tort At the time of the transaction, the prevailing exchange rate was 0.44 It Nevada cor bank does not desire to how much we amount of the change my they be willing to come when Nevada Cooks to exchange the rules for dolar? $0.51 50.45 10.40 50.50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started