i only need the journal entries.

these are the additional informations:

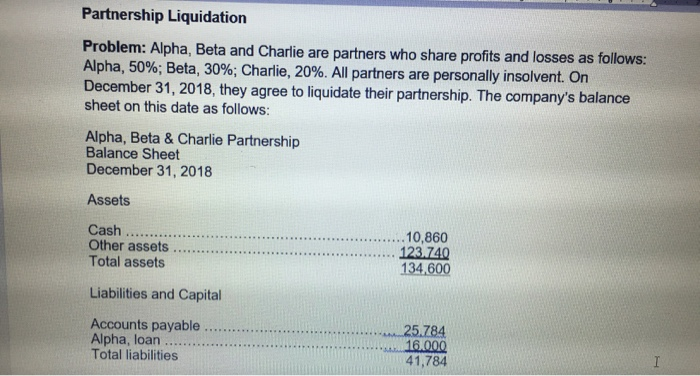

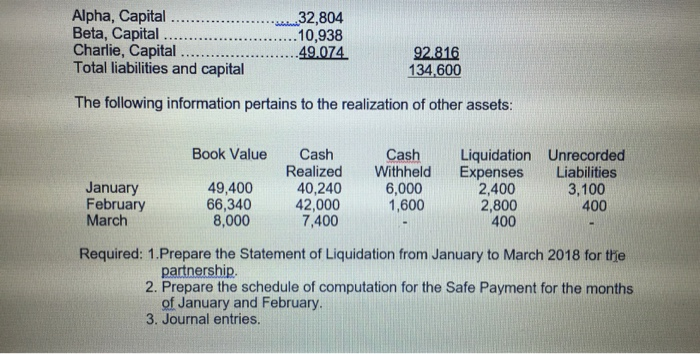

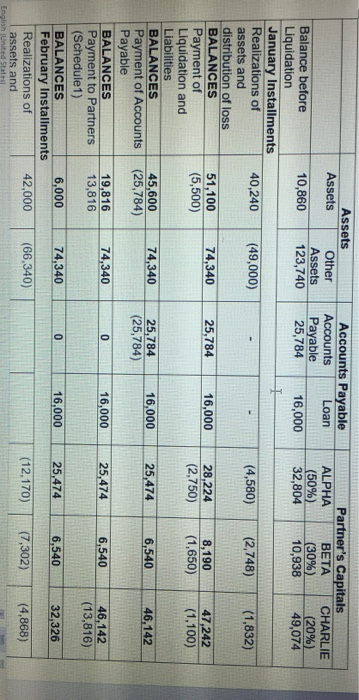

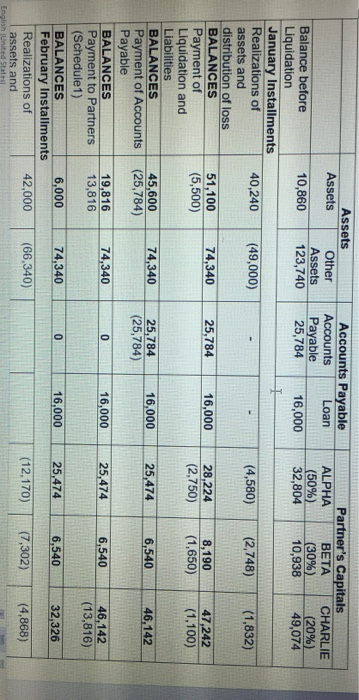

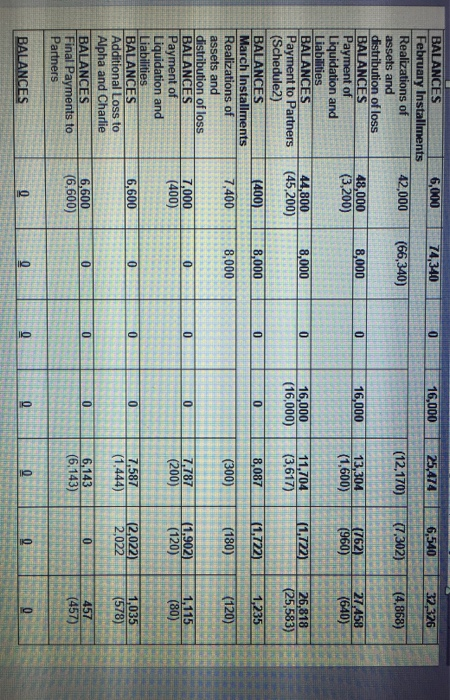

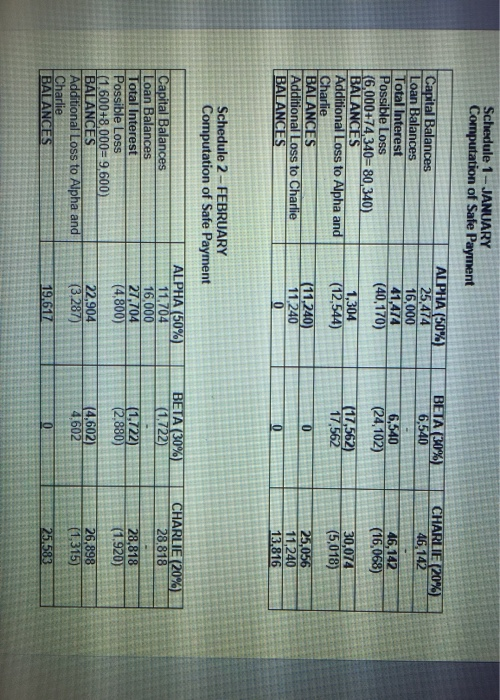

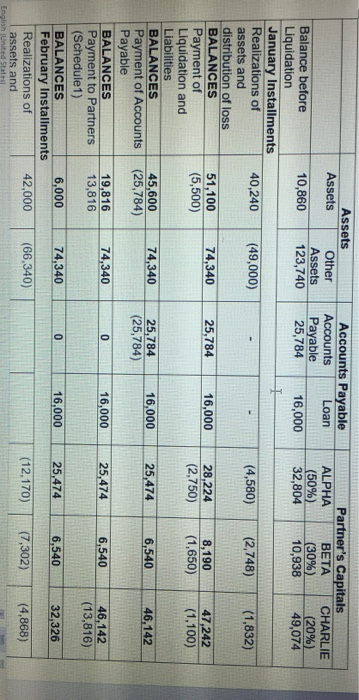

Partnership Liquidation Problem: Alpha, Beta and Charlie are partners who share profits and losses as follows: Alpha, 50%; Beta, 30%; Charlie, 20%. All partners are personally insolvent. On December 31, 2018, they agree to liquidate their partnership. The company's balance sheet on this date as follows: Alpha, Beta & Charlie Partnership Balance Sheet December 31, 2018 Assets Cash Other assets Total assets 10,860 123.740 134,600 Liabilities and Capital Accounts payable Alpha, loan Total liabilities 25.784 16.000 41,784 Alpha, Capital Beta, Capital Charlie, Capital Total liabilities and capital 32,804 .10,938 -49.074 92.816 134,600 The following information pertains to the realization of other assets: Book Value January February March 49,400 66,340 8,000 Cash Realized 40,240 42,000 7,400 Cash Withheld 6,000 1,600 Liquidation Unrecorded Expenses Liabilities 2,400 3,100 2,800 400 400 Required: 1.Prepare the Statement of Liquidation from January to March 2018 for trie partnership 2. Prepare the schedule of computation for the Safe Payment for the months of January and February. 3. Journal entries. Assets Assets Other Assets 10,860 123,740 Accounts Payable Accounts Loan Payable 25,784 16,000 Partner's Capitals ALPHA BETA CHARLIE (50%) (30%) (20%) 32,804 10,938 49,074 I 40,240 (49,000) (4,580) (2,748) (1.832) 74,340 51,100 (5,500) 25,784 16,000 28,224 (2,750) 8,190 (1,650) 47,242 (1,100) Balance before Liquidation January Installments Realizations of assets and distribution of loss BALANCES Payment of Liquidation and Liabilities BALANCES Payment of Accounts Payable BALANCES Payment to Partners (Schedule1) BALANCES February Installments Realizations of assets and 74,340 45,600 (25,784) 16,000 25,784 (25,784) 25,474 6,540 46,142 74,340 0 19,816 13,816 16,000 25,474 6,540 46,142 (13,816) 6,000 74,340 0 16,000 25,474 6,540 32,326 42,000 (66,340) (12,170) (7,302) (4,868) English (United States 74,340 16,000 25,474 6,540 32,326 (66,340) (12,170) (7,302) (4,868) 8,000 0 16,000 13,304 (1,600) (762) (960) 27,458 (640) 8,000 0 16,000 (16,000) 11,704 (3,617) (1,722) 26.818 (25,583) 8,000 0 0 8,087 (1.722) 1,235 BALANCES 6,000 February Installments Realizations of 42,000 assets and distribution of loss BALANCES 48,000 Payment of (3,200) Liquidation and Liabilities BALANCES 44,800 Payment to Partners (45,200) (Schedule2) BALANCES (400) March Installments Realizations of 7,400 assets and distribution of loss BALANCES 7,000 Payment of (400) Liquidation and Liabilities BALANCES 6,600 Additional Loss to Alpha and Charlie BALANCES 6,600 Final Payments to (6,600) Partners 8,000 (300) (180) (120) 0 0 0 7,787 (200) (1.902) (120) 1,115 (80) 0 0 0 7,587 (1.444) (2,022) 2,022 1,035 (578) 0 0 0 0 6,143 (6.143) 457 (457) BALANCES 2 0 0 0 BETA 30%) CHARLIE (20%) 46,142 6,540 Schedule 1 - JANUARY Computation of Safe Payment ALPHA (50%) Capital Balances 25,474 Loan Balances 16,000 Total Interest 41,474 Possible Loss (40,170) |6,000+74,340=80, 340) BALANCES 1,304 Additional Loss to Alpha and (12,544) Charlie BALANCES (11,240) Additional Loss to Charlie 11,240 BALANCES 0 6,540 (24,102) 46,142 (16,068) (17,562) 17,562 30,074 (5,018) 0 25,056 11,240 13,816 0 Schedule 2 - FEBRUARY Computation of Safe Payment BETA 30% (1,722) CHARLIE 20% 28,818 ALPHA (50%) 11,704 16,000 27,704 (4,800) (1.722) (2,880) 28,818 (1.920) Capital Balances Loan Balances Total Interest Possible Loss (1.600+8,000= 9.600) BALANCES Additional Loss to Alpha and Charlie BALANCES 22,904 (3.287) (4,602) 4,602 26,898 (1,315) 19,617 25583