Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I ONLY NEED THE ANSWERS IN LESS THAN 10 MINUTES PLEASE Alistair Gavos Greek Foods (AGGF) issued 20,000 non-qualified stock options (NQOs) to its employees

I ONLY NEED THE ANSWERS IN LESS THAN 10 MINUTES PLEASE

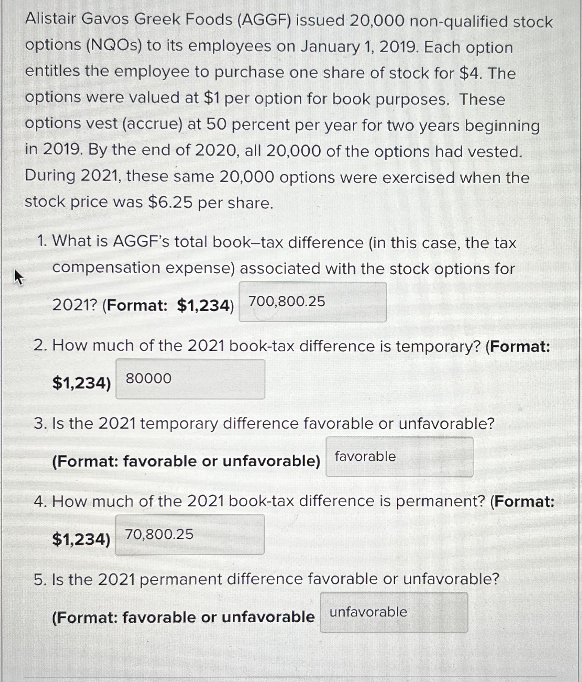

Alistair Gavos Greek Foods (AGGF) issued 20,000 non-qualified stock options (NQOs) to its employees on January 1, 2019. Each option entitles the employee to purchase one share of stock for $4. The options were valued at $1 per option for book purposes. These options vest (accrue) at 50 percent per year for two years beginning in 2019. By the end of 2020, all 20,000 of the options had vested. During 2021, these same 20,000 options were exercised when the stock price was $6.25 per share. 1. What is AGGF's total book-tax difference (in this case, the tax compensation expense) associated with the stock options for 2021? (Format: $1,234) 700,800.25 2. How much of the 2021 book-tax difference is temporary? (Format: $1,234) 80000 3. Is the 2021 temporary difference favorable or unfavorable? (Format: favorable or unfavorable) favorable 4. How much of the 2021 book-tax difference is permanent? (Format: $1,234) 70,800.25 5. Is the 2021 permanent difference favorable or unfavorable? (Format: favorable or unfavorable unfavorable Alistair Gavos Greek Foods (AGGF) issued 20,000 non-qualified stock options (NQOs) to its employees on January 1, 2019. Each option entitles the employee to purchase one share of stock for $4. The options were valued at $1 per option for book purposes. These options vest (accrue) at 50 percent per year for two years beginning in 2019. By the end of 2020, all 20,000 of the options had vested. During 2021, these same 20,000 options were exercised when the stock price was $6.25 per share. 1. What is AGGF's total book-tax difference (in this case, the tax compensation expense) associated with the stock options for 2021? (Format: $1,234) 700,800.25 2. How much of the 2021 book-tax difference is temporary? (Format: $1,234) 80000 3. Is the 2021 temporary difference favorable or unfavorable? (Format: favorable or unfavorable) favorable 4. How much of the 2021 book-tax difference is permanent? (Format: $1,234) 70,800.25 5. Is the 2021 permanent difference favorable or unfavorable? (Format: favorable or unfavorable unfavorableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started